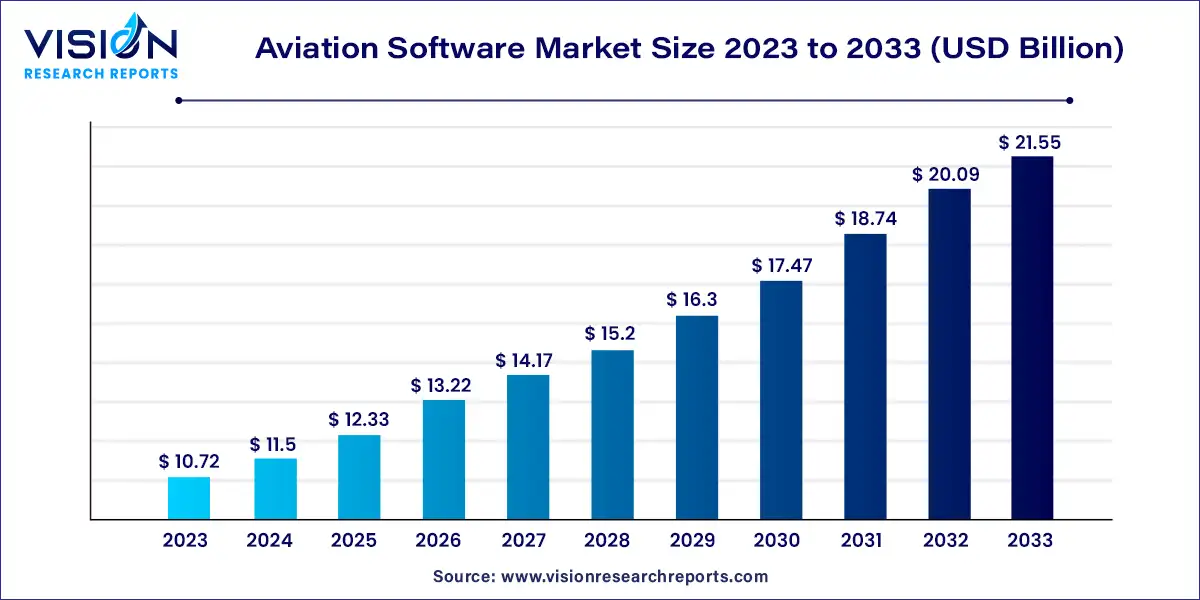

The global aviation software market size was estimated at around USD 10.72 billion in 2023 and it is projected to hit around USD 21.55 billion by 2033, growing at a CAGR of 7.23% from 2024 to 2033. The aviation software market encompasses a diverse range of applications and technologies designed to enhance the efficiency, safety, and operational capabilities of the aviation industry. This market includes software solutions for flight management, air traffic control, maintenance, and more, catering to airlines, airports, and aerospace companies.

The aviation software market is poised for substantial growth fueled by the technological advancements play a crucial role, with innovations such as artificial intelligence and big data analytics enhancing the capabilities of aviation software. These technologies enable more efficient flight management, predictive maintenance, and real-time decision-making, significantly improving operational efficiency. Additionally, the increasing volume of global air traffic necessitates sophisticated software solutions to manage complex logistics and enhance safety protocols. Airlines and airports are investing heavily in software to streamline operations, reduce costs, and provide a better passenger experience.

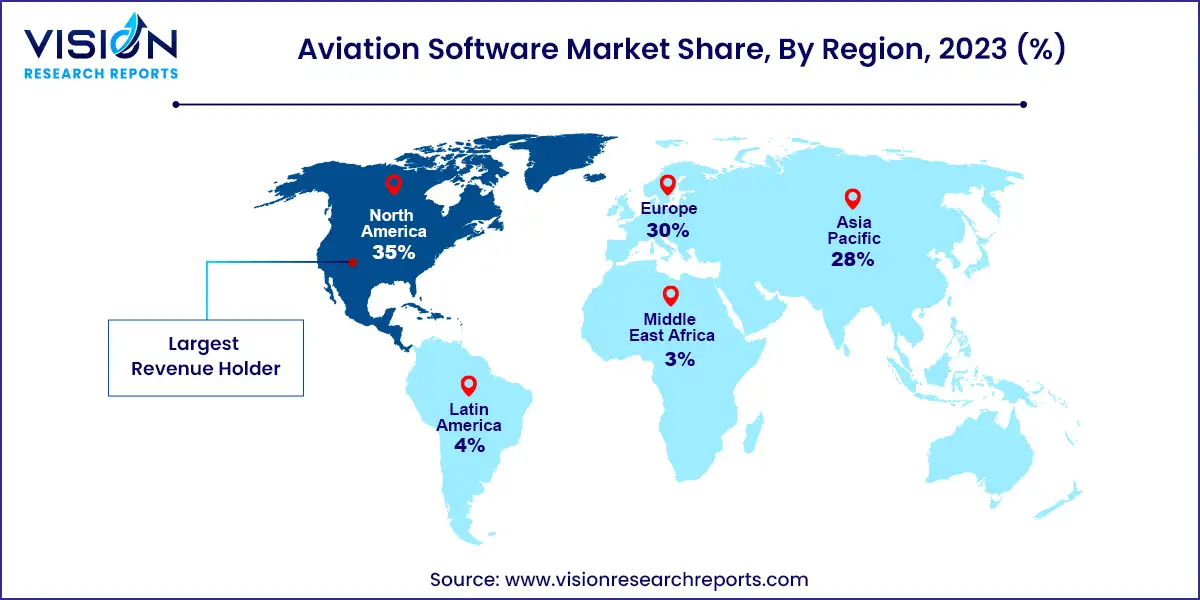

In 2023, North America held a significant revenue share of 36% in the aviation software market. The region is experiencing strong growth, supported by the adoption of advanced technologies like AI, IoT, and big data analytics. The focus on improving operational efficiency, passenger experience, and safety is driving demand for innovative software solutions. Additionally, the presence of major aviation software companies and robust aviation infrastructure in the United States and Canada are key factors contributing to market expansion.

| Attribute | North America |

| Market Value | USD 3.75 Billion |

| Growth Rate | 7.24% CAGR |

| Projected Value | USD 7.54 Billion |

The European aviation software market is projected to grow at a CAGR of approximately 8.03% from 2024 to 2033. This growth is fueled by the region's commitment to enhancing aviation safety, efficiency, and sustainability. Key drivers include the European Union's efforts to develop a Single European Sky and improve air traffic management.

In 2023, the Asia Pacific aviation software market captured a significant share and is expected to grow at the fastest CAGR of over 10.04% from 2024 to 2033. This growth is attributed to the rapid expansion of air travel and the aviation industry in the region. The focus on airport modernization and the adoption of advanced aviation technologies are driving demand. Additionally, the presence of emerging markets and the continuous growth of airline fleets are strengthening the Asia Pacific region's prominent position in the global aviation software market.

In 2023, the management software segment dominated the aviation software market, holding the largest market share. This software is crucial for airlines, airports, and other aviation entities, facilitating efficient management of daily operations. It streamlines various functions such as flight scheduling, crew management, maintenance, ticketing, and customer service, leading to cost reductions and enhanced operational efficiency. The strong demand for integrated management solutions reflects its pivotal role, and as airlines continue to expand and seek performance optimization, the reliance on advanced management software is projected to remain robust, solidifying its leading position in the market.

The simulation software segment is also experiencing rapid growth, driven by the increasing need for sophisticated training and operational planning tools. Simulation software is essential for pilot training, providing realistic, risk-free environments where trainees can refine their skills. It is also employed in testing new aircraft designs, developing flight procedures, and optimizing airport operations, contributing to its significant market expansion.

The airlines segment led the market with a notable 78% share in 2023. This dominance is due to the extensive operational demands and the critical role of software in ensuring safety, efficiency, and customer satisfaction. Airlines require advanced software for various functions, including flight operations, crew management, maintenance, and customer service. The increasing need for real-time data analytics, predictive maintenance, and enhanced passenger experiences is driving the widespread adoption of sophisticated software systems by airlines.

Meanwhile, the airport segment is seeing significant growth, driven by the complexity of modern airport operations and the need for improved efficiency and security. Airports are evolving into advanced hubs requiring integrated software solutions for air traffic control, baggage handling, passenger processing, and facility management. The rise in global air travel and airport infrastructure expansion is increasing the demand for software that can optimize operations, minimize delays, and enhance the passenger experience.

The cloud-based segment holds a substantial market share due to its advantages over traditional systems. Cloud solutions provide scalability, flexibility, and cost-efficiency, enabling aviation companies to manage operations effectively with lower infrastructure costs. Real-time data access from any location enhances operational efficiency and decision-making. Additionally, cloud technology supports easier integration with other emerging technologies, such as AI and IoT, which are becoming increasingly integral to aviation operations.

Conversely, the on-premises segment is also growing rapidly, driven by the need for high security, control, and compliance. On-premises systems are preferred by aviation companies with strict regulatory requirements or sensitive data, offering complete control over IT environments. These solutions also allow for customization to meet the specific needs of organizations.

By Deployment

By Application

By Software Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others