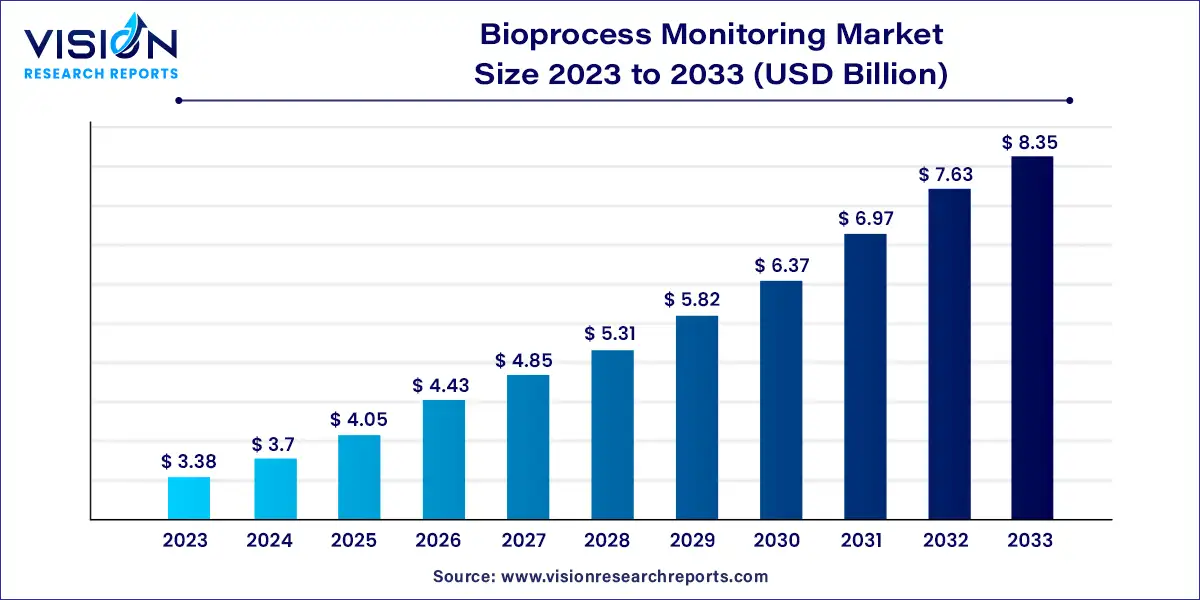

The global bioprocess monitoring market was estimated at USD 3.38 billion in 2023 and it is expected to surpass around USD 8.35 billion by 2033, poised to grow at a CAGR of 9.47% from 2024 to 2033. The bioprocess monitoring market is witnessing significant growth fueled by advancements in biotechnology and the increasing adoption of biopharmaceuticals.

The growth of the bioprocess monitoring market is propelled by the technological advancements, particularly in sensors, analyzers, and software solutions, are driving enhanced process efficiency and product quality. Additionally, the increasing demand for biopharmaceuticals, coupled with stringent regulatory requirements, is fueling the adoption of advanced monitoring solutions to ensure compliance and quality assurance. Moreover, cost reduction strategies through real-time monitoring and control are incentivizing biopharmaceutical manufacturers to invest in bioprocess monitoring technologies. These factors collectively contribute to the sustained expansion of the bioprocess monitoring market, offering significant opportunities for stakeholders across the biopharmaceutical industry.

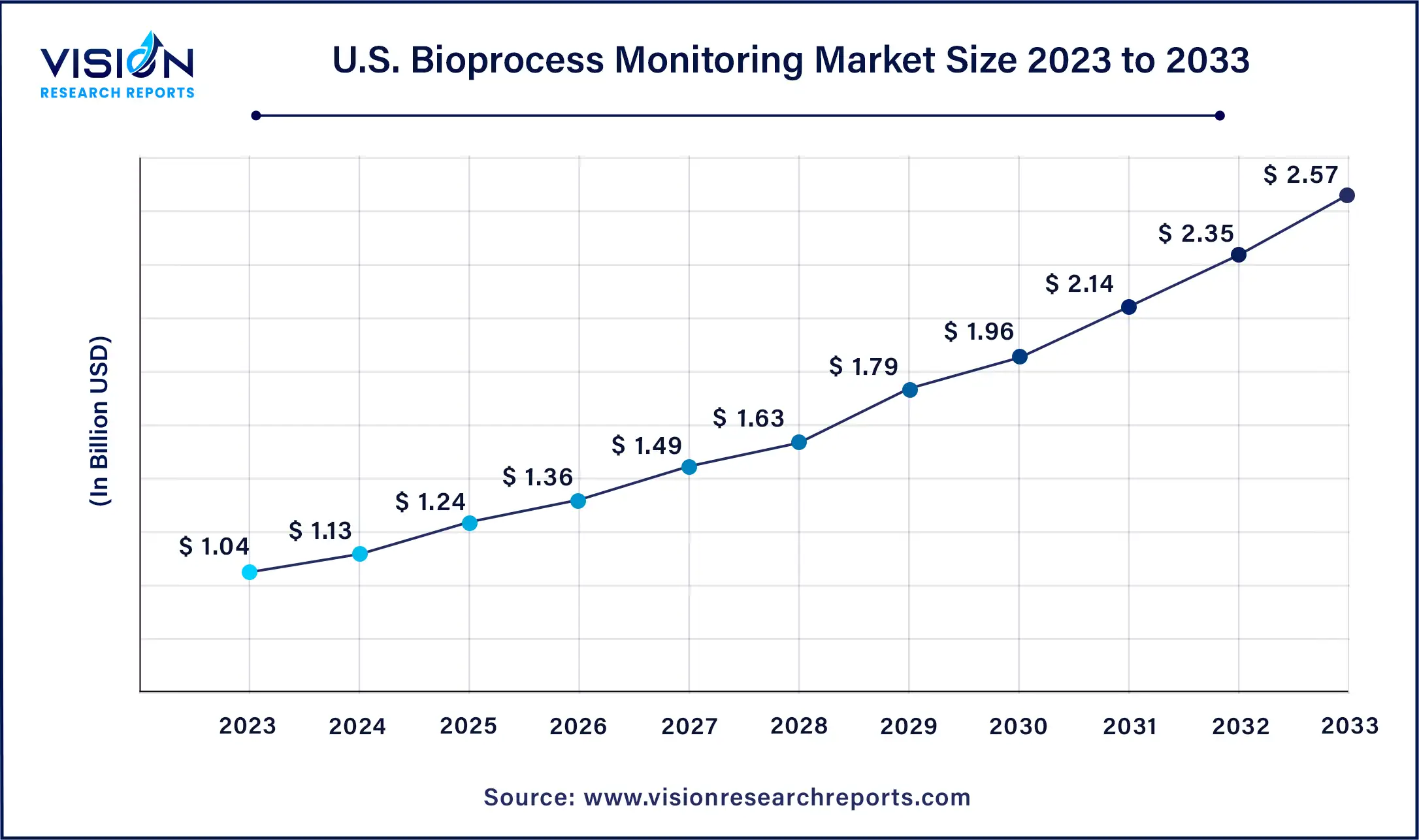

The U.S bioprocess monitoring market size was estimated at around USD 1.04 billion in 2023 and it is projected to hit around USD 2.57 billion by 2033, growing at a CAGR of 9.46% from 2024 to 2033.

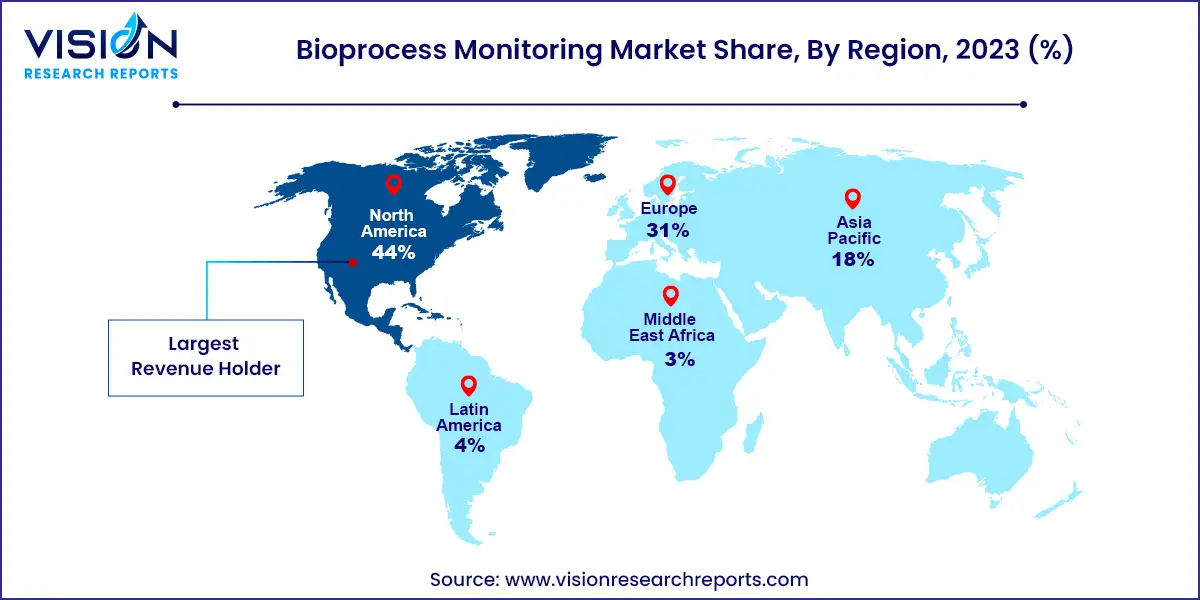

North America dominated the bioprocess monitoring market with the largest revenue share of 44% in 2023, driven by rising demand for advanced technology, increasing regulatory compliance, and a focus on improving product quality. The biopharmaceutical industry's expansion, increased R&D spending, and the rise in chronic illness prevalence are major drivers of this growth. To accommodate the growing need for state-of-the-art biotechnology solutions, Cytiva and Pall Corporation, for instance, announced a combined investment of USD 1.5 billion over two years in July 2021. New factories focused on producing bioprocessing equipment will be opened across the U.S. as part of this initiative. Market growth is also being fueled by the area's well-established healthcare system and robust government funding for life sciences programs.

The bioprocess monitoring market in Asia Pacific expected to grow at the fastest CAGR of 12.05% over the forecast period. This upsurge is attributed to the growing biotechnology & pharmaceutical sectors within the region, propelled by factors such as heightened healthcare spending and the expansion of research & development activities. As companies in these sectors are seeking to strengthen their capabilities in drug discovery, personalized medicine, and diagnostics, there is an increasing demand for cutting-edge technologies.

Based on product, the market is segmented into reagents & kits, instruments, and software. The reagents & kits segment led the market with the largest revenue share of 71% in 2023, due to several key factors. Firstly, reagents and kits are necessary for a lot of analytical techniques and bioprocess monitoring studies. They are essential for the identification, assessment, and analysis of critical variables such as protein concentration, metabolite levels, and cell viability. Ensuring product quality, complying with regulations, and optimizing bioprocesses all depend on this data. In addition, the market for bioprocess monitoring reagents and kits has seen a surge in demand because of the biotechnology sector's increased focus on R&D.

The software segment is expected to register at the fastest CAGR over the forecast period. The software segment has experienced significant market growth due to several factors. The growing understanding of the significance of data management, analysis, and interpretation in bioprocesses is one of the main causes. Large volumes of data created during bioprocess monitoring can be captured, organized, and processed with the use of powerful tools provided by advanced software systems. These resources help researchers and producers get important insights, make wise decisions, and more successfully optimize their processes. For instance, Waters Corporation plans to introduce a number of cutting-edge walk-up solutions in September 2023.

Based on application, the market is segmented into host cell residual DNA/protein quantitation, mycoplasma detection, viral titer determination, adventitious virus testing, and other applications. The host cell residual DNA/protein quantitation segment led the market with the largest revenue share of 31% in 2023. The need for precise evaluation and control of host cell impurities in the manufacturing of biopharmaceuticals is driving this expansion. Advanced quantitation technologies are becoming more and more popular because of strict regulations and increased focus on product quality assurance. Furthermore, industry cooperation is essential to the expansion of the host cell residual DNA/protein quantification market.

The mycoplasma detection segment is expected to register at the fastest CAGR over the forecast period, fueled by heightened awareness of contamination risks in biopharmaceutical production. Companies are responding by launching new products tailored to this demand. For instance, in October 2022, Cambridge Molecular Diagnostics Limited unveiled a novel lateral flow test designed to detect Mycoplasma contamination rapidly. This innovative test is quick and simple to apply, yielding accurate findings in a couple of minutes. It uses an improved PCR technique. PCR-based testing and advanced culture methods are two examples of recent technological advancements that are increasing the sensitivity and accuracy of mycoplasma detection. The mycoplasma detection market will continue to rise as a result of these advancements, which could enhance bioprocessing workflows and ensure product safety.

Based on end-use, the market is segmented into CMOs & CROs, pharmaceutical & biotechnology companies, and academic & research institutes. The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 47% in 2023. This is due to the growing demand for individualized medications, the increased emphasis on research and development for the creation of innovative therapeutics, and developments in bioprocessing monitoring. For instance, Merck and Agilent Technologies established a strategic alliance in June 2022. The alliance seeks to close the current downstream processing gap in Process Analytical Technologies (PAT). They are going to enable real-time release and encourage the adoption of Bioprocessing 4.0 by pooling their knowledge and resources.

The CROs & CMOs segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing outsourcing of research and manufacturing activities by pharmaceutical and biotechnology companies. These companies strive to be efficient and cost-effective while offering their customers high-quality services. In addition, the incorporation of state-of-the-art bioprocess monitoring technologies, such as Process Analytical Technologies (PAT) and real-time release testing, enables CROs and CMOs to provide their customers with more extensive services. Real-time data collecting, analysis, and decision-making are made possible by these technologies, which eventually leads to better product quality and shorter development times.

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others