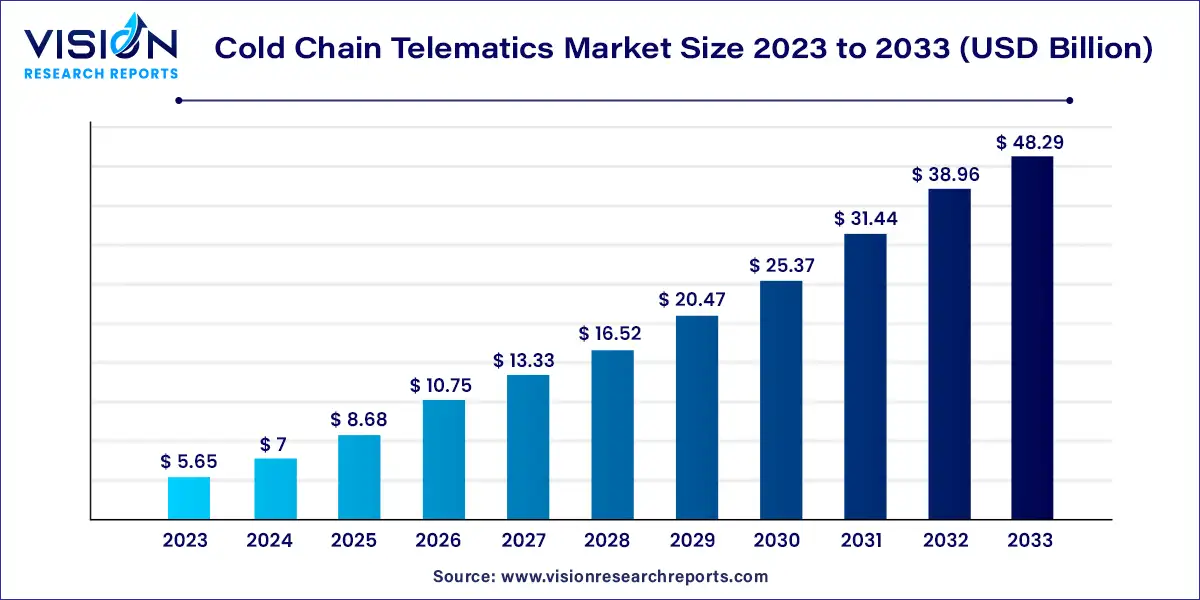

The global cold chain telematics market size was estimated at around USD 5.65 billion in 2023 and it is projected to hit around USD 48.29 billion by 2033, growing at a CAGR of 23.93% from 2024 to 2033. The cold chain telematics market is experiencing rapid growth as businesses and industries increasingly recognize the critical importance of maintaining the integrity and safety of temperature-sensitive goods during transportation. Cold chain telematics combines the power of telecommunication and informatics to monitor, manage, and optimize the cold chain logistics, ensuring that perishable goods such as pharmaceuticals, food, and chemicals are kept within specified temperature ranges throughout their journey.

The growth of the cold chain telematics market is significantly propelled by an increasing demand for perishable goods, such as fresh food, pharmaceuticals, and biologics, necessitates robust temperature control solutions during transportation. Secondly, stringent regulatory requirements and standards set by governments and health organizations to ensure the safety and efficacy of temperature-sensitive products are pushing companies to adopt advanced telematics systems. Additionally, advancements in IoT and sensor technologies have enhanced the capabilities of telematics solutions, providing real-time monitoring and data analytics, which improves operational efficiency and reduces the risk of product spoilage. These factors collectively contribute to the accelerated growth of the cold chain telematics market.

North America dominated the global market in 2023, accounting for a revenue share of over 35%. The market's growth in this region is driven by rising investments in cold chain infrastructure and the need to comply with stringent regulations and standards for food and pharmaceutical goods. Regulations and standards set by entities such as the U.S. FDA and United States Department of Agriculture (USDA) drive the adoption of cold chain telematics solutions. Additionally, investments in cold storage facilities, transportation fleets, and other infrastructure support market growth.

| Attribute | North America |

| Market Value | USD 1.97 Billion |

| Growth Rate | 24.96% CAGR |

| Projected Value | USD 16.90 Billion |

The global U.S. chain telematics market size was estimated at USD 1.38 billion in 2023 and it is expected to surpass around USD 11.83 billion by 2033, poised to grow at a CAGR of 24.96% from 2024 to 2033.

This growth is driven by technological advancements, including the integration of Internet of Things (IoT) devices with cold chain telematics, which enhance real-time monitoring and management capabilities. The presence of numerous market players, such as Verizon, Sensitech (Carrier), and ORBCOMM, also supports market growth.

The Asia Pacific market is expected to grow at the fastest CAGR of 25.63% from 2024 to 2033. This growth is driven by the expansion of e-commerce platforms and online grocery services, which necessitate efficient cold chain solutions to ensure the delivery of fresh and perishable items. Consumers in this region expect timely and reliable delivery of fresh products, driving the adoption of advanced cold chain telematics.

Europe Market Trends

The European market is projected to grow at a significant CAGR of 23.53% from 2024 to 2033. This growth is driven by the expanding pharmaceutical and biotech sectors, which require precise temperature control for sensitive drugs and vaccines. Additionally, the focus on food waste reduction and sustainability drives market growth. According to Eurostat, over 58 million tons of food waste were generated in the EU in 2021. Reducing food waste is a major priority in Europe, and cold chain telematics solutions help minimize spoilage and improve resource efficiency.

In 2023, the hardware segment led the market, accounting for over 78% of global revenue. This growth is driven by the increasing demand for real-time monitoring of temperature-sensitive products, particularly in the pharmaceuticals and food industries. The need for continuous data tracking and monitoring has led to the widespread adoption of advanced hardware components such as temperature and humidity sensors, GPS modules, and communication devices. For instance, in May 2023, Sweden-based Tridentify AB launched a real-time cold chain monitoring system. This system continuously tracks the stability and remaining shelf-life of products in transit, offering a comprehensive view of shipment conditions. It enables companies to make informed, data-driven decisions and optimize their operations by monitoring the stability budget and identifying inefficiencies in real time.

The software segment is expected to experience the fastest CAGR from 2024 to 2033. This growth is attributed to the increasing use of advanced data analytics and Machine Learning (ML) in software solutions. Modern software solutions leverage these technologies to predict potential issues before they arise, optimizing cold chain operations and reducing risks. Additionally, there is a growing demand for greater transparency and higher service levels regarding product conditions. Software solutions enhance communication and visibility, thereby improving the customer experience.

In 2023, the frozen segment (-18°C to -25°C) dominated the market, accounting for over 62% of global revenue. This growth is driven by the rising demand for frozen food, which is favored for its convenience, longer shelf life, and ease of storage. The expanding range of frozen food categories, including ready-to-eat meals, frozen vegetables, and desserts, underscores the need for effective cold chain management within this temperature range.

The chilled segment (0°C to 15°C) is projected to grow at a considerable CAGR from 2024 to 2033. This growth is driven by the rise of e-commerce and direct-to-consumer models for chilled products. The expansion of e-commerce and direct-to-consumer models necessitates robust cold chain solutions to ensure products remain within the proper temperature range during transit and delivery. Consumers' expectations for fresh, high-quality products delivered on time drive the demand for reliable temperature control and monitoring solutions, thereby propelling market growth.

In 2023, the food & beverages segment led the market, accounting for over 80% of global revenue. The segment’s growth is driven by the need to ensure regulatory compliance, reduce food waste, and manage the expanding volume of products requiring effective cold chain management. The global food and beverage industry is growing due to population growth, urbanization, and changing dietary habits. This expansion necessitates sophisticated cold chain solutions to manage diverse temperature needs. Cold chain telematics solutions help reduce food waste by preventing spoilage through accurate temperature control and monitoring, leading to better inventory and supply chain management.

The pharmaceuticals segment is expected to witness the fastest CAGR from 2024 to 2033. This growth is driven by the need to comply with stringent regulatory requirements set by bodies such as the European Medicines Agency (EMA), U.S. Food and Drug Administration (FDA), and World Health Organization (WHO). Cold chain telematics solutions help companies maintain precise temperature control, preventing spoilage and degradation of pharmaceuticals, and ensuring that products remain safe and effective upon administration.

By Component

By Temperature Range

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cold Chain Telematics Market

5.1. COVID-19 Landscape: Cold Chain Telematics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cold Chain Telematics Market, By Component

8.1. Cold Chain Telematics Market, by Component, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cold Chain Telematics Market, By Temperature Range

9.1. Cold Chain Telematics Market, by Temperature Range, 2024-2033

9.1.1. Chilled (0°C to 15°C)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Frozen (-18°C to -25°C)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Deep-frozen (Below -25°C)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cold Chain Telematics Market, By Application

10.1. Cold Chain Telematics Market, by Application, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmaceuticals

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cold Chain Telematics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Temperature Range (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Verizon.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sensitech (Carrier).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ORBCOMM.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Zebra Technologies Corp.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Controlant.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Roambee Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Monnit Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ELPRO-BUCHS AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Astrata.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Savi Technology

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others