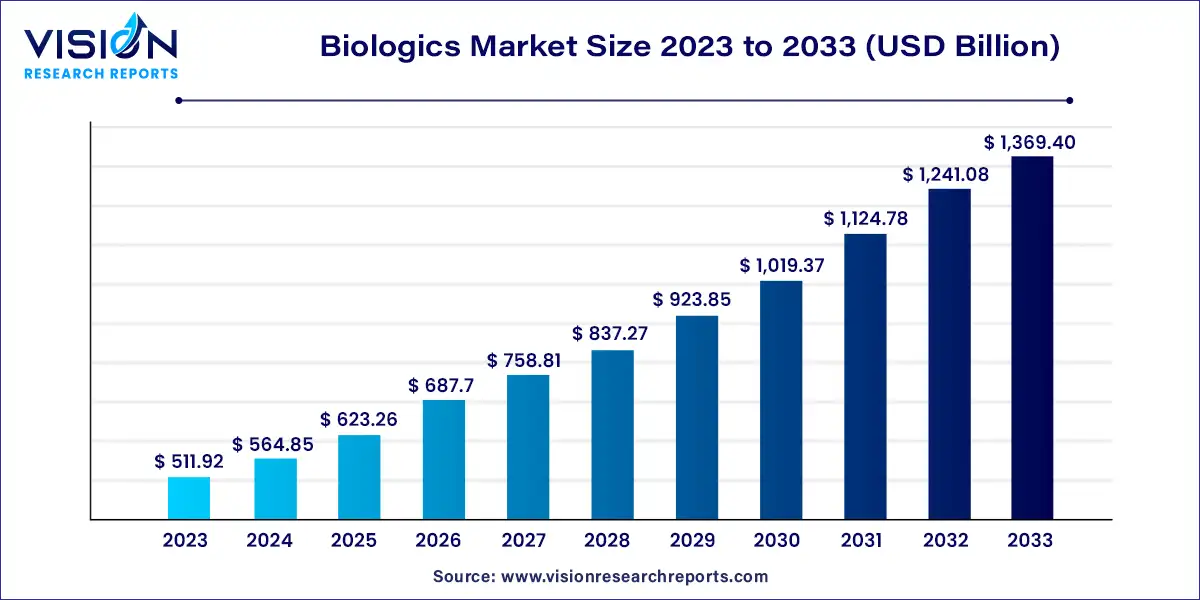

The global biologics market size was valued at USD 511.92 billion in 2023 and it is predicted to surpass around USD 1,369.40 billion by 2033 with a CAGR of 10.34% from 2024 to 2033. The biologics market has experienced significant growth over the past decade, emerging as a vital component of modern healthcare and medicine. Biologics, which are derived from living organisms, differ fundamentally from traditional chemical-based pharmaceuticals. They include a broad range of products such as vaccines, blood components, monoclonal antibodies, and gene therapies. These products offer innovative treatments for a wide array of diseases, including cancer, autoimmune disorders, and rare genetic conditions.

The growth of the biologics market is being driven by an advancement in biotechnology and increased investment in research and development leading the way. Biologics offer targeted treatment options that are more effective and have fewer side effects compared to traditional small molecule drugs, which is a major reason for their rising adoption. Additionally, the growing prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is fueling demand for these innovative therapies. Government initiatives and favorable regulatory frameworks are also playing a crucial role by accelerating the approval process for new biologic drugs. Moreover, the increasing availability of biosimilars—more affordable versions of biologic therapies—is expanding access to these treatments, further contributing to market growth. As healthcare providers continue to seek out more personalized medicine approaches, the biologics market is expected to see sustained expansion in the coming years.

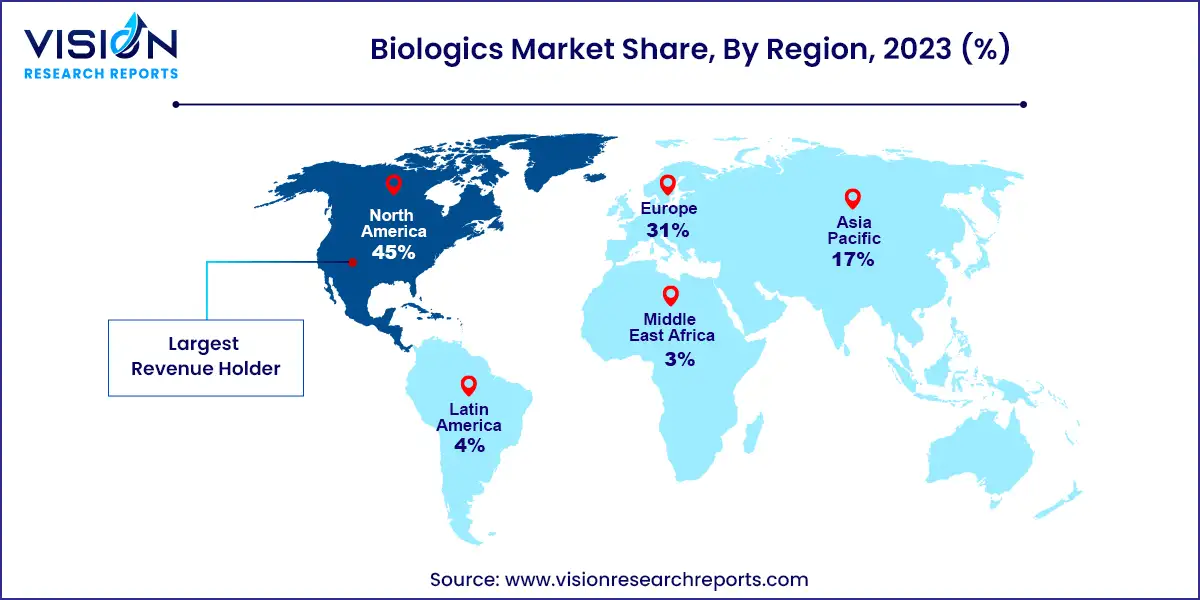

North America held the largest revenue share of 45% in 2023. Key factors include high chronic disease prevalence, the presence of major biopharmaceutical companies, favorable reimbursement policies, and significant R&D investments. Biologics represented 37% of total drug spending in the U.S., with increasing biologic prescriptions and investment in targeted drug development contributing to market growth.

The Asia Pacific region is projected to grow at a CAGR of 11.03% during the forecast period. Rising rates of cancer, diabetes, and cardiovascular diseases, along with an aging population, are driving demand for biologics. Market leaders are investing in advanced biologic products to meet this demand. The adoption of biosimilars is a significant growth driver, enhancing the accessibility and affordability of biologic therapies in the region.

In 2023, oncology led the biologics market, accounting for 29% of the sector. The American Cancer Society reported approximately 1.92 million new cancer cases and around 609,360 cancer-related deaths in the U.S. that year. Globally, cancer was the second leading cause of death with an estimated 9.6 million fatalities in 2020. Biologic treatments, particularly monoclonal antibodies and immunotherapies, have revolutionized cancer care by enhancing survival rates and minimizing side effects. Notably, biologics have significantly impacted breast cancer treatment, exemplified by the success of Herceptin. The global 0biologics market is projected to exceed $100 billion by 2023.

The hematological disorders segment is anticipated to experience the fastest growth, with a CAGR of 11.73% during the forecast period. This surge is driven by advancements in gene therapies for rare blood disorders like hemophilia. For example, the U.S. FDA approved CSL Behring’s Hemgenix for hemophilia B in November 2023, and BioMarin’s ROCTAVIAN for hemophilia A in Europe in August 2023. Pfizer’s PF-07055480 and PF-06838435 are also in phase 3 trials for hemophilia types A and B, respectively.

The microbial segment dominated the biologics market with a 59% share in 2023. Most approved biologics are produced using microbial systems, including products like platelet-derived growth factor, recombinant insulin, granulocyte-macrophage colony-stimulating factor, and recombinant interferons.

The mammalian expression systems segment is expected to grow significantly during the forecast period. These systems are crucial for developing recombinant proteins and viral-vector vaccines. Common mammalian cell lines include CHO and HEK. Notable products manufactured in mammalian systems include Perjeta (Pertuzumab), Adcetris (Brentuximab-Vedotin), Shingrix (zoster vaccine), Kadycla (Trastuzumab emtansine), and Aimovig (erenumab).

The in-house manufacturing segment led the market with an 85% share in 2023. Biologic drug production is more intricate than small molecules, involving live microorganism cultures and strict regulatory standards. In-house manufacturing provides direct control, allowing for more effective day-to-day management of biologic drugs.

The outsourcing segment is projected to grow at a CAGR of 10.73% during the forecast period. Many Contract Development and Manufacturing Organizations (CDMOs), such as WuXi Biologics, Lonza, and Samsung Biologics, have state-of-the-art biologic manufacturing facilities. Collaborations with these CDMOs provide access to manufacturing expertise and new technologies. For example, WuXi Biologics opened its integrated biologics center in Shanghai in November 2023, offering comprehensive facilities for product development, quality control, and manufacturing.

Monoclonal antibodies (MABs) held a 67% market share in 2023 due to their extensive use across various therapeutic areas. MABs target unhealthy cells while sparing healthy ones, making them a dominant category of biologic drugs. The U.S. FDA approved its 100th monoclonal antibody product in 2021, just six years after its 50th approval. Humanized monoclonal antibodies lead the market due to their lower risk of immune response compared to murine or chimeric antibodies.

Antisense and RNAi Therapeutics segment is expected to grow at a CAGR of 20.63% during the forecast period. These products enable precise gene silencing, leading to the development of drugs for genetic disorders. For instance, Alnylam Pharmaceuticals’ RNAi therapeutic AMVUTTRA for hereditary transthyretin-mediated amyloidosis received FDA approval in June 2023.

By Source

By Product

By Disease Category

By Manufacturing

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biologics Market

5.1. COVID-19 Landscape: Biologics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biologics Market, By Source

8.1. Biologics Market, by Source

8.1.1. Microbial

8.1.1.1. Market Revenue and Forecast

8.1.2. Mammalian

8.1.2.1. Market Revenue and Forecast

8.1.3. Others

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Biologics Market, By Product

9.1. Biologics Market, by Product

9.1.1. Monoclonal Antibodies

9.1.1.1. Market Revenue and Forecast

9.1.2. Vaccines

9.1.2.1. Market Revenue and Forecast

9.1.3. Recombinant Proteins

9.1.3.1. Market Revenue and Forecast

9.1.4. Antisense & RNAi Therapeutics

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Biologics Market, By Disease Category

10.1. Biologics Market, by Disease Category

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast

10.1.2. Infectious Diseases

10.1.2.1. Market Revenue and Forecast

10.1.3. Immunological Disorders

10.1.3.1. Market Revenue and Forecast

10.1.4. Cardiovascular Disorders

10.1.4.1. Market Revenue and Forecast

10.1.5. Hematological Disorders

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Biologics Market, By Manufacturing

11.1. Biologics Market, by Manufacturing

11.1.1. Outsourced

11.1.1.1. Market Revenue and Forecast

11.1.2. In-house

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Biologics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Source

12.1.2. Market Revenue and Forecast, by Product

12.1.3. Market Revenue and Forecast, by Disease Category

12.1.4. Market Revenue and Forecast, by Manufacturing

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Source

12.1.5.2. Market Revenue and Forecast, by Product

12.1.5.3. Market Revenue and Forecast, by Disease Category

12.1.5.4. Market Revenue and Forecast, by Manufacturing

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Source

12.1.6.2. Market Revenue and Forecast, by Product

12.1.6.3. Market Revenue and Forecast, by Disease Category

12.1.6.4. Market Revenue and Forecast, by Manufacturing

12.2. Europe

12.2.1. Market Revenue and Forecast, by Source

12.2.2. Market Revenue and Forecast, by Product

12.2.3. Market Revenue and Forecast, by Disease Category

12.2.4. Market Revenue and Forecast, by Manufacturing

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Source

12.2.5.2. Market Revenue and Forecast, by Product

12.2.5.3. Market Revenue and Forecast, by Disease Category

12.2.5.4. Market Revenue and Forecast, by Manufacturing

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Source

12.2.6.2. Market Revenue and Forecast, by Product

12.2.6.3. Market Revenue and Forecast, by Disease Category

12.2.6.4. Market Revenue and Forecast, by Manufacturing

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Source

12.2.7.2. Market Revenue and Forecast, by Product

12.2.7.3. Market Revenue and Forecast, by Disease Category

12.2.7.4. Market Revenue and Forecast, by Manufacturing

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Source

12.2.8.2. Market Revenue and Forecast, by Product

12.2.8.3. Market Revenue and Forecast, by Disease Category

12.2.8.4. Market Revenue and Forecast, by Manufacturing

12.3. APAC

12.3.1. Market Revenue and Forecast, by Source

12.3.2. Market Revenue and Forecast, by Product

12.3.3. Market Revenue and Forecast, by Disease Category

12.3.4. Market Revenue and Forecast, by Manufacturing

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Source

12.3.5.2. Market Revenue and Forecast, by Product

12.3.5.3. Market Revenue and Forecast, by Disease Category

12.3.5.4. Market Revenue and Forecast, by Manufacturing

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Source

12.3.6.2. Market Revenue and Forecast, by Product

12.3.6.3. Market Revenue and Forecast, by Disease Category

12.3.6.4. Market Revenue and Forecast, by Manufacturing

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Source

12.3.7.2. Market Revenue and Forecast, by Product

12.3.7.3. Market Revenue and Forecast, by Disease Category

12.3.7.4. Market Revenue and Forecast, by Manufacturing

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Source

12.3.8.2. Market Revenue and Forecast, by Product

12.3.8.3. Market Revenue and Forecast, by Disease Category

12.3.8.4. Market Revenue and Forecast, by Manufacturing

12.4. MEA

12.4.1. Market Revenue and Forecast, by Source

12.4.2. Market Revenue and Forecast, by Product

12.4.3. Market Revenue and Forecast, by Disease Category

12.4.4. Market Revenue and Forecast, by Manufacturing

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Source

12.4.5.2. Market Revenue and Forecast, by Product

12.4.5.3. Market Revenue and Forecast, by Disease Category

12.4.5.4. Market Revenue and Forecast, by Manufacturing

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Source

12.4.6.2. Market Revenue and Forecast, by Product

12.4.6.3. Market Revenue and Forecast, by Disease Category

12.4.6.4. Market Revenue and Forecast, by Manufacturing

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Source

12.4.7.2. Market Revenue and Forecast, by Product

12.4.7.3. Market Revenue and Forecast, by Disease Category

12.4.7.4. Market Revenue and Forecast, by Manufacturing

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Source

12.4.8.2. Market Revenue and Forecast, by Product

12.4.8.3. Market Revenue and Forecast, by Disease Category

12.4.8.4. Market Revenue and Forecast, by Manufacturing

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Source

12.5.2. Market Revenue and Forecast, by Product

12.5.3. Market Revenue and Forecast, by Disease Category

12.5.4. Market Revenue and Forecast, by Manufacturing

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Source

12.5.5.2. Market Revenue and Forecast, by Product

12.5.5.3. Market Revenue and Forecast, by Disease Category

12.5.5.4. Market Revenue and Forecast, by Manufacturing

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Source

12.5.6.2. Market Revenue and Forecast, by Product

12.5.6.3. Market Revenue and Forecast, by Disease Category

12.5.6.4. Market Revenue and Forecast, by Manufacturing

Chapter 13. Company Profiles

13.1. Samsung Biologics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Amgen Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Novo Nordisk A/S

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. AbbVie Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Sanofi

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Johnson & Johnson Services, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Celltrion Healthcare Co., Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Bristol-Myers Squibb Company

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Eli Lilly and Company

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. F. Hoffmann La-Roche Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others