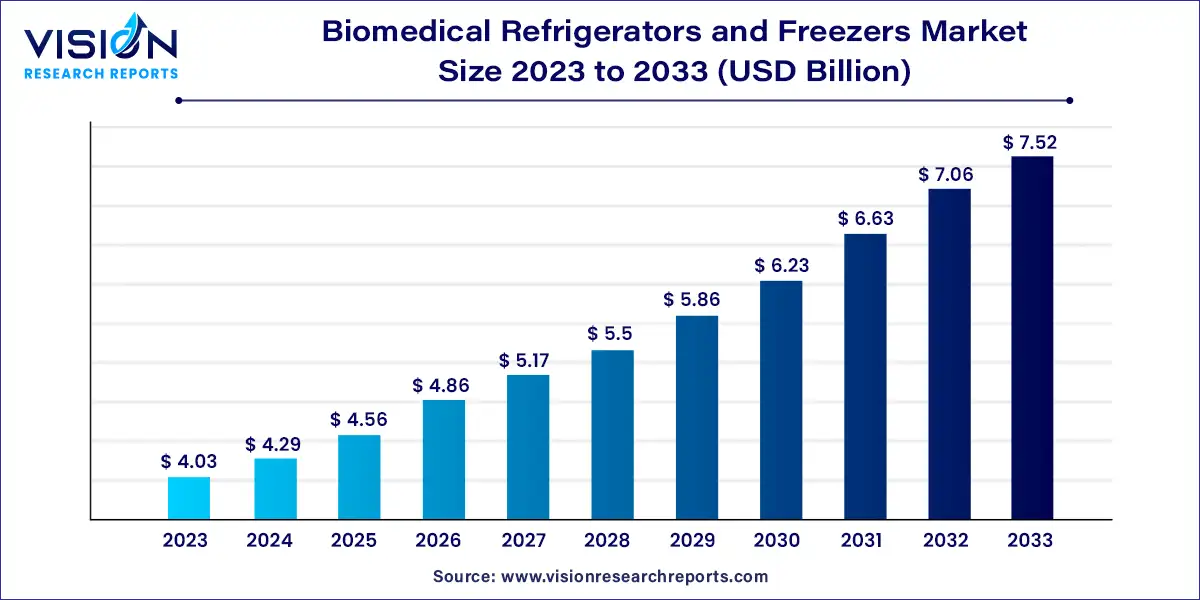

The global biomedical refrigerators and freezers market size was estimated at USD 4.03 billion in 2023 and it is expected to surpass around USD 7.52 billion by 2033, poised to grow at a CAGR of 6.43% from 2024 to 2033. Biomedical refrigerators and freezers are essential for the storage of biological specimens, pharmaceuticals, vaccines, and other temperature-sensitive materials. These units are crucial in healthcare, research, and pharmaceutical industries, ensuring that critical materials are kept at optimal temperatures to maintain their efficacy and safety.

The biomedical refrigerators and freezers market is experiencing robust growth due to the burgeoning biopharmaceutical sector is a significant driver, as the demand for the storage of temperature-sensitive biologics and vaccines escalates. Advances in refrigeration technology also play a crucial role, with innovations such as energy-efficient systems and smart, IoT-integrated units enhancing operational efficiency and reliability. Additionally, the heightened focus on global vaccination programs and the expansion of healthcare infrastructure worldwide further fuel the need for sophisticated storage solutions. These elements collectively underpin the expanding market for biomedical refrigeration and freezing equipment, ensuring the preservation of critical materials in research and clinical settings.

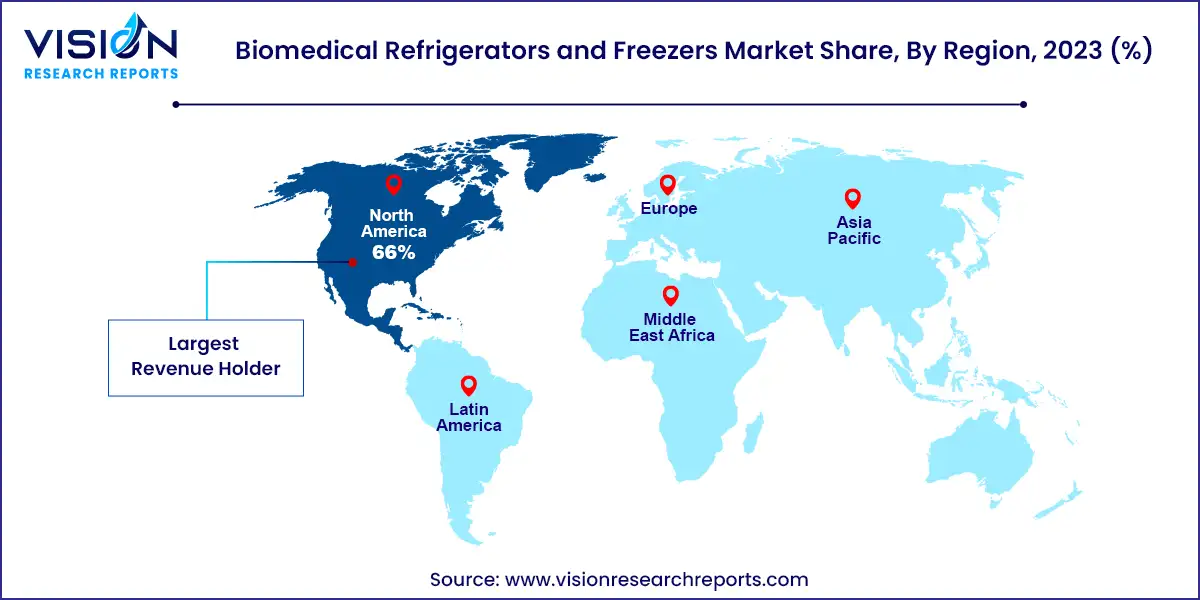

North America dominated the global market with the largest market share of 66% in 2023. This dominance is driven by the high prevalence of chronic diseases and an aging population, resulting in more blood transfusions and pharmaceutical product usage. Enhanced healthcare infrastructure and government investments in patient care and waste reduction have also supported market growth.

| Attribute | North America |

| Market Value | USD 2.65 Billion |

| Growth Rate | 6.46% CAGR |

| Projected Value | USD 4.96 Billion |

The European market for biomedical refrigerators and freezers showed strong potential in 2023, fueled by technological advancements. The aging population and rising incidences of heart and circulatory diseases have contributed to market expansion. Furthermore, an increase in organ transplants has bolstered growth. For example, the European Directorate for the Quality of Medicines & Healthcare reported a 6% increase in organ transplants in 2023 compared to 2021. In 2022, about 40,000 organ transplants were conducted across over 1,000 centers in Council of Europe member states. Additionally, the Eurostat 2024 report highlighted that circulatory diseases were responsible for 32.7% of deaths in the EU in 2020, further driving demand for advanced storage solutions.

The Asia-Pacific market for biomedical refrigerators and freezers is expected to grow significantly. The increasing burden of chronic diseases is driving demand for improved healthcare facilities. Rising awareness among healthcare providers and patients about the benefits of advanced storage solutions, such as biomedical refrigerators and freezers, is further boosting market growth. Additionally, with approximately 3.9 million deaths annually in the WHO South-East Asia Region due to cardiovascular diseases, there is a growing emphasis on enhanced healthcare infrastructure, which positively impacts market expansion.

In 2023, plasma freezers led the market with a 29% share. The growing incidence of chronic diseases has heightened research efforts and the need for the storage of biological samples, including blood and plasma products. This demand has fueled the expansion of the plasma freezers segment. Manufacturers have introduced several innovations to enhance these freezers' efficiency, such as reducing energy consumption, preventing crystallization, and ensuring uniform temperature distribution. These advancements have improved the reliability and efficiency of plasma freezers, further accelerating their adoption.

The segment for laboratory, pharmacy, and medical refrigerators is projected to experience the fastest growth rate during the forecast period. This surge can be attributed to the need to minimize wastage of laboratory chemicals, vaccines, and other biological products due to inadequate storage conditions. Such wastage impacts the profitability and operational efficiency of laboratories and pharmacies. Additionally, the growing implementation of Good Laboratory Practices (GLP) and increased government scrutiny on quality management are driving the segment's expansion.

In 2023, blood banks held the largest market revenue share at 39%. This dominance is due to the rising number of blood banks globally and the increasing need for blood transfusions. Awareness around blood donation and the necessity for a cold chain to store blood during transportation have also contributed to market growth. For example, the American Cancer Society reported approximately 1.9 million cancer diagnoses in 2023, increasing the demand for blood during chemotherapy treatments. This heightened need for biomedical refrigerators and freezers positively impacts market growth.

By Product

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biomedical Refrigerators and Freezers Market

5.1. COVID-19 Landscape: Biomedical Refrigerators and Freezers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Biomedical Refrigerators and Freezers Market, By Product

8.1. Biomedical Refrigerators and Freezers Market, by Product

8.1.1. Blood Bank Refrigerators

8.1.1.1. Market Revenue and Forecast

8.1.2. Shock Freezers

8.1.2.1. Market Revenue and Forecast

8.1.3. Plasma Freezers

8.1.3.1. Market Revenue and Forecast

8.1.4. Ultra Low Temperature Freezers

8.1.4.1. Market Revenue and Forecast

8.1.5. Laboratory /Pharmacy/Medical Refrigerators

8.1.5.1. Market Revenue and Forecast

8.1.6. Laboratory /Pharmacy/Medical Freezers

8.1.6.1. Market Revenue and Forecast

Chapter 9. Biomedical Refrigerators and Freezers Market, By End Use

9.1. Biomedical Refrigerators and Freezers Market, by End Use

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast

9.1.2. Research Laboratories

9.1.2.1. Market Revenue and Forecast

9.1.3. Pharmacies

9.1.3.1. Market Revenue and Forecast

9.1.4. Diagnostic Centers

9.1.4.1. Market Revenue and Forecast

9.1.5. Blood Banks

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Biomedical Refrigerators and Freezers Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. Panasonic Healthcare Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Haier Biomedical

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eppendorf AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Power Scientific, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Aegis Scientific, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Follett LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Helmer Scientific

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Thermo Fisher Scientific

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Azbil Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others