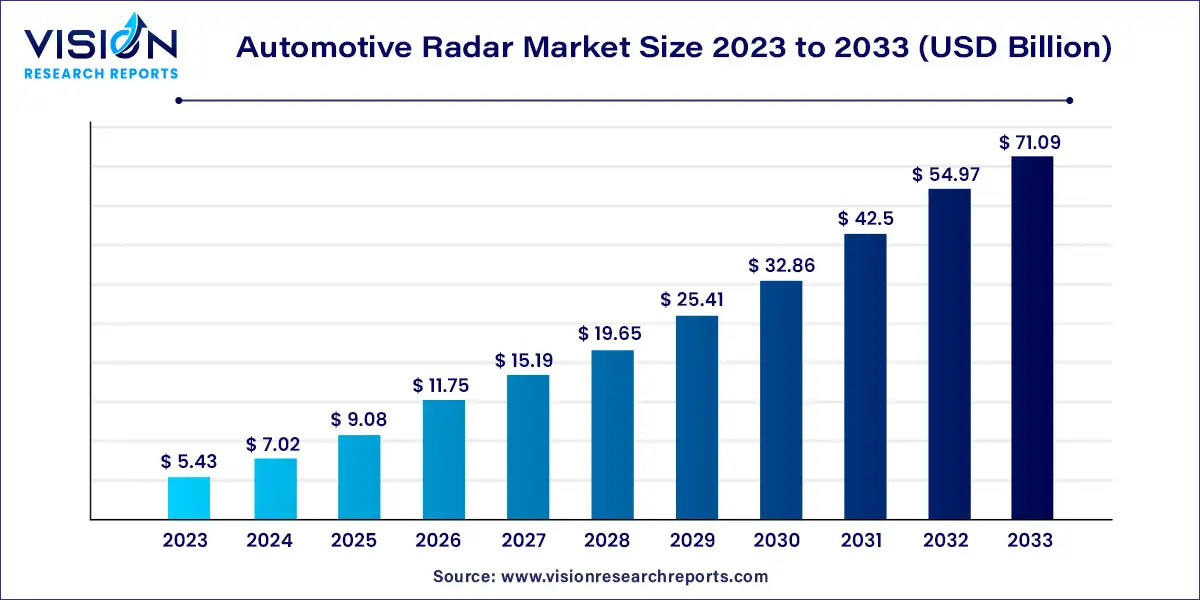

The global automotive radar market size was estimated at USD 5.43 billion in 2023 and it is expected to surpass around USD 71.09 billion by 2033, poised to grow at a CAGR of 29.33% from 2024 to 2033. The automotive radar market is experiencing robust growth, driven by the increasing integration of radar systems into vehicles to enhance safety, support advanced driver assistance systems (ADAS), and facilitate the development of autonomous driving technologies. Radar systems are essential for various applications, including adaptive cruise control, collision avoidance, lane departure warning, and parking assistance.

The growth of the automotive radar market is primarily driven by an advancement in technology and increasing demand for safety features in vehicles. Enhanced radar systems offer improved accuracy and reliability, which are crucial for the development of advanced driver assistance systems (ADAS) and autonomous vehicles. Additionally, stringent regulations and safety standards across global automotive markets are pushing manufacturers to integrate radar technology to meet these requirements. The rise in consumer preference for enhanced safety and convenience features, such as adaptive cruise control and collision avoidance systems, further fuels market expansion. Moreover, continuous innovations in radar technology, including the development of compact and cost-effective radar sensors, are making these systems more accessible and attractive to a broader range of automotive applications.

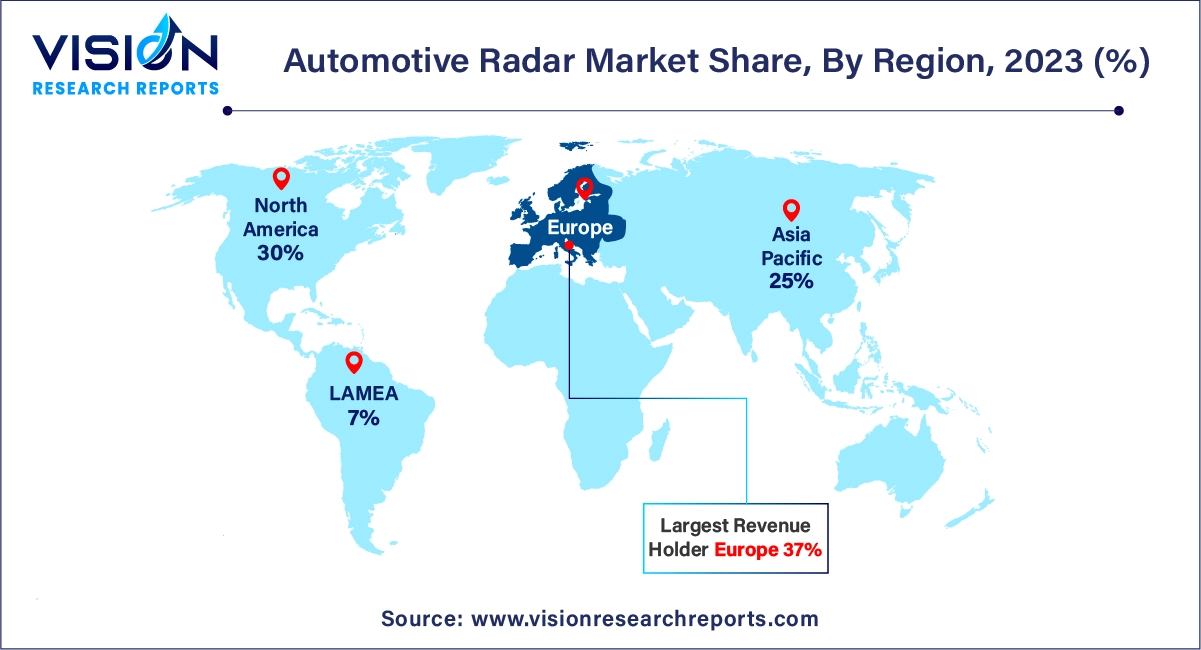

Europe dominated the automotive radar market with a 37% share in 2023. This growth is primarily due to government initiatives in the UK, Germany, and other European nations promoting safe transportation. Strict safety regulations and the EU's General Safety Regulation, which mandates ADAS functions such as automatic emergency braking and lane-keeping assist, are driving the increased demand for radar technology.

| Attribute | Europe |

| Market Value | USD 2.01 Billion |

| Growth Rate | 29.35% CAGR |

| Projected Value | USD 26.30 Billion |

North America emerged as a key market in 2023, influenced by stringent safety regulations, a growing consumer preference for advanced driver assistance systems (ADAS), and an increased focus on automotive radar applications.

The Asia Pacific automotive radar market is expected to grow significantly, driven by rising vehicle ownership and the increasing popularity of electric vehicles in the region. Market growth is further supported by manufacturing activities in China, India, and Japan. As safety concerns rise in India and ASEAN countries, automotive companies are incorporating additional sensors into affordable vehicles, leading to a growing need for vehicle radar sensors.

In 2023, medium and short-range radar technologies led the market, holding a 55% share, and are projected to experience the highest growth rate of 30.32% CAGR in the forecast period. This growth is driven by advancements in features such as rear cross-traffic alerts, adaptive cruise control (ACC), heading distance indicators, and autonomous emergency braking (AEB). Medium-range radar, equipped with Digital Beamforming (DBF) and three to four receiving channels, enhances measurement precision by providing separate channels for various directions.

The 77 GHz frequency range captured the largest revenue share in 2023 and is expected to register the fastest CAGR due to its superior accuracy in object detection and its ability to function effectively in diverse weather conditions. Operating within the 76-81 GHz frequency range, 77 GHz radar is used for short-range applications like adaptive cruise control, collision alerts, and lane departure warnings. Despite its high accuracy, this frequency can be impacted by other vehicle electrical components. Its long range, high resolution, and improved object discrimination are essential for ADAS and autonomous driving systems. The rising emphasis on electric and autonomous vehicles is further fueling the demand for 77 GHz radar.

In 2023, Internal Combustion Engine (ICE) vehicles dominated the market due to their widespread presence. Although electric vehicles (EVs) are growing rapidly, ICE vehicles still constitute the majority on the roads. This extensive fleet provides substantial opportunities for integrating radar technology. Many radar systems were initially developed for ICE vehicles and are being adapted for EVs.

The electric vehicle sector, however, is expected to grow at the highest CAGR over the forecast period, driven by environmental concerns, technological advancements, and government support. Radar systems are crucial for EV safety and autonomous functionalities, and specialized radar solutions are emerging to address unique features such as regenerative braking and weight distribution in EVs.

Adaptive Cruise Control (ACC) led the market in 2023, largely due to stringent government regulations pushing for collision prevention technologies. ACC systems adjust vehicle speed based on the speed of vehicles ahead, using front-mounted radar to detect and respond to traffic conditions. If the system detects the car ahead is out of range, it resumes accelerating to the preset speed without requiring manual intervention.

Forward Collision Warning (FCW) systems are expected to grow at the fastest rate due to the rising frequency of rear-end collisions. FCW systems significantly reduce the risk of such accidents, increasing their demand. Enhanced consumer awareness of safety features and technological advancements in radar, sensors, and cameras are driving this growth. Additionally, government regulations mandating advanced safety systems in new vehicles are further supporting the FCW market.

In 2023, commercial vehicles led the market, driven by the need for enhanced safety measures due to the higher accident risk associated with these vehicles. Radar technology plays a crucial role in improving road safety and preventing collisions for commercial vehicles. The demand for radar-based systems such as adaptive cruise control and collision avoidance is rising due to the need for better fuel efficiency and fleet management. As commercial vehicle fleets expand and operate under varied conditions, the demand for reliable and robust radar technology increases.

The passenger car segment is projected to grow at the fastest rate, driven by the increasing demand for modern safety features. Technologies like lane departure warnings, adaptive cruise control, and blind spot detection are becoming more common in passenger vehicles. The rise in urbanization and traffic congestion is also highlighting the importance of ADAS in enhancing safety and the driving experience.

By Range

By Frequency

By Engine

By Vehicle

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others