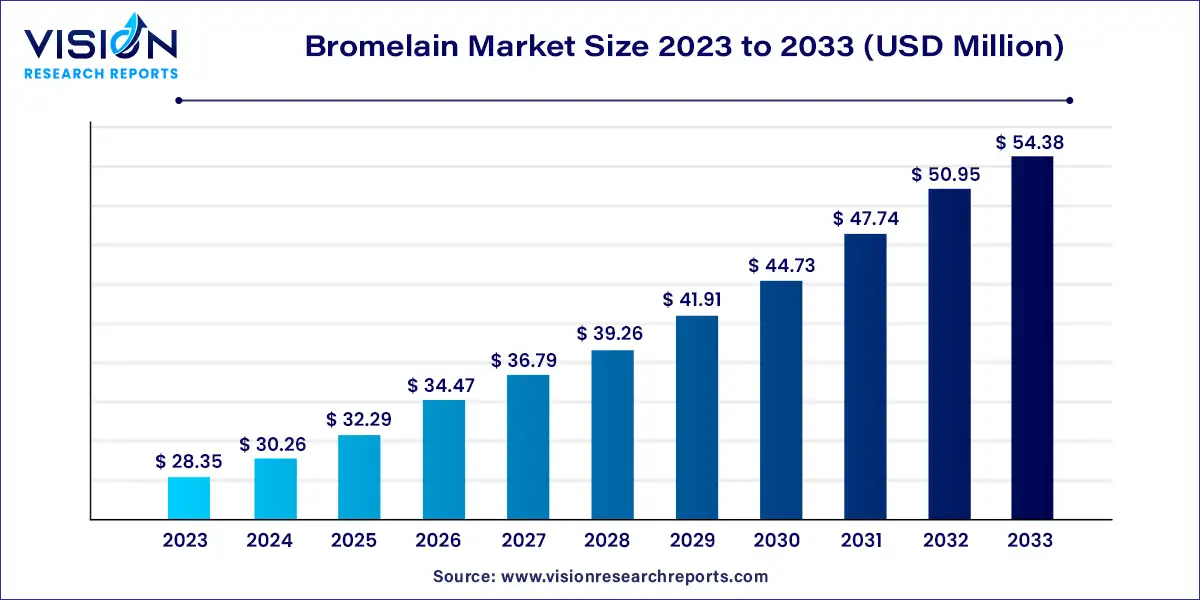

The global bromelain market size was valued at USD 28.35 million in 2023 and it is predicted to surpass around USD 54.38 million by 2033 with a CAGR of 6.73% from 2024 to 2033. Bromelain, a natural enzyme extracted from pineapple stems and fruit, has garnered significant attention across various industries due to its wide range of applications. Its proteolytic properties, which enable it to break down proteins, have made it a popular ingredient in the food and beverage, pharmaceutical, and cosmetics industries. The Bromelain market is witnessing steady growth, driven by increasing consumer awareness of natural and organic products, as well as the growing demand for plant-based alternatives.

The growth of the Bromelain market is primarily driven by an increasing consumer preference for natural and plant-based ingredients, which has led to a surge in demand across various industries. The expanding awareness of Bromelain's health benefits, particularly its anti-inflammatory, digestive, and immune-boosting properties, has fueled its adoption in the pharmaceutical and dietary supplement sectors. Additionally, the rising popularity of clean label products in the food and beverage industry is further propelling market growth, as Bromelain is increasingly used as a natural meat tenderizer and food processing aid. Moreover, the cosmetics industry’s growing focus on natural exfoliants and anti-aging products has also contributed to the market's expansion.

The meat and seafood segment led the Bromelain market in 2023, capturing a significant share of 46%. The increasing global consumption of meat and seafood is a major driver for the use of Bromelain, which is employed to tenderize these foods and improve their palatability. This enzyme works by breaking down proteins in tougher meats, resulting in a more tender and enjoyable product for consumers. Through protein hydrolysis, Bromelain enhances both the texture and tenderness of meat, making it a valuable component in food processing.

The dietary supplements segment is projected to experience the fastest growth, with a compound annual growth rate (CAGR) of 7.03% over the forecast period. This surge is fueled by rising health awareness and greater consumer purchasing power, especially in developing regions. Previously underserved markets are now the focus of awareness campaigns aimed at promoting the benefits of Bromelain, thereby increasing demand. For example, in January 2023, MediNiche, Inc. launched Bone-Tite, a supplement designed to aid osseointegration in dental implant patients. This formula includes a "bone-building complex" containing nutrients such as manganese, potassium, magnesium, copper, calcium, zinc, vitamins C, D-3, and K-1, along with bone-strengthening agents like Bromelain, L-lysine, boron, and ipriflavone.

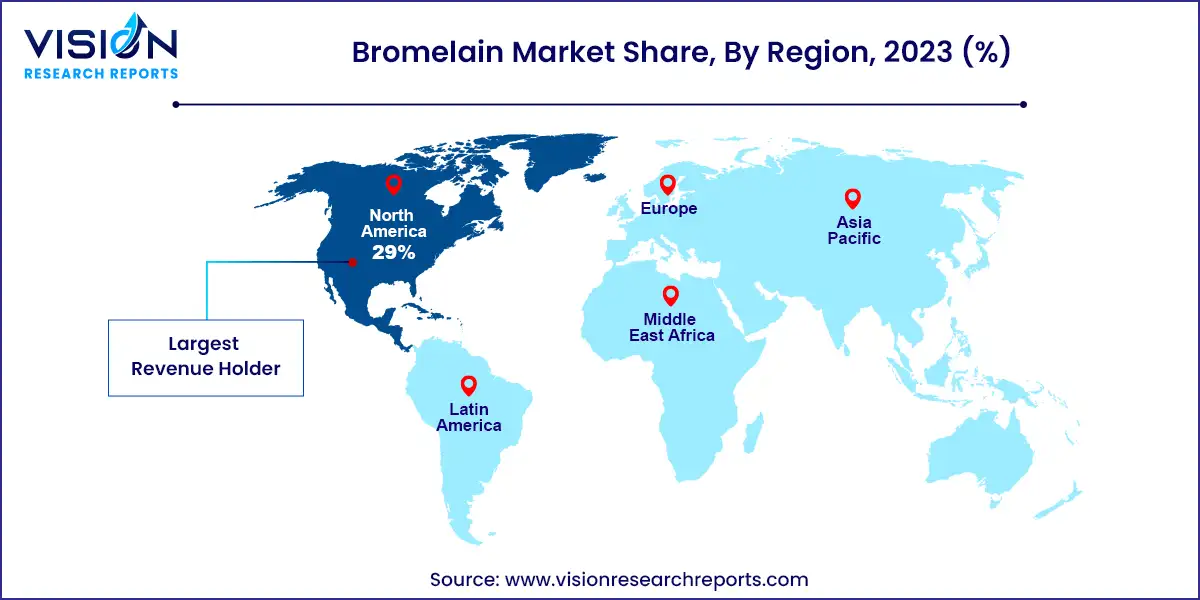

North America dominated the Bromelain market in 2023, holding a 29% share. The region's growing awareness of Bromelain's benefits, coupled with increased consumer purchasing power, is driving demand. Additionally, the expanding needs within the healthcare and meat and seafood industries are contributing to the enzyme's rising popularity. According to the U.S. Bureau of Labor Statistics, consumer spending in North America reached USD 18,678.07 billion, reflecting a 9.01% increase from 2021. The most notable spending increases were in cash contributions (up 14.1%), food (up 12.7%), personal care products and services (up 12.3%), and transportation (up 12.2%). The only significant decline was in entertainment, which saw a 3.1% drop.

Europe Bromelain Market Trends

In 2023, Europe was recognized as a lucrative region for the Bromelain market. The region benefits significantly from Bromelain's application in the cosmetics industry, where its exfoliating and skin-soothing properties meet consumer demand for innovative beauty solutions. This trend is driving market growth as more individuals seek effective, natural ingredients for their skincare routines. In 2023, the European cosmetics and personal care market reached a substantial value of USD 104.79 billion in retail sales, positioning Europe as a leading global market in this sector. Germany led with sales of USD 17.36 billion, followed by France at USD 14.95 billion, Italy at USD 13.64 billion, the UK at USD 12.01 billion, Spain at USD 11.35 billion, and Poland at USD 5.68 billion.

Asia Pacific Bromelain Market Trends

The Asia Pacific Bromelain market is expected to grow at the fastest CAGR of 7.53% during the forecast period. As the world's leading producer of pineapples, Asia Pacific hosts major Bromelain manufacturing facilities, benefiting from the region's ideal land and climate conditions for pineapple cultivation. This steady supply of high-quality raw materials ensures robust Bromelain production. According to Vietnam Agriculture, Asia leads global pineapple production and consumption, driven by high local demand and extensive cultivation areas. In 2021, Indonesia topped the region with 2.88 million metric tons of production, followed closely by the Philippines with 2.86 million metric tons and India with 1.7 million metric tons.

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others