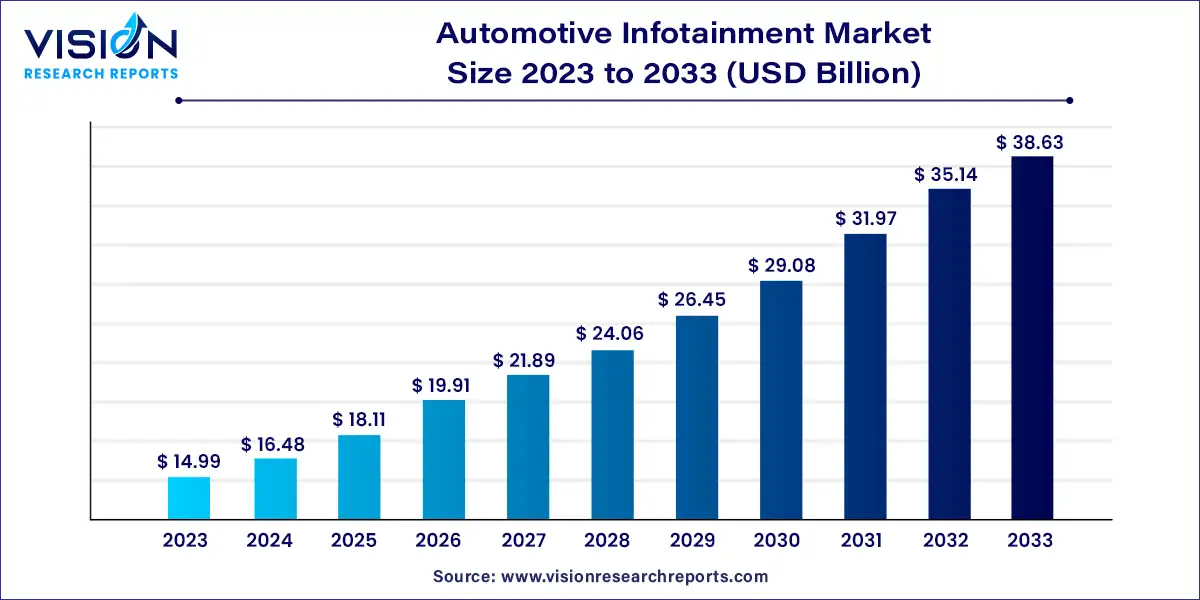

The global automotive infotainment market size was estimated at around USD 14.99 billion in 2023 and it is projected to hit around USD 38.63 billion by 2033, growing at a CAGR of 9.93% from 2024 to 2033.

The automotive infotainment market continues to evolve rapidly driven by advancements in technology and increasing consumer demand for connected, immersive driving experiences. This sector encompasses a wide range of systems that integrate entertainment, navigation, communication, and vehicle management functionalities into one cohesive interface. Key drivers include the integration of smartphones, advancements in connectivity such as 5G, and the rise of autonomous vehicles, which require sophisticated infotainment solutions.

The growth of the automotive infotainment market is fueled by the technological advancements such as the integration of AI-driven interfaces and augmented reality (AR) features are enhancing user experience and driving demand. Increasing consumer preference for connected vehicles that offer seamless integration with smartphones and other devices is also a significant growth driver. Moreover, regulatory mandates promoting vehicle safety and connectivity, along with the proliferation of electric vehicles (EVs) and autonomous driving technologies, are further accelerating market expansion. These factors collectively create a dynamic landscape for automotive infotainment systems, promising robust growth and innovation in the coming years.

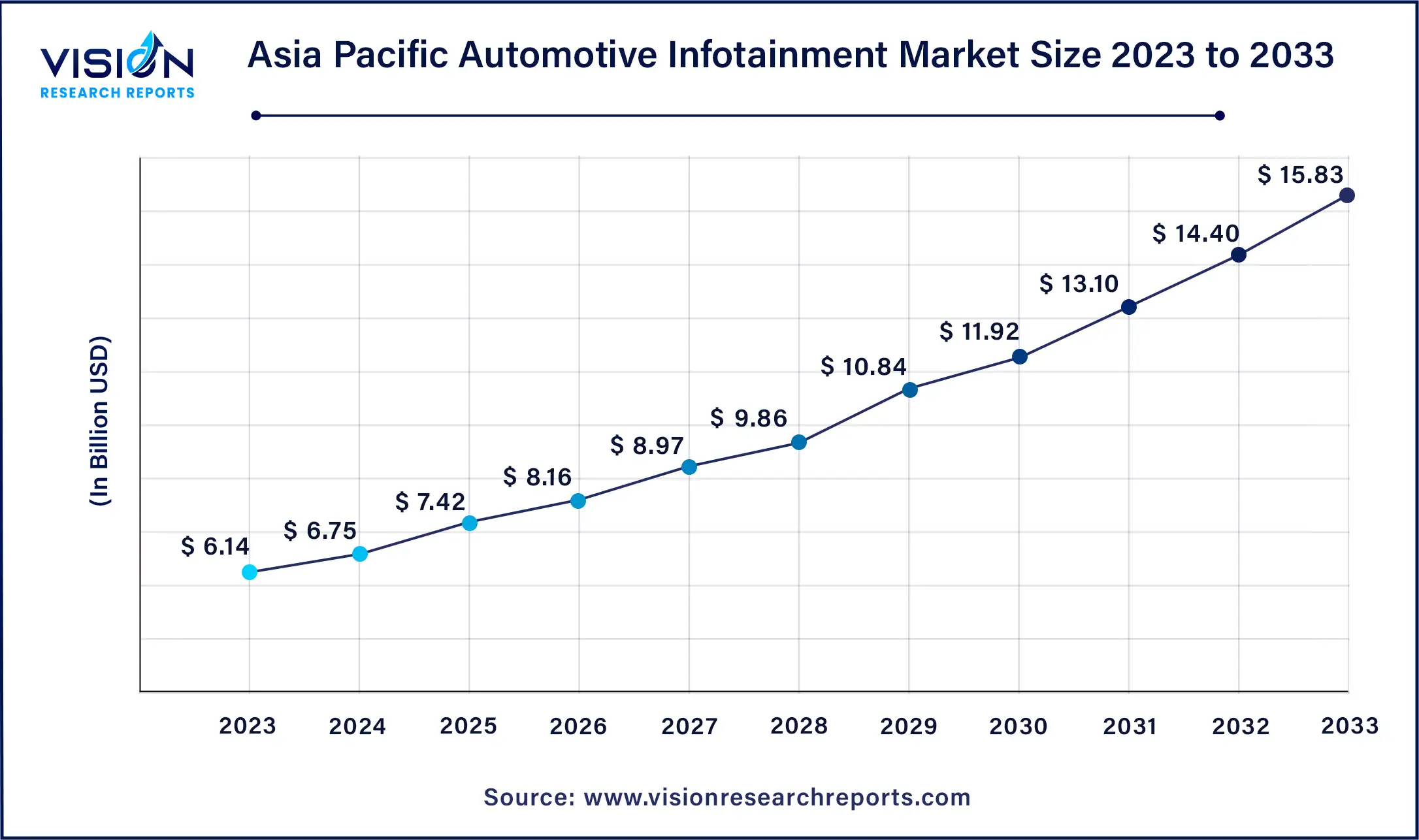

The Asia Pacific automotive infotainment market size was estimated at USD 6.14 billion in 2023 and it is expected to surpass around USD 15.83 billion by 2033, poised to grow at a CAGR of 9.93% from 2024 to 2033.

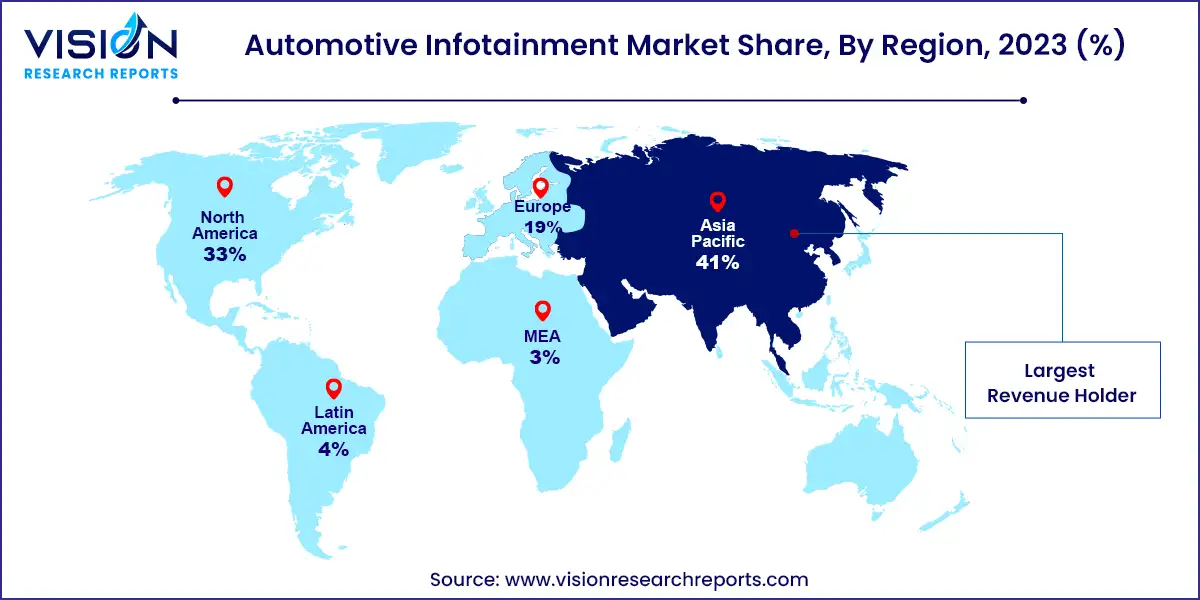

Asia Pacific dominated the market with a 41% share in 2023, driven by growing sales and production of passenger cars in the region. Rising income levels and high demand for automobiles have fueled growth in the luxury and mid-sized premium car segments. The increasing traction for electric vehicles in the region is also expected to boost demand for in-car entertainment systems. Key benefits of these systems include enhanced connectivity, improved user experience, hands-free operation, and a wide range of entertainment options.

Europe holds a significant share in the global automotive infotainment industry, supported by the presence of prominent automobile manufacturers collaborating with global software companies to launch advanced infotainment systems. The rapid adoption of cloud technology in vehicles has further bolstered demand for advanced in-car infotainment systems in the region. The industry's expansion is driven by the user-friendly interfaces of in-car infotainment systems that integrate various functionalities seamlessly.

The navigation unit segment led the market with a share of 38% in 2023. Advanced onboard features such as 3D navigation, hands-free calling, satellite radio, and media streaming are increasingly popular among consumers. This trend motivates automobile manufacturers to integrate communication units into basic car models launched in the market. Additionally, the adoption of 5G networks enhances real-time data collection speed and communication unit accuracy, further driving the adoption of infotainment devices in automobiles.

The heads-up display segment is expected to witness the highest growth rate over the forecast period. This growth is attributed to the rising application of Augmented Reality (AR) technology. AR enables the display and analysis of real-time information such as speed, arrow indicators, and warning signals. Heads-up displays project graphics onto the windshield, providing essential details like steering wheel information and aiding in parking, all within the driver's line of sight. Consequently, heads-up display devices are increasingly preferred by automobile customers worldwide.

The OEM fitted segment accounted for the largest market share of 73% in 2023, driven by its ease of service and low maintenance features. OEM fitted systems are included in the car warranty provided by the manufacturer, eliminating additional costs for OE systems and thereby increasing their preference over aftermarket products. By integrating OEM systems into automobiles, manufacturers gain access to stored data that can be utilized by the company's sales and marketing teams for campaigns.

However, the aftermarket segment is expected to witness significant growth during the forecast period. Factors contributing to this growth include lower costs compared to OEM-fitted systems and the ability to customize systems according to customer preferences. Aftermarket suppliers offer basic automotive infotainment systems suitable for owners of entry-level car models, often including audio units. They also provide options to upgrade to more advanced systems within the same price range.

The passenger cars segment dominated the market with a revenue share of 80% in 2023. This dominance is attributed to the increasing adoption of luxury cars by consumers in developing nations. Luxury cars offer advanced technology, safety features, and cabin comforts that necessitate sophisticated infotainment systems. Automobile manufacturers enhance customer appeal by offering subscription-based services, improved sales, and financing options, thereby driving sales of luxury cars. Additionally, ride-sharing companies like Uber and OLA are enhancing passenger vehicle interactivity and hands-free operation, further maintaining a substantial market share.

The commercial vehicles segment is expected to register significant growth over the forecast period. Increasing demand for commercial vehicles and the integration of vehicle-to-vehicle communications by automotive companies to enhance fleet management efficiency are key drivers for automotive infotainment systems in commercial vehicles. Vendors are integrating infotainment systems with IoT technology to facilitate end-to-end connectivity between vehicles as part of ADAS and DMS systems, aiding commercial fleet operators in efficient fleet management.

By Product Type

By Fit Type

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others