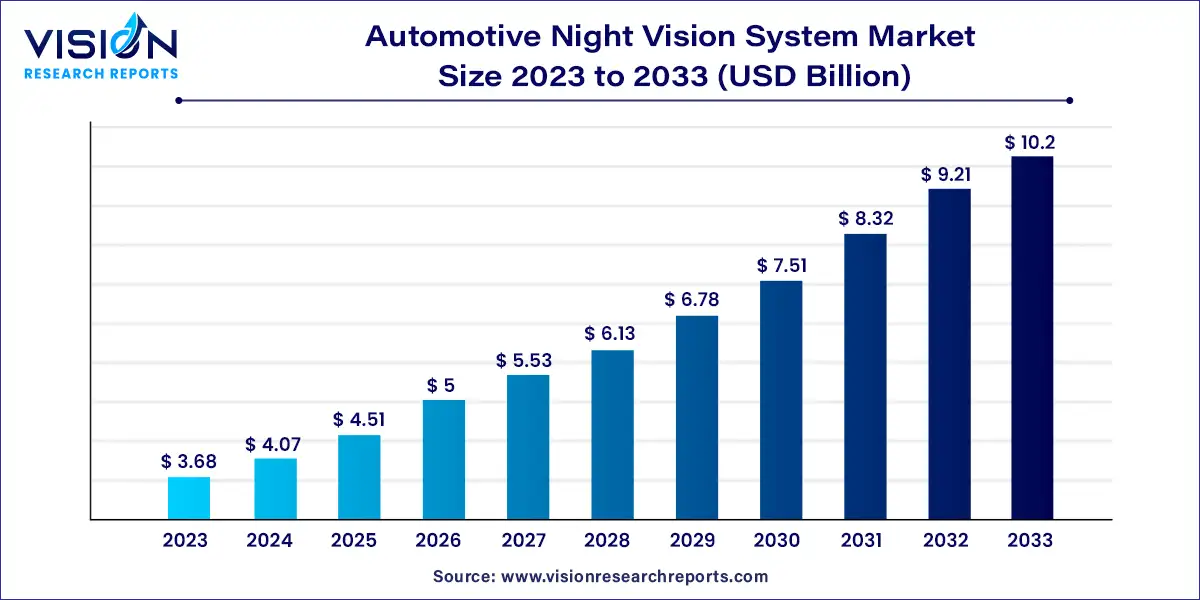

The global automotive night vision system market size was estimated at USD 3.68 billion in 2023 and it is expected to surpass around USD 10.2 billion by 2033, poised to grow at a CAGR of 10.73% from 2024 to 2033. Automotive night vision systems (ANVS) have rapidly evolved from niche luxury features to mainstream safety components in modern vehicles. Designed to enhance driver visibility in low-light conditions, these systems use advanced technologies to detect and display images of objects, animals, and pedestrians beyond the reach of standard headlights.

The growth of the automotive night vision system market is primarily driven by an increasing emphasis on road safety and the rising adoption of advanced driver assistance systems (ADAS). Night vision systems enhance visibility in low-light conditions, significantly reducing the risk of accidents caused by poor visibility at night. This safety benefit has made night vision systems a critical component in high-end luxury vehicles and is now gaining traction in mid-range and even some entry-level cars as the technology becomes more affordable. Furthermore, technological advancements in thermal imaging and infrared sensors have improved the accuracy and reliability of night vision systems, making them more attractive to both manufacturers and consumers. In addition, growing consumer awareness about vehicle safety features and the increasing implementation of stringent government regulations to improve road safety are further propelling the demand for night vision systems in the automotive industry.

The North America automotive night vision system market led the global market in 2023, with a revenue share of 34%. The market in this region has a significant focus on premium and luxury vehicles, where advanced safety features are highly valued. Night vision systems are frequently included in option packages for these high-end vehicles, appealing to consumers who are willing to invest in cutting-edge technology for enhanced safety and comfort.

| Attribute | North America |

| Market Value | USD 1.25 Billion |

| Growth Rate | 10.75% CAGR |

| Projected Value | USD 3.46 Billion |

The automotive night vision system market in Europe is expected to see significant growth from 2024 to 2033. Europe is at the forefront of developing and testing autonomous and semi-autonomous vehicles, which heavily rely on advanced sensor technologies to operate safely. Night vision systems are crucial for these vehicles to function effectively in low-light conditions, ensuring comprehensive situational awareness.

The automotive night vision system market in the Asia Pacific region is anticipated to grow at the highest compound annual growth rate (CAGR) from 2024 to 2033. Rapid urbanization and the increasing rate of vehicle ownership in the region are driving the demand for advanced automotive safety technologies, including night vision systems.

The Far Infrared (FIR) segment led the market in 2023, accounting for a 61% share of global revenue. FIR technology provides superior detection capabilities, especially in low-light or no-light environments. Unlike near-infrared or visible light cameras, FIR sensors detect thermal radiation emitted by objects, making them highly effective in identifying living beings such as pedestrians, animals, and cyclists, even in complete darkness. This capability to detect heat signatures regardless of lighting conditions offers a significant safety advantage, particularly when traditional headlights and cameras may not suffice.

The Near-Infrared (NIR) segment is expected to experience substantial growth from 2024 to 2033. This growth is driven by NIR's enhanced performance in adverse weather conditions compared to traditional visible-light cameras and thermal imaging systems. NIR technology can penetrate rain, fog, and snow more effectively, delivering clearer images in challenging weather. This ability is particularly valuable in regions with harsh weather conditions, where nighttime visibility is often compromised.

The night vision camera segment was the market leader in 2023, largely due to rapid advancements in camera technology. Modern night vision cameras have become increasingly sophisticated, offering higher resolution, improved sensitivity to low light, and enhanced image processing capabilities. These advancements enable more accurate and precise detection of objects, pedestrians, and animals during low-light or nighttime driving conditions.

The display unit segment is expected to see significant growth from 2024 to 2033. The integration of display units with advanced infotainment and driver assistance systems is a major factor driving this growth. Contemporary vehicles are often equipped with advanced infotainment systems that provide a range of information, from navigation to vehicle diagnostics. Integrating night vision system data into these displays makes it easier for drivers to access crucial safety information without diverting their attention from the road.

The passenger vehicles segment dominated the market in 2023. The inclusion of advanced features such as night vision systems can enhance the resale value of passenger cars. Vehicles equipped with such safety technologies are often perceived as more valuable and appealing, potentially leading to higher resale prices. For both consumers and manufacturers, night vision systems represent an investment in the vehicle’s long-term value, encouraging automakers to offer these features more widely, which supports market growth.

The commercial vehicles segment is projected to grow significantly from 2024 to 2033. Operators of commercial vehicles are increasingly recognizing the operational efficiencies and cost savings associated with night vision systems. Enhanced visibility can lead to more efficient driving, reducing the likelihood of accidents and related delays, which improves overall fleet productivity. Additionally, night vision systems can help prevent costly repairs and legal issues stemming from accidents, leading to better operational efficiency and long-term savings for commercial fleets.

By Technology

By Component

By Vehicle

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Night Vision System Market

5.1. COVID-19 Landscape: Automotive Night Vision System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Night Vision System Market, By Technology

8.1. Automotive Night Vision System Market, by Technology

8.1.1 Far Infrared (FIR)

8.1.1.1. Market Revenue and Forecast

8.1.2. Near Infrared (NIR)

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Automotive Night Vision System Market, By Component

9.1. Automotive Night Vision System Market, by Component

9.1.1. Night Vision Camera

9.1.1.1. Market Revenue and Forecast

9.1.2. Controlling Unit

9.1.2.1. Market Revenue and Forecast

9.1.3. Display Unit

9.1.3.1. Market Revenue and Forecast

9.1.4. Sensor

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Automotive Night Vision System Market, By Vehicle

10.1. Automotive Night Vision System Market, by Vehicle

10.1.1. Passenger Vehicles

10.1.1.1. Market Revenue and Forecast

10.1.2. Commercial Vehicles

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Automotive Night Vision System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology

11.1.2. Market Revenue and Forecast, by Component

11.1.3. Market Revenue and Forecast, by Vehicle

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology

11.1.4.2. Market Revenue and Forecast, by Component

11.1.4.3. Market Revenue and Forecast, by Vehicle

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology

11.1.5.2. Market Revenue and Forecast, by Component

11.1.5.3. Market Revenue and Forecast, by Vehicle

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology

11.2.2. Market Revenue and Forecast, by Component

11.2.3. Market Revenue and Forecast, by Vehicle

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology

11.2.4.2. Market Revenue and Forecast, by Component

11.2.4.3. Market Revenue and Forecast, by Vehicle

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology

11.2.5.2. Market Revenue and Forecast, by Component

11.2.5.3. Market Revenue and Forecast, by Vehicle

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology

11.2.6.2. Market Revenue and Forecast, by Component

11.2.6.3. Market Revenue and Forecast, by Vehicle

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology

11.2.7.2. Market Revenue and Forecast, by Component

11.2.7.3. Market Revenue and Forecast, by Vehicle

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology

11.3.2. Market Revenue and Forecast, by Component

11.3.3. Market Revenue and Forecast, by Vehicle

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology

11.3.4.2. Market Revenue and Forecast, by Component

11.3.4.3. Market Revenue and Forecast, by Vehicle

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology

11.3.5.2. Market Revenue and Forecast, by Component

11.3.5.3. Market Revenue and Forecast, by Vehicle

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology

11.3.6.2. Market Revenue and Forecast, by Component

11.3.6.3. Market Revenue and Forecast, by Vehicle

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology

11.3.7.2. Market Revenue and Forecast, by Component

11.3.7.3. Market Revenue and Forecast, by Vehicle

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology

11.4.2. Market Revenue and Forecast, by Component

11.4.3. Market Revenue and Forecast, by Vehicle

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology

11.4.4.2. Market Revenue and Forecast, by Component

11.4.4.3. Market Revenue and Forecast, by Vehicle

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology

11.4.5.2. Market Revenue and Forecast, by Component

11.4.5.3. Market Revenue and Forecast, by Vehicle

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology

11.4.6.2. Market Revenue and Forecast, by Component

11.4.6.3. Market Revenue and Forecast, by Vehicle

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology

11.4.7.2. Market Revenue and Forecast, by Component

11.4.7.3. Market Revenue and Forecast, by Vehicle

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology

11.5.2. Market Revenue and Forecast, by Component

11.5.3. Market Revenue and Forecast, by Vehicle

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology

11.5.4.2. Market Revenue and Forecast, by Component

11.5.4.3. Market Revenue and Forecast, by Vehicle

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology

11.5.5.2. Market Revenue and Forecast, by Component

11.5.5.3. Market Revenue and Forecast, by Vehicle

Chapter 12. Company Profiles

12.1. Robert Bosch GmbH.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Valeo.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. OmniVision.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Lanmodo.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. InfiRay.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Teledyne Technologies Incorporated

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Teledyne FLIR LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Continental AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. HUDWAY

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Autoliv Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others