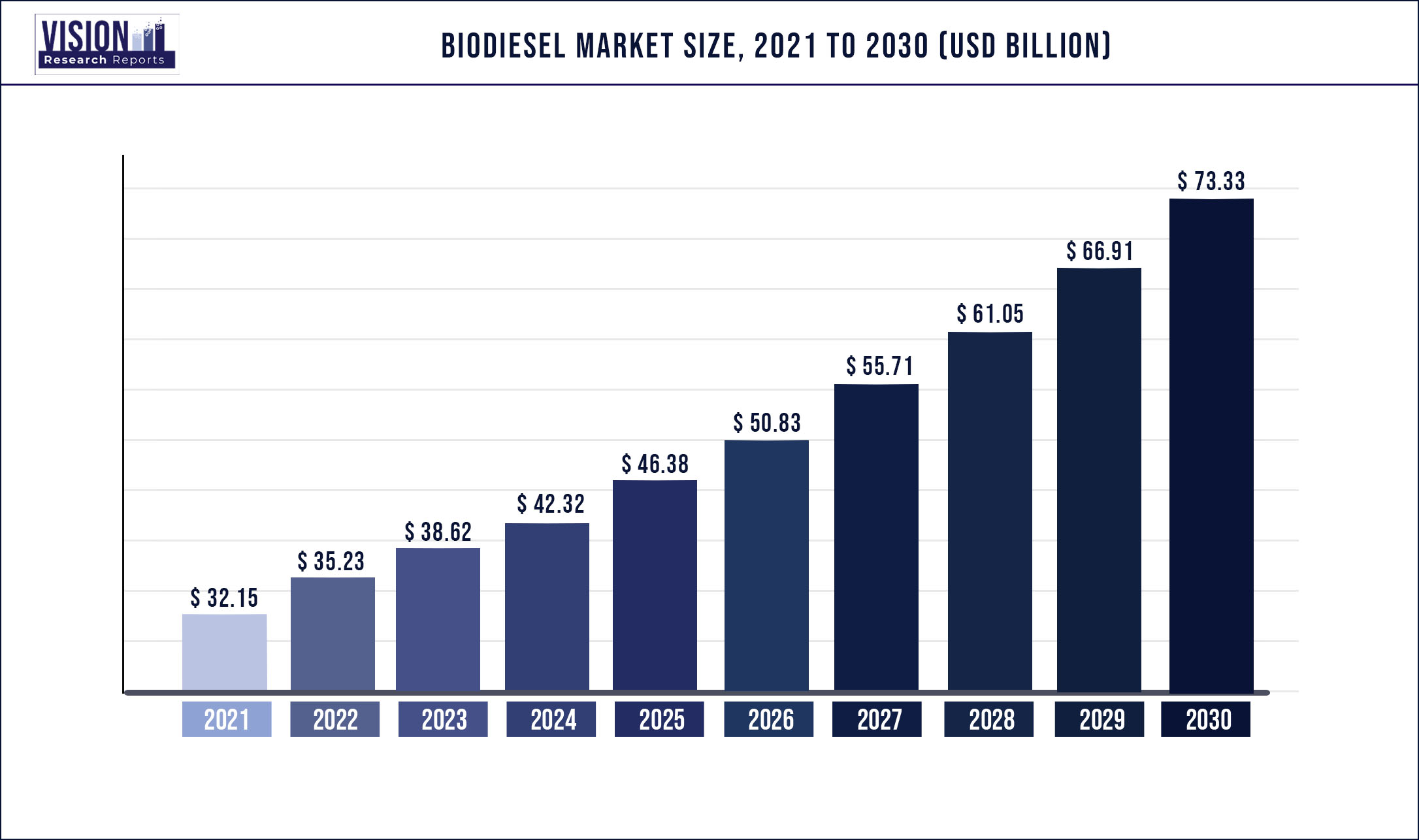

The global biodiesel market was valued at USD 32.15 billion in 2021 and it is predicted to surpass around USD 73.33 billion by 2030 with a CAGR of 9.59% from 2022 to 2030

Report Highlights

Growing demand for biodiesel as automobile fuel due to its eco-friendly properties, such as the reduced risk of GHG emissions, is expected to drive the industry growth. The market is distinguished by the presence of numerous players, the majority of whom are based in North America and Europe. Industry participants are embracing integration strategies to reduce their reliance on raw material suppliers and strengthen their position in the global industry. In 2021, North America accounted for over USD 5,114.7 million.

Environmental support, better regulatory support, geopolitical support, customer support, and economic and agricultural support are all driving the market growth. Biodiesel made from vegetable oils is popular in a variety of industries because the saturated fat content is low, making the production process simple and lowering overall production costs. Furthermore, the feedstock required to produce vegetable oils is more readily available than greases and animal fats. The market is expected to be led by the fuel application type segment, followed by power generation. The Europe region is expected to be the product’s primary market. The high product demand from the automotive sector and various government initiatives to reduce GHG emissions are expected to propel market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 32.15 billion |

| Revenue Forecast by 2030 | USD 73.33 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.59% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Feedstock, application, region |

| Companies Covered | FutureFuel Corp.; Ecodiesel Colombia S.A.; Manuelita S.A.; TerraVia Holdings, Inc.; Renewable Biofuels, Inc.; Ag Processing, Inc.; Archer Daniels Midland Company (ADM); Wilmar International Ltd.; Bunge Ltd.; Cargill, Inc.; Louis Dreyfus Company; Biox Corp.; Munzer Bioindustrie GmbH; Neste Oyj; Renewable Energy Group, Inc. |

Feedstock Insights

Based on feedstock, the market has been further categorized into vegetable oils and animal fats. The vegetable oils feedstock segment is further sub-segmented into canola oil, soybean oil, palm oil, corn oil, and others. Simultaneously, the animal fats segment is sub-segmented into poultry, tallow, white grease, and others. In 2021, the vegetable oil segment accounted for the largest share of more than 97.04% of the global revenue. However, raw material selection varies by region, based on the availability and feedstock cost. Palm oil is expected to be a major feedstock for the market and has been widely used in the production of biodiesel in countries, such as Indonesia, Thailand, Germany, France, and Colombia.

Indonesia and Thailand dominated palm oil production, accounting for more than 80% of total output, with a large portion of the product used for biofuel production. Whereas the European countries were reliant on imports of feedstock from these Asian countries for biofuel production. Other vegetable oils, such as UCO and rapeseed, accounted for a significant portion of the industry, accounting for more than 17% of total feedstock demand. China and India are expected to be the most important markets for UCO-based biodiesel in Asia Pacific (UCOME). However, uncertainty about product availability has been a major concern for UCOME manufacturers in these regions, weighing on growth.

Application Insights

Based on application, the global market has been further divided into fuel, power generation, and others. In 2021, the fuel application segment dominated the global market and accounted for the largest share of more than 77.93% of the overall revenue. The automotive fuel segment dominated the demand for the product in 2021. The industry is expected to benefit from increased demand for fuel in commercial vehicles as a replacement for crude oil as it emits fewer Volatile Organic Compounds (VOCs) than traditional fuels, such as diesel.

Because it is biodegradable, free of aromatics and sulfur, and non-toxic, the product finds application in the marine industry and is expected to grow at a significant CAGR over the forecast period. Furthermore, the agricultural sector’s growth, combined with increased mechanization, is expected to drive product demand in agricultural applications over the forecast period. Governments around the world are constantly attempting to adopt renewable energy sources to generate power to reduce GHG emissions. As a result, the demand for the product in power generation applications is expected to grow at a significant CAGR from 2022 to 2030.

Regional Insights

Europe accounted for a share of more than 46.84% of the global market in 2021 and is expected to grow at a steady CAGR from 2022 to 2030. It has historically been the largest market for the product due to early acceptance of the product in the region as well as government emphasis on replacing carbon-emitting sources with bio-based sources. Rapeseed oil, UCO, palm oil, soybean oil, animal fats, and sunflower oil are the most common feedstocks used to produce biodiesel in Europe. The product demand in the region is primarily driven by Germany, which accounts for the highest share of feedstock production among the European countries.

The low-interest rate on raw materials is expected to lead to a rise in consumption, thereby propelling the overall regional market growth over the forecast period. Asia Pacific is also projected to register a significant CAGR from 2022 to 2030. Thailand is likely to be one of the fastest-growing markets, as demand for diesel-powered automobiles in the region is increasing rapidly. Malaysia and Indonesia produce more than 80% of palm oil creating a great opportunity for biodiesel manufacturing.

The production is expected to increase, which, in turn, is expected to propel market growth over the forecast period. However, palm oil is also used in the food industry, which is expected to hamper the market growth. The government’s initiative to promote green fuels to reduce pollution and reduce reliance on crude oil is expected to drive market growth over the forecast period. Furthermore, the Indian government planned to blend more than 5% biodiesel by 2022, which is expected to propel growth over the forecast period. In 2021, the production in Central & South America totaled 10,960.1 million liters. The increase was attributed to a rise in domestic consumption as a result of a growth in blending levels to utilize excess palm oil production.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biodiesel Market

5.1. COVID-19 Landscape: Biodiesel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biodiesel Market, By Feedstock

8.1. Biodiesel Market, by Feedstock, 2022-2030

8.1.1. Vegetable Oil

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Animal Fats

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Biodiesel Market, By Application

9.1. Biodiesel Market, by Application, 2022-2030

9.1.1. Fuel

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Power Generation

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Biodiesel Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Feedstock (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Ag Processing, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Archer Daniels Midland Company (ADM)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bunge Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cargill, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Ecodiesel Colombia S.A.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. FutureFuel Corp.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Manuelita S.A.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Renewable Biofuels, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. TerraVia Holdings, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wilmar International Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others