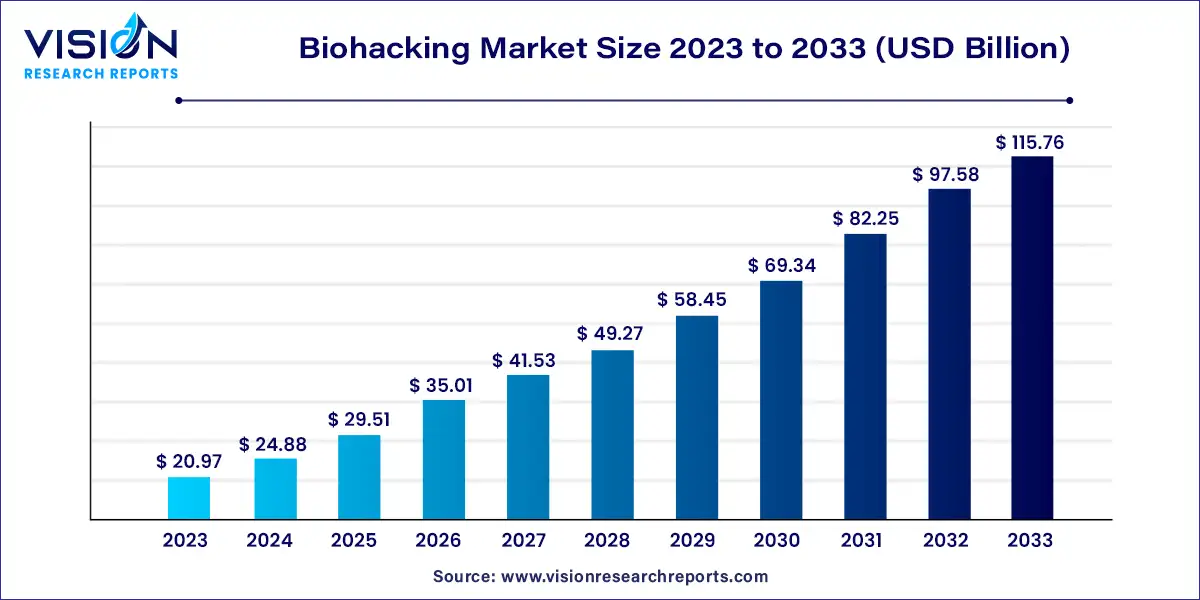

The global biohacking market size was estimated at USD 20.97 billion in 2023 and it is expected to surpass around USD 115.76 billion by 2033, poised to grow at a CAGR of 18.63% from 2024 to 2033. The biohacking market is rapidly emerging as a significant segment within the broader health and wellness industry. Biohacking, often referred to as DIY biology, involves making incremental changes to one's body, diet, or lifestyle to enhance physical and cognitive performance. This can range from simple dietary adjustments and exercise routines to more advanced techniques like genetic engineering, nootropics, and even the use of wearable technology to monitor and optimize body functions.

The growth of the biohacking market is fueled by the technological advancements, particularly in wearable devices and biotechnology, are making biohacking more accessible and effective for the general public. The rising consumer awareness and demand for health optimization, coupled with a growing interest in personalized medicine, are driving the adoption of biohacking practices. Additionally, the increasing availability of nootropics, supplements, and DIY biology resources is empowering individuals to take control of their health and well-being, further propelling the market's expansion. The convergence of these factors positions the biohacking market for significant growth in the coming years.

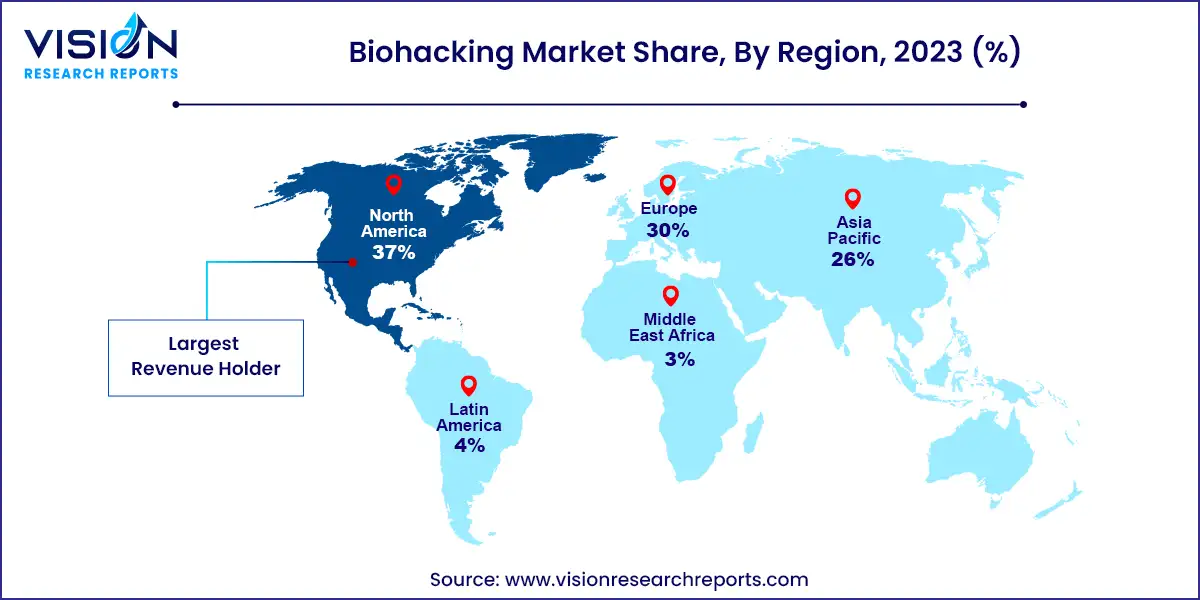

North America dominated the biohacking market in 2023, with a 37% market share. This is due to the high prevalence of chronic diseases, increased awareness of biohacking, and an aging population in the region. Significant government investments in research and development have also contributed to this growth.

| Attribute | North America |

| Market Value | USD 7.75 Billion |

| Growth Rate | 18.65% CAGR |

| Projected Value | USD 42.83 Billion |

The Asia Pacific biohacking market is poised for substantial growth in 2023, with a projected CAGR of 20.63%. This growth is fueled by increased healthcare spending and a growing interest in innovative health solutions, leading to greater use of biohacking tools and methods to enhance overall health, lifespan, and cognitive and physical abilities.

Europe Biohacking Market & Trends

Europe emerged as a significant market with a share of over 30% in 2023. The rise in diabetes, largely due to obesity, poor diet, and insufficient exercise, has contributed to the market's attractiveness.

In 2023, the wearables segment captured a notable 30% share of the market. Current advancements are focused on technological innovations, including the integration of additional health functions, the use of Artificial Intelligence for tailored recommendations, and real-time data transmission to healthcare professionals for timely interventions and improved patient outcomes. Wearable health sensors are revolutionizing the fitness and wellness sectors by empowering users to better manage their health and well-being.

Smartwatches, popular among biohackers, not only tell time but also track various bioindicators such as heart rate, sleep quality, and stress levels, providing a comprehensive view of health. Fitness trackers are also widely favored, helping individuals monitor daily steps, calories burned, and exercise intensity.

The mobile app and pharmaceutical sectors are expected to grow significantly, driven by advancements in digital technology. Mobile applications, in conjunction with wearable devices, facilitate the tracking of water intake, daily steps, and calorie expenditure. The popularity of implants is anticipated to rise, with innovations like Tesla's Neuralink offering a fully implantable brain-computer interface that allows for seamless control of computers and mobile devices.

The diagnosis and treatment segment led with over 33% of the revenue in 2023, attributed to the widespread use of biohacking practices like nootropics and wearable technologies aimed at body enhancement. The growing trend of using biohacking for diagnostic purposes and subsequent improvements is a key driver of this segment’s growth.

Additionally, the market is propelled by the increasing adoption of smart drugs and genetic modification kits. With such advancements, biohackers can make informed decisions to enhance their longevity and overall health.

Hospitals and clinics held the largest market share of 41% in 2023, driven by the rising prevalence of chronic diseases and advancements in treatment. The availability of devices like wearables and performance monitors also supports this segment's growth.

Forensic laboratories are expected to exhibit the highest compound annual growth rate (CAGR) of over 21.53% during the forecast period. This growth is fueled by the adoption of biohacking practices in forensic research, with increased investment in R&D to improve treatment methodologies.

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others