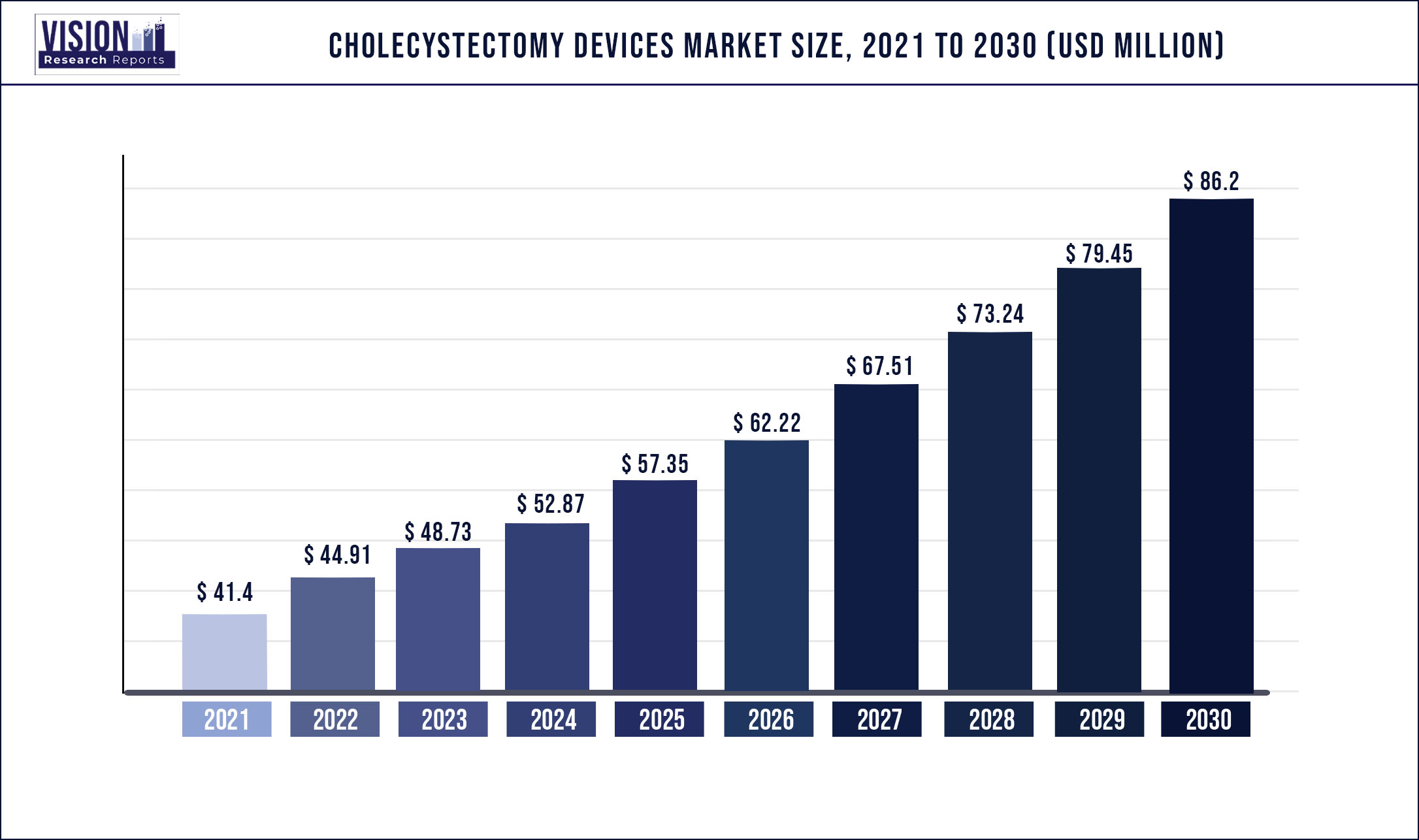

The global cholecystectomy devices market was surpassed at USD 41.4 million in 2021 and is expected to hit around USD 86.2 million by 2030, growing at a CAGR of 8.49% from 2022 to 2030.

The industry is projected to be driven by the rising acceptance of elective laparoscopic surgery. For instance, laparoscopic cholecystectomy is one of the most frequently performed procedures, with almost 400,000 ambulatory laparoscopic cholecystectomies performed in the United States in 2019. Since the 1990s, laparoscopic cholecystectomy has been regarded as the preferred surgical procedure for treating gallstone disease. The advancement of cholecystectomy technologies is thought to be a significant market driver.

A number of major players are investing in R&D to introduce cutting-edge products. One significant development in the field is the introduction of medical robots that help surgeons during operations. Robotic surgery has lately gained acceptability and application in general surgery, and in specific gastrointestinal operations, it may provide superior results over laparoscopic surgery. Robotic cholecystectomy has been proven to be a secure and efficient procedure. According to reports, the robot has enhanced instrumentation, dexterity, and visualization during minimal access surgery. The industry is also being driven by the growing geriatric population as elderly people are more at risk for gallstone diseases.

People aged 70 years and above have an almost 50% chance of acquiring gallstones, whereas people under the age of 40 years have an about 8% chance of developing gallstones. In addition, due to an increased preference for laparoscopic operations and an increase in elective surgery volumes, the rate of cholecystectomy surgeries has grown by 60%. But, approximately, 10% of cholecystectomy patients experienced comparable post-surgery symptoms; this disorder is referred to as a post-cholecystectomy syndrome. Moreover, risks, such as infection of the surgical site, bile duct damage, retained gallstones, abscess formation, severe bleeding, and bile duct stenosis, may hamper the growth of the industry in the future.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 41.4 million |

| Revenue Forecast by 2030 | USD 86.2 million |

| Growth rate from 2022 to 2030 | CAGR of 8.49% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Device, surgery type, indication, end-use, region |

| Companies Covered |

Surgical Holding; B. Braun SE; Surtex Instruments Limited.; Sklar Surgical Instruments; Olympus; Millennium Surgical; Stryker Corp.; Medtronic; Intuitive Surgical; GerMedUSA |

Device Insights

On the basis of devices, the industry has been further segmented into conventional and robotic-assisted cholecystectomy surgery devices. The conventional surgical devices segment includes laparoscopes, energy systems, trocars, closure devices, suction/irrigation devices, insufflation devices, and hand access instruments, such as an electrode, scissors, dissectors, forceps, and grasper. The segment dominated the global industry in 2021 and accounted for the largest share of 90.08% of the total revenue. Among the conventional devices, the energy systems segment dominated the industry in 2021.

Energy systems allow rapid sequential tissue and vessel sealing, transection, and coagulation during laparoscopic cholecystectomy surgery. The laparoscope segment is expected to expand at the highest CAGR during the forecast period. A laparoscope is a small tool that has a tiny video camera and light on the end, which allows a surgeon to see inside the body without creating a larger opening. The robotic-assisted cholecystectomy surgery devices segment is expected to register the fastest CAGR during the forecast period. The robotic devices can manipulate tissue considerably more precisely than laparoscopic tools in the hands of an expert robotic surgeon.

As a result, there is a lower possibility of bleeding, bile leakage, and unintentional harm to surrounding tissues during surgery. About 3,000 incidences of common bile duct injury have been reported annually in the U.S. alone during the laparoscopic cholecystectomy era. It is conceivable that robotic cholecystectomy could lower this figure. The stated advantages of robotic-assisted cholecystectomy surgery devices include relatively shorter hospital stays and faster healing time with a noticeable reduction in post-operative pain. However, the lack of skilled professionals and the high cost of robotic devices explain the lower penetration rate and justify the lesser market size.

Surgery Type Insights

On the basis of surgery type, the global industry has been further segmented into laparoscopic cholecystectomy and open cholecystectomy. The laparoscopic cholecystectomy segment dominated the global industry in 2021 and accounted for the maximum share of more than 79.71% of the overall revenue. The laparoscopic cholecystectomy is conducted by inserting a small video camera in the abdomen with small incisions and usually takes one to two hours. Laparoscopic surgery has recently gained popularity due to its advantages, including a shorter hospital stay, less blood loss, and lower patient morbidity.

It also offers quick recovery, quick and successful outcomes, a low risk of infection, a small or no incision, and less pain. The demand for cholecystectomy devices is projected to increase during the forecast period since laparoscopic cholecystectomy surgery is in high demand. Moreover, open cholecystectomy is a conventional method used for the removal of the gallbladder, and it is only done where laparoscopic cholecystectomy surgery cannot be done safely. However, considerable factors, such as recent advancements in technology, increased preference for minimally invasive surgeries, longer postoperative hospital stays, excessive bleeding, and common bile duct injuries, have resulted in a slower growth rate and lesser market share of the segment.

Indication Insights

On the basis of indications, the global industry has been further categorized into indications, such as cholelithiasis, choledocholithiasis, cholecystitis, pancreatitis, and others. The cholecystitis segment dominated the global industry in 2021 and accounted for the largest share of more than 41.91% of the overall revenue. Cholecystitis is the condition where the gallbladder gets inflamed due to the presence of gallstones. The segment dominance is due to the high prevalence and incidence of cholecystitis. For instance, globally, the incidence rate of acute cholecystitis is around 6,300 per 100,000 in individuals below 50 years of age and 20,900 per 100,000 in individuals aged above 50 years.

The prevalence of acute cholecystitis is approximately 369 per 100,000 individuals in the United States. In addition, females are more commonly affected by gallstone diseases than males. Choledocholithiasis is expected to grow at the highest CAGR during the forecast period. Choledocholithiasis occurs when a gallstone blocks the common bile duct and bile cannot flow past it. It impedes the flow of bile from the liver to the intestine. Pressure rises resulting in elevation of liver enzymes and jaundice. It develops in about 10 to 20% of patients with gallbladder stones. Obesity, pregnancy, rapid weight loss, high fat diet, and a liver disorder are the major risk factors.

End-use Insights

Based on end-uses, the industry has been classified into hospitals, Ambulatory Surgical Centers (ASCs), and others. The hospital segment dominated the global industry in 2021 and accounted for the maximum share of more than 56.93% of the overall revenue. A rise in patients suffering from gallstone disorders and the resultant rise in surgical treatments are the factors responsible for segment expansion. Due to the simplicity of managing any crises that may develop during surgical procedures and the availability of a wide range of treatment options in such facilities, hospitals have a substantially larger patient inflow than other healthcare settings.

In addition, hospitals are the primary provider of healthcare in the majority of nations, therefore more laparoscopic procedures are performed there than in alternative healthcare facilities like clinics or surgery centers. As a result, compared to other end-use segments, the demand for laparoscopic devices is relatively high in hospitals. On the other hand, the ASCs segment is expected to witness the highest growth rate during the forecast period. The segment growth can be attributed to the rising interest in outpatient surgery, the adoption of minimally invasive treatments, and the affordability of ASC-based laparoscopic procedures. Furthermore, a high number of robotic-assisted procedures are carried out in outpatient facilities or ASCs.

Regional Insights

The industry is dominated by North America, which held a major revenue share of more than 36.6% in 2021. One of the main factors driving the region’s growth includes the high preference for laparoscopic cholecystectomy procedures over open cholecystectomy procedures. In addition, the market is impacted by the competition between well-known players in terms of product innovation. Laparoscopy is now preferred over traditional surgeries by surgeons since it encourages quick recovery and successful outcomes. Moreover, rising healthcare costs in the U.S. may encourage both new and established competitors to enter the industry.

For instance, according to the Centers for Medicaid and Medicare Services, U.S. healthcare spending was USD 4.1 trillion in 2020, or 19.7% of the country’s GDP, up 9.7% from 2019. In the Asia Pacific region, the market is expected to witness the fastest CAGR during the forecast period. This is owing to an increase in the number of advanced, well-equipped hospitals and a large volume of cholecystectomy surgical procedures. Gallstone diseases are comparatively less prevalent in developing countries. Among the developing countries, India and Taiwan have a higher prevalence of acute cholecystitis.

Australia and South Korea are some of the emerging economies in the Asia Pacific region. Advancing technology, increasing investments, improving reimbursement scenarios, and growing medical tourism is likely to drive the market in the region. Other driving factors include affordable devices, an increase in M&A activities, and supportive government initiatives to improve healthcare services. The government has made significant investments to provide basic health insurance to all citizens.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cholecystectomy Devices Market

5.1. COVID-19 Landscape: Cholecystectomy Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cholecystectomy Devices Market, By Device

8.1. Cholecystectomy Devices Market, by Device, 2022-2030

8.1.1. Conventional Cholecystectomy Devices

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Robotic-assisted Cholecystectomy Surgery Devices

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cholecystectomy Devices Market, By Surgery Type

9.1. Cholecystectomy Devices Market, by Surgery Type, 2022-2030

9.1.1. Laparoscopic Cholecystectomy

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Open Cholecystectomy

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cholecystectomy Devices Market, By Indication

10.1. Cholecystectomy Devices Market, by Indication, 2022-2030

10.1.1. Cholelithiasis

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Choledocholithiasis

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Cholecystitis

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Pancreatitis

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Cholecystectomy Devices Market, By End-use

11.1. Cholecystectomy Devices Market, by End-use, 2022-2030

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Ambulatory Surgical Centers

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Cholecystectomy Devices Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Device (2017-2030)

12.1.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Indication (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Device (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Indication (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Device (2017-2030)

12.2.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Indication (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Device (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Indication (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Device (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Indication (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Device (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Indication (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Device (2017-2030)

12.3.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Indication (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Device (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Indication (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Device (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Indication (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Device (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Indication (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Device (2017-2030)

12.4.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Indication (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Device (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Indication (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Device (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Indication (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Device (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Indication (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Device (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Indication (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Device (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Surgery Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Indication (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Surgical Holding

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. B. Braun SE

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Surtex Instruments Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sklar Surgical Instruments

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Olympus

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Millennium Surgical

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Stryker Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Medtronic

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Intuitive Surgical

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. GerMedUSA

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others