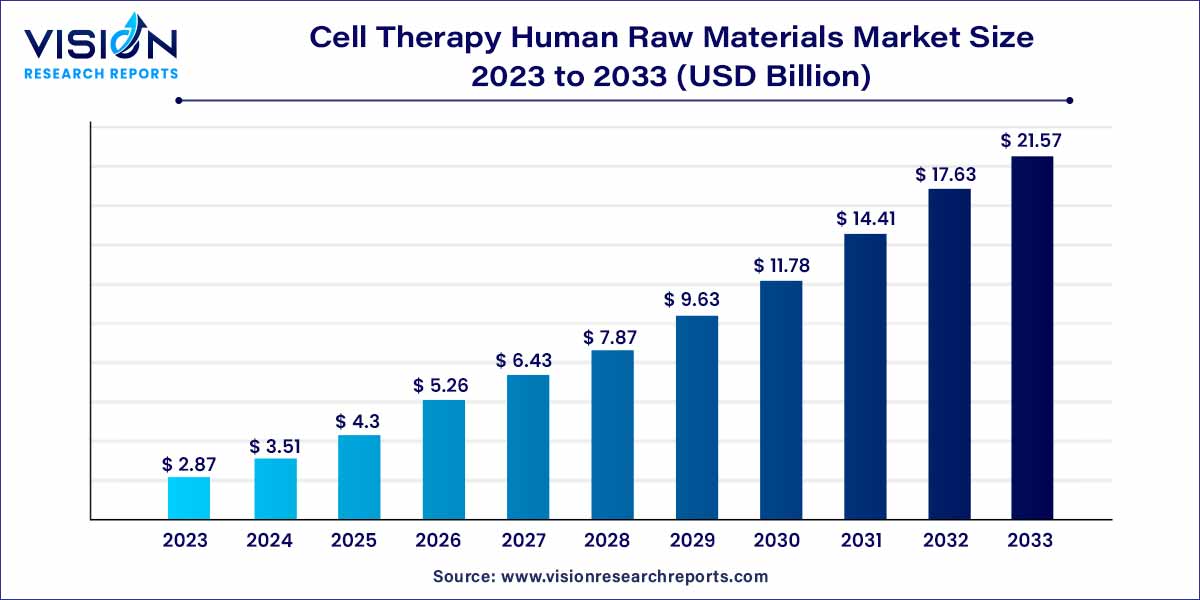

The global cell therapy human raw materials market size was estimated at around USD 2.87 billion in 2023 and it is projected to hit around USD 21.57 billion by 2033, growing at a CAGR of 22.35% from 2024 to 2033. The cell therapy human raw materials market is driven by the growing demand for personalized therapies, advancements in cell therapy research, rise in regenerative medicine practices, and increased focus on ethical sourcing.

The cell therapy industry has witnessed significant growth in recent years, driven by advancements in regenerative medicine and an increasing focus on personalized healthcare. A critical aspect of cell therapy development is the utilization of high-quality human raw materials. This article provides an insightful overview of the Cell Therapy Human Raw Materials Market, exploring its key components and market dynamics.

The growth of the cell therapy human raw materials market is propelled by several key factors. First and foremost, the increasing demand for personalized therapies has emerged as a significant driver, as the industry responds to the growing trend of tailoring cell therapies to individual patient needs. This shift towards personalized medicine necessitates the careful selection of human raw materials to ensure compatibility and enhance therapeutic efficacy. Additionally, continuous advancements in cell therapy research play a pivotal role in driving market growth. Ongoing efforts in understanding cell biology lead to the identification of novel cell sources and the optimization of culture conditions, contributing to the expansion and diversification of the human raw materials market. Furthermore, the regulatory landscape remains a critical factor influencing market dynamics. Stringent regulatory requirements governing the use of human raw materials underscore the importance of compliance with quality standards and ethical considerations, ensuring the sustained growth and integrity of the cell therapy industry.

In 2023, the cell culture supplements segment claimed the largest market share at 28%, with subdivisions including proteins, growth factors, nucleotides, and other supplements. The segment is poised for growth during the forecast period, primarily driven by the increasing demand for animal-free cell-based therapies. Market participants are actively exploring untapped opportunities through initiatives like the creation of new products and business expansion. Among cell culture supplements, growth factors dominate the market share. These supplements enable achieving serum-free conditions while providing essential growth factors and nutrients for robust cell growth. A noteworthy example is a 2020 study reporting the sequential delivery of cryogel-released growth factors and cytokines, demonstrating accelerated wound healing and improved tissue regeneration.

Concurrently, the cell culture media segment is anticipated to record the fastest CAGR throughout the forecast period. This media creates a controlled and optimized environment by offering essential nutrients, growth factors, and other critical components necessary for cell survival and proliferation. This controlled setting empowers researchers and manufacturers to optimize conditions, ensuring reproducibility and scalability of cell cultures for therapeutic applications. Notably, various companies are making substantial investments in the development of cell culture media to enhance the effectiveness of the cell therapy process. An illustrative case is Lonza's introduction of the TheraPEAK T-VIVO Cell Culture Medium in May 2023, aiming to expedite the development of cell therapy.

The market is segmented based on end use, encompassing biotechnology and pharmaceutical companies, Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), and other entities. In 2023, the biopharmaceutical and pharmaceutical companies segment took the lead, attributing its dominance to increased investments in Research and Development (R&D), a growing demand for cell-based therapies, and the presence of advanced healthcare infrastructure. The substantial R&D investments by these companies, coupled with their biotechnological expertise, contribute to the discovery and production of novel cell therapies. An example is NewBiologix securing USD 50 million in funding in May 2023, supporting the advancement of its technology platform dedicated to improving gene and cell therapy manufacturing processes.

Concurrently, the CROs and CMOs segment is anticipated to exhibit the fastest CAGR during the forecast period. CROs play a crucial role by offering valuable services in preclinical and clinical research, aiding in the development of cell therapies through expertise in trial design, patient recruitment, and regulatory compliance. Meanwhile, CMOs provide cost-effective manufacturing solutions for biopharmaceutical companies lacking specific expertise. Consequently, due to their provision of highly specialized services, both CROs and CMOs have emerged as key players in the end-use segment.

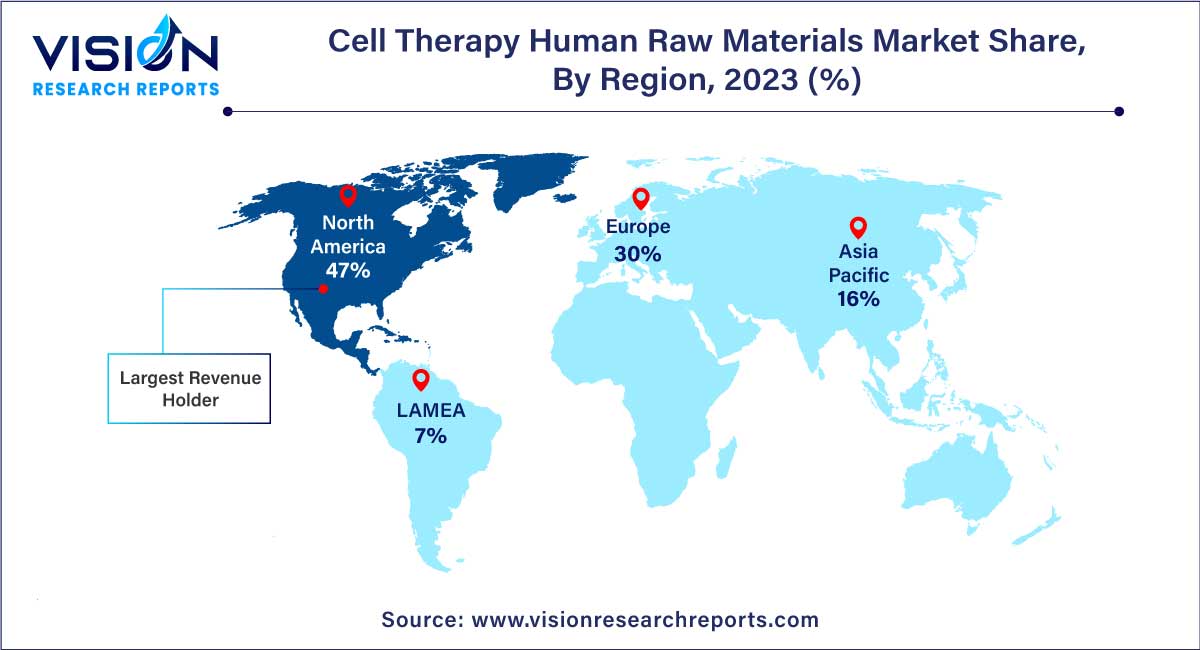

In 2023, North America dominated the market with the largest market share of 47%. This regional leadership is attributed to supportive government regulations, a growing demand for innovative therapeutics, and concerted efforts by key market players to advance cell-based therapy products for addressing various chronic disorders. The presence of numerous leading companies engaged in the production and commercialization of cell-based products within North America is expected to further fuel the demand for cell therapy human raw materials, contributing significantly to market growth. Additionally, collaborations between major players and smaller biotechnology firms intensify competition as companies strive to fortify their positions in the dynamically evolving cell therapy market. An example of such collaboration occurred in January 2023 when Kite, a Gilead subsidiary, initiated a strategic collaboration with Arcellx, Inc. to jointly develop and commercialize CART-ddBCMA for treating relapsed multiple myeloma.

Looking ahead, Asia Pacific is poised to witness the fastest growth in the market from 2024 to 2033. This growth is attributed to the region's increasing focus on biotechnology and a rising demand for advanced cell therapies. Key factors contributing to this growth include a surge in Research and Development (R&D) activities, strategic collaborations, and the establishment of manufacturing facilities by major market players. For instance, an article published by TEIJIN CDMO in April 2023 reported that Japan's cell & gene therapies and regenerative medicines sector, valued at USD 185.5 million, is projected to grow significantly to USD 6.3 million by 2030.

By Product

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Therapy Human Raw Materials Market

5.1. COVID-19 Landscape: Cell Therapy Human Raw Materials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Therapy Human Raw Materials Market, By Product

8.1. Cell Therapy Human Raw Materials Market, by Product, 2024-2033

8.1.1. Cell Culture Media

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cell Culture Sera

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cell Culture Supplements

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Reagents & Buffers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other Raw Materials

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Therapy Human Raw Materials Market, By End-Use

9.1. Cell Therapy Human Raw Materials Market, by End-Use, 2024-2033

9.1.1. Biopharmaceutical & Pharmaceutical Companies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. CROs & CMOs

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Academic & Research Institutions

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Therapy Human Raw Materials Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 11. Company Profiles

11.1. Thermo Fisher Scientific, Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Merck KGaA

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Actylis

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ACROBiosystems

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. STEMCELL Technologies

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Grifols, S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Charles River Laboratories

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. RoosterBio, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. PromoCell GMBH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Danaher

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others