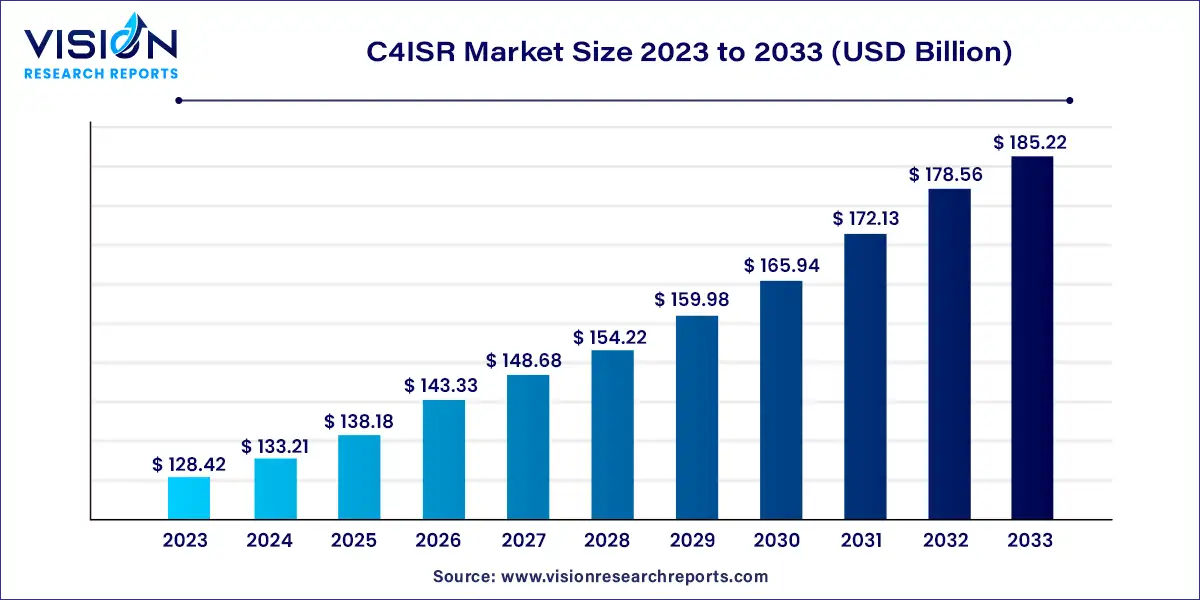

The global C4ISR market size was estimated at around USD 128.42 billion in 2023 and it is projected to hit around USD 185.22 billion by 2033, growing at a CAGR of 3.73% from 2024 to 2033.

When delving into the C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market overview, it's essential to grasp the multifaceted landscape of this critical sector. C4ISR systems serve as the backbone for military operations, providing commanders with the tools necessary to make informed decisions swiftly and effectively.

At its core, the C4ISR market encompasses a wide array of technologies, solutions, and services designed to enhance situational awareness, streamline communication channels, and bolster intelligence gathering capabilities. This includes advanced command and control systems, robust communication networks, sophisticated intelligence platforms, and cutting-edge surveillance and reconnaissance technologies.

The growth of the C4ISR market is propelled by an increasing global security threats and geopolitical tensions are driving nations to invest in modernizing their defense capabilities, thereby boosting the demand for advanced command, control, and intelligence systems. Secondly, the advent of disruptive technologies such as artificial intelligence, big data analytics, and cyber security solutions is reshaping the C4ISR landscape, offering enhanced capabilities for information processing, decision-making, and situational awareness. Additionally, the growing adoption of network-centric warfare concepts and the need for seamless interoperability among different military platforms are driving the demand for integrated C4ISR solutions. Furthermore, the rise of asymmetric threats and non-state actors necessitates the development of agile and adaptive C4ISR systems capable of addressing complex and dynamic operational environments.

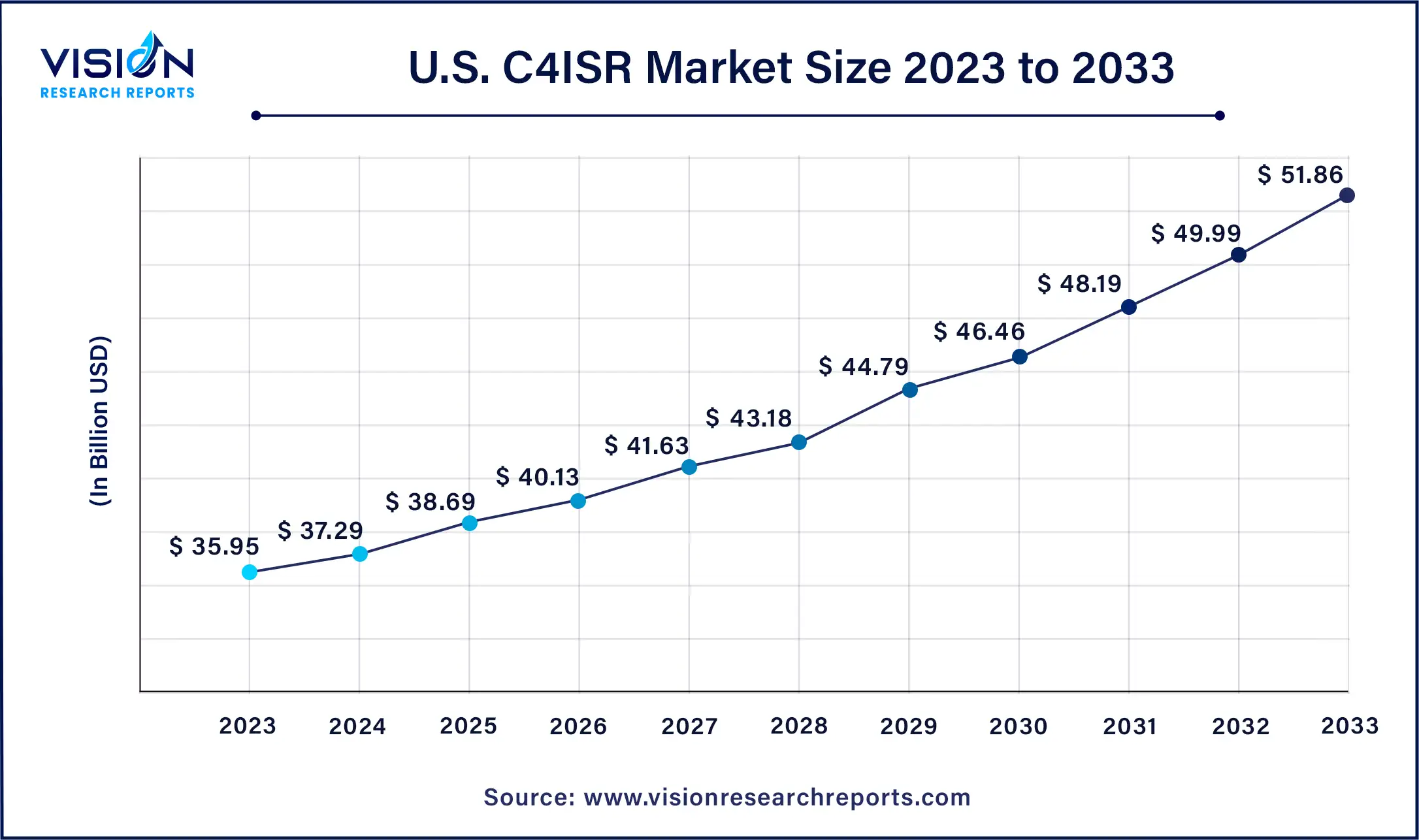

The U.S. C4ISR market size was estimated at USD 35.95 billion in 2023 and is expected to be worth around USD 51.86 billion by 2033, at a CAGR of 3.73% from 2024 to 2033. This growth is propelled by increasing demand across various industries and is evidenced by significant revenue and sales volume growth. Factors contributing to this expansion include technological advancements, heightened consumer awareness, and the growing adoption of C4ISR in diverse applications.

In 2023, the North American C4ISR market claimed the largest share at 40%. The U.S. military strategically allocates significant resources to enhance its C4ISR capabilities, aiming to maintain a decisive edge in the ongoing technological competition with adversaries. This substantial commitment underscores a key priority in the nation's warfare strategy, with substantial funds dedicated to developing advanced C4ISR solutions. Moreover, the U.S. government actively pursues the expansion and modernization of its current fleet of land, air, and sea platforms by integrating cutting-edge communication and situational awareness systems.

Asia Pacific C4ISR market is poised to witness robust growth, with a projected CAGR exceeding 4.55% from 2024 to 2033. This growth is primarily driven by the escalating defense budgets of major Asian economies. Advancements in battlefield communications and enhanced efficiency in surveillance and reconnaissance operations further fuel market expansion within the region. Notably, countries like China, India, and Japan are set to bolster their demand for electronic warfare, demonstrating a significant commitment to refining their C4ISR capabilities for future challenges.

In 2023, the hardware segment dominated with a commanding share of 59%. This segment encompasses a wide array of equipment vital for C4ISR systems, including communication devices, sensors, computing systems, and networking infrastructure. These components play a crucial role in ensuring the seamless operation of C4ISR systems, meeting the stringent demands of modern military operations. With defense agencies worldwide prioritizing technological modernization, the hardware segment is expected to maintain its lead.

The service segment is poised to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. Rapid technological advancements necessitate ongoing support, maintenance, and upgrades to ensure optimal performance of C4ISR systems. Given the complexity of these systems, which comprise hardware, software, and communication components, there is a rising demand for services such as system integration, training, consulting, and maintenance. Service providers play a critical role in ensuring the cybersecurity, adaptability, and efficiency of C4ISR systems.

In 2023, the intelligence, surveillance, and reconnaissance (ISR) segment dominated, boasting the highest revenue share. The escalating complexity of security challenges, coupled with the urgent need for real-time, actionable intelligence, has fueled the demand for cutting-edge ISR technologies. These encompass a spectrum of advanced sensors, Unmanned Aerial Vehicles (UAVs), satellite systems, and ground-based surveillance tools. ISR capabilities empower defense forces to swiftly gather, analyze, and disseminate information, thereby enhancing situational awareness and decision-making processes.

Conversely, the computer segment is projected to witness the swiftest compound annual growth rate (CAGR) exceeding 3.75% from 2024 to 2033. This surge is attributed to the burgeoning demand for enhanced computing capabilities, heightened data processing efficiency, and seamless connectivity in defense applications. As modern military operations lean heavily on sophisticated technologies, the significance of computers within C4ISR systems is paramount. The evolving nature of contemporary warfare, characterized by information-centric methodologies, necessitates robust computing solutions capable of handling intricate algorithms, artificial intelligence applications, and real-time data analysis.

In 2023, the air segment emerged as the frontrunner in the market. The escalating complexity of air operations, coupled with the surging adoption of Unmanned Aerial Vehicles (UAVs) and cutting-edge airborne platforms, has fueled the demand for advanced C4ISR systems. These systems play a pivotal role in augmenting situational awareness, communication channels, and intelligence gathering within the aerospace domain. Encompassing a broad spectrum of applications, including manned and unmanned aircraft, helicopters, and other airborne platforms, this segment necessitates seamless integration of C4ISR technologies.

The naval segment is poised to witness the swiftest compound annual growth rate (CAGR) from 2024 to 2033. This accelerated growth is attributed to the escalating focus on naval modernization initiatives and the integration of advanced technologies to fortify maritime capabilities. Naval forces worldwide are making substantial investments in C4ISR systems to bolster their situational awareness, command and control capabilities, and overall operational efficacy.

In 2023, the defense & military segment emerged as the market leader. Investments in advanced technologies geared towards situational awareness, communication, and data analysis have surged within the defense sector, reflecting a global priority to strengthen defense capabilities. C4ISR systems play a pivotal role in facilitating seamless coordination of military activities, ensuring real-time information flow, strategic decision-making, and heightened operational efficiency. The escalating complexity of modern warfare, characterized by diverse threats and evolving challenges, has fueled the demand for sophisticated C4ISR solutions.

Conversely, the government segment is poised to witness the swiftest compound annual growth rate (CAGR) from 2024 to 2033. Governments worldwide are increasingly acknowledging the critical role of advanced command, control, and surveillance systems in addressing evolving security challenges. With mounting geopolitical tensions and a heightened need for enhanced situational awareness, there is a growing emphasis on modernizing defense and intelligence capabilities. Governments are allocating substantial budgets for the development and acquisition of C4ISR technologies to bolster national security.

In 2023, the new installation type emerged as the leader in the market. This installation type signifies the adoption of fresh C4ISR systems, reflecting a growing demand for state-of-the-art technologies and modernization within the defense and security sectors. It encompasses the deployment of advanced sensor networks, communication systems, and integrated technologies aimed at augmenting situational awareness and decision-making capabilities. The focus on new installations underscores a commitment to remaining at the forefront of technological advancements, ensuring that defense forces are equipped with the latest tools to effectively address modern security challenges.

Conversely, the retrofit type segment is poised to witness the highest compound annual growth rate (CAGR) of over 4.02% from 2024 to 2033. Retrofitting, which involves upgrading or enhancing existing systems with advanced technologies, gains prominence due to its cost-effectiveness and efficiency in modernizing legacy C4ISR infrastructure. As technological advancements continue to progress rapidly, retrofit solutions offer a strategic advantage, enabling defense organizations to harness new capabilities without the need for complete system replacements.

By Component

By Application

By End-use

By Vertical

By Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others