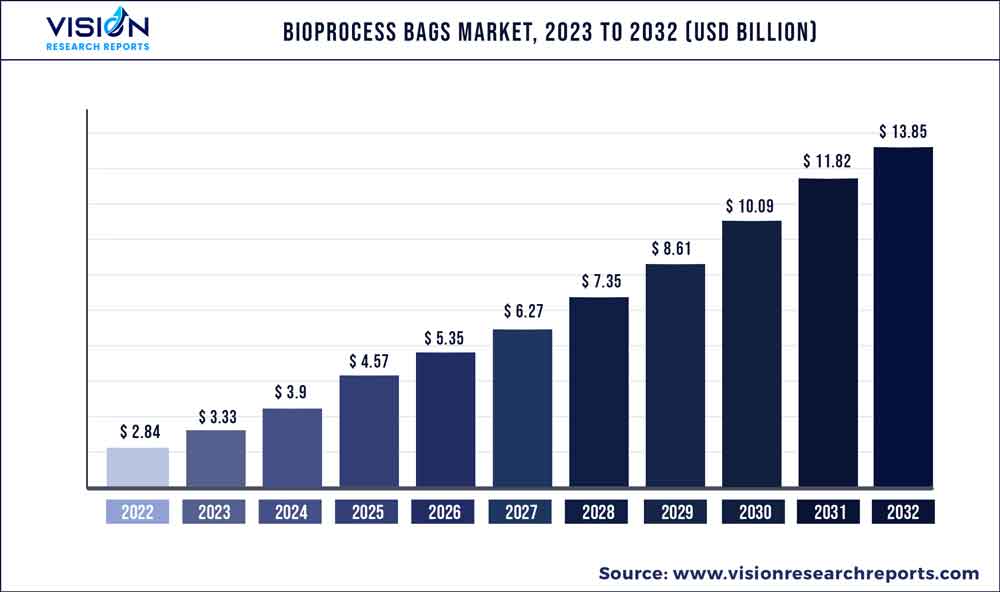

The global bioprocess bags market was valued at USD 2.84 billion in 2022 and it is predicted to surpass around USD 13.85 billion by 2032 with a CAGR of 17.17% from 2023 to 2032.

Key Pointers

Report Scope of the Bioprocess Bags Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.84 billion |

| Revenue Forecast by 2032 | USD 13.85 billion |

| Growth rate from 2023 to 2032 | CAGR of 17.17% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; Saint-Gobain; Corning Incorporated; Entegris, Meissner Filtration Products, Inc.; PROAnalytics, LLC; CellBios Healthcare And Lifesciences Pvt Ltd. |

One of the primary drivers of growth in this market is the growing trend towards personalized medicine, the rising focus on sustainability in the pharmaceutical industry, and the increasing adoption of single-use bioprocessing technologies.

The market is driven by a growing number of biologics and an increase in research and development activities by biopharmaceutical companies and academic institutions. There is an increasing trend towards modular manufacturing in the biopharmaceutical industry, wherein manufacturing processes are scaled down into smaller, more flexible units. Bioprocess bags play a crucial role in this trend as they enable the production of smaller batches, reducing waste and increasing efficiency.

Advancement in bioprocess technology has played a significant role in the growth of the market. A major advancement in bioprocess technology is the use of single-use bioreactors, which are designed to be used along with bioprocess bags. These bioreactors are small, more flexible, and easier to use than traditional stainless-steel bioreactors. These offer several benefits, including reduced risk of contamination, increased efficiency, and lower cost.

For instance, in March 2020, Sartorius AG partnered with CanSino Biologics Inc. and the Institute of Bioengineering at the Academy of Military Medical Sciences in China to develop the first vaccine candidate against SARS-CoV-2. During the clinical trials of this vaccine, Sartorius' BIOSTAT STR single-use bioreactor system was used for the upstream preparation of the recombinant vaccine. The bioreactor system includes an updated BioPAT toolbox for process monitoring and Flexsafe STR integrated single-use bioprocess bags.

Another key advancement is the development of cell and gene therapies, which requires specialized materials and equipment, such as bioprocess bags, to produce and deliver the therapies to patients. For instance, in December 2022, Food and Drug Administration (FDA) approved 27 cell and gene therapies (CGTs). The number is expected to grow in the coming years as there are over 1,500 ongoing clinical trials for cell and gene therapies registered with ClinicalTrials.gov.

Cell and gene therapies require specialized manufacturing processes, which often involve the use of single-use technologies such as bioprocess bags. These therapies require the use of sterile and controlled environments to produce therapeutic products, and bioprocess bags provide an ideal solution for the storage and transfer of the materials used in the manufacturing process. The growth of the cell and gene therapy market is expected to drive demand for bioprocess bags in the coming years.

However, the potential for leachable and extractable (L&E) compounds to migrate from the bag material into the bioprocess fluid is one of the major concerns related to the market. L&E compounds can be derived from various sources, including bag material, processing aids, and other components used during bag manufacturing. This has increased regulatory concerns about L&E compounds in relation to bioprocess bags. This has led to increased scrutiny and testing requirements for manufacturers, to ensure the safety and efficacy of bioprocess products for patients.

Type Insights

The 2D bioprocess bag segment held the highest market share of over 55.02% in 2022. This is due to the increasing demand for biopharmaceuticals and cell therapies. As the prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders continues to rise, the need for innovative and effective treatments continues to rise. Biopharmaceuticals offer a promising solution, and the use of 2D bioprocess bags can help streamline the manufacturing process and reduce costs.

The 2D bioprocess bags segment is also driven by technological advancements in bag design and materials. Manufacturers are developing bags with improved strength, durability, and resistance to punctures and leaks. Additionally, there is a growing trend toward customization and scalability, with bags designed to meet the specific requirements of different bioprocessing applications.

The 3D bioprocess bags segment is anticipated to grow at the fastest CAGR of 18.68% during the forecast period. They are commonly used in the production and storage of biologics, such as monoclonal antibodies, vaccines, and cell-based therapies. They provide a closed and sterile environment for cell culture, reducing the risk of contamination and ensuring the quality and consistency of the end product.

The growing demand for regenerative medicine and increasing government funding for regenerative medicine is driving the growth of the industry. For instance, in 2021, The Regenerative Medicine Innovation Project (RMIP) was introduced in collaboration between the US National Institutes of Health (NIH) and the Food and Drug Administration (FDA). The program supports the development of safe and effective regenerative medicine products. It also guides various industry stakeholders with information on best practices and the development of new tools and standards for evaluating regenerative medicine products. The program also encourages robust product development to ensure patient safety.

Workflow Insights

The upstream process segment held the highest market share of 43.47% in 2022. Bioprocessing bags are widely used in upstream processes for cell culture, media preparation, and fermentation. These bags provide a sterile and controlled environment for cell growth. Furthermore, these are designed to optimize cell growth and productivity. They are available in various sizes and offer varying attributes, making way for much-needed flexibility and scalability in upstream processes. The demand for bioprocessing bags in upstream processes is driven by several factors, including the growing demand for biopharmaceuticals and vaccines, the shift toward single-use technologies, and the benefits of using disposable bags in terms of cost, efficiency, and risk reduction.

The downstream process segment is anticipated to register the fastest CAGR of 17.69% during the forecast period. Bioprocess bags are widely used in the downstream process for storing and transporting the product during various stages of purification. They offer several advantages over traditional stainless steel vessels, including a lower risk of contamination, reduced cleaning and validation requirements, and faster turnaround times. For instance, Sartorius AG offers flexsafe bags, which are made from high-quality materials and are available in various sizes, ranging from 50 mL to 1,000 L. The bags are designed to be used with Sartorius' flexboy and flexboy Advance disposable bioreactors, providing a complete single-use solution for downstream bioprocessing.

End-User Insights

The pharmaceutical & biopharmaceutical companies segment held the highest market share of 46.2% in 2022. The strategic initiatives undertaken by key market players such as expansion, new product launch, merger & acquisition, and collaboration offer lucrative opportunities. For instance, in February 2021, Saint-Gobain announced the launch of highly efficient cell culture bags for T-cell expansion. These new cell culture bags are designed to provide a sterile and controlled environment for the growth and expansion of T-cells, which are an essential component of the immune system and are used in cell-based therapies for the treatment of various diseases.

The CMOs & CROs segment is anticipated to register the fastest CAGR of 18.18% over the forecast period. The adoption of contract services is being fueled by several benefits offered by CROs and CMOs, including scalability, flexibility, reduced internal infrastructure requirements, and dedicated supply channels. As a result, these advantages are expected to have a positive impact on the growth of the industry in the near future. Also, the outsourcing of bioprocessing activities allows companies to focus on their core competencies, reduce costs, and improve efficiency. This trend has led to an increase in the number of CMOs and CROs, which, in turn, is expected to drive the growth of the market.

Regional Insights

North America region dominated the global market with a share of 35.29% in 2022. The increasing demand for biopharmaceuticals is expected to drive the growth of the bioprocess bags market in the region. Other factors that are expected to contribute to the growth include the increasing adoption of single-use bioprocessing technologies and the growing focus on reducing the high costs associated with the bioprocessing of advanced therapies. Additionally, the presence of major biopharmaceutical companies and contract manufacturing organizations (CMOs) in North America is expected to drive the growth of the market in the region. These companies require high-quality bioprocess bags for their operations.

The Asia Pacific is estimated to become the fastest-growing region with a CAGR of 20.07% during the forecast period. The growing population, with increasing healthcare needs is expected to remain the key contributor to growth. Another factor driving the growth of the bioprocess bags industry in the Asia Pacific region is the increasing investment in the biopharmaceutical industry. Governments and private investors in countries like China, Japan, and South Korea are investing heavily in the biopharmaceutical industry, which is expected to drive the demand for bioprocess bags.

Bioprocess Bags Market Segmentations:

By Type

By Workflow

By End-User

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioprocess Bags Market

5.1. COVID-19 Landscape: Bioprocess Bags Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioprocess Bags Market, By Type

8.1. Bioprocess Bags Market, by Type, 2023-2032

8.1.1 2D Bioprocess Bags

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 3D Bioprocess Bags

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Other Bags & Accessories

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bioprocess Bags Market, By Workflow

9.1. Bioprocess Bags Market, by Workflow, 2023-2032

9.1.1. Upstream Process

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Downstream Process

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Process Development

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bioprocess Bags Market, By End-User

10.1. Bioprocess Bags Market, by End-User, 2023-2032

10.1.1. Pharmaceutical & Biopharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. CMOs & CROs

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Bioprocess Bags Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.1.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.2.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.3.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Workflow (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-User (2020-2032)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sartorius AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Saint-Gobain

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Corning Incorporated

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Entegris

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Meissner Filtration Products, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PROAnalytics, LLC

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. CellBios Healthcare And Lifesciences Pvt Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others