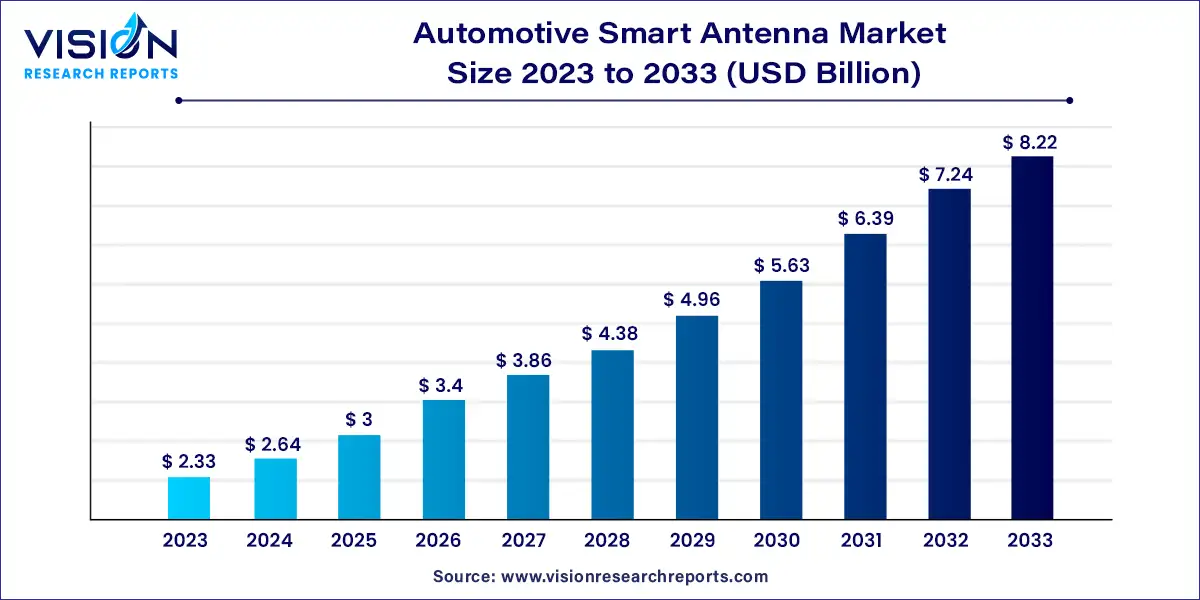

The global automotive smart antenna market size was estimated at USD 2.33 billion in 2023 and it is expected to surpass around USD 8.22 billion by 2033, poised to grow at a CAGR of 13.43% from 2024 to 2033. The automotive industry is witnessing a transformative shift with the integration of smart technologies, and smart antennas are at the forefront of this evolution. These advanced antennas are revolutionizing vehicle connectivity by enhancing communication capabilities and enabling seamless integration with external networks.

The growth of the automotive smart antenna market is driven by several key factors. Increasing consumer demand for connected vehicles and advanced infotainment systems has propelled the adoption of smart antennas, which enhance communication capabilities and support seamless integration with external networks. The integration of 5G technology in automotive applications is another significant driver, requiring robust antennas capable of high-speed data transmission and low-latency communication. Additionally, advancements in vehicle-to-everything (V2X) communication systems and regulatory mandates promoting vehicle safety and connectivity further contribute to market expansion. As automakers continue to prioritize innovation in vehicle design and connectivity, the automotive smart antenna market is expected to witness continued growth in the coming years.

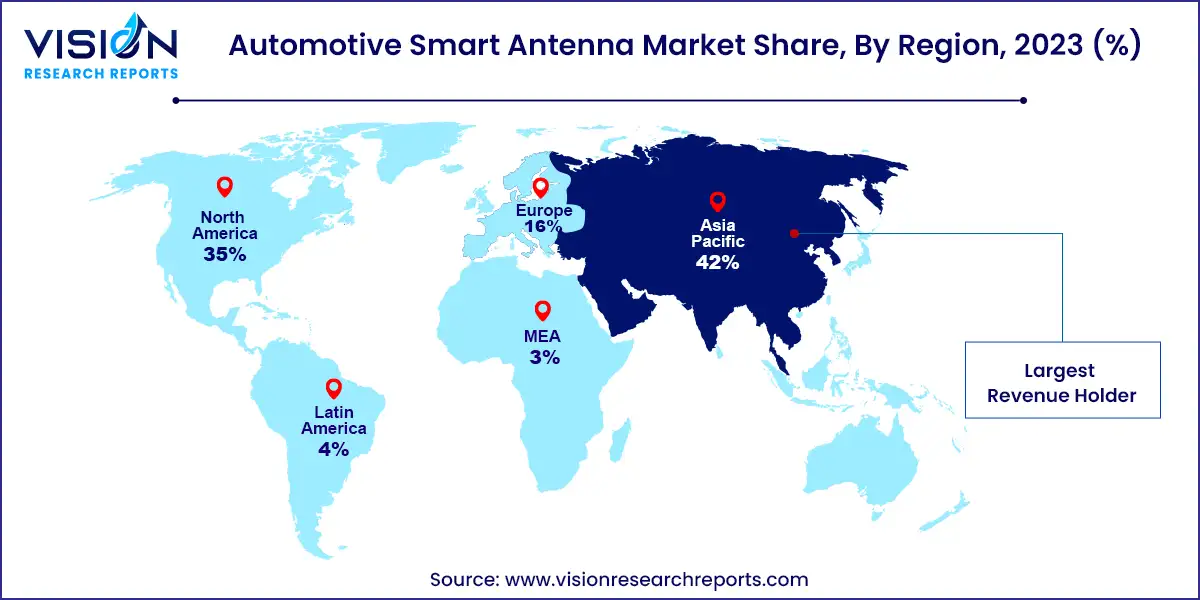

Asia Pacific dominated the automotive smart antenna market with a revenue share exceeding 42% in 2023. The region's automotive industry is expanding rapidly, particularly in countries like China, Japan, India, and South Korea. With increasing automotive manufacturing capacities and a strong presence of global and domestic automakers, Asia Pacific is a pivotal hub for market growth. The rising demand for connected vehicles in this region presents lucrative opportunities for smart antenna adoption.

| Attribute | Asia Pacific |

| Market Value | USD 0.97 Billion |

| Growth Rate | 13.52% CAGR |

| Projected Value | USD 3.45 Billion |

India's automotive smart antenna market is expected to exhibit notable growth from 2024 to 2033. Increasing consumer spending on connected vehicles due to rising disposable incomes and the presence of numerous automotive manufacturers are driving market expansion in the country.

North America's automotive smart antenna market is poised for significant growth between 2024 and 2033. This growth is driven by increasing consumer demand for vehicles equipped with advanced connectivity, infotainment systems, and seamless smartphone integration. The region's tech-savvy population favors smart technologies, bolstering demand for advanced automotive features. Furthermore, North America boasts a robust presence of leading technology firms and automakers, enhancing growth prospects for the regional market.

The U.S. automotive smart antenna market is projected to grow at a notable rate of over 11.03% from 2024 to 2033. This growth is attributed to technological advancements and rising consumer preference for connected cars and advanced infotainment. The proliferation of electric and autonomous vehicles further contributes to market expansion in the country.

Passenger Vehicles Segment held the largest revenue share of approximately 75% in 2023, driven by growing consumer preference for cars equipped with advanced navigation, infotainment systems, and seamless connectivity features reliant on robust antenna systems. Regulatory mandates for vehicle safety and emissions reduction are also promoting the integration of advanced antenna technologies in passenger vehicles.

Commercial Vehicles Segment anticipated to register the highest CAGR of over 15.03% from 2024 to 2033. Commercial vehicles, essential for logistics and transportation, increasingly rely on advanced communication systems for fleet management. Upgrading antennas in commercial vehicles enhances real-time tracking, monitoring, and operational efficiency, driving market growth.

Non-Electric Propulsion Segment dominated the market in 2023, favored for its lower upfront costs compared to electric vehicles and widespread availability of gasoline and diesel fueling infrastructure globally.

Electric Propulsion Segment expected to witness the fastest CAGR from 2024 to 2033. The rising popularity of electric vehicles, driven by environmental concerns, technological advancements, and changing consumer preferences, necessitates sophisticated communication systems, thereby boosting demand for smart antennas.

OEM Segment held the largest market share in 2023, preferred for its adherence to industry standards and rigorous quality control measures. OEMs invest in research and development to innovate antenna technology, ensuring products remain competitive in performance and functionality.

Aftermarket Segment expected to grow at the fastest CAGR from 2024 to 2033. Offering a diverse range of automotive antennas, including upgraded technologies for older vehicle models, aftermarket channels cater to varied consumer preferences and vehicle requirements.

Ultra-High Frequency Segment led the market in 2023, driven by demand for vehicles with sophisticated infotainment systems requiring reliable high-speed data transmission. Ultra-high frequency antennas support diverse applications like digital radio and in-car internet services, enhancing road safety and traffic management.

Very High Frequency Segment projected to grow significantly from 2024 to 2033. Very high frequency antennas facilitate FM radio reception and communication with emergency services, contributing to enhanced vehicle safety and responsiveness.

By Vehicle

By Propulsion

By Sales Channel

By Frequency

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Smart Antenna Market

5.1. COVID-19 Landscape: Automotive Smart Antenna Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Smart Antenna Market, By Vehicle

8.1. Automotive Smart Antenna Market, by Vehicle, 2024-2033

8.1.1. Passenger Vehicles

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Vehicles

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Smart Antenna Market, By Propulsion

9.1. Automotive Smart Antenna Market, by Propulsion, 2024-2033

9.1.1. Electric

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Non-electric

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Smart Antenna Market, By Sales Channel

10.1. Automotive Smart Antenna Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Smart Antenna Market, By Frequency

11.1. Automotive Smart Antenna Market, by Frequency, 2024-2033

11.1.1. High

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Very High

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Ultra-high

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Automotive Smart Antenna Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Frequency (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Frequency (2021-2033)

Chapter 13. Company Profiles

13.1. Continental AG

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DENSO Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. HARADA INDUSTRY CO., LTD.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. TE Connectivity Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Yokowo Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. HELLA GmbH & Co. KGaA

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Laird Technologies, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Schaffner Holding AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. NXP Semiconductors N.V.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. FICOSA Group

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others