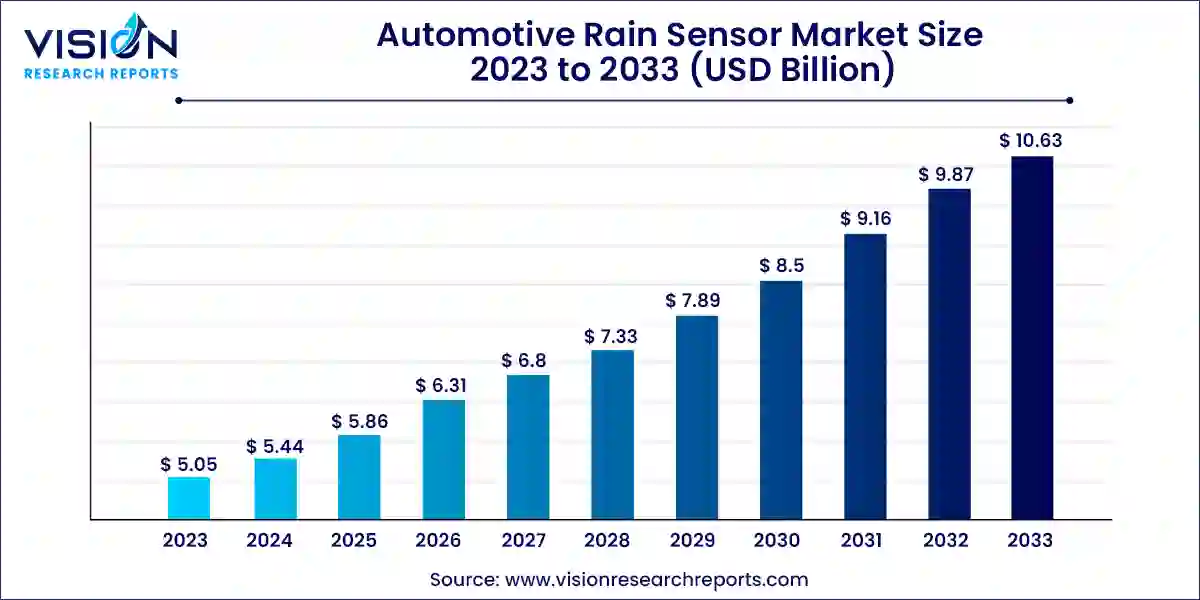

The global automotive rain sensor market size was estimated at around USD 5.05 billion in 2023 and it is projected to hit around USD 10.63 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

The automotive rain sensor market is characterized by its crucial role in enhancing driver safety and convenience. These sensors detect rainfall and automatically activate windshield wipers, thereby improving visibility during adverse weather conditions. The market is driven by increasing vehicle safety regulations and consumer demand for advanced driver assistance systems (ADAS). Key players in the industry are continually innovating to integrate rain sensors seamlessly into vehicles, enhancing their reliability and performance.

The growth of the automotive rain sensor market is fueled by the stringent safety regulations worldwide mandate the integration of advanced driver assistance systems (ADAS), including rain sensors, in vehicles. These regulations aim to enhance driver safety by ensuring optimal visibility during adverse weather conditions. Secondly, rising consumer demand for convenience features in vehicles drives the adoption of rain sensors, which automatically activate windshield wipers based on real-time precipitation detection. Moreover, technological advancements in sensor accuracy and reliability contribute to market expansion, as automakers prioritize robust and efficient sensor solutions.

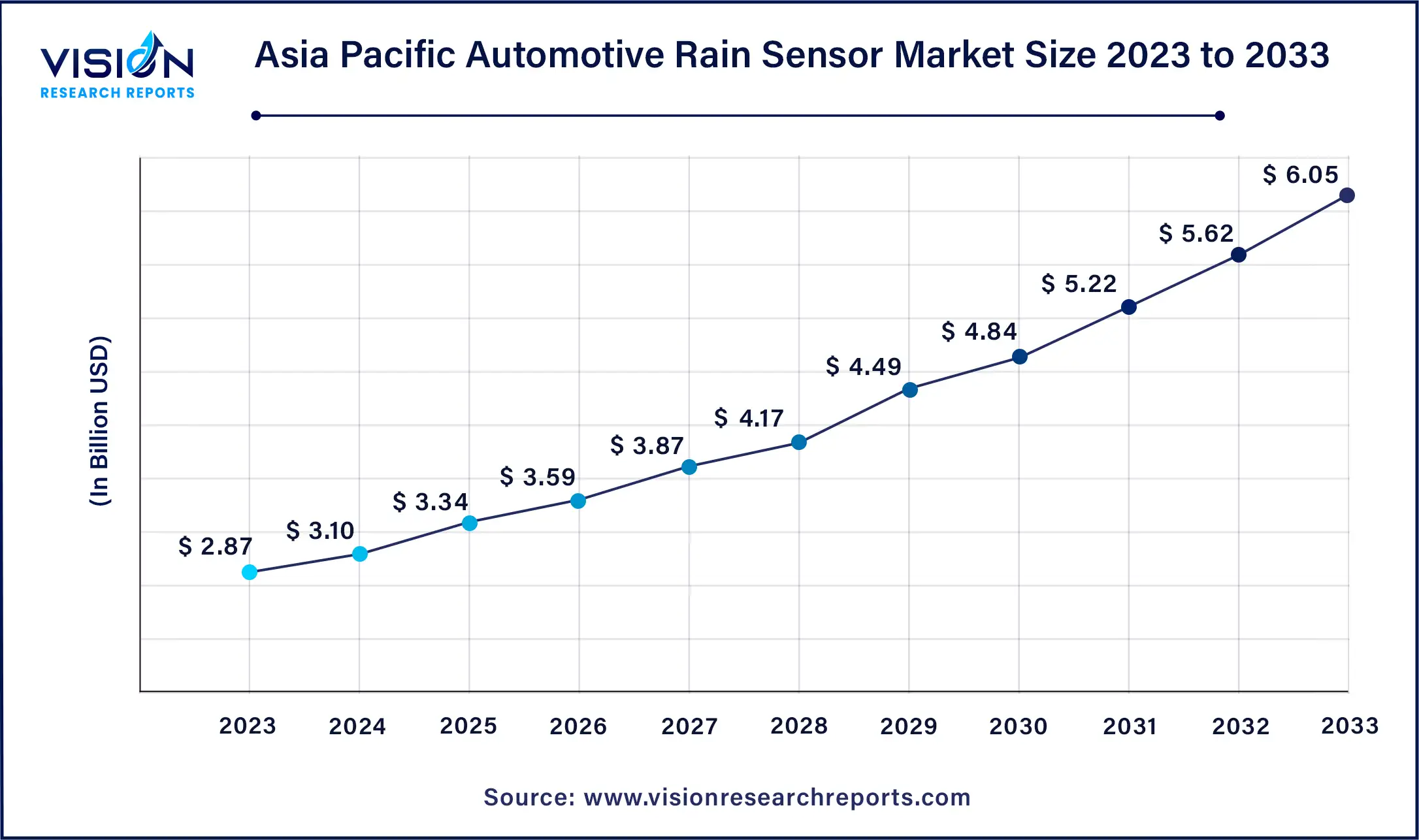

The Asia Pacific automotive rain sensor market size was valued at USD 2.87 billion in 2023 and is anticipated to reach around USD 6.05 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

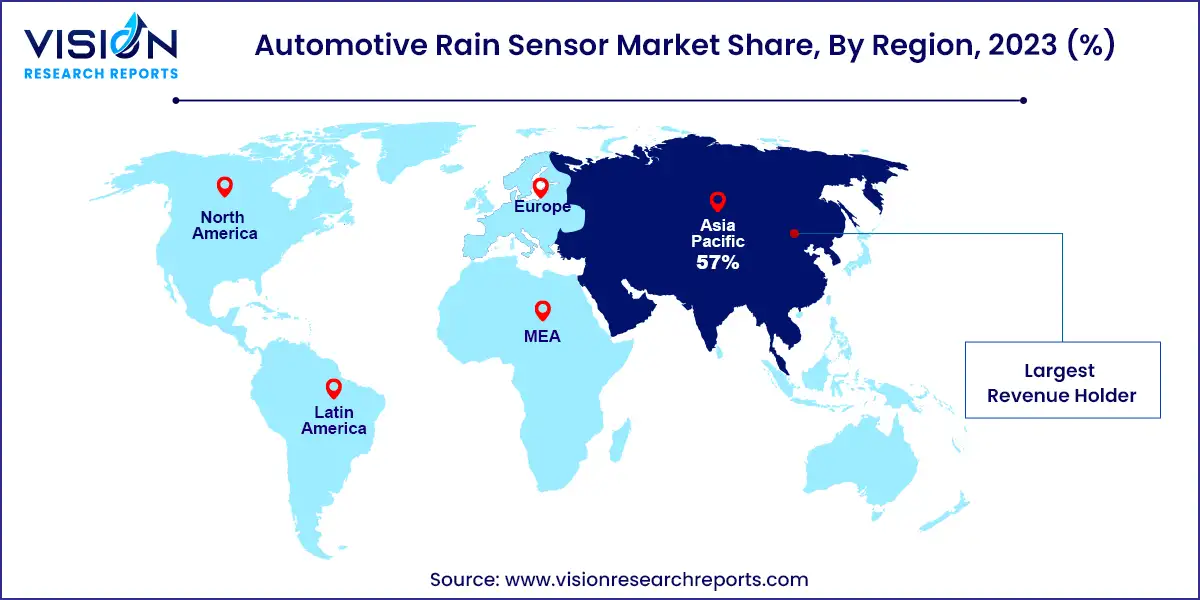

In 2023, the Asia Pacific automotive rain sensor market commanded the largest market share, accounting for 57% of the global market. This dominance is attributed to the region's status as the largest automobile market, particularly driven by robust sales in China and India. The increasing population, rising disposable incomes, and growing demand for advanced safety features are key factors propelling the adoption of automotive rain sensors across Asia Pacific. These sensors play a crucial role in enhancing vehicle safety by automatically activating windshield wipers in response to changing weather conditions, thereby improving road visibility and driver comfort.

The North America automotive rain sensor market is expected to exhibit the fastest CAGR during the forecast period, driven by advancements in autonomous driving technologies. These technological advancements are poised to bolster market growth across the region, further solidifying North America's position in the automotive rain sensor market.

In 2023, the passenger vehicle segment dominated the market with a substantial share of 78%. This growth can be attributed to factors such as increasing global population, rising disposable incomes, and advancements in vehicle technology, particularly autonomous driving assistance systems. These factors have driven consumer demand for passenger vehicles equipped with comfort and convenience features like automatic climate control, panoramic sunroofs, 360° parking cameras, automatic headlights, and rain-sensing wipers.

The commercial vehicle segment is poised to achieve the fastest CAGR during the forecast period. This growth is fueled by escalating demand for enhanced safety features in commercial vehicles. Factors such as rapid industrialization, expansion of e-commerce, infrastructure development, and heightened requirements for goods transportation have significantly bolstered sales in this segment. Rain sensors, for instance, play a crucial role in enhancing road visibility by automatically activating wipers during rain or snow. In May 2023, Volkswagen launched the Amarok in the UK, a new-generation pickup truck boasting a payload capacity of 1.19 tons. The truck includes advanced safety features such as lane keep assist, automatic rain-sensing wipers, and autonomous emergency braking.

In 2023, the OEM segment led the market with the largest revenue share and is projected to maintain a robust growth rate throughout the forecast period. This growth is driven by increased vehicle production, technological advancements, and heightened consumer demand for enhanced safety features.

Conversely, the aftermarket segment is anticipated to grow at the fastest CAGR during the forecast period. Aftermarket manufacturers and suppliers are witnessing rising demand for rain sensors from automobile manufacturers. This demand is fueled by growing consumer awareness of safety features and the cost-effectiveness associated with repairing or replacing rain sensors in the aftermarket. Aftermarket sensors are typically more cost-effective compared to OEM sensors, making them a preferred choice for repair and replacement needs.

By Vehicle Type

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Rain Sensor Market

5.1. COVID-19 Landscape: Automotive Rain Sensor Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Rain Sensor Market, By Vehicle Type

8.1. Automotive Rain Sensor Market, by Vehicle Type, 2024-2033

8.1.1. Passenger Vehicle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Vehicle

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Light Commercial Vehicle

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Heavy Commercial Vehicle

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Rain Sensor Market, By Sales Channel

9.1. Automotive Rain Sensor Market, by Sales Channel, 2024-2033

9.1.1. OEM

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Aftermarket

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Rain Sensor Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 11. Company Profiles

11.1. HELLA GmbH & Co. KGaA

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. MITSUBISHI MOTORS CORPORATION.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Hamamatsu Photonics K.K.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Valeo SA

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. KOSTAL Automobil Elektrik GmbH & Co. KG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DENSO ELECTRONICS CORPORATION

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. TOYOTA MOTOR CORPORATION.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. General Motors

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Volkswagen Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Daimler Truck AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others