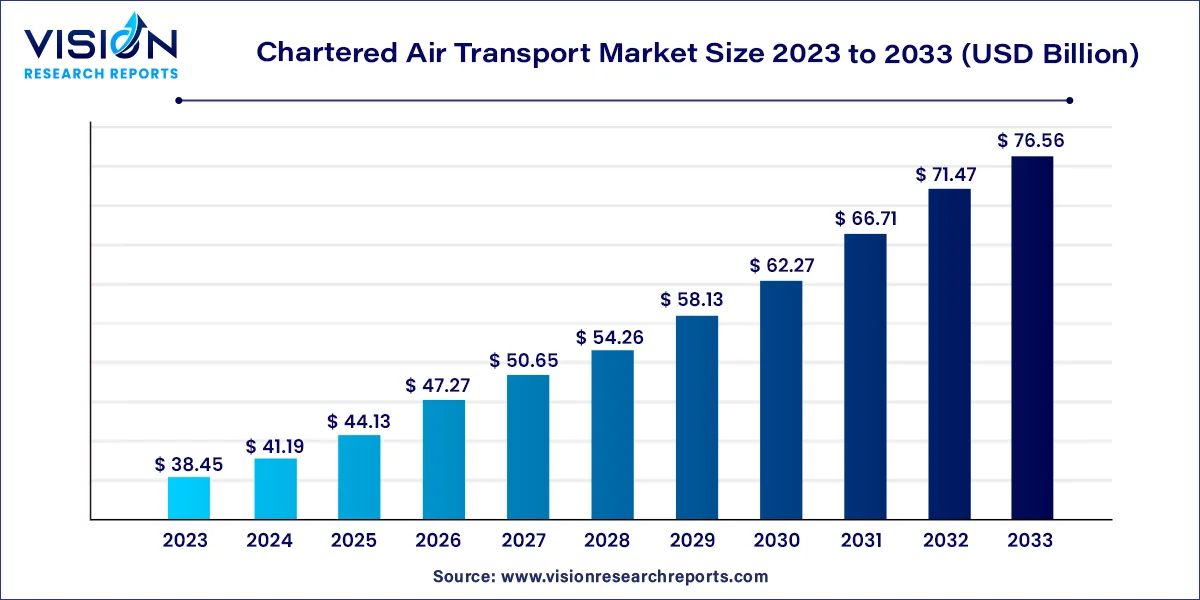

The global chartered air transport market size was valued at USD 38.45 billion in 2023 and is anticipated to reach around USD 76.56 billion by 2033, growing at a CAGR of 7.13% from 2024 to 2033. The chartered air transport market plays a crucial role in the aviation industry by providing tailored services that cater to individual and business travel needs. This segment includes various aircraft types, from small private jets to large commercial airliners, available for rent on a per-flight basis, offering flexibility and convenience that traditional airlines may not provide.

The growth of the chartered air transport market is primarily driven by an increasing demand for personalized travel solutions. As more individuals and corporations seek customized travel experiences, charter services offer the flexibility to tailor itineraries and select preferred aircraft. Additionally, the rise in disposable incomes among high-net-worth individuals has spurred interest in luxury travel options, making chartered flights an attractive alternative to commercial airlines. Furthermore, the growing trend of business travel, especially for executives needing efficient and time-sensitive transportation, contributes significantly to market expansion. Technological advancements in booking platforms and communication tools have streamlined the process of reserving chartered flights, enhancing customer convenience and satisfaction. Collectively, these factors underscore the chartered air transport market's robust growth potential, catering to the evolving needs of both leisure and business travelers.

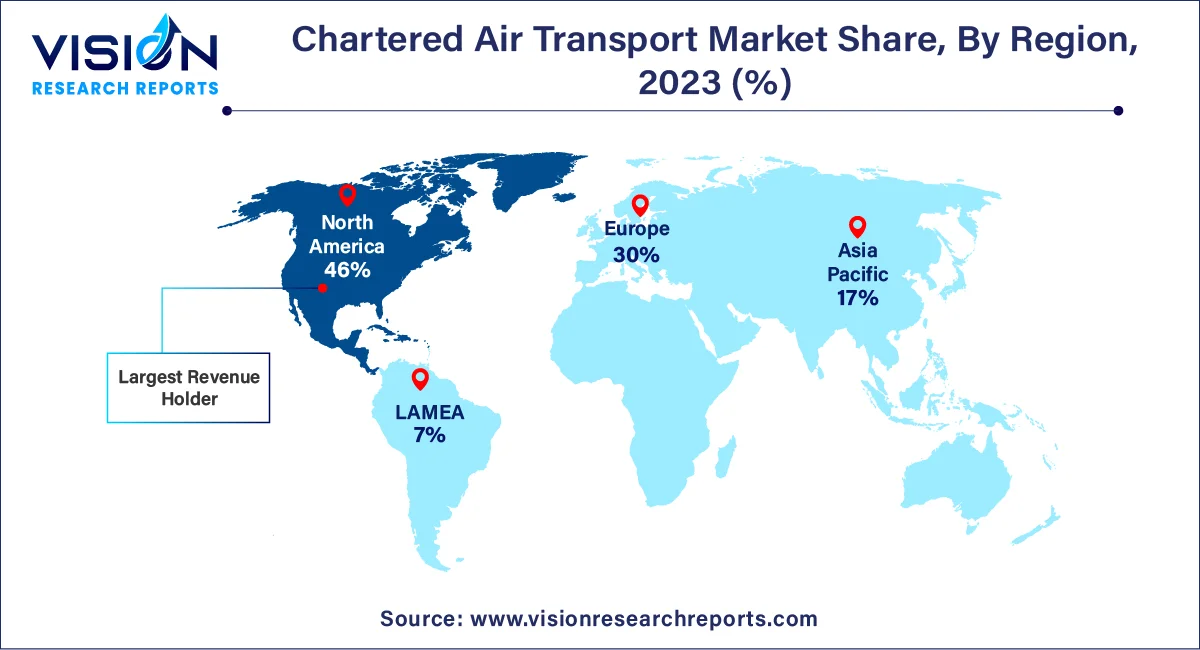

North America accounted for the largest revenue share at 46% in 2023 and is anticipated to maintain its dominance throughout the forecast period. The region boasts one of the most advanced and extensive aviation infrastructures globally, with a multitude of airports, including major international hubs and smaller regional airports well-equipped to handle chartered flights. This vast airport network enhances the accessibility of charter services, allowing charter companies to offer flexible, customized routes tailored to their clients' specific needs. Additionally, the supportive regulatory environment for aviation in North America fosters the growth of charter services.

The U.S. has a substantial population of high-net-worth and ultra-high-net-worth individuals who prefer private charters for leisure travel due to the privacy, luxury, and personalized service offered. The affluence within the country drives the demand for chartered flights for both business and personal use, allowing the market to thrive. Furthermore, the government & defense sector significantly contributes to the growing demand for chartered air transport, with agencies frequently utilizing these services for emergency response, disaster relief, and diplomatic missions.

The Asia Pacific region has witnessed a considerable increase in the number of high-net-worth individuals, particularly in countries like China, Japan, Singapore, and India. These individuals, who prioritize privacy, convenience, and time efficiency, are increasingly opting for chartered air travel for both business and leisure. Additionally, chartered air transport in the Asia Pacific is increasingly utilized for transporting high-value cargo, such as medical supplies, pharmaceuticals, and advanced technology components, which require safe and direct delivery.

European countries continue to invest in expanding their aviation infrastructure, facilitating the operations of chartered air transport services. Airports in major cities and secondary locations are enhancing their capacity to accommodate private and chartered flights. Additionally, many high-net-worth individuals and tourists are choosing chartered flights to access remote and exclusive destinations like the French Riviera, Greek islands, and Swiss Alps. These locations often necessitate customized travel routes that are not easily reachable by commercial airlines, making chartered flights the preferred choice.

The market is categorized into private charter services and business charter services. In 2023, the private charter services segment captured the largest market share at 63%. The surge in demand for private charters is largely attributed to the growing number of high-net-worth and ultra-high-net-worth individuals. Increased disposable incomes and wealth concentration in key regions such as North America, Europe, and parts of Asia-Pacific have broadened the luxury private air travel customer base. This financial growth has enabled more people to afford private charters for both leisure and personal travel, further enhancing the segment’s market share.

Conversely, the business charter services segment experienced the highest compound annual growth rate (CAGR) of 7.93% during the forecast period. As businesses expand their global reach, the demand for swift and dependable travel solutions has risen. Corporate executives often need to attend meetings, finalize deals, or manage operations across various regions at short notice. Business charters facilitate direct flights to a wider array of destinations, including secondary airports that may lack commercial flight options, which is essential for companies operating in global or emerging markets. This capability to circumvent commercial flight limitations is driving the demand for business charter services.

In terms of application, the market is divided into passenger transport and cargo transport. The passenger transport segment dominated the market with a revenue share of 72% in 2023. The escalating demand for luxury travel has significantly boosted the growth of the passenger charter segment. Wealthy travelers seeking unique and exclusive experiences are opting for chartered flights to reach remote or exotic locations that may not be serviced directly by commercial airlines. For these travelers, chartered flights provide not just transportation but also an essential component of the overall luxury experience, complete with premium amenities, personalized services, and dedicated attention.

The cargo transport segment is expected to achieve the highest CAGR of 8.03% during the forecast period. Air cargo is vital for transporting time-sensitive and high-value goods, including pharmaceuticals, electronics, perishable items, and luxury products. Industries such as healthcare, biotechnology, and high-tech manufacturing depend on the swift and secure delivery of their products, which has led to a surge in demand for chartered air cargo services. For instance, the transport of vaccines and medical supplies during the COVID-19 pandemic highlighted the critical role of air cargo. Chartered air transport is often preferred for these goods due to the necessity for controlled environments, quick delivery times, and direct routes that avoid the delays associated with commercial shipping.

The market is segmented by end use into corporates, individuals, government & defense, and others. The corporate segment held the largest market share at 47% in 2023. This significant share reflects the high value businesses place on the benefits of flexibility, efficiency, security, and personalized service. As companies navigate an increasingly globalized and fast-paced landscape, the demand for chartered air transport services that cater to specific corporate needs remains robust. The ability to facilitate productive, confidential travel, access remote locations, and provide an enhanced travel experience makes chartered flights the preferred choice for corporate clients.

The government & defense segment recorded the highest CAGR of 8.23% during the forecast period. Governments and defense organizations are increasing their budgets for various operations, including defense initiatives, disaster relief, and diplomatic missions. Chartered air transport plays a critical role in these activities by offering quick and flexible transportation solutions for personnel, equipment, and supplies. Rising defense budgets and the need for rapid deployment across various regions contribute to the increasing demand for chartered air services in this sector. Additionally, the government & defense sector often requires specialized transport solutions, including secure and confidential transportation for high-profile individuals or sensitive materials. Chartered air services can provide the necessary security and customization to meet these demands.

By Services

By Application

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others