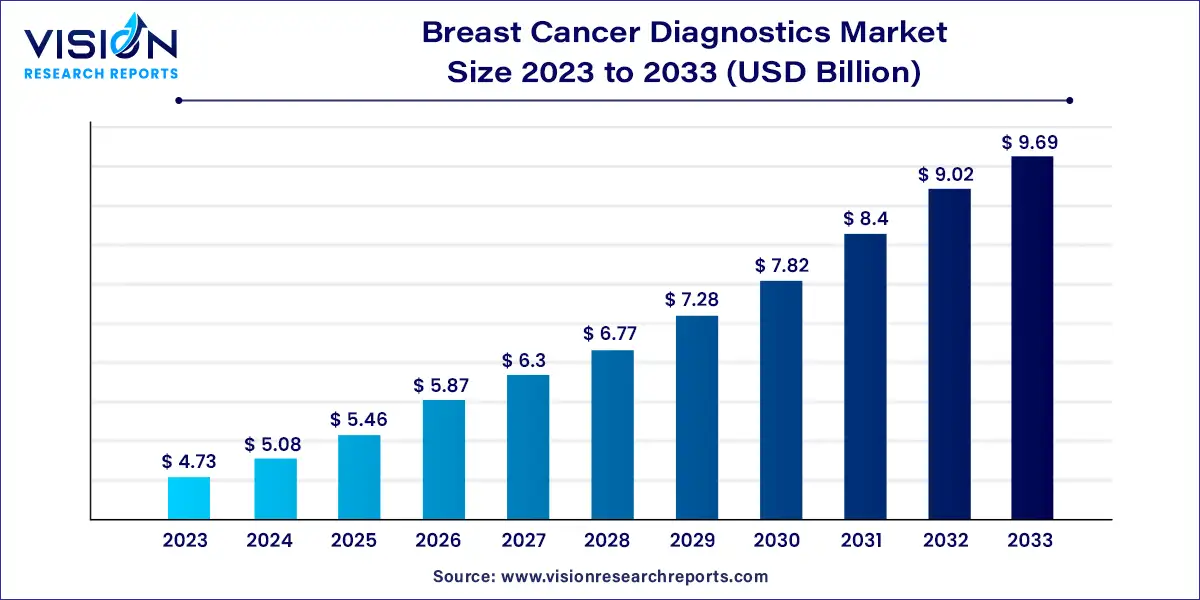

The global breast cancer diagnostics market size was valued at USD 4.73 billion in 2023 and it is predicted to surpass around USD 9.69 billion by 2033 with a CAGR of 7.44% from 2024 to 2033. The breast cancer diagnostics market is a critical segment within the broader healthcare industry, focusing on early detection, diagnosis, and monitoring of breast cancer. With advancements in technology and increased awareness, the market has experienced significant growth.

Several key factors are driving the growth of the breast cancer diagnostics market. Firstly, the rising incidence of breast cancer globally significantly boosts demand for effective diagnostic tools. As more cases are identified, the need for advanced screening and diagnostic solutions becomes increasingly urgent. Additionally, technological advancements in imaging techniques, such as digital mammography, 3D mammography, and MRI, enhance the accuracy of diagnoses, contributing to market growth. The integration of artificial intelligence and machine learning in imaging analysis further improves diagnostic precision, creating new opportunities for market expansion. Furthermore, increased awareness and education about breast cancer and its early detection encourage more women to seek regular screenings, driving up market demand. Supportive government initiatives, including funding for research and public health campaigns, also play a crucial role in promoting the adoption of advanced diagnostic technologies.

The breast cancer diagnostics market is categorized by type into imaging, biopsy, genomic tests, blood tests, and others. In 2023, the imaging segment led the market, commanding a revenue share of 53%. The substantial growth in this segment was driven by the broad adoption of imaging technologies such as mammography, ultrasound, and MRI, which have become essential tools for diagnosing breast cancer. Innovations like molecular breast imaging (MBI), computed tomography (CT), 3D breast tomosynthesis, and positron emission tomography (PET) are further enhancing diagnostic capabilities.

The blood test segment is projected to experience the fastest growth, with a compound annual growth rate (CAGR) of 9.93% during the forecast period. This growth is attributed to extensive research and advancements in liquid biopsy technologies. In April 2023, Syantra received CE Mark approval for its Syantra DX Liquid Biopsy Platform, a blood-based test for breast cancer detection, marking a significant development in breast cancer diagnostics.

The market is divided into platform-based and instrument-based products. In 2023, instrument-based products led the market, holding a revenue share of 72%. This segment includes biopsy and imaging tools, which are crucial for breast cancer diagnosis. Various organizations, such as the National Breast Cancer Foundation, are actively promoting awareness and early detection, reinforcing the reliance on imaging for population-based screening.

The platform-based products segment is expected to grow at a CAGR of 9.33% over the forecast period. This segment includes technologies like Next-generation Sequencing (NGS), PCR, and microarrays. Platform-based products are favored for their low false-positive rates and their ability to guide treatment based on genetic profiles, enhancing their application in laboratory settings.

The market is segmented by application into screening, diagnostic & predictive, prognostic, and research. The diagnostic & predictive segment dominated in 2023, accounting for 49% of the market. This segment includes various tests such as biopsies, MRIs, CT scans, and PET scans, which are essential for confirming the presence of breast cancer and evaluating tumor characteristics. The focus on predictive diagnosis is increasing as the market becomes more competitive.

The prognostic segment is anticipated to grow at a CAGR of 8.43% during the forecast period. Prognostic tests, such as BRACAnalysis CDx and PD-L1 IHC 22C3 pharmDx, are crucial for matching patients with suitable therapies and improving survival rates. Recent presentations at the American Society of Clinical Oncology (ASCO) 2023 highlighted the significance of prognostic tests like the Oncotype DX Breast Recurrence Score.

The market is divided into hospitals & clinics, diagnostics centers & medical laboratories, and others. Hospitals & clinics held the largest share, accounting for 51% of the market in 2023, due to the increasing number of hospitalizations and the rising burden of breast cancer. These facilities play a key role in performing biopsies and utilizing advanced imaging technologies for effective disease monitoring.

The diagnostics centers & medical laboratories segment is projected to grow at the highest rate, with a CAGR of 8.13%. This growth is driven by government initiatives to support diagnostic services, including reimbursement policies. Collaboration between healthcare institutions and laboratories to integrate various diagnostic tests is also contributing to this segment's expansion.

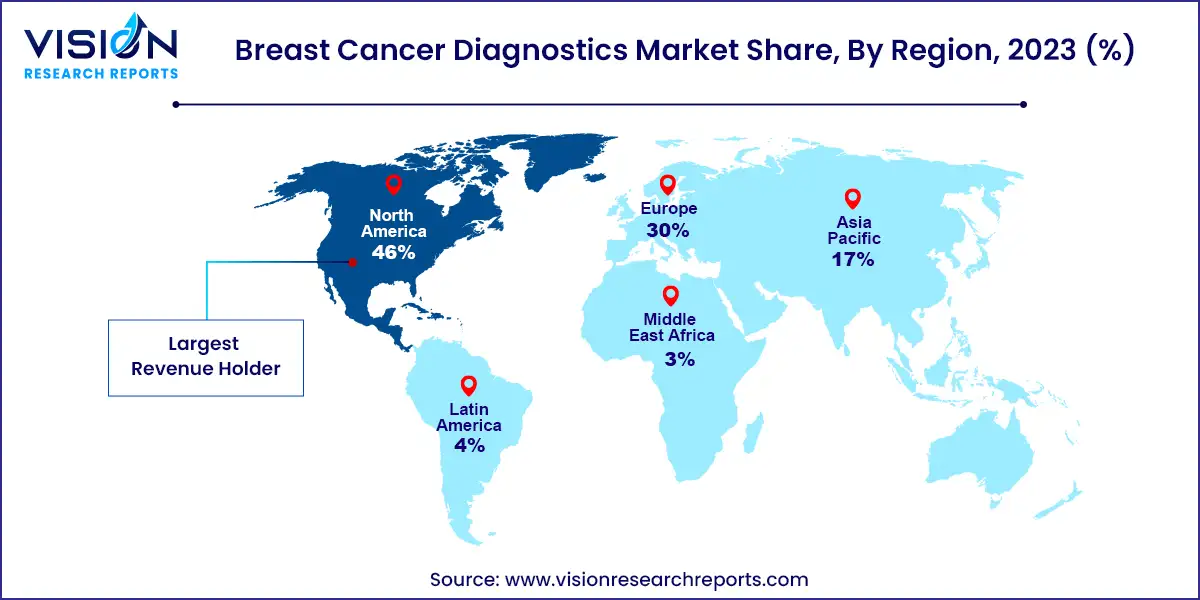

In 2023, North America led the market with a revenue share of 46%, driven by high breast cancer prevalence and supportive government initiatives aimed at increasing screening and diagnostic rates. For example, the American Cancer Society reported approximately 49,290 breast cancer-related deaths in the U.S. in 2021, with an anticipated 281,550 new cases. The U.S. remains the largest market in North America, with a growing demand for advanced diagnostic products that enhance accuracy and efficiency.

The Asia Pacific market is expected to grow significantly due to factors such as healthcare reforms, increasing breast cancer incidence, and substantial investments in research and technology. Breast cancer rates in Asian countries are rising rapidly, influenced by lifestyle and dietary changes. The development of healthcare infrastructure in this region is expected to drive further growth in the market.

By Type

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others