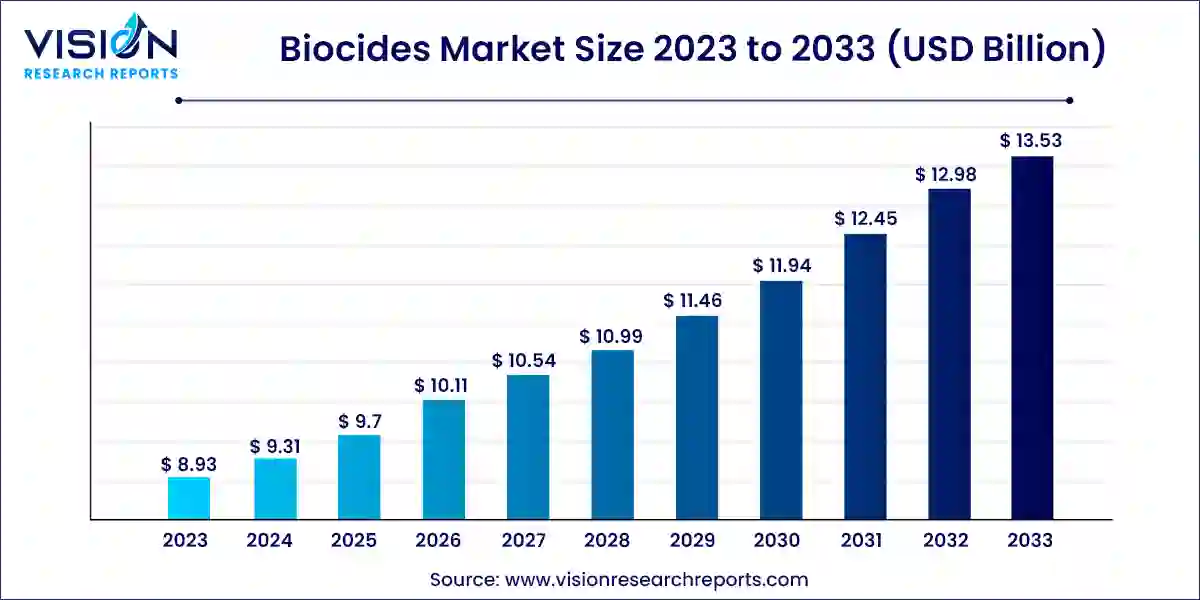

The global biocides market size was estimated at around USD 8.93 billion in 2023 and it is projected to hit around USD 13.53 billion by 2033, growing at a CAGR of 4.24% from 2024 to 2033.

The biocides market plays a critical role in various industries, providing essential solutions for controlling harmful microorganisms and ensuring safety and hygiene. Biocides are chemical substances or microorganisms intended to deter, render harmless, or exert a controlling effect on harmful organisms by chemical or biological means. The market for biocides is vast and diverse, encompassing a wide range of applications, from healthcare and agriculture to water treatment and industrial processes.

The biocides market is experiencing robust growth driven by several key factors. Increasing urbanization and industrialization worldwide have led to a heightened demand for clean water, thereby boosting the use of biocides in water treatment processes. The expansion of the healthcare sector, coupled with rising awareness about infection control and hygiene, has significantly propelled the market, as hospitals and pharmaceutical industries rely heavily on biocides for maintaining sterile environments. Additionally, the agricultural sector's need for effective pest control solutions to ensure high crop yields is fueling biocide adoption. Furthermore, advancements in biocide formulations and the development of eco-friendly alternatives are opening new avenues for market expansion, addressing both regulatory requirements and environmental concerns. Emerging markets, particularly in Asia-Pacific, offer substantial growth opportunities due to their rapid industrialization and improving infrastructure. These factors collectively drive the dynamic growth of the biocides market.

The Asia Pacific biocides market size was estimated at USD 3.30 billion in 2023 and is expected to surpass around USD 5 billion by 2033, poised to grow at a CAGR of 4.24% from 2024 to 2033.

The Asia Pacific region led the market in 2023, capturing the highest revenue share of 37%. Several factors contributed to this dominance, including the increased production of disinfectants, particularly during the COVID-19 pandemic, and the high demand for application-specific cleaning products.

In industrial, commercial, and residential applications, disinfectants require antimicrobial agents with high efficacy. This has significantly increased the demand for cost-effective and efficient biocide active ingredients. The pulp and paper industry are expected to see a rise in biocide demand, driven by the growing production of high-end paper, extensive recycling efforts, and stricter regulations regarding effluent discharges from the pulp and paper sector

The Central & South America region is projected to grow at a significant rate, driven by the increasing demand for water treatment and wood preservation. The adoption of water-based paints and coatings, which are more environmentally friendly, is expected to boost product consumption in the paints and coatings sector. Additionally, the ultra-low sulfur demand from the marine transportation industry is anticipated to propel market growth in fuel applications.

Halogen compounds led the market in 2023, capturing the highest revenue share of 26%. This dominance is due to the use of halogens such as fluorine, chlorine, and iodine in biocide formulations. An iodine-based compound, iodophor, enhances the stability and biocidal effectiveness of iodine. Chlorine, one of the most extensively used halogens, is favored for its strong antibacterial and oxidizing properties, making it suitable for municipal drinking water plants and wastewater treatment facilities, among other applications.

In the food and beverage industry, chlorine-based formulations like calcium hypochlorite and sodium hypochlorite are commonly used. Chlorine dioxide, another chlorine-based compound, is utilized in water treatment applications and is available in gas form. The primary market drivers are the efficacy of halogens in reducing microbial growth and their versatility across various application areas.

The metallic compounds segment is projected to grow during the forecast period due to their effectiveness in binding to microbial proteins and inhibiting enzyme activity. Metals such as silver and other heavy metals are frequently used as biocides. Copper is considered more effective than silver due to its higher toxicity to bacteria and microbes. Copper sulfate-based biocide formulations are widely used in water treatment facilities to control algae growth and in marine anti-fouling paints.

The paints and coatings segment dominated the market in 2023, achieving the highest revenue share of 27%. This dominance is primarily due to the significant use of biocides in marine coating applications, where painted surfaces are frequently exposed to humid and aquatic environments. Water-borne paints and coatings, in particular, require substantial biocide application. However, the market faces challenges from other paint and coating segments, such as powder coatings and solvent-borne coatings, which do not require in-can preservation, posing competition to water-borne paints and coatings.

The Asia Pacific region, which holds a substantial share of the paints and coatings market volume, presents lucrative growth opportunities, especially in countries like China and India. According to the American Coatings Association, the Asia Pacific paints and coatings market was projected to reach over USD 96.0 billion by 2023, up from USD 56.2 billion in 2016. However, this forecast is now expected to be lower due to the growth decline caused by the COVID-19 pandemic in 2020.

The water treatment segment is projected to experience significant growth over the forecast period. This growth is primarily driven by the use of biocides to prevent biofouling, film formation, and algal or bacterial contamination in various water systems. These systems include municipal drinking water treatment facilities, cooling water systems, spas and pools, and industrial water treatment setups. Common biocides used in these applications include sodium bromide, hypobromous acid, hydrogen peroxide, silver, bromine, chlorine tablets, stabilized bromine, sodium hypochlorite, calcium hypochlorite, Bronopol, QACs, and isothiazolinone.

By Product

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others