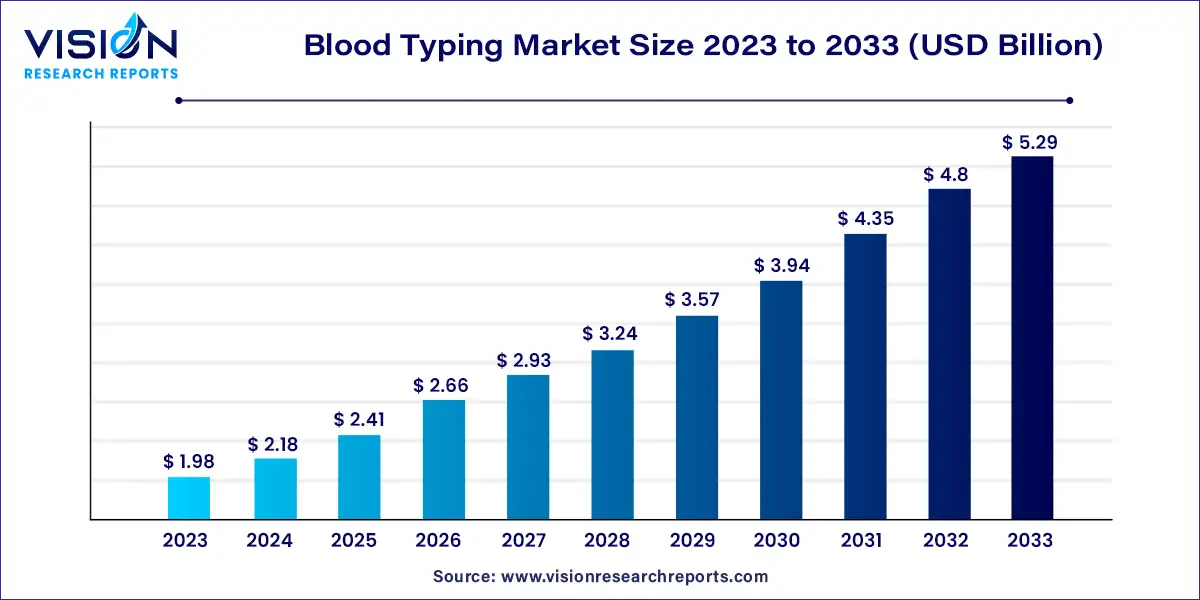

The global blood typing market size was estimated at USD 1.98 billion in 2023 and it is expected to surpass around USD 5.29 billion by 2033, poised to grow at a CAGR of 10.33% from 2024 to 2033.

The blood typing market is witnessing significant growth owing to advancements in healthcare infrastructure and rising demand for blood transfusions in various medical procedures. Blood typing, also known as blood group typing, refers to the process of determining the blood group and Rh factor of an individual's blood. This information is crucial for blood transfusions, organ transplants, and prenatal care.

The growth of the blood typing market is driven by an advancement in healthcare infrastructure and technology are enhancing the accuracy and efficiency of blood typing procedures, thereby driving market expansion. Secondly, the increasing prevalence of chronic diseases and trauma cases necessitates a higher demand for blood transfusions, stimulating market growth. Additionally, growing awareness about the significance of blood donation and blood typing in medical procedures is further fueling market demand.

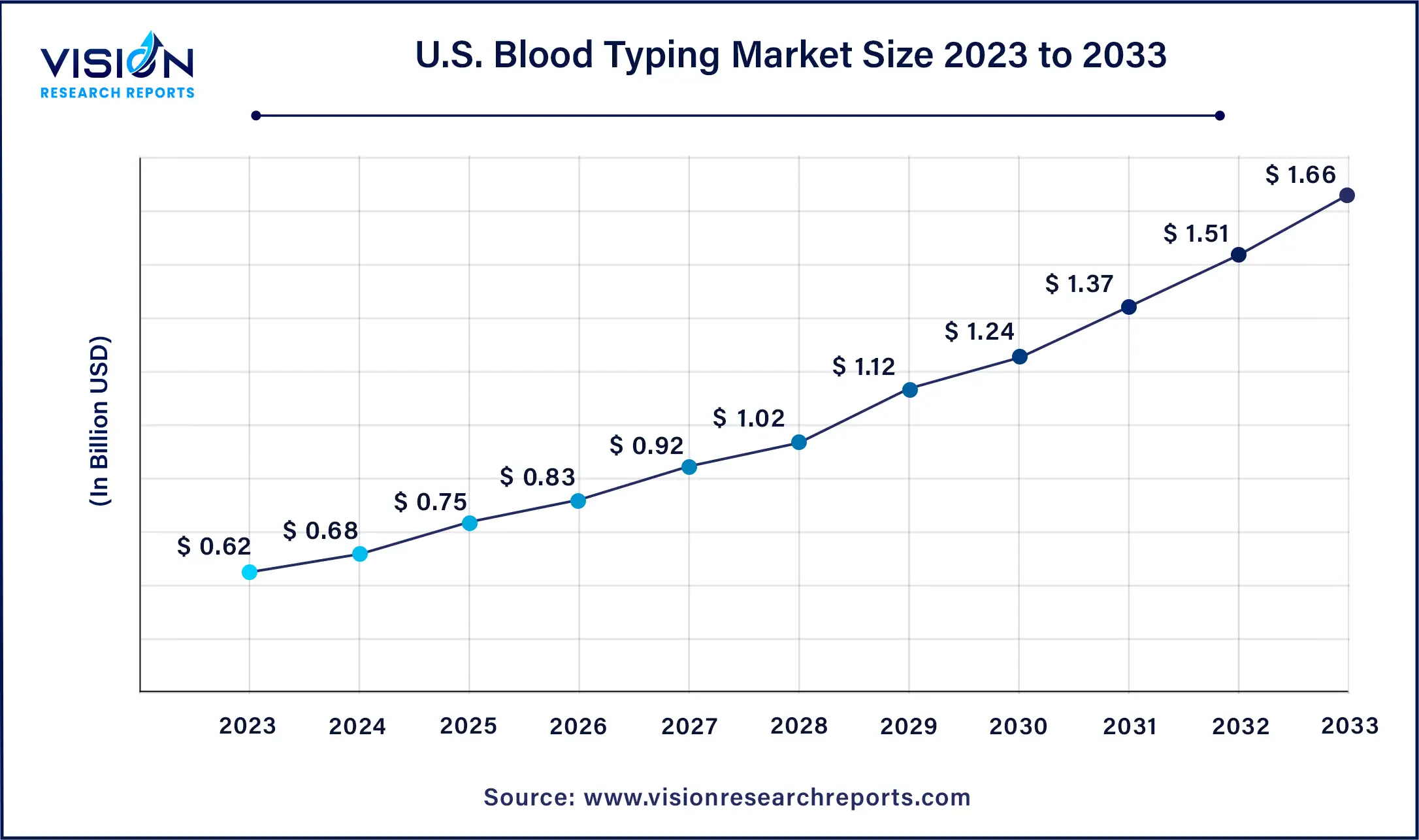

The U.S. blood typing market size was estimated at around USD 0.62 billion in 2023 and it is projected to hit around USD 1.66 billion by 2033, growing at a CAGR of 10.34% from 2024 to 2033.

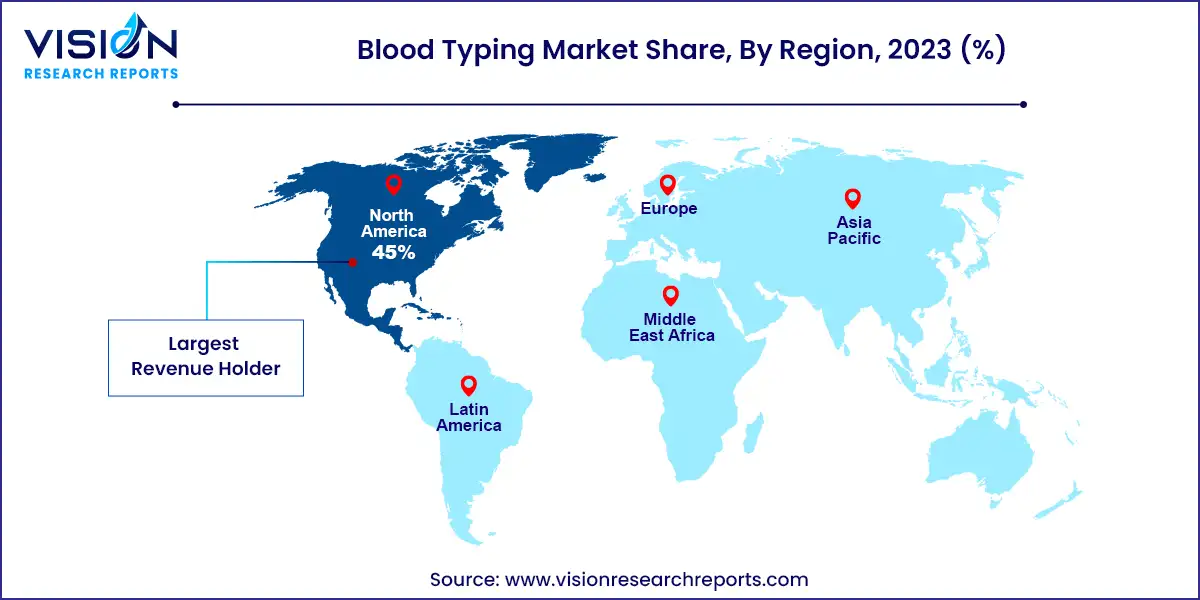

North America dominated the blood typing market with a revenue share of 45% in 2023, owing to factors such as the region's well-developed healthcare infrastructure and a large number of transfusions happening in the region. Major companies operating in the blood group typing sector, such as Bio-Rad Laboratories, Inc., QuidelOrtho Corporation, and Thermo Fisher Scientific Inc., have significant expertise, resources, and established distribution networks. The companies' comprehensive product portfolios, expansive global footprint, and well-established brand recognition further support region dominance.

The blood typing market in Asia Pacific is anticipated to witness at the fastest CAGR over the forecast period. The increasing number of donation activities and the rising incidence of trauma, accidents, and surgeries requiring transfusion are key drivers. In addition, the growing demand for blood group typing in prenatal and postnatal testing, along with the stringency of prudent transfusions, is expected to boost the market growth.

The reagents and consumables segment led the market with the largest revenue share of 72% in 2023 and is anticipated to grow at a lucrative CAGR over the forecast period. The recurring cost associated with frequent requirement of reagents & kits is a significant factor contributing to the market's growth. This constant need for consumables is driven by the high frequency of blood typing tests in various clinical settings, including hospitals, clinical laboratories, and blood banks. Technological advancements continuously drive the development of new and improved reagents, enhancing the accuracy and efficiency of blood typing processes.

The services segment is anticipated to grow at a significant CAGR over the forecast period. The increasing demand for transfusions and organ transplantations, rise in surgical operations, and growing use of reagents and serological fluids in laboratories. The elevated donation rates, which result in more blood sample analysis, also contribute to the expansion of the services segment. The importance of blood group analysis is projected to rise as the trend of donation out of societal concern increases, further driving the demand for services related to blood group testing.

Based on test type, the antibody screening segment led the market with the largest revenue share of 39% in 2023, due to the growing volume of prenatal testing, increasing transfusions, and rising prevalence of chronic diseases. Pregnant patients require various screening tests, including blood group and antibody screening, increasing the segment growth. According to a study published in the Journal of Personalized Medicine in April 2023, between 2012 and 2022, there were 51,803 new genetic tests introduced to the market in the U.S., with a significant portion of these being diagnostic tests, which are fundamental for prenatal screening. This indicates a substantial volume of prenatal testing, including blood group and antibody screening, contributing to market growth.

The HLA typing segment is anticipated to grow at the fastest CAGR over the forecast period. The number of individuals on the national transplant waiting list, which stands at 103,223 significantly contributes to this growth. Transplants require HLA typing to ensure compatibility between donor and recipient, crucial for preventing graft rejection and ensuring transplant success. HLA typing allows for more precise matching between donors and transplant patients, reducing the incidence and severity of graft-versus-host disease (GvHD) and increasing long-term survival.

Based on technique, the PCR-based and microarray-based segment led the market with the largest revenue share of 53% in 2023. The adoption of automated blood typing technologies, including PCR-based and microarray techniques, has improved the speed, standardization, and safety of transfusion diagnostics. A team from Tokyo University of Science has developed a technologically advanced lab-on-a-chip device that can determine a person’s blood type within five minutes, significantly speeding up the process of transfusion in emergency situations. These technologies offer advantages over manual typing, including cost efficiency, increased efficiency, and reduced errors highlighting the market's shift towards automated and high-throughput solutions.

The assay-based techniques segment is expected to grow at a significant CAGR during the forecast period. These techniques, including slide methods, test-tube methods, microplate methods, and gel/column centrifugation, are commonly used in hospitals and blood banks for general blood typing due to their convenience. As technologies continue to evolve, the efficiency and accuracy of these methods contribute significantly to the safety and success of transfusions and transplantation procedures. Increasing requirement for blood during surgical treatments and a growing number of hospitals further fuel the demand for accurate and swift blood group testing procedures, highlighting the essential role of assay-based techniques in the market.

Based on application, the diagnostic testing segment led the market with the largest revenue share of 55% in 2023. The adoption of automated blood analysis technologies, such as PCR-based and microarray techniques, which improves diagnostic speed, standardization, and safety. These technologies offer cost, efficiency, and error reduction benefits, making them attractive for healthcare institutions. The development of lab-on-a-chip devices for rapid blood type determination further enhances diagnostic testing's appeal. This growth is supported by the need for various screening tests during pregnancy, including blood group and antibody screening.

The organ transplants segment is anticipated to grow at the fastest CAGR over the forecast period. Technological advancements, such as the introduction of molecular diagnostics methods such as NGS and PCR, have made organ transplantation more feasible and safer, thereby increasing the market's growth. In addition, the rising incidence of infectious diseases and the aging population contribute to the need for organ transplants, further driving the demand for blood group testing services. The industry growth is also supported by strategic collaborations among firms, which accelerate product innovation and market expansion.

Based on end-use, the diagnostic laboratories segment led the market with the largest revenue share of 44% in 2023. The rising prevalence of chronic diseases and traumatic injuries, necessitates increased transfusions and organ transplantations. This demand is fueled by the development of advanced blood typing technologies, enhancing accuracy, speed, and efficiency. In addition, growing awareness of the importance of blood typing for safe transfusions and transplantations, coupled with investments in healthcare infrastructure, particularly in emerging economies, drives the demand for blood typing products and services. Government policies and initiatives aimed at improving healthcare access and infrastructure further contribute to market growth.

The blood banks segment is anticipated to grow at the fastest CAGR during the forecast period, driven by several key factors and drivers. The primary reason for this growth is the increasing demand for transfusions and organ transplantations, which necessitate blood typing to ensure compatibility between donors and recipients. This demand is fueled by a combination of factors including the rise in major surgical procedures, the volume of donations, and the growing prevalence of chronic diseases and blood disorders. Furthermore, the establishment of large blood banks and donation campaigns to ensure a constant supply of blood contributes to the market's growth. These initiatives are crucial in meeting the high demand for transfusions and organ transplantations, which in turn drives the need for blood typing services.

By Product & Services

By Test Type

By Technique

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blood Typing Market

5.1. COVID-19 Landscape: Blood Typing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Blood Typing Market, By By Product & Services

8.1. Blood Typing Market, by By Product & Services, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents & Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. RBC Reagents

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Antisera Reagents

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Anti-Human Globulin Reagents

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Blood Saline Reagents

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Services

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Blood Typing Market, By Test Type

9.1. Blood Typing Market, by Test Type, 2024-2033

9.1.1. Antibody Screening

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. HLA Typing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cross-matching

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. ABO Blood Tests

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Blood Typing Market, By Technique

10.1. Blood Typing Market, by Technique, 2024-2033

10.1.1. PCR Based and Microarray Based

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Assay Based Technique

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Massively Parallel Sequencing

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Blood Typing Market, By Application

11.1. Blood Typing Market, by Application, 2024-2033

11.1.1. Blood Transfusions

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Organ Transplants

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Diagnostic Testing

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Blood Typing Market, By End-use

12.1. Blood Typing Market, by End-use, 2024-2033

12.1.1. Hospitals & Clinics

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Diagnostic Laboratories

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Blood Banks

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Blood Typing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.1.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.2.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Technique (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.3.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Technique (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.4.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Technique (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.5.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by By Product & Services (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Technique (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Mesa Laboratories, Inc. (Agena Bioscience, Inc.)

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Danaher Corporation (Beckman Coulter)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Bio-Rad Laboratories, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. DIAGAST

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Grifols, S.A.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. AXO Science

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Merck KGaA

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Quotient, Ltd.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Thermo Fisher Scientific

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Immucor, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others