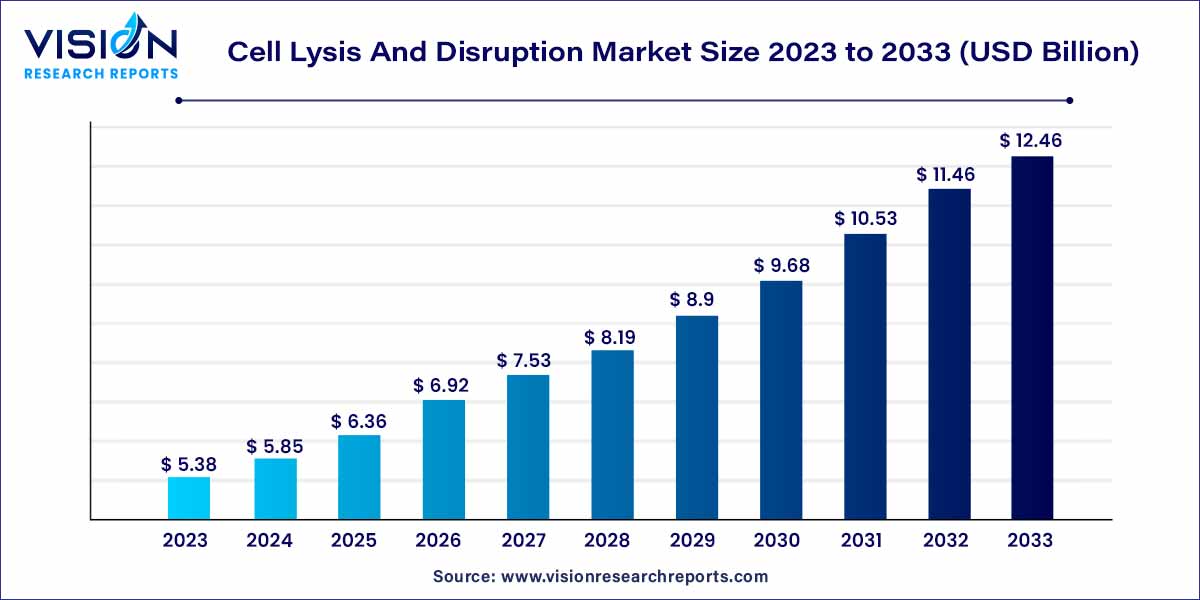

The global cell lysis and disruption market size was estimated at around USD 5.38 billion in 2023 and it is projected to hit around USD 12.46 billion by 2033, growing at a CAGR of 8.76% from 2024 to 2033. The cell lysis and disruption market is a pivotal segment within the broader life sciences and biotechnology landscape, serving as a fundamental process in various applications across research and industrial settings. This market revolves around the essential step of breaking down cellular structures to extract intracellular components, a process crucial for advancing fields such as genomics, proteomics, and biopharmaceutical production.

The robust growth of the cell lysis and disruption market can be attributed to several key factors driving its expansion. Technological advancements in the field of life sciences and biotechnology have significantly enhanced the efficiency and precision of cell lysis processes, thereby fueling market growth. The escalating demand for cellular components in diverse applications, including genomics, proteomics, and biopharmaceutical production, has created a sustained need for innovative cell lysis and disruption solutions. Moreover, the increasing focus on personalized medicine and the continuous evolution of cell biology research contribute to the market's dynamic nature, fostering a climate of exploration and innovation. Collaborations, mergers, and acquisitions among key market players further amplify the market's momentum, resulting in a competitive landscape characterized by diverse product portfolios and global market reach. As the market continues to respond to emerging trends, such as miniaturization, automation, and environmentally friendly solutions, stakeholders can anticipate a continued upward trajectory in the cell lysis and disruption market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 12.46 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.76% |

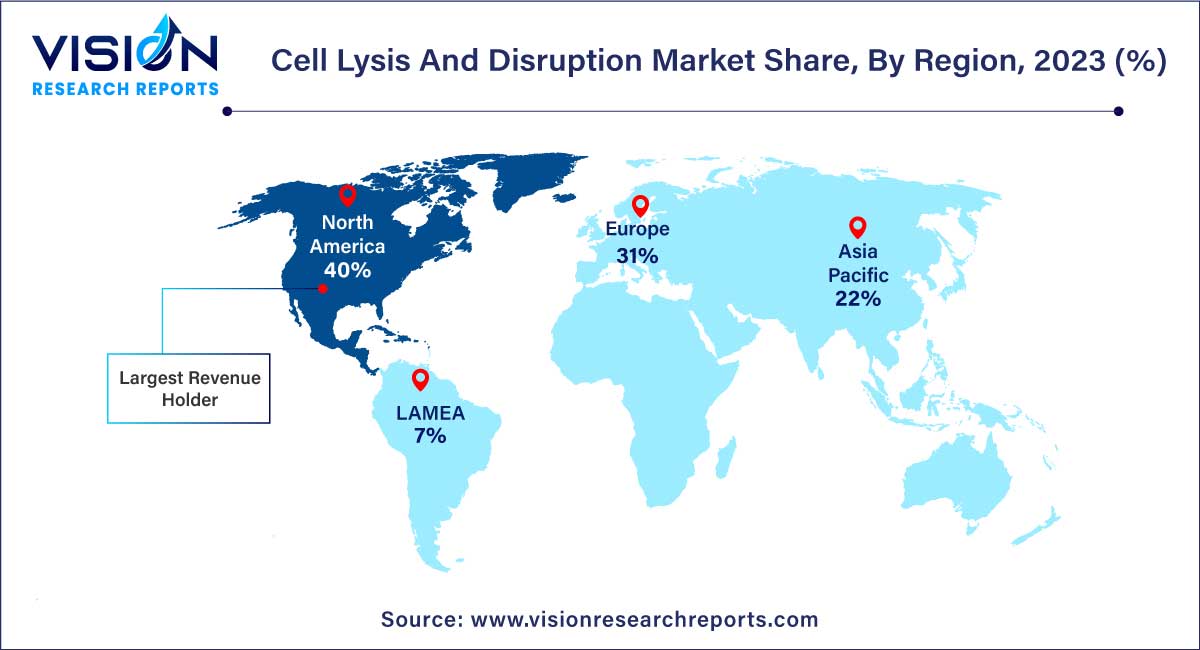

| Revenue Share of North America in 2023 | 40% |

| CAGR of Asia Pacific from 2024 to 2033 | 10.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The cell lysis & disruption market is divided into segments based on the technique used to carry out the disruption. The reagent-based method is the most widely accepted segment by technique. As these methods do not destroy the biological activity of the final products, they are mild and ideally suited for laboratory samples. These facts make them a suitable choice for laboratory usage, consequently leading to their dominance in terms of market share throughout the forecast period.

Major players operating in this space have traditionally adopted physical disruption methods to extract intracellular contents. However, adopting these methods has decreased due to expensive and cumbersome equipment requirements. Owing to the presence of variability in the apparatus, physical disruption methods are difficult to repeat, thus reducing their market penetration.

Based on the product type, the cell lysis and disruption market is classified into instruments, reagents & consumables, and kits & reagents. The reagents & consumables segment is the most widely used segment, and it is estimated to advance at a significant CAGR during the forecast period. Factors attributing to the segment’s high estimated share include their application for selective product release and controlled lysis, as they provide biological specificity to the process.

Different kits and enzymes are available for bacterial, plant, yeast, and mammalian samples due to the enzyme specificity. These enzymes are commercially available in a variety of forms. Major brands include, but are not limited to, Alfa Aesar, MilliporeSigma, MP Biomedicals LLC, Pierce Biotechnology Inc., and Promega Corp.

The mammalian cells segment accounted for the highest revenue share of over 46% in 2023 and is expected to remain dominant throughout the forecast period. This is because mammalian culture systems are extensively used to bio-manufacture viral vaccines, therapeutic proteins, and other recombinant products. In addition, the adoption of 3D mammalian culture systems in the areas of stem cell and cancer research is anticipated to further boost segment growth.

As the efficiency of reagents varies with the type of cell used, key players have developed reagents that work specifically on mammalian cells. For instance, Merck Millipore provides a range of mammalian lysis reagents that are utilized to prepare mammalian phosphorylated, cytosolic, and nuclear proteins. Some of these products include CytoBuster protein extraction reagent, NucBuster protein extraction kit, PhosphoSafe extraction reagent, and ProteoExtract kits.

Based on the application, the cell lysis & disruption market is divided into protein isolation, downstream processing, cell organelle isolation, and nucleic acid isolation. The protein isolation segment accounted for the highest revenue share in 2023. The major application areas of protein isolation include proteomics, western blotting, and immunoprecipitation. Demand for efficient and rapid lysis techniques that can extract the proteins with minimal protein breakdown or oxidation is expected to fuel segment growth.

Besides this, viscosity, which results from cell debris and genomic contamination, is another challenge that needs to be addressed, pronouncing research activities in this segment. The development of advanced bioprocessing reagents and equipment that can readily complement the established disruption procedures is anticipated to propel segment growth in the market.

On the other hand, the demand for industrial biotechnology products, such as hormones, antibodies, enzymes, antibiotics, and vaccines, has driven the market demand for downstream processing. Extensive efforts for the COVID-19 vaccine development have also supplemented market growth. Pfizer-BioNTech, Moderna, and Johnson & Johnson’s Janssen are some of the approved vaccines for COVID-19 that make use of these techniques.

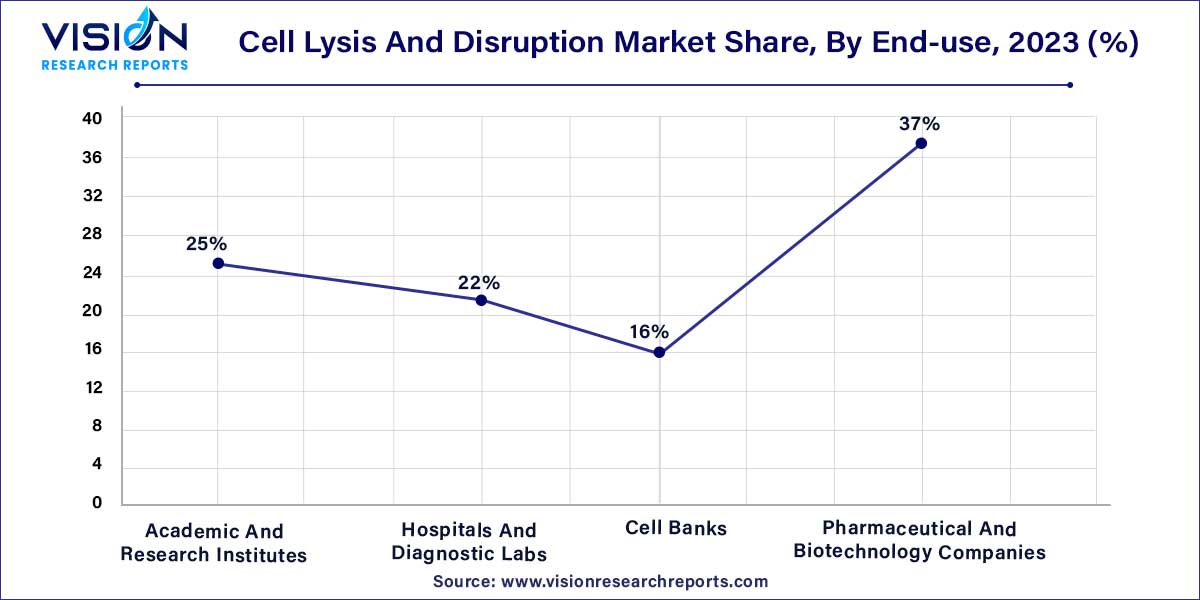

The pharmaceutical & biotechnology companies segment contributed the largest market share of 37% in 2023. This growth is aided by the presence of several biotechnology companies that are exploring molecular biology and bioprocess techniques, thus extensively employing cell lysis protocols. The rise in demand for biopharmaceuticals is expected to drive segment growth.

The safety and efficacy offered by biopharmaceutical products, along with their ability to tackle clinical conditions that were untreatable previously, have driven their demand. Therefore, pharmaceutical organizations are increasingly shifting toward manufacturing biopharmaceutical products, which, in turn, would drive the market. The presence of several protocols for tumorigenicity testing and research has led to a substantial usage of cell disruption methods in biospecimen banking facilities. Clinical research for drug development is further expected to drive potential growth in the coming years.

Based on end-use, the market is segmented into academic and research institutes, hospitals and diagnostic labs, cell banks, and pharmaceutical and biotechnology companies. The academic and research institutes segment is anticipated to grow at the noteworthy CAGR of 11.73% during the projection period. The growth of this segment can be attributed to the increase in expenditure on related research and development activities globally.

North America dominated the market with the largest revenue share of 40% in 2023. The presence of several government initiatives in the U.S. and Canada that support molecular biology research, precision medicine, and cancer research is attributed to the market dominance of this region. Extensive private and public investments in target therapeutics and novel drug discovery of various complicated and rare diseases are anticipated to drive the demand further.

Asia Pacific is expected to expand at the fastest CAGR of 10.93% over the forecast period. This growth can be credited to the increasing interest of key players in emerging markets of the APAC region to reap higher profits. In Asian countries, such as Japan and China, rapid adoption of technological innovations and regulatory environment that supports innovation further influence market growth. In addition, the fast-emerging field of personalized cancer medicine in Asian countries is anticipated to impact market growth positively.

By Technique

By Product

By Cell Type

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Lysis and Disruption Market

5.1. COVID-19 Landscape: Cell Lysis and Disruption Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Lysis and Disruption Market, By Technique

8.1. Cell Lysis and Disruption Market, by Technique, 2024-2033

8.1.1. Reagent-based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Physical Disruption

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Lysis and Disruption Market, By Product

9.1. Cell Lysis and Disruption Market, by Product, 2024-2033

9.1.1. Instruments

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Reagents & Consumables

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Enzymes

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Detergent Solutions

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Kits & Reagents

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Lysis and Disruption Market, By Cell Type

10.1. Cell Lysis and Disruption Market, by Cell Type, 2024-2033

10.1.1. Mammalian Cell

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Bacterial Cell

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Yeast/Algae/Fungi

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Plant Cell

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cell Lysis and Disruption Market, By Application

11.1. Cell Lysis and Disruption Market, by Application, 2024-2033

11.1.1. Protein Isolation

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Downstream Processing

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Cell Organelle Isolation

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Nucleic Acid Isolation

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cell Lysis and Disruption Market, By End-use

12.1. Cell Lysis and Disruption Market, by End-use, 2024-2033

12.1.1. Academic And Research Institutes

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Hospitals And Diagnostic Labs

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Cell Banks

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Pharmaceutical And Biotechnology Companies

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Cell Lysis and Disruption Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Technique (2021-2033)

13.1.2. Market Revenue and Forecast, by Product (2021-2033)

13.1.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Technique (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Product (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Technique (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Product (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Technique (2021-2033)

13.2.2. Market Revenue and Forecast, by Product (2021-2033)

13.2.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Technique (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Technique (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Product (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Technique (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Product (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Technique (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Product (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Technique (2021-2033)

13.3.2. Market Revenue and Forecast, by Product (2021-2033)

13.3.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Technique (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Technique (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Product (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Technique (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Product (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Technique (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Product (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Technique (2021-2033)

13.4.2. Market Revenue and Forecast, by Product (2021-2033)

13.4.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Technique (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Technique (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Product (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Technique (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Product (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Technique (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Product (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Technique (2021-2033)

13.5.2. Market Revenue and Forecast, by Product (2021-2033)

13.5.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Technique (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Product (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Technique (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Product (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Cell Type (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Merck KGaA

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Bio-Rad Laboratories, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. F. Hoffmann-La Roche Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. QIAGEN

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Danaher

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Miltenyi Biotec

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Claremont BioSolutions, LLC

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. IDEX

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Parr Instrument Company

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others