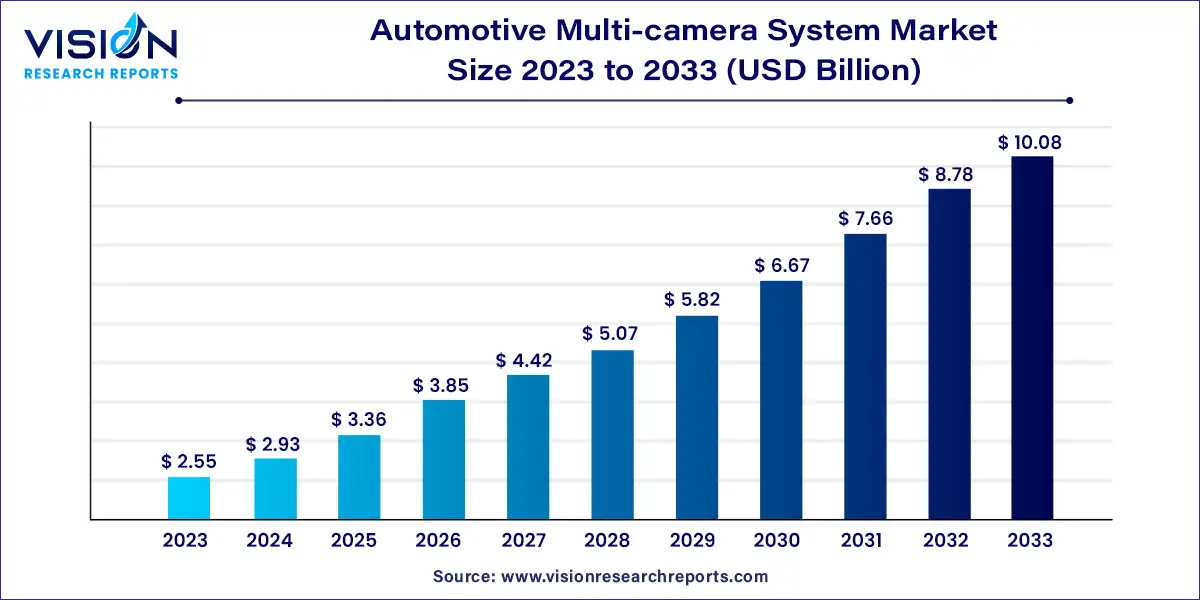

The global automotive multi-camera system market size was estimated at around USD 2.55 billion in 2023 and it is projected to hit around USD 10.08 billion by 2033, growing at a CAGR of 14.73% from 2024 to 2033.

The automotive multi-camera system market has seen significant growth over the past few years, driven by advancements in vehicle safety, autonomous driving technologies, and increasing consumer demand for enhanced driving experiences. This market is integral to the development of Advanced Driver Assistance Systems (ADAS), providing a comprehensive visual understanding of the vehicle's surroundings.

The growth of the automotive multi-camera system market is primarily driven by the rising demand for advanced safety features and the rapid adoption of autonomous driving technologies. Consumers are increasingly prioritizing vehicle safety, leading to a surge in the integration of multi-camera systems, which offer enhanced visibility and comprehensive monitoring of the vehicle's surroundings. Additionally, technological advancements in camera resolution, image processing, and sensor fusion are enabling more accurate and reliable systems, further boosting their adoption. As the automotive industry continues to innovate and develop autonomous vehicles, the need for sophisticated multi-camera systems will only increase, driving significant market growth.

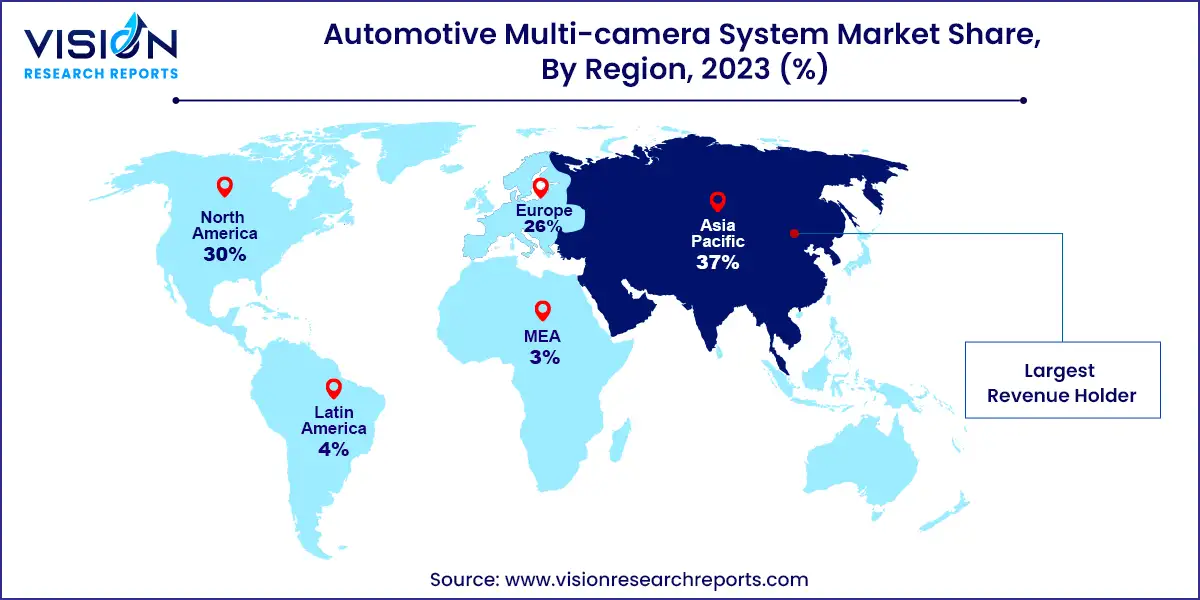

Asia Pacific dominated the automotive multi-camera system market with a revenue share of 37% in 2023. The region holds the largest share in the global market due to its significant automotive manufacturing industry. Countries such as China, Japan, and South Korea are home to some of the world's largest automakers, driving high demand for advanced vehicle technologies. Additionally, the growing middle-class population and increasing urbanization in the region are boosting consumer demand for vehicles equipped with advanced safety and convenience features, including multi-camera systems.

| Attribute | Asia Pacific |

| Market Value | USD 0.94 Billion |

| Growth Rate | 14.74% CAGR |

| Projected Value | USD 3.72 Billion |

The automotive multi-camera system market in North America is expected to register a significant CAGR from 2024 to 2033. The high rate of vehicle production and technological innovation in the automotive sector fuel market growth, with major automakers integrating these systems into both passenger vehicles and commercial fleets. Additionally, the emphasis on reducing accidents and enhancing the overall driving experience contributes to the market's prominence, positioning North America as a pivotal hub for advancements and deployments in automotive camera technology.

U.S. Automotive Multi-camera System Market Trends:

The U.S. automotive multi-camera system market is expected to register a significant CAGR from 2024 to 2033. The strong focus on innovation and technological advancements in vehicle safety features further fuels the demand for multi-camera systems. The growing trend of integrating advanced safety features in both premium and mid-range vehicles is a key driver in the U.S. market.

Europe Automotive Multi-camera System Market Trends:

The automotive multi-camera system market in Europe is anticipated to grow at a significant CAGR from 2024 to 2033. The presence of major automotive manufacturers and a well-established automotive industry supports the demand for multi-camera systems. Additionally, the growing trend towards autonomous driving and the integration of advanced safety features in vehicles are key factors driving market growth in Europe.

In 2023, the passenger vehicles segment dominated the market, holding the largest revenue share of 74%. The segment's growth is largely driven by increasing consumer demand for enhanced safety and convenience features. Advanced Driver Assistance Systems (ADAS) with multi-camera setups are gaining popularity for their ability to provide comprehensive vehicle surroundings, thereby improving driving safety. Moreover, the rise of autonomous driving technology is prompting manufacturers to incorporate more sophisticated camera systems to support high-level perception capabilities. This surge in adoption of multi-camera systems in passenger vehicles is fueled by both regulatory requirements and consumer preferences.

The commercial vehicles segment is expected to experience a significant CAGR from 2024 to 2033. Commercial vehicles like trucks and buses benefit greatly from multi-camera systems, which enhance driver visibility, reduce blind spots, and prevent accidents. Fleet operators are increasingly investing in these technologies to minimize downtime, lower insurance costs, and improve overall safety records. Additionally, the implementation of regulatory mandates for commercial vehicle safety systems in various regions is driving the uptake of multi-camera systems. The growth of e-commerce and the expansion of delivery and logistics fleets also contribute to the demand for advanced camera systems, as they play a crucial role in ensuring timely and secure deliveries.

In 2023, the 2D view segment led the market with the largest revenue share of 62%. The growth of the 2D view segment is primarily driven by its cost-effectiveness and sufficient performance for basic safety and convenience features. 2D camera systems are widely used in applications such as rearview cameras, blind-spot detection, and lane departure warnings, providing essential visual support to drivers. These systems remain popular in entry-level and mid-range vehicles where affordability is a key consideration. The simplicity and reliability of 2D camera systems make them an attractive option for manufacturers looking to offer safety features without significantly increasing vehicle costs. As a result, while the market is increasingly leaning towards 3D view systems for advanced functionalities, the 2D view segment maintains a strong presence due to its practicality and cost benefits.

The 3D view type segment is anticipated to grow at a significant CAGR from 2024 to 2033. The increasing demand for advanced visibility during driving and parking is a key factor contributing to the growth of the segment. 3D camera systems provide superior depth perception and spatial awareness, which are crucial for features such as automated parking, 360-degree surround view, and obstacle detection. Rapid advancements in image processing technology and growing consumer preference for high-tech, safety-oriented vehicle features further boost the adoption of 3D view systems.

In 2023, the parking assist system segment led the market with the largest revenue share of 31% and is expected to maintain its dominance. The growth of this segment is largely driven by increasing urbanization and the resulting rise in parking challenges. Consumers are increasingly seeking vehicles equipped with advanced technologies that simplify parking in tight spaces. Multi-camera systems offer superior accuracy and a 360-degree view, making parking assist systems highly desirable. Furthermore, the integration of automated parking features in mid-range and luxury vehicles is boosting the adoption of these systems, catering to consumer demands for convenience and safety.

The blind spot detection segment is expected to grow at a significant CAGR from 2024 to 2033. Blind spot detection systems significantly reduce the risk of accidents by alerting drivers to vehicles or obstacles in their blind spots. As safety regulations become more stringent worldwide, automakers are compelled to integrate these systems into their vehicles. The growing consumer awareness and demand for safer driving experiences further propel the adoption of blind spot detection technology. Technological advancements in multi-camera systems, which enhance the accuracy and reliability of blind spot detection, also contribute to the segment's growth, making these systems a standard feature in modern vehicles.

By Vehicle

By View

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others