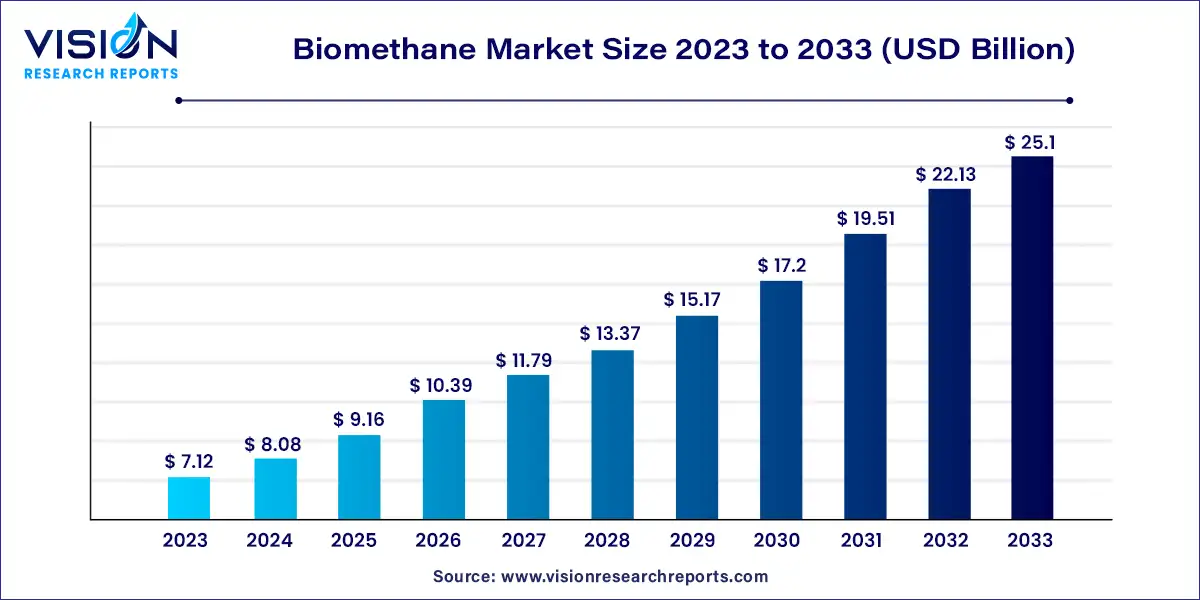

The global biomethane market size was estimated at around USD 7.12 billion in 2023 and it is projected to hit around USD 25.1 billion by 2033, growing at a CAGR of 13.43% from 2024 to 2033.

The biomethane market is rapidly gaining traction globally as a sustainable and renewable energy source. Biomethane, a high-quality gas derived from biogas, is primarily composed of methane and is considered a viable alternative to natural gas. It can be produced through anaerobic digestion of organic matter or via gasification of biomass followed by methanation. The increasing focus on reducing greenhouse gas emissions and transitioning to cleaner energy sources has significantly driven the demand for biomethane.

The growth of the biomethane market is significantly driven by an increasing global focus on reducing greenhouse gas emissions and combating climate change has led to greater adoption of renewable energy sources, with biomethane emerging as a viable alternative to fossil fuels. Secondly, supportive government policies and incentives, such as subsidies for renewable energy projects and carbon credits, are encouraging investments in biomethane production. Additionally, advancements in biogas upgrading technologies have enhanced the efficiency and cost-effectiveness of converting biogas into high-quality biomethane. The growing awareness of waste management benefits, as biomethane production utilizes organic waste, also contributes to its market expansion.

Europe dominated the global market, accounting for over 46% of the total revenue. This growth is expected to continue from 2024 to 2033 due to the increasing sources of biomethane and the focus on alternative and renewable energy sources. European universities and research institutes are receiving grants and funding from the European Commission for cutting-edge research to reduce technology costs.

| Attribute | Europe |

| Market Value | USD 3.27 Billion |

| Growth Rate | 13.43% CAGR |

| Projected Value | USD 11.54 Billion |

The North America biomethane market is projected to witness a CAGR of 13.53% from 2024 to 2033, driven by the renewable energy transition and the trend of using green materials in industries, particularly in the U.S.

The U.S. biomethane market dominated in 2023, with about USD 1.8 billion in capital investment for biogas projects, including methane capture systems for biomethane production. The market is driven by the increased use of recyclable construction infrastructure and the need to reduce carbon emissions.

According to the World Biogas Association, the Asia Pacific region has significant potential to enhance biogas generation and subsequently increase biomethane demand. This aligns with its waste management policies and efforts to combat climate change.

In 2023, the construction sector accounted for the highest revenue share, exceeding 44%. According to the IEA, bioenergy constituted around 10% of the global primary energy demand, with a significant portion used as biogas, notably biomethane. In construction, biomethane is utilized for cooking and heating, and a large amount is integrated into the gas network as a transport fuel.

Industries such as food, drink, and chemicals generate byproducts rich in organic content, ideal for biomethane production. The demand for biomethane in these sectors is expected to rise due to its role in reducing greenhouse gas emissions and promoting sustainable production methods.

In 2023, municipal waste accounted for the highest revenue share, approximately 39%. This includes organic waste from food, green waste, paper, wood, and cardboard not used for composting or recycling, as well as waste from food processing industries. Biogas, primarily composed of methane, is produced through anaerobic digestion and converted into biomethane after processing. Significant growth in the biogas industry is anticipated to boost market growth. For example, Maruti Suzuki India Ltd. installed a pilot plant for biogas generation and purification at its Manesar Plant in Haryana, India, in June 2024.

Animal manure is another valuable segment in the market. Biogas production from livestock farming manure positively impacts both the economy and the environment. According to the European Biogas Association, the agricultural sector (including manure, sequential crops, and other residues) contributed 64% to European biomethane production in 2023.

By Source

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biomethane Market

5.1. COVID-19 Landscape: Biomethane Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biomethane Market, By Source

8.1. Biomethane Market, by Source, 2024-2033

8.1.1. Energy Crops

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Animal Manure

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Municipal Waste

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Waste Water Sludge

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Biomethane Market, By End Use

9.1. Biomethane Market, by End Use, 2024-2033

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Power Generation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Transport

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Biomethane Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2021-2033)

10.1.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2021-2033)

10.2.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2021-2033)

10.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 11. Company Profiles

11.1. Air Liquide

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Engie

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nature Energy Biogas A/S

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Gasum

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Terega Solutions

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Waga Energy

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. TotalEnergies

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Chevron

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Kinder Morgan

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Archea Energy

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others