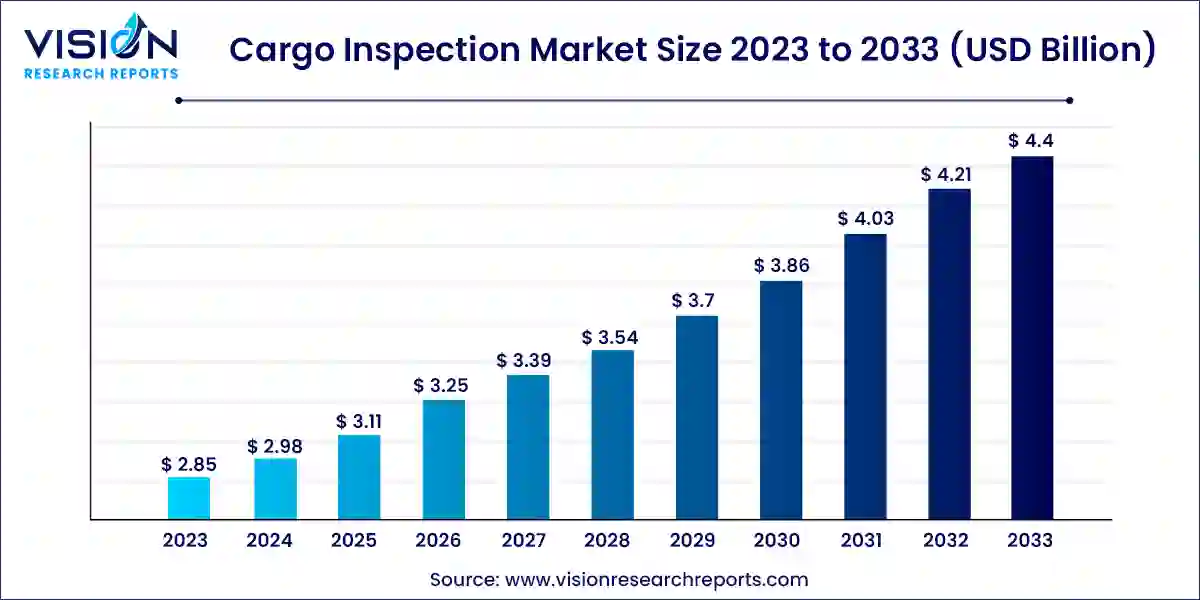

The global cargo inspection market size was estimated at around USD 2.85 billion in 2023 and is projected to hit around USD 4.4 billion by 2033, growing at a CAGR of 4.43% from 2024 to 2033.

The cargo inspection market plays a vital role in ensuring the smooth and secure flow of goods across international borders. Imagine a global game of commercial Tetris, where every piece – from smartphones to soybeans needs to fit together seamlessly. Cargo inspectors act as meticulous observers, verifying that each shipment meets quality standards, regulatory requirements, and safety protocols.

The cargo inspection market thrives on the very dynamism it safeguards global trade. A surge in international commerce necessitates robust inspection procedures to ensure smooth flow and prevent disruptions. Governments, prioritizing heightened security, implement stricter cargo screening to deter contraband and threats. Furthermore, consumers and businesses alike demand quality and compliance, driving the need for inspections that verify product integrity and adherence to safety regulations. These converging factors expanding trade volume, security concerns, and focus on quality act as the primary growth engines propelling the cargo inspection market forward.

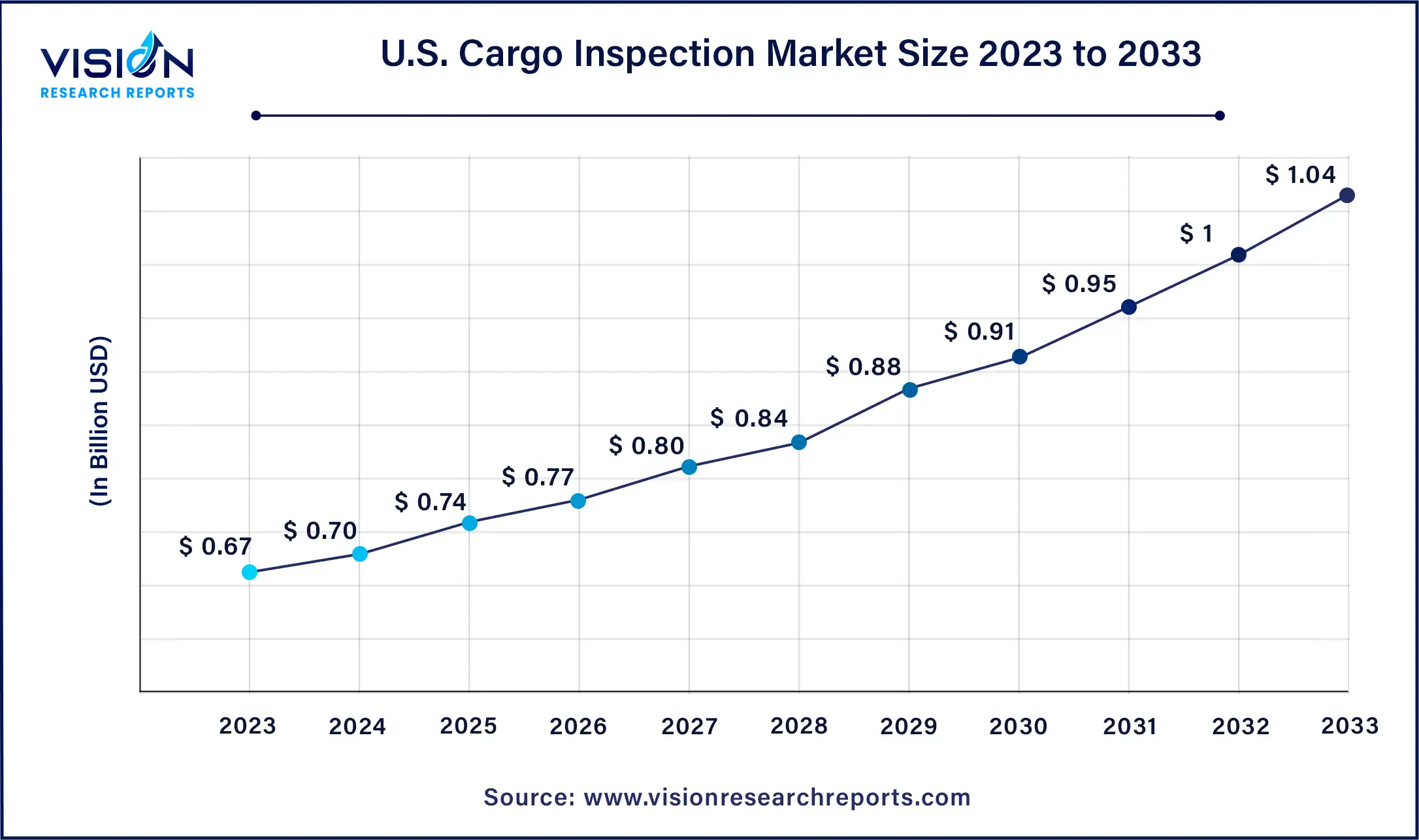

The U.S. cargo inspection market was estimated at USD 0.67 billion in 2023 and is expected to surpass around USD 1.04 billion by 2033, poised to grow at a CAGR of 4.49% from 2024 to 2033.

The North America cargo inspection market recorded the fastest CAGR of 5.33% from 2024 to 2033. Strict import and export regulations require robust inspection procedures to guarantee compliance. This drives the demand for cargo inspection services in North America that ensure product safety, quality, and origin. Furthermore, technological advancements like digital cargo documentation and non-intrusive inspection tools are optimizing processes and boosting efficiency. These factors eventually bolster the growth of inspection services in the region.

The cargo inspection market in Asia Pacific dominated the global market in 2023 and captured the largest share of 34% of the overall revenue. This expansion is driven by several factors, including the region's robust economic growth, growing international trade activities, and increasing investments in infrastructure and logistics. As economies in the region continue to develop and urbanize, there is a growing demand for efficient and reliable cargo surveying services to ensure compliance with regulatory standards and mitigate risks associated with international trade. Moreover, the emergence of new industries and the expansion of existing ones are fueling the demand for these services. With its strategic geographical location and growing prominence in global trade, Asia Pacific presents lucrative opportunities for market players to expand their operations and capitalize on the growing demand for their services.

The physical inspection segment dominated the market and accounted for the largest revenue share of over 39% in 2023. Physical inspection, the traditional method of manually examining shipments for damage, quality, and compliance, remains a vital segment of the market. While technological advancements are fostering growth in areas like X-ray scanning, physical inspection offers a cost-effective solution for low-risk goods and continues to be mandated for certain commodities. Moreover, the growing focus on anti-counterfeiting measures necessitates a human element to detect subtle discrepancies. As a result, the segment is expected to maintain steady growth, complementing rather than being replaced by, technological innovations in the overall market.

The non-intrusive inspection (NII) segment is expected to register the highest CAGR of 5.03% over the forecast period. NII utilizes advanced technologies like X-ray scanners and millimeter wave systems to examine shipment containers without physically opening them. NII enhances efficiency by expediting inspections and reducing congestion at ports. In addition, it minimizes potential damage to delicate goods and offers superior safety compared to physical inspections. Furthermore, with growing security concerns and stricter regulations, NII's ability to effectively detect contraband and hazardous materials is propelling its market dominance.

The product inspection segment asserted its dominance in the market and accounted for the largest share of 41% of the overall revenue in 2023. Product inspection, a meticulous examination of individual items within a shipment, is experiencing a resurgence within the market. This growth is attributed to a confluence of factors. The rise of e-commerce and complex global supply chains necessitates stricter quality control measures to ensure product integrity and consumer safety. Furthermore, increasingly stringent regulations in various regions demand thorough product inspections to comply with safety standards and labeling requirements.

The growing prevalence of counterfeit goods underscores the need for detailed product inspections to mitigate brand reputation risks and protect intellectual property. Consequently, the segment is poised for significant expansion, playing a critical role in safeguarding product quality and brand integrity in the ever-evolving global trade landscape. The container inspection segment is expected to register the highest CAGR of 5.13% from 2024 to 2033. Container inspection involves rigorous examination of shipping containers for structural integrity, security breaches, and proper cargo stowage.

The destination inspection (DI) segment dominated the target market in 2023 and accounted for a revenue share of 44%. DI is a post-shipment verification process where goods are physically examined upon arrival in the importing country. Governments are setting up DI programs to prevent fraud and ensure they get the right amount of money in taxes. Safety and security worries are also making DI more popular, especially for things like dangerous materials or food. Furthermore, advancements in technology, such as non-intrusive imaging scanners, are expediting the DI process, making it a more viable option for businesses. This confluence of factors positions DI as a key growth driver within the market.

The during-shipment inspection (DSI) segment is expected to grow at the fastest CAGR of 5.13% over the forecast period. The inspection of goods before their international journey, known as DSI, entails a thorough examination at their starting point. This segment is experiencing a surge in popularity within the market, driven primarily by its proactive cost-saving advantages. DSI helps manufacturers avoid the delays and expenses of fixing issues upon arrival by identifying and correcting defects before shipping. In addition, it reduces the risk of shipments being rejected at the destination port, safeguarding the reputation of importers and the profits of exporters. Moreover, advancements in mobile screening technology make on-site DSI more efficient, making it a more accessible and attractive option for businesses.

The oil & gas segment dominated the market in 2023 and accounted for a revenue share of 29%. The rising global energy needs, especially in developing countries like India, China, and Brazil, necessitate the secure & efficient transport of crucial resources like hydrocarbons, emphasizing the significance of specialized inspections to ensure the quality, quantity, and safety of these valuable shipments. Moreover, stringent environmental regulations are driving the need for inspections to validate compliance with emission standards and minimize environmental risks. In addition, the growing complexity of global supply chains necessitates independent verification of cargo specifications to prevent fraud and ensure smooth transactions. Collectively, these factors establish the oil & gas sector as a pivotal growth segment within the evolving landscape of cargo inspections.

The agriculture segment is expected to grow at the fastest CAGR of 5.25% over the forecast period. Increasing demand for safe and high-quality food necessitates stricter regulations and inspections for compliance with food safety standards. Rising concerns about biosecurity, particularly regarding the spread of pests and diseases, are prompting more stringent import controls on agricultural products. Furthermore, the growing complexity of global food supply chains, characterized by extensive product transportation, necessitates independent verification of both quality and quantity to mitigate the risks of spoilage and fraud. These factors define the growth of the agriculture segment in the market.

By Type

By Offering

By Inspection Phase

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others