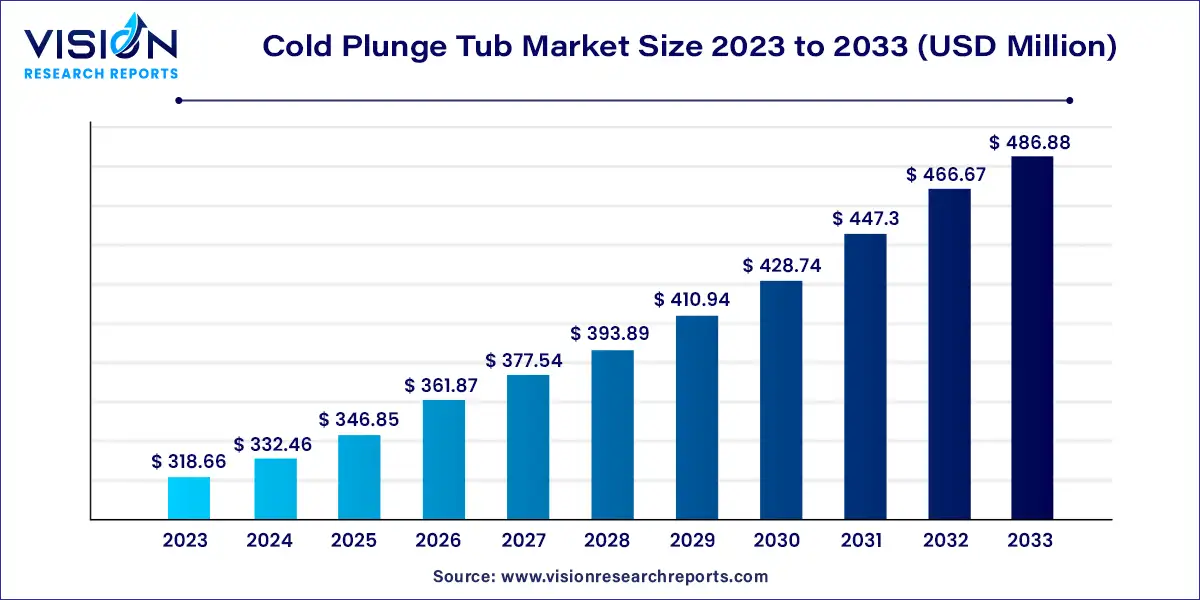

The global cold plunge tub market size was estimated at around USD 318.66 million in 2023 and it is projected to hit around USD 486.88 million by 2033, growing at a CAGR of 4.33% from 2024 to 2033. The cold plunge tub market has seen significant growth as wellness and recovery practices gain traction across various demographics. Cold plunge tubs, designed to facilitate immersion in cold water for therapeutic purposes, have become increasingly popular among athletes, wellness enthusiasts, and individuals seeking alternative health treatments. This market encompasses a diverse range of products, from luxury models with advanced features to more basic, budget-friendly options.

The growth of the cold plunge tub market is driven by the increasing emphasis on health and wellness has led to a greater adoption of recovery and self-care practices, including cold water immersion. As more people become aware of the potential benefits, such as enhanced circulation and reduced muscle soreness, demand for cold plunge tubs has surged. Additionally, endorsements from athletes and fitness influencers who highlight the benefits of cold water therapy further fuel market interest. Technological advancements, including improved temperature control and user-friendly designs, also contribute to market growth by making these products more appealing and accessible to a broader audience. Moreover, the expansion of wellness-focused facilities and the growing trend of integrating advanced recovery solutions into home environments bolster the market’s development

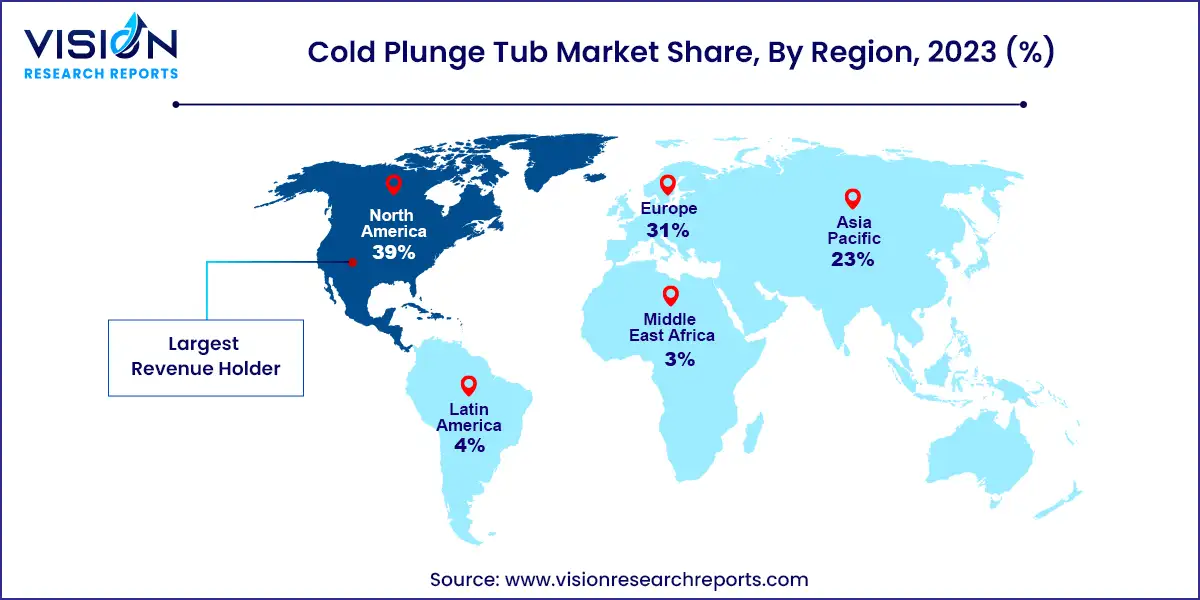

North America dominated the cold plunge tub market and accounted for largest revenue share of over 39% in 2023 on account of rising demand for cold water baths among sports person and athletes. Additionally, rising investments in private health and wellness sector, spas, and fitness sectors is expected to provide major opportunities for market players. For instance, in Baltimore, as a part of Baltimore City Recreation and Parks’ (BCRP) redevelopment plan, the city council announced the construction of a new fitness center with a funding of USD 23.1 Million that include construction of plunge pools, lap pools, and an open fitness area, aimed to improve public health.

Asia Pacific is expected to register the fastest CAGR of 5.06% during the forecast period. It is developing as a result of increased use by resorts, gyms, and spas. Additionally, the fast developing health and wellness sector will open up new potential for the industry in the region, due to the expanding population of countries like India, China, Australia, and Japan. Throughout the predicted period, rising production rates and manufacturers' focus on employing less expensive raw material substitutes are anticipated to overcome any cost limitations putting more emphasis on launching new product launches in the region.

In Middle East and Africa, the market for cold plunge tub is expected to showcase strong growth in near future on account of rising healthcare expenditure. Growing industrialization in countries like Brazil, South Africa, among others has resulted in an increase in the population's disposable income, which is predicted to promote benefits of healthy lifestyle, consequently favorably impacting the industry development over the forecast period.

The commercial application segment dominated the market for cold plunge tub and accounted for the largest revenue share of around 82% in 2023 and is expected to maintain its dominance over the forecast period. The segment covers use of cold water tubs at various commercial places including spas, sports training centers, gyms, and other activity premises. The growth of the segment is mainly driven by rising adoption of cold water therapy among several commercial premises. Hydrotherapy has become more crucial in treating illnesses including cardiovascular diseases, high blood pressure, circulatory issues, and chronic pain. As consumer awareness grows, more hospitals, physical therapy offices, and fitness facilities are providing specialized hydrotherapy treatments to address a range of medical issues. This is expected to drive the commercial applications of cold water plunge tubs in coming years.

Modern customers also favor less invasive procedures to address orthopedic conditions including arthritis, low back pain, and hand pain as well as sports-related injuries. Private hospitals, wellness centers, and clinics are emphasizing hydrotherapy and water therapy as a form of treatment as a consequence in expanding markets. As a result, the demand for cold plunge tub is expected to witness exponential growth in commercial sector. The residential application segment accounted for revenue share of around 19.0% in 2022. This is owing to rising awareness about the benefits of cold water baths. Additionally, consumers have also undergone renovations to add cold water bath tubs in response to increased knowledge of the benefits of regular exercise. The desire for luxurious houses and rented bungalows equipped with bath tubs and swimming pools have also stimulated the industry in recent years.

By Application

By Region

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Cold Plunge Tub Market

5.1. COVID-19 Landscape: Cold Plunge Tub Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Cold Plunge Tub Market, By Application

8.1.Cold Plunge Tub Market, by Application Type, 2024-2033

8.1.1. Commercial

8.1.1.1.Market Revenue and Forecast (2021-2033)

8.1.2. Residential

8.1.2.1.Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cold Plunge Tub Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10.Company Profiles

10.1. Hotbarrel

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. The Ice Bath Co.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Ice Barrel

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Cold Tub

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. iCool

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Renu Therapy

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Plunge

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Brass Monkey Health Ltd

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Jacuzzi Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. BuiltHQ.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others