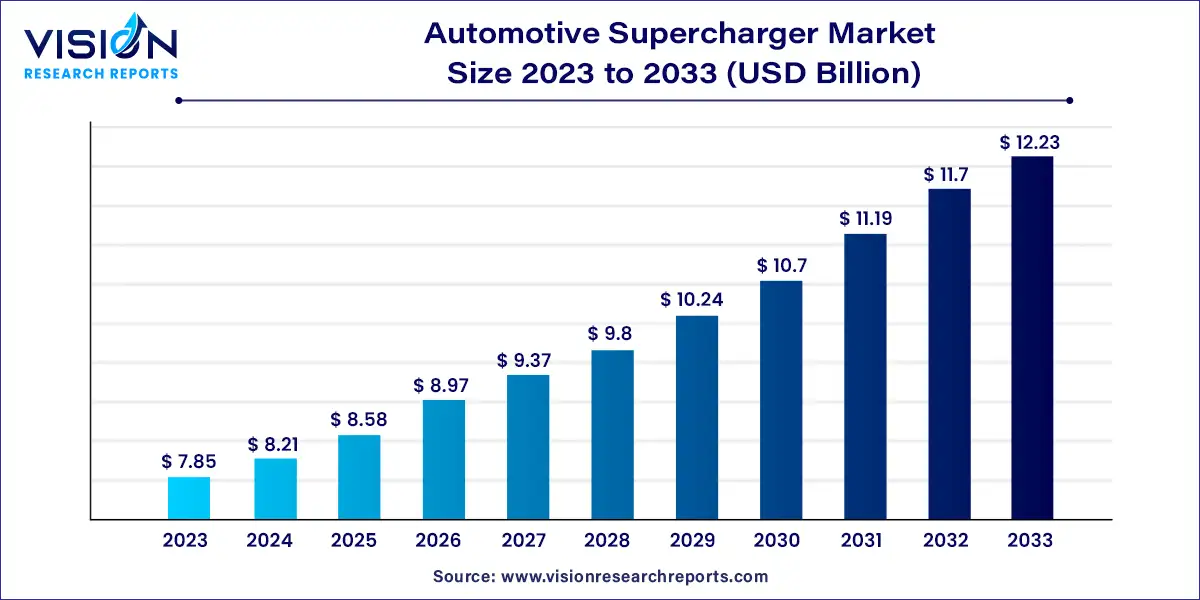

The global automotive supercharger market size was estimated at USD 7.85 billion in 2023 and it is expected to surpass around USD 12.23 billion by 2033, poised to grow at a CAGR of 4.53% from 2024 to 2033.

The automotive supercharger market is an integral segment of the automotive industry, characterized by the increasing demand for enhanced engine performance, fuel efficiency, and stringent emission norms. Superchargers are air compressors that boost the intake air pressure of an internal combustion engine, providing more oxygen to support combustion, thereby enhancing engine power and performance.

The growth of the automotive supercharger market is propelled by an increasing demand for enhanced engine performance in sports and luxury vehicles is a significant driver. Superchargers, known for their ability to boost engine power without the lag associated with turbochargers, are becoming increasingly popular among performance enthusiasts. Additionally, stringent emission regulations worldwide are pushing manufacturers to adopt technologies that improve fuel efficiency and reduce emissions, making superchargers a favorable option. Technological advancements, such as the development of electric superchargers, are also playing a crucial role in market expansion by offering improved performance and efficiency.

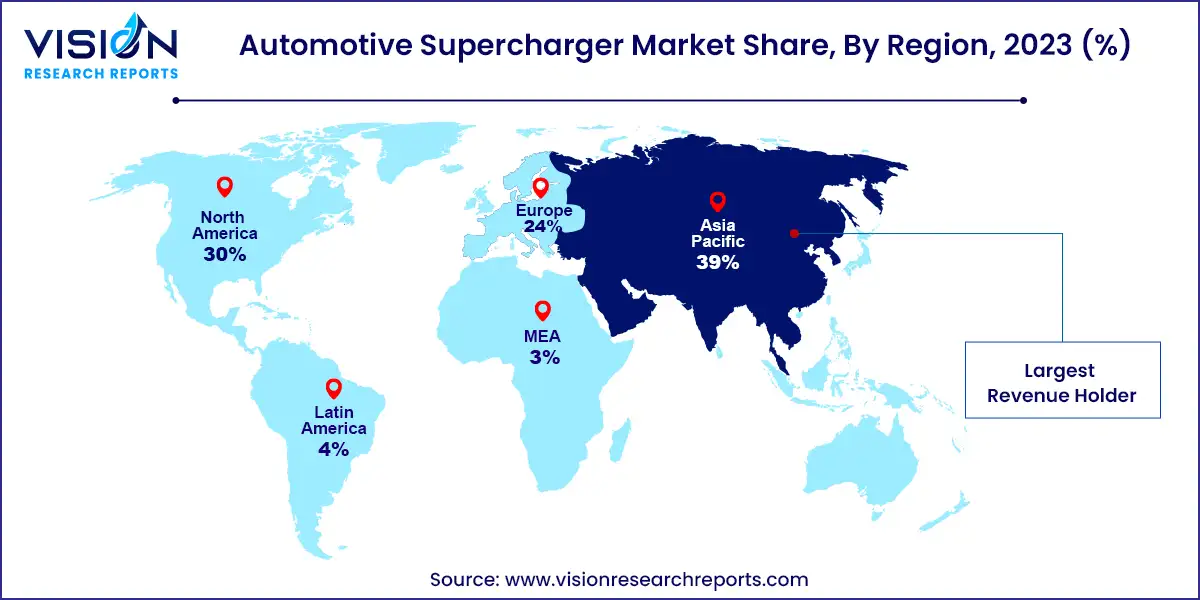

The Asia Pacific automotive supercharger market dominated the market in 2023, accounting for a revenue share of 39%. The segment is propelled by rapid industrialization and the growing automotive industry in countries like China, Japan, and India. Increasing disposable income and a rising middle-class population lead to higher demand for high-performance vehicles. The focus on reducing vehicular emissions and improving fuel efficiency drives the adoption of superchargers in the region. Government policies promoting green technologies and the presence of key automotive manufacturers contribute to market growth.

| Attribute | Asia Pacific |

| Market Value | USD 3.06 Billion |

| Growth Rate | 4.53% CAGR |

| Projected Value | USD 4.76 Billion |

The North American automotive supercharger market is expected to grow at a CAGR of 3.93% from 2024 to 2033. The region's robust automotive industry, coupled with a strong consumer preference for high-performance vehicles, fuels the demand for superchargers. Technological advancements and the presence of leading automotive manufacturers further bolster market growth. Additionally, stringent emission regulations have prompted automakers to adopt superchargers to enhance engine efficiency and reduce emissions. The growing trend of vehicle customization and the popularity of motorsports also contribute significantly to the segment's expansion in North America.

Europe Automotive Supercharger Market Trends

The European automotive supercharger market is characterized by rapid growth due to the region's stringent emission norms and fuel efficiency standards. The European Union’s regulations to curb carbon emissions drive automakers to integrate superchargers into their vehicle designs to enhance performance while meeting environmental standards. The presence of leading automotive manufacturers and a well-established automotive industry in countries like Germany, France, and Italy supports market expansion.

Among the various technologies, the centrifugal supercharger segment dominated the market in 2023, holding a market share of 52%. Centrifugal superchargers are highly favored in diverse automotive applications, ranging from high-performance sports cars to everyday passenger vehicles. Their popularity stems from their ability to provide a consistent power boost without the significant lag often associated with other supercharger types. Additionally, centrifugal superchargers are typically more compact and lighter, making them an attractive option for manufacturers aiming to enhance engine performance without adding excessive weight.

The twin-supercharger segment is expected to register significant growth over the forecast period. Twin superchargers combine the benefits of both centrifugal and positive displacement superchargers, offering a unique advantage by providing immediate power at low engine speeds and sustained boost at higher RPMs. This dual capability makes them ideal for high-performance and luxury vehicles, where seamless power delivery is crucial. Advances in technology and engineering have also made twin superchargers more reliable and cost-effective, contributing to their rising adoption.

Among the different vehicle types, the passenger vehicle segment held the largest market share in 2023. The increased demand for high performance and improved fuel efficiency among passenger car owners has driven the adoption of superchargers. These devices enable engines to produce more power without increasing engine size, appealing to consumers seeking high-performance vehicles. The growing popularity of sports cars and luxury vehicles, which often come equipped with superchargers, has also contributed to the segment's dominance. Furthermore, advancements in supercharger technology have made these systems more efficient and reliable, enhancing their appeal in the passenger vehicle market. Consequently, the passenger vehicle segment continues to hold a substantial share of the automotive supercharger market.

The commercial vehicle segment also demonstrates significant demand for superchargers, driven by the need for powerful and efficient engines in vehicles transporting heavy loads and covering long distances. Superchargers help commercial vehicles achieve better performance by increasing engine power and efficiency, essential for meeting the rigorous demands of commercial operations. Additionally, stringent emission regulations have prompted the adoption of superchargers as they optimize fuel combustion, thereby reducing emissions.

Among the sales channels, the OEM segment held the largest market share in 2023, due to the preference of automobile manufacturers for incorporating superchargers directly into their vehicle designs. This trend is driven by the growing emphasis on enhancing vehicle performance and efficiency, meeting stringent emission standards, and providing a better driving experience. OEM superchargers are designed to seamlessly integrate with the vehicle’s engine, ensuring optimal performance and reliability. Major automotive companies invest heavily in research and development to produce advanced supercharger systems that deliver superior power, fuel efficiency, and reduced emissions.

The aftermarket segment is anticipated to register significant growth over the forecast period, driven by the rising demand among car enthusiasts and performance-driven consumers for vehicle customization and enhancement. Unlike OEM superchargers, aftermarket superchargers allow vehicle owners to upgrade their existing engines to achieve higher power outputs and improved acceleration. This segment benefits from a broad range of products tailored to various vehicle models and performance needs, offering greater flexibility and choice for consumers.

By Vehicle

By Technology

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vehicle Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Supercharger Market

5.1. COVID-19 Landscape: Automotive Supercharger Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Supercharger Market, By Vehicle

8.1. Automotive Supercharger Market, by Vehicle, 2024-2033

8.1.1 Passenger Vehicle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Vehicle

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Supercharger Market, By Technology

9.1. Automotive Supercharger Market, by Technology, 2024-2033

9.1.1. Centrifugal Supercharger

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Twin Supercharger

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Root Supercharger

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Supercharger Market, By Sales Channel

10.1. Automotive Supercharger Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Supercharger Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.2.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.3.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vehicle (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Mitsubishi Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Eaton.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IHI Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Federal Mogul Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ford Motor Company.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mercedes-Benz Group AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Honeywell International Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Vortech Superchargers

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. A&A Corvette Performance, Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Koenigsegg Automotive AB

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others