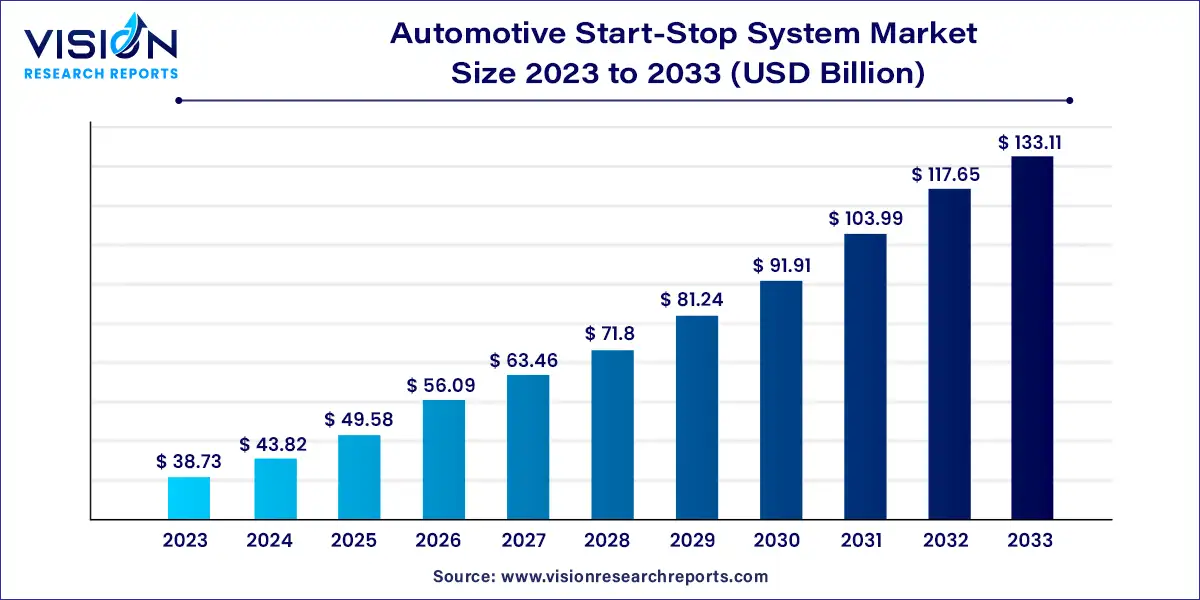

The global automotive start-stop system market size was estimated at USD 38.73 billion in 2023 and it is expected to surpass around USD 133.11 billion by 2033, poised to grow at a CAGR of 13.14% from 2024 to 2033. An automotive start-stop system automatically shuts down and restarts the internal combustion engine to reduce the amount of time the engine spends idling, thereby saving fuel and reducing emissions. This system is predominantly used in vehicles with internal combustion engines (ICEs) and is increasingly being integrated into hybrid vehicles.

The growth of the automotive start-stop system market is primarily driven by an increasing demand for fuel-efficient vehicles and the stringent emission regulations being enforced globally. As governments push for lower carbon footprints, automakers are compelled to integrate technologies like start-stop systems to meet these standards. Additionally, rising fuel prices and consumer awareness about the benefits of fuel-saving technologies further bolster the market's expansion. Technological advancements in battery systems, particularly in absorbent glass mat (AGM) and enhanced flooded battery (EFB) technologies, are also key factors contributing to the increased adoption of start-stop systems in modern vehicles.

Europe dominated the market with a 35% share in 2023, driven by stringent emissions regulations and the European Union's commitment to reducing carbon footprints. European consumers are increasingly adopting start-stop systems for their environmental benefits, such as lower CO2 emissions and improved fuel efficiency. The region's robust automotive industry, characterized by leading car manufacturers and high technological innovation, supports market growth. The rising demand for hybrid and electric vehicles, which frequently feature start-stop systems, further propels the market in Europe.

| Attribute | Europe |

| Market Value | USD 13.55 Billion |

| Growth Rate | 13.16% CAGR |

| Projected Value | USD 46.58 Billion |

Asia Pacific Automotive Start-Stop System Market Trends

Asia Pacific is experiencing rapid growth due to the booming automotive industry in countries like China, Japan, and India. Rising urbanization and vehicle ownership rates are driving demand for fuel-efficient technologies to address traffic congestion and reduce fuel costs. Government policies aimed at lowering vehicular emissions and the increasing adoption of electric and hybrid vehicles are also key drivers. Additionally, the presence of major automotive manufacturers and a strong focus on technological innovation in the region are fueling market growth.

North America Automotive Start-Stop System Market Trends

The North America Automotive Start-Stop System Market is projected to grow at a CAGR of 13.04% from 2024 to 2033. This growth is fueled by stringent fuel efficiency and emission regulations enforced by agencies like the Environmental Protection Agency (EPA). Rising consumer demand for fuel-efficient vehicles, driven by increasing fuel prices and environmental concerns, is prompting automakers to incorporate start-stop systems. The region's established automotive industry and growing popularity of hybrid and electric vehicles further support market expansion.

In 2023, the two-wheelers segment held the largest market share, exceeding 47%. This prominence stems from the growing need for fuel efficiency and emission reduction in urban settings, where two-wheelers are a common transportation choice. Integrating start-stop systems in two-wheelers helps reduce fuel consumption during idle periods and lowers carbon emissions. Additionally, advancements in scooter and motorcycle technologies, combined with government regulations aimed at reducing vehicular pollution, have accelerated the adoption of start-stop systems in this segment. Manufacturers are increasingly focusing on improving the efficiency and reliability of these systems, which is expected to maintain the segment's significant market share in the future.

The commercial vehicle segment is projected to experience substantial growth from 2024 to 2033. This expansion is driven by the sector's shift towards more sustainable and cost-effective solutions. Fleet operators and logistics companies are focusing on reducing fuel costs and meeting stringent emission standards. Start-stop systems, which conserve fuel during frequent stops and starts, are particularly beneficial for trucks and buses operating in congested urban areas. The push towards green transportation and the rise of hybrid and electric commercial vehicles are also boosting demand for these systems, promising continued market growth driven by technological advancements and regulatory pressures.

In 2023, the internal combustion engine (ICE) segment dominated the market with a 76% share. This dominance is due to the widespread use of ICE vehicles, which still make up the majority of the global automotive fleet. Start-stop systems are especially advantageous for ICE vehicles as they reduce fuel consumption and emissions by automatically shutting off the engine during idle periods and restarting it when needed. The established infrastructure for ICE vehicles and their lower cost compared to electric vehicles contribute to the ongoing demand for start-stop systems in this segment. Stringent emission regulations in many countries also encourage automakers to adopt this technology.

The electric segment is expected to see significant growth from 2024 to 2033, driven by the rapid adoption of electric vehicles, government incentives, and advancements in battery technology. While traditional start-stop systems are not applicable to pure electric vehicles, similar energy-saving mechanisms are used in hybrid vehicles that combine ICE and electric powertrains. The expanding hybrid market, which bridges the gap between ICE vehicles and fully electric models, has increased the demand for start-stop systems. Furthermore, the shift towards electrification in the automotive industry is leading to innovations in start-stop technology, making it more efficient and adaptable to various powertrain configurations.

In 2023, the OEM segment captured the largest revenue share due to the integration of start-stop systems into new vehicle models. As fuel efficiency and emission reduction become critical for automotive manufacturers, OEMs are increasingly incorporating start-stop technology to meet regulatory standards and consumer demands. This system, which automatically stops and restarts the engine to minimize idling time, has become a standard feature in many new vehicles, especially in regions with strict emission regulations. OEMs benefit from economies of scale and the ability to seamlessly integrate advanced start-stop systems into vehicle designs, securing a leading position in the market.

The aftermarket segment is expected to grow at the fastest CAGR of 14.03% during the forecast period. This growth is driven by rising interest in retrofitting existing vehicles with fuel-saving start-stop technology. As consumers become more aware of the benefits of start-stop systems, such as improved fuel efficiency and reduced emissions, there is increased demand for upgrading older vehicles. The aftermarket is responding by offering a range of start-stop system solutions compatible with various vehicle models. Technological advancements and the availability of cost-effective options are making it easier for vehicle owners to access these systems, and this trend is expected to continue as more drivers seek to enhance vehicle efficiency and environmental performance without buying new cars.

By Propulsion Type

By Vehicle Type

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Propulsion Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Start-Stop System Market

5.1. COVID-19 Landscape: Automotive Start-Stop System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Start-Stop System Market, By Propulsion Type

8.1. Automotive Start-Stop System Market, by Propulsion Type, 2024-2033

8.1.1 ICE

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electric

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Start-Stop System Market, By Vehicle Type

9.1. Automotive Start-Stop System Market, by Vehicle Type, 2024-2033

9.1.1. Two wheelers

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Passenger Cars

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Commercial Vehicle

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Start-Stop System Market, By Sales Channel

10.1. Automotive Start-Stop System Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftersales

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Start-Stop System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Continental AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Denso Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Robert Bosch GmbH.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BorgWarner Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hitachi Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Volvo Cars Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Valeo.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Maxwell technologies Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Schaeffler Technologies AG & Co. KG.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others