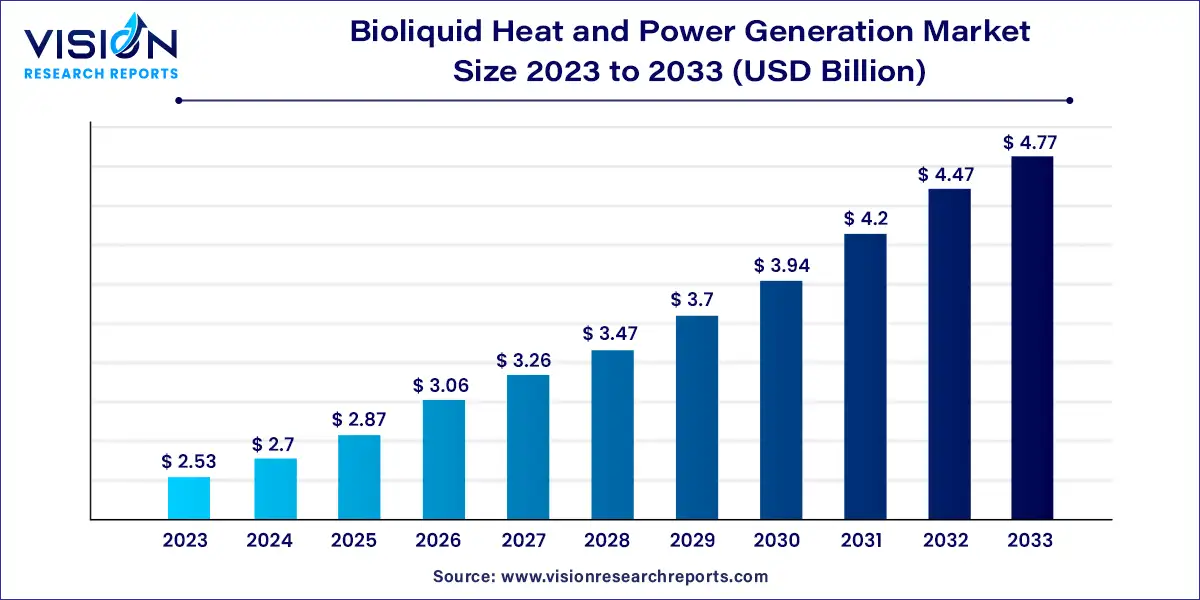

The global bioliquid heat and power generation market size was valued at USD 2.53 billion in 2023 and it is predicted to surpass around USD 4.77 billion by 2033 with a CAGR of 6.54% from 2024 to 2033. The bioliquid heat and power generation market is a dynamic sector within the renewable energy industry, focused on harnessing bioliquids for the generation of heat and power. Bioliquids, derived from biomass, offer a sustainable alternative to fossil fuels, contributing to reduced greenhouse gas emissions and promoting environmental sustainability.

The growth of the bioliquid heat and power generation market is propelled an increasing emphasis on reducing greenhouse gas emissions is a significant driver. Governments and regulatory bodies are instituting stringent environmental policies and offering incentives to promote the use of renewable energy sources, including bioliquids. These measures encourage the adoption of bioliquid technologies by providing financial support and regulatory benefits.

Additionally, advancements in bioliquid production and conversion technologies are enhancing market growth. Innovations in feedstock processing, such as improved extraction and refining techniques, have increased the efficiency and cost-effectiveness of bioliquids. Enhanced energy conversion technologies, such as advanced combustion systems and gasification methods, are also contributing to the market's expansion by improving energy yields and reducing operational costs.

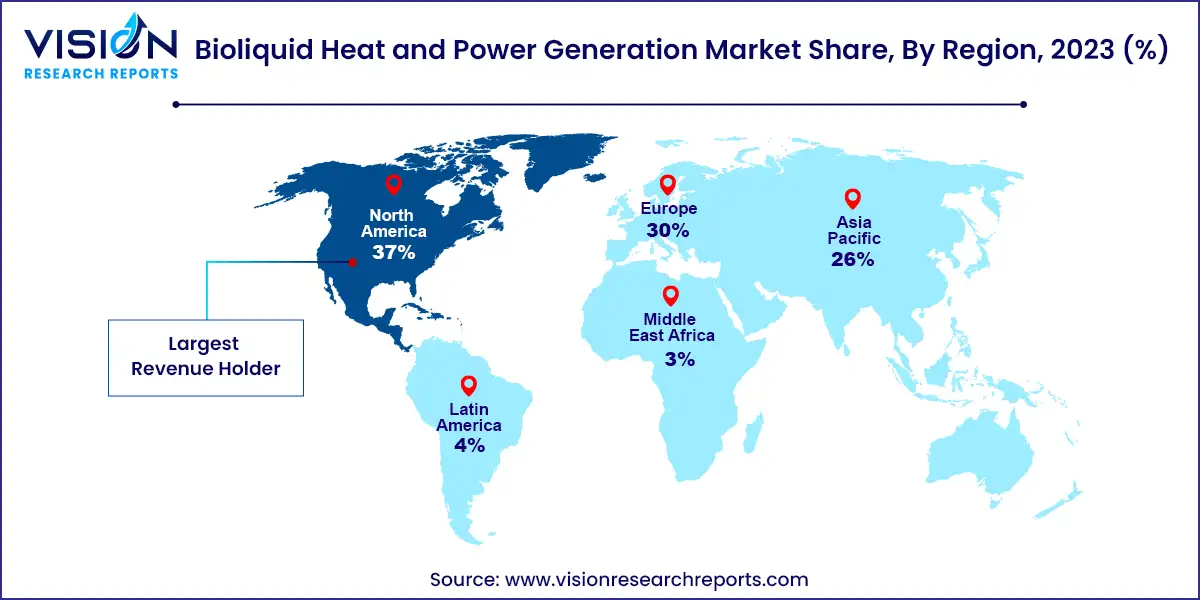

North America accounted for over 37% of the total revenue in the bioliquid heat and power generation market. Supportive governmental policies and incentives for biofuels are expected to drive market growth in the region. North America's commitment to reducing greenhouse gas emissions and increasing the proportion of renewables in its energy mix is anticipated to present new opportunities for market participants.

| Attribute | North America |

| Market Value | USD 0.93 Billion |

| Growth Rate | 6.54% CAGR |

| Projected Value | USD 1.76 Billion |

The European market is distinguished by stringent environmental regulations and ambitious renewable energy targets, making it a leading region for the adoption of bioliquid heat and power generation technologies. Europe's emphasis on reducing its carbon footprint and enhancing energy security is expected to remain a driving factor for regional market growth.

The rapid economic growth and rising energy demands in the Asia Pacific region are likely to act as significant growth drivers for the market. The availability of agricultural residues and the pressing energy needs in countries such as China, India, and Southeast Asia are expected to accelerate biofuel production and drive market expansion.

The bioethanol segment captured over 61% of the revenue share in 2023, making it the leading bioliquid in the market. As one of the most extensively utilized bioliquids for energy production, bioethanol is poised to continue driving market growth. Derived from feedstocks like sugarcane, corn, and wheat, bioethanol is a versatile fuel suitable for both heat and power generation. Government mandates and blending requirements have bolstered its market presence. Its straightforward production process, low carbon emissions, and compatibility with existing energy infrastructure position bioethanol as a significant player in the renewable energy sector.

Ongoing technological advancements and innovations in bioethanol production, particularly with cellulosic and algae-based ethanol, are expected to open new opportunities for market participants. These advanced products are gaining attention for their potential to deliver energy more efficiently and sustainably compared to traditional bioethanol. Increased investment and research in these areas could significantly boost the viability and appeal of bioethanol as a renewable energy source.

In 2023, the heat production application segment led the market with over 56% of the revenue share. Bioliquids, as a cleaner and renewable alternative to conventional heating fuels like coal, oil, and natural gas, are anticipated to drive market growth. Their use in residential and commercial heating systems presents new opportunities for decarbonizing the heating sector, which is a major contributor to global greenhouse gas emissions. Additionally, local production of bioliquids supports energy independence and security, further encouraging interest and investment in this sector.

The flexibility and renewability of bioliquids also benefit the power generation segment. These bioliquids can be used in traditional combustion engines and turbines, making them suitable for both large-scale power plants and smaller, decentralized energy systems. This adaptability allows bioliquids to integrate into existing energy infrastructures, facilitating the shift towards more sustainable energy practices. Their ability to provide stable and controllable power generation, in conjunction with wind and solar energy, supports overall market growth.

By Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others