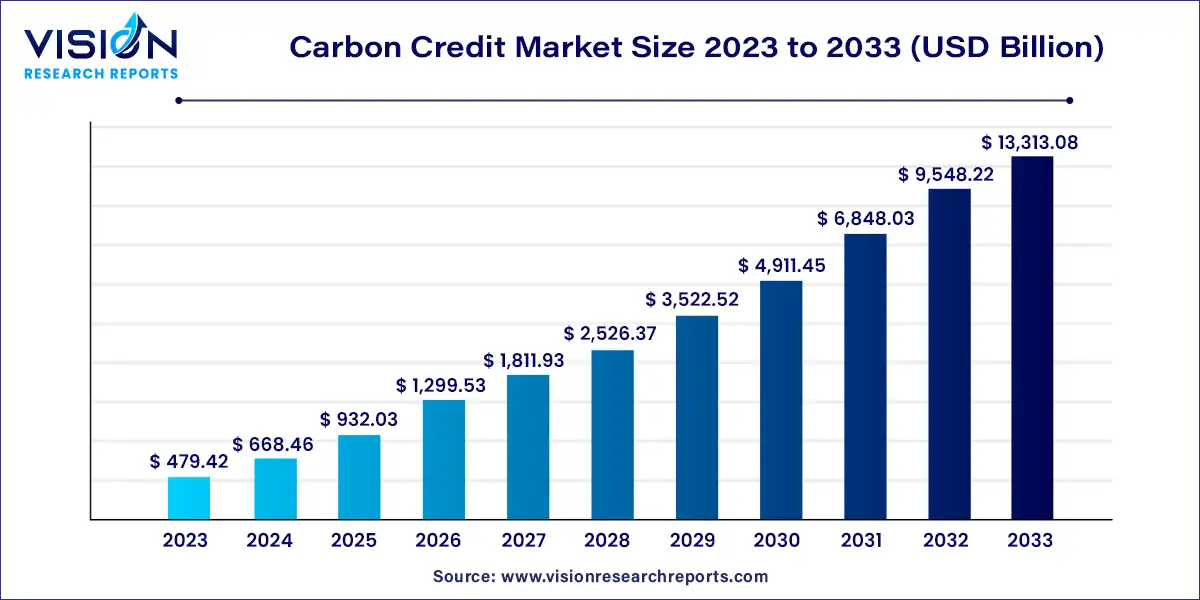

The global carbon credit market size was valued at USD 479.42 billion in 2023 and is anticipated to reach around USD 13,313.08 billion by 2033, growing at a CAGR of 39.43% from 2024 to 2033. The carbon credit market has emerged as a pivotal mechanism in the global effort to combat climate change. It facilitates the trading of carbon credits, which represent a permit to emit a specific amount of carbon dioxide or equivalent greenhouse gases. This market enables companies, governments, and other entities to meet their emissions reduction targets while promoting sustainable practices.

The growth of the carbon credit market is primarily driven by increasing regulatory frameworks aimed at reducing greenhouse gas emissions. Governments worldwide are implementing stricter emissions targets and cap-and-trade systems, compelling companies to participate in the carbon market to comply with regulations. Additionally, the rising awareness of climate change impacts has led to a surge in corporate social responsibility initiatives, where businesses seek to offset their carbon footprints by purchasing credits. Technological advancements, such as improved monitoring and verification methods, are enhancing the credibility of carbon credits, further attracting investment. The expansion of voluntary markets, driven by consumers demanding sustainable practices, also contributes significantly to market growth, as more individuals and organizations aim to offset their environmental impact.

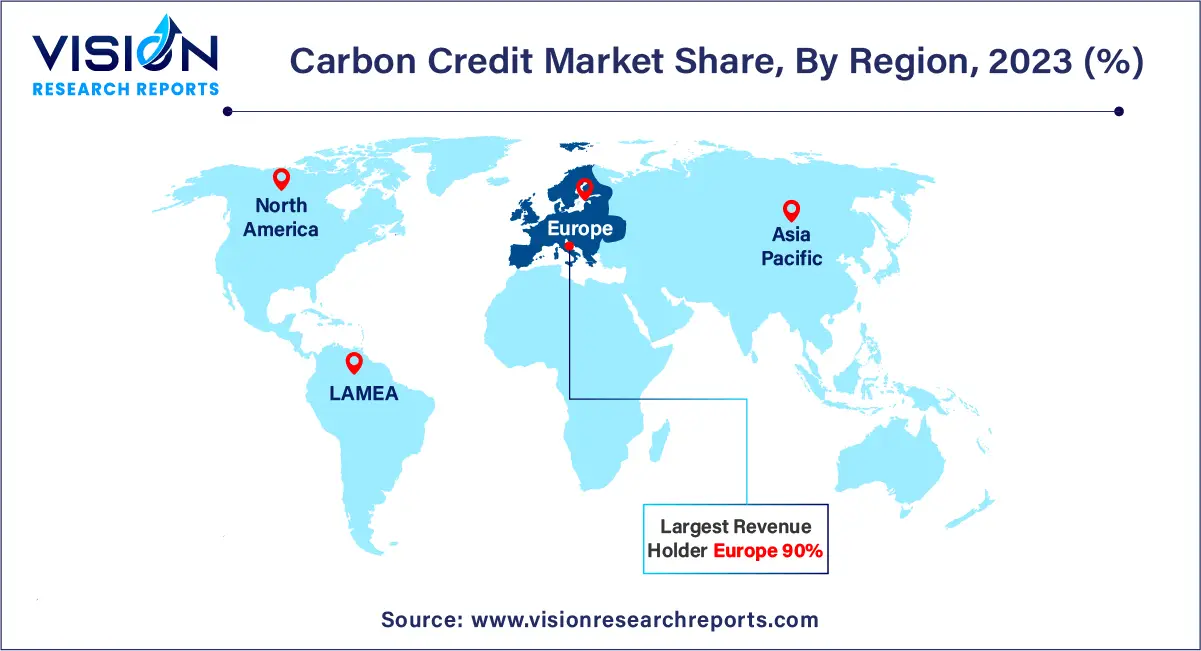

In 2023, Europe accounted for the largest revenue share of 90% in the carbon credit market, driven by the EU’s Emissions Trading System (ETS), the world’s largest carbon market. Established in 2005, the ETS encompasses over 11,000 installations in the power and industrial sectors across 31 European countries, responsible for approximately 45% of the EU's GHG emissions. The price of carbon offsets in the ETS is influenced by supply and demand, with the EU capping the total allowances. Factors such as economic conditions, energy prices, and climate policies affect the price of carbon credits, while demand can be influenced by fossil fuel prices and the availability of renewable energy sources.

| Attribute | Europe |

| Market Value | USD 431.47 Billion |

| Growth Rate | 39.44% CAGR |

| Projected Value | USD 11981.77 Billion |

The carbon credit market in North America is fueled by a combination of government initiatives and voluntary participation. Various state-level cap-and-trade programs have been established, capping total greenhouse gas emissions and requiring companies to buy carbon credits to comply.

The Asia Pacific region, home to rapidly growing economies like China and India, is witnessing increasing demand for fossil fuels for energy generation, which is expected to elevate carbon emissions and drive market growth.

In Central and South America, the demand for carbon credit projects is projected to rise due to growing power generation, transportation needs, industrial growth, and infrastructure development. The region's expanding manufacturing output is contributing to an increase in energy demand.

Countries in the Middle East and Africa, such as the UAE and Saudi Arabia, are actively engaged in international agreements like the Paris Agreement, which mandate reductions in GHG emissions. As these countries adopt sustainability measures to lower their carbon footprints, international collaboration and investments in carbon removal projects are expected to bolster market demand.

The carbon credit market is categorized into two main types: compliance and voluntary. In 2023, the compliance segment held a dominant revenue share of 99%. This segment involves companies and organizations that are regulated by government authorities and must offset their carbon emissions by purchasing carbon credits. These credits are derived from verified reductions in greenhouse gas (GHG) emissions from approved initiatives, such as renewable energy projects or energy efficiency measures.

Globally, governments are enacting policies aimed at reducing GHG emissions to tackle climate change, often mandating that companies offset their emissions through the purchase of carbon credits. These regulations are expected to drive growth in the compliance carbon credit market, as credits incentivize investments in low-carbon technologies. By reducing emissions and acquiring carbon credits, companies can also mitigate exposure to carbon taxes and related costs.

The market is further divided based on project type into removal/sequestration and avoidance/reduction projects. The avoidance/reduction projects segment led the market in 2023, accounting for 67% of total revenue. This segment focuses on implementing strategies to prevent or decrease carbon emissions by enhancing energy efficiency and initiating renewable energy projects. According to a May 2023 report from the World Meteorological Organization (WMO), there is a 66% chance that the average annual increase in near-surface global temperatures will exceed 1.5 degrees Celsius above pre-industrial levels at least once between 2023 and 2027, largely due to greenhouse gas emissions.

The carbon credit market is also segmented by end-use into energy, power, transportation, buildings, industrial applications, and others. The power segment was the largest in 2023, representing 32% of total revenue. This segment encompasses sectors like agriculture, forestry, and waste management. The power sector is a significant emitter and is increasingly adopting low-GHG technologies to engage in carbon-offsetting initiatives. Companies globally are transitioning to renewable energy sources such as solar, wind, and geothermal, aiming to lower carbon emissions and generate carbon credits, which can be sold on the open market for additional revenue.

Essentially, carbon offsets allow entities to finance emission reduction projects elsewhere to balance their own emissions. In the energy sector, this often involves investing in renewable energy projects or methane reduction initiatives. The industrial sector also contributes to carbon emissions through processes like steel and chemical manufacturing, where carbon dioxide is released as a byproduct. The International Energy Agency (IEA) reported that direct carbon dioxide emissions from primary chemical production reached approximately 935 Mt globally in 2022.

By Type

By Project Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Credit Market

5.1. COVID-19 Landscape: Carbon Credit Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Credit Market, By Type

8.1. Carbon Credit Market, by Type, 2024-2033

8.1.1 Compliance

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Voluntary

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Carbon Credit Market, By Project Type

9.1. Carbon Credit Market, by Project Type, 2024-2033

9.1.1. Avoidance / Reduction Projects

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Removal / Sequestration Projects

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Nature-based

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Technology-based

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Carbon Credit Market, By End-use

10.1. Carbon Credit Market, by End-use, 2024-2033

10.1.1. Power

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Energy

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Aviation

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Transportation

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Buildings

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Industrial

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Carbon Credit Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Project Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. 3Degrees Group, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Carbon Care Asia Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CarbonBetter

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ClearSky Climate Solutions

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. EKI Energy Services Limited

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Finite Carbon

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. NativeEnergy.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. South Pole Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Torrent Power Limited.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. WGL Holdings Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others