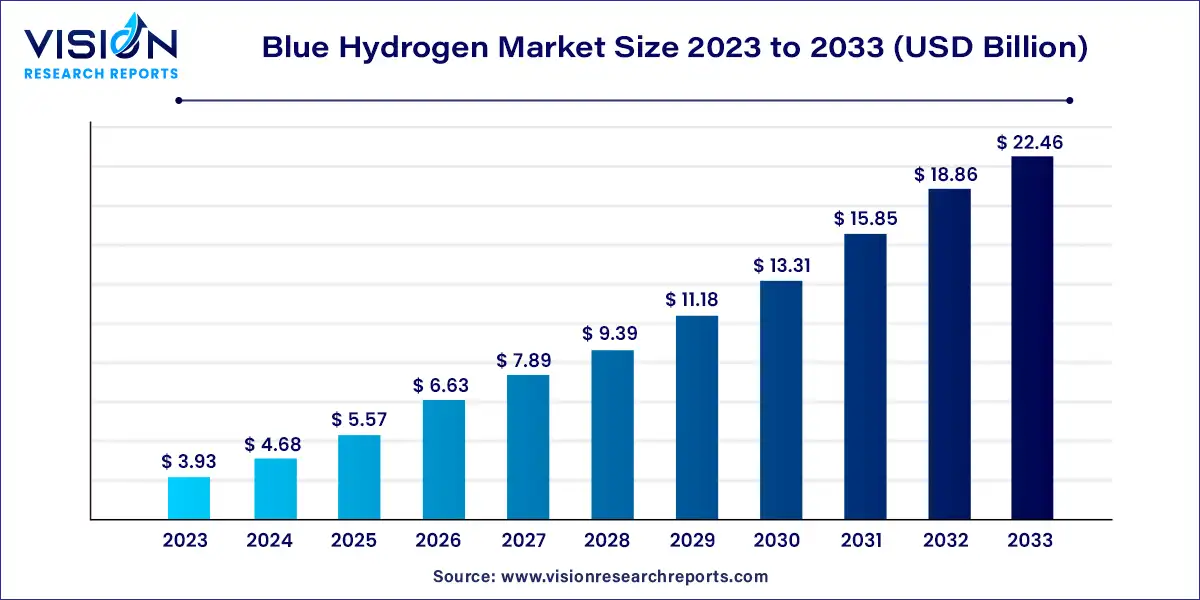

The global blue hydrogen market size was estimated at around USD 3.93 billion in 2023 and it is projected to hit around USD 22.46 billion by 2033, growing at a CAGR of 19.04% from 2024 to 2033. The blue hydrogen market is a rapidly evolving sector within the global energy landscape. Blue hydrogen is produced from natural gas through a process known as steam methane reforming (SMR), with carbon dioxide emissions captured and stored or utilized. This approach contrasts with grey hydrogen, which involves similar production but without capturing CO₂ emissions, and green hydrogen, which is produced from renewable energy sources. As industries and governments worldwide intensify efforts to combat climate change, blue hydrogen is emerging as a key player in the transition to a low-carbon economy.

The blue hydrogen market is experiencing notable growth due to the towards decarbonization. As nations and industries set ambitious targets to reduce carbon emissions, blue hydrogen emerges as a pivotal solution, offering a way to decarbonize hard-to-abate sectors like steel production and heavy-duty transport. Technological advancements in carbon capture and storage (CCS) are also playing a crucial role, making blue hydrogen production more economically viable and efficient. Enhanced CCS technologies reduce the costs associated with capturing and storing CO₂, thereby improving the overall feasibility of blue hydrogen projects. Additionally, supportive government policies and incentives are fostering market growth. Many countries are implementing regulations that encourage the adoption of low-carbon technologies, including blue hydrogen, by offering subsidies, tax breaks, and establishing carbon pricing mechanisms. The industrial demand for cleaner energy solutions further propels market growth, as key industries seek to transition away from fossil fuels towards more sustainable alternatives.

In 2023, the Middle East & Africa led the market with over 34% revenue share, driven by substantial investments in blue hydrogen projects in countries like Qatar, UAE, and Saudi Arabia. For instance, Qatar announced plans in August 2023 to build the world’s largest blue ammonia plant, using blue hydrogen as a feedstock.

Europe is expected to grow at the fastest CAGR of 22.63% during the forecast period due to supportive government policies and increased adoption of blue hydrogen. The region's heightened reliance on Russian fossil fuels and subsequent energy shortages due to the Ukraine invasion have led to increased regulatory measures and a push for blue hydrogen production. For example, the European Parliament proposed including blue hydrogen derived from natural gas in the Renewable Energy Directive and Gas Package of the EU in December 2021.

In North America, the market is driven by the abundant availability of natural gas, used as a raw material for blue hydrogen. Major suppliers in the region include Chevron Corporation and Exxon Mobil Corporation.

Asia Pacific, with its major economies like China, India, and Japan, is actively seeking energy transition alternatives such as blue hydrogen to meet climate goals. For instance, China announced in March 2023 a target to generate 100 metric tons of hydrogen by 2060, with blue hydrogen expected to play a significant role.

The market is segmented based on technology into steam methane reforming, gas partial oxidation, and auto thermal reforming. In 2023, steam methane reforming technology dominated the market with over 62% revenue share. This prominence is due to the increasing demand for blue hydrogen as a low-carbon fuel. Steam methane reforming captures and stores the carbon dioxide generated underground through the Carbon Capture, Utilization, and Storage (CCUS) process, thereby preventing greenhouse gas and carbon emissions. This makes it the preferred method for blue hydrogen production.

Auto thermal reforming technology is projected to grow at a compound annual growth rate (CAGR) of 20.43% during the forecast period. This growth is attributed to its cost-effective nature and enhanced energy efficiency in blue hydrogen production. Auto thermal reforming combines gas partial oxidation and steam methane reforming to convert natural gas and other hydrocarbons into syngas, combining the benefits of both methods. While gas partial oxidation requires a smaller reactor vessel and operates more quickly compared to other technologies, the initial hydrogen output per fuel unit is lower than that of steam methane reforming. Major producers, like Shell Group, employ this technology for blue hydrogen production, utilizing Shell Gas Partial Oxidation (SGP) technology and holding over 30 active gas licenses for residue gasification.

The market for blue hydrogen transportation is categorized into pipeline and cryogenic liquid tankers. In 2023, pipeline transportation led the market with over 72% revenue share. This preference is due to the cost-effectiveness and efficiency of transporting large volumes of gaseous blue hydrogen over long distances via pipelines. These pipelines are typically located near major consumers such as chemical manufacturing units, refineries, and power plants.

Cryogenic liquid tankers are anticipated to experience a CAGR of 20.73% during the forecast period. This growth is driven by their use in countries like India and Brazil, where blue hydrogen production and consumption are relatively low. Liquid blue hydrogen is transported via cryogenic liquid tankers, which are suitable for long-distance distribution where pipeline infrastructure is not viable. This mode of transport is more cost-effective for reaching end-use industries compared to pipelines, thereby boosting its demand.

The blue hydrogen generation market is divided into chemical, refinery, power generation, and other applications. The power generation sector held the largest revenue share of over 38% in 2023. This is due to major industry players, such as Equinor ASA, focusing on decarbonizing power systems by reducing carbon dioxide emissions from hydrogen use and minimizing fossil fuel dependency. Blue hydrogen facilitates the conversion of renewable energy into storable and transportable fuels and is used in coal-fired power stations and gas turbines to cut carbon emissions.

The refinery application segment is projected to grow at a CAGR of 20.63% over the forecast period. This growth is driven by petrochemical companies like Exxon Mobil Corp., which use steam methane reforming technology to generate hydrogen for oil and petroleum refineries. Companies are adopting sustainable practices, such as installing carbon capture storage systems, to convert grey hydrogen into blue hydrogen with zero carbon emissions, thus driving demand in the refinery sector.

By Technology

By Transportation Mode

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blue Hydrogen Market

5.1. COVID-19 Landscape: Blue Hydrogen Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Blue Hydrogen Market, By Technology

8.1. Blue Hydrogen Market, by Technology, 2024-2033

8.1.1 Steam Methane Reforming

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Gas Partial Oxidation

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Auto Thermal Reforming

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Blue Hydrogen Market, By Transportation Mode

9.1. Blue Hydrogen Market, by Transportation Mode, 2024-2033

9.1.1. Pipeline

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cryogenic Liquid Tankers

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Blue Hydrogen Market, By Application

10.1. Blue Hydrogen Market, by Application, 2024-2033

10.1.1. Chemicals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Refinery

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Power Generation

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Blue Hydrogen Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Transportation Mode (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Linde plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Shell Group of Companies.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Air Liquide

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Air Products and Chemicals, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Engie

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Equinor ASA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SOL Group

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Iwatani Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. INOX Air Products Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Exxon Mobil Corp.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others