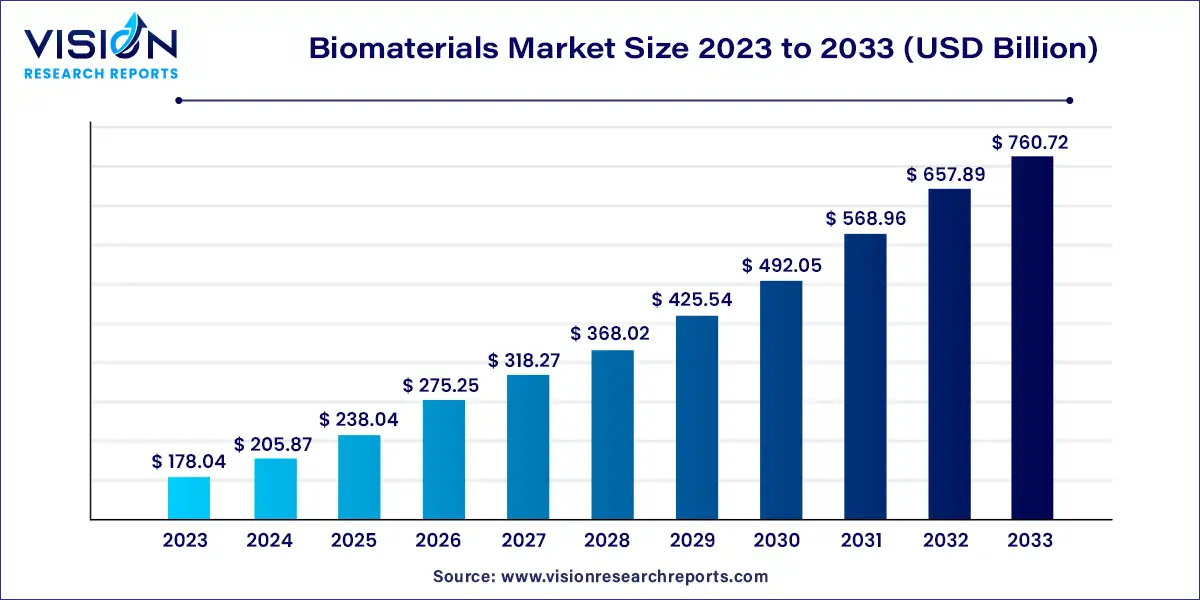

The global biomaterials market size was estimated at USD 178.04 billion in 2023 and it is expected to surpass around USD 760.72 billion by 2033, poised to grow at a CAGR of 15.63% from 2024 to 2033.

The biomaterials market is experiencing a period of significant growth and innovation driven by advancements in medical technology, increasing prevalence of chronic diseases, and growing demand for biocompatible materials.

The growth of the biomaterials market is propelled by an increasing prevalence of chronic diseases worldwide, such as cardiovascular disorders and orthopedic ailments, is driving the demand for advanced biomaterials. These materials are essential for the development of medical devices, implants, and drug delivery systems aimed at treating and managing these conditions. Additionally, the aging population demographic and rising healthcare expenditure are contributing to the market expansion, as biomaterials play a crucial role in addressing age-related health issues and degenerative conditions. Furthermore, rapid advancements in material science and technology, including nanotechnology and 3D printing, are fostering innovation in biomaterials research and development, leading to the creation of novel biomaterials with improved functionality and performance. Overall, these growth factors underscore the significance of biomaterials in advancing healthcare solutions and meeting the evolving needs of patients and healthcare providers.

The U.S. biomaterials market size was estimated at around USD 47.35 billion in 2023 and it is projected to hit around USD 202.35 billion by 2033, growing at a CAGR of 15.63% from 2024 to 2033.

Within North America, the United States claimed the largest portion of the biomaterials market in 2023. This is largely due to the strong presence of leading market players engaged in the development and introduction of innovative solutions for reconstructive surgical procedures. Additionally, domestic companies forge strategic alliances with both local and foreign enterprises to strengthen their foothold in the implants market, further propelling market growth in the foreseeable future.

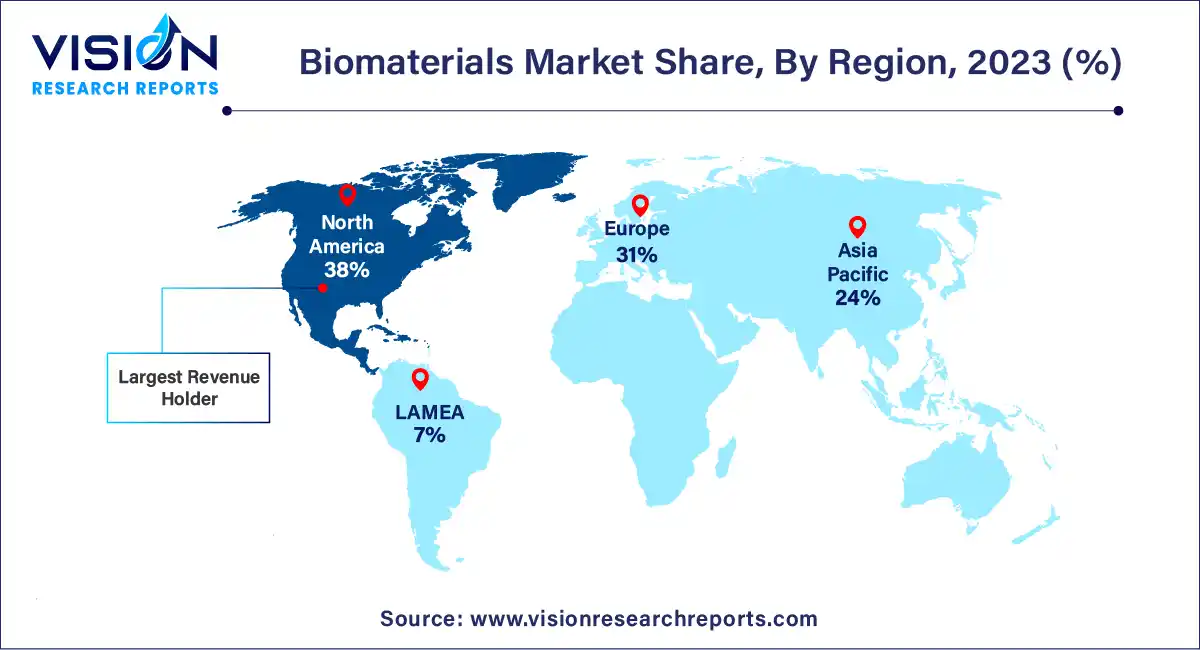

In 2023, North America emerged as the dominant force in the biomaterials market. This can be attributed to the concerted efforts of various public and private entities, such as the National Science Foundation and the National Institute of Standards and Technology, which offer expertise and support for the integration of biomaterials in biomedical applications. Consequently, there has been a notable increase in the adoption of biomaterials across the region. Moreover, favorable governmental policies and the presence of numerous major market players have significantly bolstered the regional market share.

Meanwhile, the European biomaterials market is poised for substantial growth in the forecast period. The region has witnessed remarkable expansion, driven by investments and innovations from key industry players, well-established industrial infrastructure, and supportive governmental regulations. Notably, several organizations based in Germany are dedicated to advancing the development of safer and more biocompatible biomaterials in the coming years. Furthermore, increased investments from biopharmaceutical manufacturing companies serve as a pivotal market driver, contributing to the region's anticipated growth trajectory.

The metallic segment accounted for the largest share of revenue, surpassing 41% in 2023. This was primarily attributed to the unique blend of mechanical properties, biocompatibility, and corrosion resistance offered by metals. Widely used in load-bearing implants, metals play a pivotal role in orthopedic surgeries, featuring in various forms such as wires, screws, fracture fixation plates, and total joint prostheses for hips, knees, shoulders, and ankles. The extensive use of metallic biomaterials in medical applications, alongside ongoing research aimed at enhancing their functionalities, cements their dominance in the market and underscores their widespread adoption in diverse medical devices and implants.

On the other hand, the natural segment is poised for significant growth in the forecast period. Natural biomaterials offer advantages in terms of biodegradability, biocompatibility, and remodeling compared to synthetic counterparts. They find increasing application in replacing or restoring damaged organs or tissues, such as in biosensors, analytical devices utilized to detect biomolecules or biological elements. Moreover, when implanted, natural biomaterials facilitate cell adhesion, proliferation, and differentiation, thereby playing a pivotal role in driving growth in this segment in the forthcoming years.

In 2023, the orthopedic segment emerged as the top revenue generator. This growth is primarily driven by the rising utilization of metallic biomaterials in orthopedic applications, thanks to their robust load-bearing capacity. Furthermore, ongoing efforts by market players to introduce cutting-edge orthopedic implants are anticipated to bolster revenue. Notably, DiFusion Inc. secured FDA approval in November 2019 for its Xiphos-ZF spinal interbody device, featuring the innovative biomaterial Zfuze, a blend of poly-ether-ether-ketone and titanium. This novel biomaterial has exhibited noteworthy reductions in cytokine markers linked to inflammation and fibrous tissue formation.

Meanwhile, the plastic surgery segment is poised to register the highest compound annual growth rate (CAGR) during the forecast period. This surge is attributed to the escalating demand for cosmetic procedures and the necessity for reconstructive surgeries following accidents or illnesses. Additionally, advancements in biomaterial technology have led to the creation of more resilient and customizable implants, driving market expansion. Moreover, the increasing elderly population, coupled with a growing desire for youthful aesthetics, is projected to further propel the demand for plastic surgery, thereby positively influencing overall segment growth.

By Product

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others