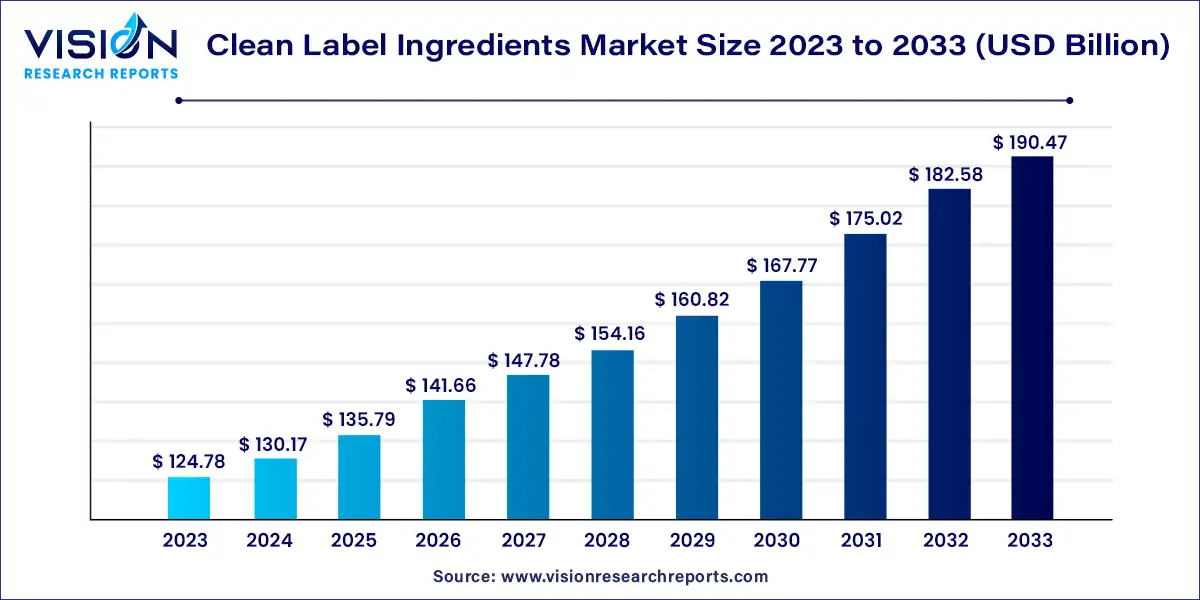

The global clean label ingredients market size was estimated at USD 124.78 billion in 2023 and it is expected to surpass around USD 190.47 billion by 2033, poised to grow at a CAGR of 4.32% from 2024 to 2033. The clean label ingredients Market has gained significant traction in recent years, driven by increasing consumer demand for transparency and natural products. Clean label ingredients refer to food additives and ingredients that are perceived as natural, wholesome, and free from synthetic chemicals, artificial additives, or genetically modified organisms (GMOs). Consumers today are more health-conscious and prefer products that have a short, simple ingredient list, with items they can easily recognize and understand.

The growth of the clean label ingredients market is primarily driven by anincreasing consumer demand for transparency and natural products. As consumers become more health-conscious, there is a rising preference for food and beverages made with ingredients that are simple, natural, and free from synthetic additives, artificial colors, and preservatives. Additionally, the growing awareness about the potential health risks associated with artificial ingredients has led to a shift towards clean label products. Manufacturers are responding by reformulating their products to meet these demands, which is further accelerating market growth. Moreover, stringent government regulations on food labeling and a growing trend toward plant-based and organic foods are also contributing to the expansion of the clean label ingredients market.

The Europe region accounted for a dominant revenue share of 40% in 2023. This dominance is driven by the presence of leading clean-label ingredient manufacturers, along with increased R&D efforts and the introduction of innovative products. Additionally, favorable government initiatives addressing the negative health effects associated with synthetic food additives and flavors are further boosting the demand for clean-label products in the region.

| Attribute | Europe |

| Market Value | USD 51.15 Billion |

| Growth Rate | 4.34% CAGR |

| Projected Value | USD 78.09 Billion |

In North America, the clean label ingredients market is projected to grow at the fastest CAGR of 4.83% during the forecast period. The rising consumer interest in plant-based foods and healthier beverages is significantly driving the demand for clean-label ingredients. This growing trend presents a promising opportunity for companies to develop and offer innovative products to consumers in the region.

The Asia Pacific region is expected to experience a steady CAGR of 8.23% over the forecast period, largely due to the increasing demand for fast food products. The growing popularity of plant-based diets and the rise in health-conscious consumers are fueling the demand for organic products in the region. For example, in November 2022, India-based Vecan Foods launched plant-based meals. In response to evolving consumer preferences, several companies are expanding their product portfolios to gain a competitive edge.

The powder segment held the largest share of 63% in terms of revenue in 2023. Factors such as longer shelf life and ease of storage are the major factors fueling the demand for powder-based clean-label ingredients. Powdered clean label ingredients can be easily blended into dry mixes, dough, and batters enabling precise control over the ratio of ingredients and achieving a suitable texture for the product. Additionally, powders also provide versatility in terms of dispersion in liquids thereby allowing manufacturers to provide different product formulations. In July 2023, Givaudan partnered with Manus Bio to announce the launch of BioNooKatone, a sustainably sourced citrus flavor sourced from natural citrus extracts.

On the other hand, the liquid segment promises a significant CAGR of 3.94% during the forecast period. Factors such as dispersion and ease of use in food and beverage applications are fueling the demand for the segment. Liquid ingredients disperse uniformly resulting in a consistent distribution of the product leading to improved flavor and texture. In October 2020, Kerry Group announced the launch of natural citrus extracts made of orange, tangerine, lime, and lemon. The citrus extracts are ideal to use in ready-to-drink beverages and sparkling drinks.

The natural flavor segment held the largest share of 21% in 2023. Several consumers are seeking healthier alternatives to artificial flavors, leading to a surge in demand for flavors sourced from natural sources. In addition, favorable regulatory scenario and government support toward the usage of natural flavors in diverse application is fueling the demand for the segment. Rising innovations and product developments in natural food flavor sources have also profited the natural flavor industry. In September 2023, Belgium-based Solvay announced the launch of three naturally sourced flavor ingredients Sublima, Delica, and Alta. The flavors are sourced from vanillin.

The fruit & vegetable ingredients segment is expected to showcase a CAGR of 7.15% during the forecast period. Consumers are increasingly concerned about artificial additives, preservatives, and synthetic ingredients in their food. Fruits and vegetables are natural ingredients that can enhance the appeal of clean-label products. Also, the rising demand for plant-based food and beverages is driving the demand for naturally sourced fruit and vegetable ingredients. In March 2023, Ingredion Incorporated announced the launch of citrus-based texturizers FIBERTEX CF 102 and FIBERTEX CF 502 in its clean-label ingredient portfolio. The citrus fibers are sourced from peels of citrus fruits and can be used in dressings, sauces, baked goods, and meat alternatives.

The food segment held the largest market share of 41% in 2023. The growing consumer interest in minimally processed ingredients has prompted manufacturers to revamp their product portfolios to meet clean label standards. In July 2023, as per Ingredion’s study, 71% of consumers are willing to pay higher prices for clean-label products.

The COVID-19 pandemic has further amplified the significance of clean-label food products, as consumers have become more cautious about the food products they purchase. Consumers are prioritizing clean labels as they seek greater assurance about the safety and quality of the food they consume. As a result, clean label renovation has become a key priority for many manufacturers, aligning their offerings with consumer expectations and preferences.

The dairy, non-dairy, and fermented beverages segment is expected to showcase the fastest CAGR of 4.97% during the forecast period. Factors such as the high prevalence of allergies coupled with the demand for beverages free from additives and synthetic chemicals are the major factors driving the demand for clean-label beverages. In September 2021, Clean Energy, a provider of sports nutrition products announced the launch of on-the-go smoothie packs sourced from organic vegetables and fruits. The pack is available in flavors such as strawberry, blueberry, spinach, and flaxseed.

Based on distribution channel, the clean label ingredient market is bifurcated into B2B and B2C. The B2B segment held the largest share of 72% in 2023. Food manufacturers and ingredient suppliers are placing a stronger emphasis on the use of sustainably sourced ingredients owing to the changing consumer landscape. Utilization of clean-label ingredients enables B2B businesses to provide their customers with the assurance that their products adhere to specific quality standards and cater to consumer preferences. Furthermore, stricter labeling regulations is also encouraging B2B business to offer products that are minimally processed.

The B2C segment is anticipated to grow at a CAGR of 4.64% during the forecast period. The B2C segment includes online channels, supermarkets, hypermarkets, specialty stores, and other convenience stores. The rise in the number of companies offering clean-label food and beverages coupled with the wider availability of newer brands through online channels and supermarkets is boosting the demand for the B2C segment. Manufacturers are increasingly utilizing the use of social media and marketing techniques to garner interest from consumers.

By Form

By Type

By Application

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clean Label Ingredients Market

5.1. COVID-19 Landscape: Clean Label Ingredients Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clean Label Ingredients Market, By Form

8.1. Clean Label Ingredients Market, by Form, 2024-2033

8.1.1. Powder

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Liquid

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Clean Label Ingredients Market, By Type

9.1. Clean Label Ingredients Market, by Type, 2024-2033

9.1.1. Natural Colors

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Natural Flavors

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Fruit & Vegetable Ingredients

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Starch & Sweeteners

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Flour

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Malt

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Clean Label Ingredients Market, By Application

10.1. Clean Label Ingredients Market, by Application, 2024-2033

10.1.1. Food

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pet Food

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Dairy, Non-Dairy, and Fermented Beverages

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Clean Label Ingredients Market, By Distribution Channel

11.1. Clean Label Ingredients Market, by Distribution Channel, 2024-2033

11.1.1. B2B

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. B2C

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Clean Label Ingredients Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Form (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Form (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Form (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Form (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Form (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Form (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Form (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Form (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Form (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Form (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Form (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Form (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Form (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Form (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Form (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Form (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Tate & Lyle

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Ingredion Incorporated

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cargill

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Archer Daniels Midland

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Koninklijke DSM N.V

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Dupont De Nemours and Company

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Kerry Group Plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Corbion Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Frutarom

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Kerry Group PLC

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others