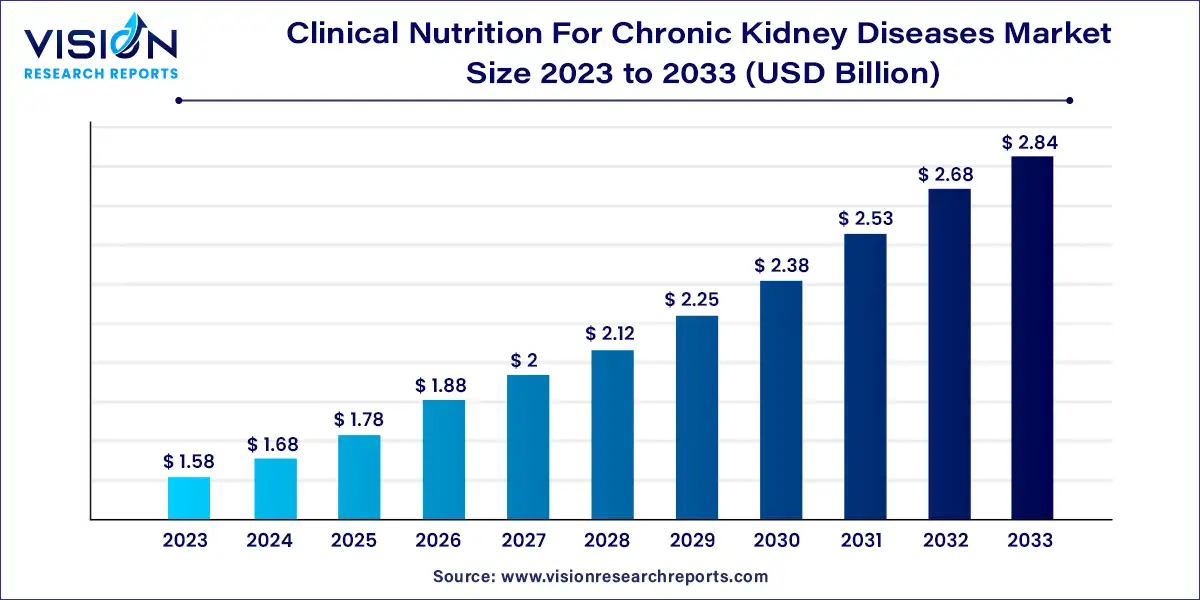

The global clinical nutrition for chronic kidney diseases market size was estimated at around USD 1.58 billion in 2023 and it is projected to hit around USD 2.84 billion by 2033, growing at a CAGR of 6.05% from 2024 to 2033.

The market for clinical nutrition specifically designed for chronic kidney disease (CKD) patients is experiencing significant growth. As the prevalence of CKD rises globally, driven by factors such as aging populations, increasing incidences of diabetes and hypertension, and greater awareness and diagnosis of the condition, the demand for specialized nutritional products tailored to this patient group is expanding.

The growth of the clinical nutrition market for chronic kidney diseases (CKD) is propelled by the rising global prevalence of CKD, fueled by an aging population and increasing rates of diabetes and hypertension, significantly boosts the demand for specialized nutritional products. Additionally, heightened awareness and improved diagnostic capabilities are leading to earlier detection and management of CKD, further driving the need for tailored clinical nutrition. Advances in nutritional science and technology are also contributing to market growth by enabling the development of innovative products that address the unique dietary requirements of CKD patients. Finally, the expansion of healthcare infrastructure and services, particularly in emerging markets, is facilitating greater access to these specialized nutritional solutions, thereby supporting market expansion.

Oral clinical nutrition led the market in 2023, capturing over 51% of the market share. The demand for orally administered medical foods is driven by a growing preference for these products, their commercial viability, and supportive initiatives. Additionally, the increasing production of oral products in various forms such as pre-thickened products, powders, and pills is expected to boost this segment further.

Conversely, parenteral feeding formulas are projected to experience the fastest growth over the forecast period. Patients with CKD often face malnutrition and difficulties with oral feeding, making parenteral nutrition a necessary alternative. Particularly for those undergoing extracorporeal renal replacement therapies, like hemodialysis or peritoneal dialysis, parenteral nutrition becomes essential due to the severity of the condition and the associated metabolic demands.

In 2023, adults dominated the segment, accounting for over 86% of market revenue. This is attributed to the rising prevalence of nutritional deficiencies and malnutrition among the adult population. Adults, particularly women over 30, often face issues such as decreased muscle strength and deficiencies in vitamins and calcium. Additionally, they may suffer from apathy, weakened immunity, high blood pressure, and fatigue, all of which contribute to nutritional deficiencies.

The adult segment is also expected to experience the fastest growth over the forecast period. According to the NCBI, an estimated 843.6 million individuals worldwide are affected by CKD stages 1-5. Furthermore, the CDC reports that CKD is more common in people aged 65 years or older (34%) compared to those aged 45-64 years (12%) or 18-44 years (6%). The increasing incidence of CKDs globally highlights the need for collaborative initiatives to prevent and manage CKD and its associated complications on a global scale.

In 2023, the institutional sales segment led the market, capturing over 41% of revenue. This sales channel includes commercial sales to government organizations, hospitals, and research institutes. The rising global prevalence of CKDs has led to an increase in patient visits to medical facilities for diagnosis and treatment. As patient awareness grows, there is a corresponding rise in the use of official hospital channels to obtain CKD nutrition prescriptions.

The online sales segment is expected to experience the fastest growth over the forecast period. Advancements in telemedicine have facilitated the global distribution of clinical nutrition products, enabling manufacturers to expand their market reach and serve underserved communities. As a result, online sales have surged, driven by increasing customer demand for CKD supplements through various online platforms and stores.

North America dominated the market and accounted for over 31% of the revenue share in 2023. The growth in this region can be attributed to its well-developed healthcare infrastructure and supportive reimbursement policies. Moreover, significant public and private investments in healthcare have contributed to the market’s expansion in the area.

Clinical nutrition for CKD in Asia Pacific is anticipated to grow at the fastest CAGR of nearly 7.02% from 2024 to 2033. Moreover, Japan and China have a large elderly population, which is at a high risk of chronic conditions. Nutritional deficiencies are more common in the geriatric population, which is expected to boost the demand for medical foods in Asia Pacific. In the coming years, Asia Pacific is expected to become a crucial market due to the increasing prevalence of CKD among the elderly population and the continuous growth of healthcare infrastructure.

By Product

By Stage

By Sales Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others