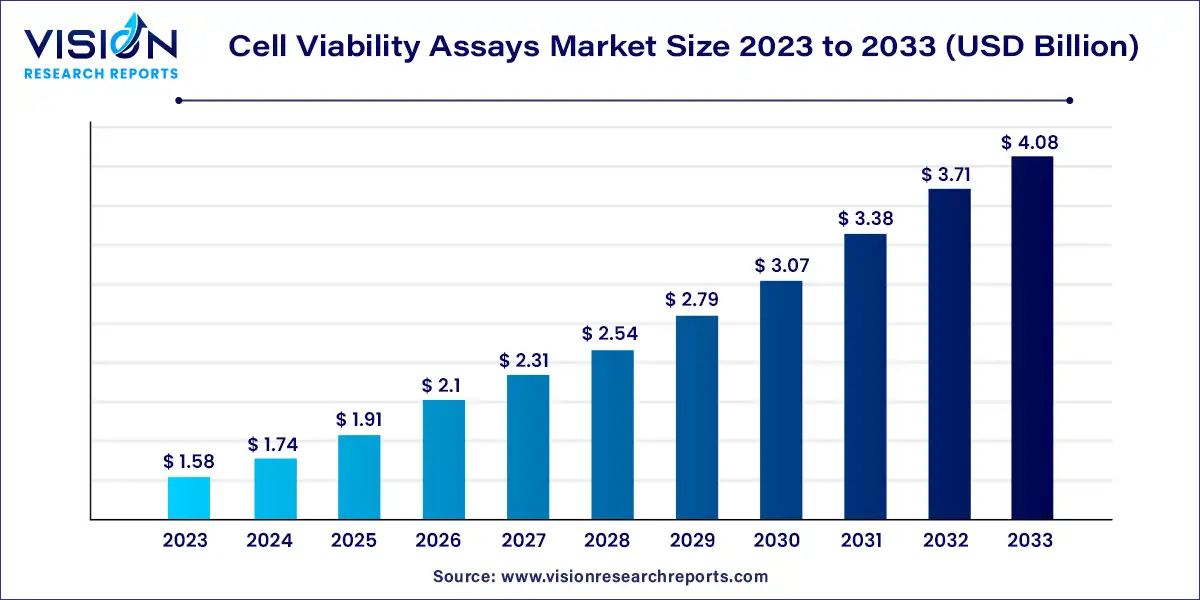

The global cell viability assays market size was valued at USD 1.58 billion in 2023 and it is expected to surpass around USD 4.08 billion by 2033, poised to grow at a CAGR of 9.96% from 2024 to 2033.

Cell viability assays are critical tools in biomedical research, pharmaceutical development, and clinical diagnostics. These assays measure the ability of cells to survive and thrive under various conditions, making them essential for understanding cellular health, proliferation, and response to treatments. The market for cell viability assays is experiencing significant growth, driven by advancements in technology, increased research and development activities, and the rising prevalence of chronic diseases.

The growth of the cell viability assays market is primarily driven by technological advancements, increasing research and development activities, and the rising prevalence of chronic diseases. Technological innovations such as high-throughput screening and automation have significantly enhanced assay efficiency and accuracy, facilitating large-scale studies. The surge in biopharmaceutical R&D, particularly in fields like oncology and regenerative medicine, has amplified the demand for these assays in drug discovery and toxicity testing. Additionally, the growing incidence of chronic diseases such as cancer and diabetes necessitates effective diagnostic and therapeutic solutions, further bolstering market expansion. Moreover, increased funding from governmental and private entities for life sciences research is propelling the development and adoption of advanced cell viability assays.

The consumables segment dominated the market in 2023 and captured over 62% share. The segment is also anticipated to expand at the fastest rate during the forecast period. This can be attributed to the utility of consumables in various pharmaceutical and biopharmaceutical, diagnostic, and stem cell research applications. In addition, several players in the market are offering a wide range of cell viability assay reagents that are non-toxic and ready to use and offer instant high-quality results. For instance, alamarBlue cell viability reagent offered by Thermo Fisher Scientific, Inc. is a non-toxic ready-to-use reagent solution that functions as a cell health indicator by consuming the decreasing power of live cells to quantitatively measure viability.

Luminometric assays held a dominant share in 2023 and are anticipated to witness the fastest growth in the projected timeframe due to their simple protocols, uncomplicated equipment requirement, robustness, and superior sensitivity. Fluorometric assays accounted for the second-largest share in 2023 due to their advantages over colorimetric and dye exclusion assays since they are more sensitive. These qualities altogether enable easy scalability and adaptability from bench research to high throughput applications. Such features of cell viability assay are boosting the consumables segment growth.

The stem cell research segment held the largest share of over 42% in 2023 and is anticipated to register the fastest CAGR during the forecast period. Stem cell therapy has become an advanced and promising scientific research area in recent times. Key players in the market are marching towards the development of novel instruments to support the research. For instance, in May 2023, Beckman Coulter Life Sciences launched a novel solution AQUIOS STEM System for stem cell analysis. The innovation helps in analyzing and enumerating viable cells by decreasing the manual and error-prone steps and significantly reducing the turnaround time. Furthermore, the funding associated to stem cell research has augmented in recent years, which has further hastened the research growth in this field. For instance, in May 2023, Canada’s Stem Cell Network announced funding worth USD 19.5 million for 32 regenerative medicine and stem cell research clinical trials and projects.

The drug discovery and development segment held the second-largest share in 2023. Cell viability assays play a vital role in various stages of drug discovery and development due to their versatility, flexibility, and adaptability. Cell viability assays are fundamentally used for screening the response of the cells against a chemical compound or a drug during the drug discovery and development process. Furthermore, they are used to estimate the cellular variations related to cell death such as modifications in protein expression and loss of membrane integrity in enzymatic activity upon exposure to a test compound. Such applications of cell viability assay in drug discovery and development are driving the segment.

The biopharmaceutical and pharmaceutical companies segment captured the largest revenue share of over 32% in 2023 owing to the widespread use of viability assay in pharmaceuticals to evaluate the influence of developed agents on cells. Researchers use numerous types of assays to monitor the effect of developed therapeutics that often target cancer tumors. In addition, toxicity levels of the compounds or agents can be evaluated using a cell viability assay. Such broad applications of cell viability assay in the biopharmaceutical and pharmaceutical industry drive the segment.

CROs and CMOs are expected to grow at the fastest rate of 11.58% over the forecast period. Pharmaceutical companies are entering into collaborations with CROs and CMOs for numerous reasons. These collaborations have the potential to improve process efficiency, cut costs, and decrease time to market. In November 2021, Hamlet Pharma signed a collaboration with a CRO Galenica AB for the development of BAMLET for pharmaceutical use. BAMLET is a potent therapeutic for colon cancer and cell viability assays have applications in revealing the biological activity of the product and for the development of suitable drug formulation. Such collaborations are projected to increase the usage of cell viability assays in various applications including drug discovery and development, thereby fueling the industry growth during forecast years.

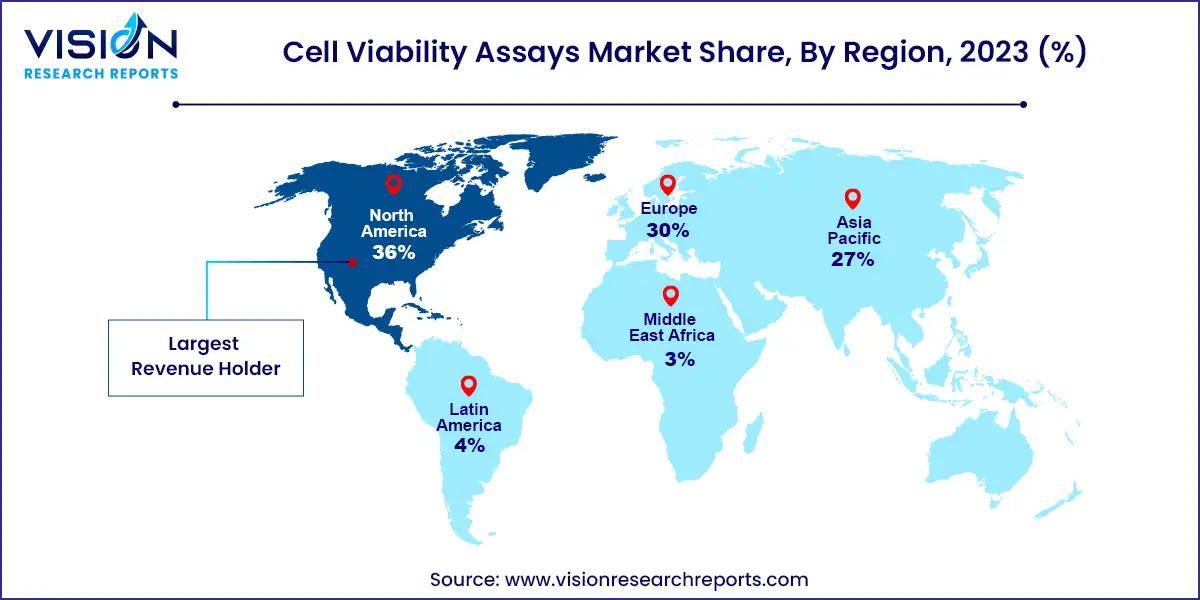

North America dominated the market with a revenue share of over 36% in 2023. This major share can be attributed to the rise in investment initiatives by the government, the increasing incidence of chronic diseases such as cancer, and the presence of high-quality infrastructure for clinical and laboratory research in North America. For instance, according to Globocanreport, approximately 2,281,658 new cancer cases were recorded in the U.S. in 2020, with nearly 612,390 deaths. Thus, the rising prevalence of chronic and infectious diseases and the increasing focus on cell-based therapeutics are expanding the growth prospects of the market.

Asia Pacific is estimated to witness the fastest growth over the forecast period due to rising demand for novel therapeutics in the region. Furthermore, increasing R&D investment by governments and rapid infrastructural development are the other factors boosting regional growth. In addition, several regional players are receiving funding for developing a treatment for various chronic diseases such as cancer. For instance, in June 2023, Immuneel Therapeutics received funding worth USD 15 million for the development of affordable cell and gene therapy for cancer patients in India. Such initiatives in this region are likely to propel industry growth during the forecast period.

By Product

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Viability Assays Market

5.1. COVID-19 Landscape: Cell Viability Assays Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Viability Assays Market, By Product

8.1. Cell Viability Assays Market, by Product, 2024-2033

8.1.1 Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Viability Assays Market, By Application

9.1. Cell Viability Assays Market, by Application, 2024-2033

9.1.1. Drug Discovery And Development

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Stem Cell Research

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Diagnostics

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Viability Assays Market, By End-user

10.1. Cell Viability Assays Market, by End-user, 2024-2033

10.1.1. Biopharmaceutical & Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. CROs & CMOs

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Diagnostic Labs

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cell Viability Assays Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agilent Technologies, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bio-Rad Laboratories, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. BD

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PerkinElmer Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Promega Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Biotium

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Creative Bioarray

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Abcam plc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others