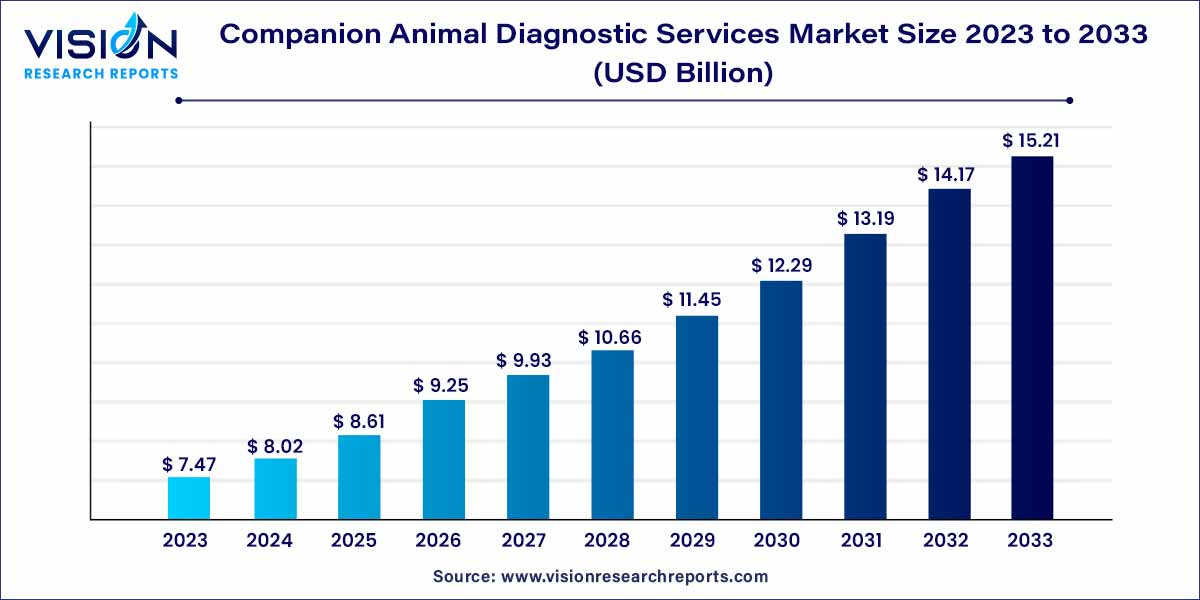

The global companion animal diagnostic services market size was estimated at around USD 7.47 billion in 2023 and it is projected to hit around USD 15.21 billion by 2033, growing at a CAGR of 7.37% from 2024 to 2033. The companion animal diagnostic services market is a crucial segment within the broader veterinary industry, dedicated to providing comprehensive diagnostic solutions for the health and well-being of our cherished animal companions. This market has witnessed substantial growth in recent years, fueled by a heightened awareness of the importance of preventive healthcare measures for pets.

The robust growth of the companion animal diagnostic services market can be attributed to several key factors. Firstly, the escalating rates of pet ownership worldwide have driven an increased demand for advanced veterinary diagnostics, as pet owners seek comprehensive healthcare solutions for their beloved animals. Furthermore, continuous advancements in veterinary diagnostic technologies, particularly in areas such as diagnostic imaging, laboratory services, and point-of-care testing, have significantly enhanced the precision and efficiency of disease detection. The growing emphasis on preventive healthcare among pet owners, coupled with the expanding trend of veterinary specialization, has further fueled the demand for a diverse range of diagnostic services. The globalization of pet care standards has standardized the need for diagnostic services across regions, contributing to the overall market growth. In summary, a combination of increased pet ownership, technological innovations, a proactive approach to animal healthcare, specialization within the veterinary field, and globalized healthcare standards collectively propels the expansion of the Companion Animal Diagnostic Services Market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 15.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.37% |

| Revenue Share of North America in 2022 | 36% |

| CAGR of Asia Pacific from 2024 to 2033 | 9.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The dogs segment dominated the market with the largest market share of 56% in 2023. This is owing to initiatives by key market players, a high pet dog population, and the availability of a range of diagnostic services specific to canine patients. In April 2022, Embark Veterinary, Inc. for example launched a new canine genetic screening test for veterinary professionals. The launch represents a notable shift for the dog DNA segment, which otherwise, has been largely focused on determining breed mix.

Other companion animals segment is anticipated to grow the fastest CAGR of 9.05% from 2024 to 2033. The popularity of small mammals, birds, and exotic pets such as reptiles has grown in recent years, leading to increased pet health concerns. Pet owners are becoming more aware of the importance of regular check-ups and early disease detection, driving the demand for diagnostic services for other companion animals. The Ohana Animal Hospital in the U.S. for instance is one of the many service providers in the country that offer laboratory testing, digital imaging, and other critical diagnostic services to exotic pets.

The clinical chemistry segment held the largest revenue share of 21% in 2023 by testing category. The segment includes testing of chemical composition of body fluids such as serum or plasma, urine, joint fluid, etc., and includes applications such as organ function testing for kidney, liver, pancreas, and more. The high segment share can be attributed to a wide range of clinical chemistry testing services offered by key companies, increasing uptake of these services, as well as growing advancements in the sector.

The cytopathology segment is projected to grow at the highest CAGR of 90.7% during the forecast period. Zoetis Reference Laboratories is one of the many key players that offer cytopathology testing for pets. This includes Cytopathology Simple/Single Site and Cytopathology Complex tests for cats and dogs. In October 2021, Zoetis added digital cytology testing to its multipurpose diagnostics technology platform- Vetscan Imagyst. This provided veterinary professionals remote access to expert clinical pathologists and enabled rapid and minimally invasive diagnosis of cancer, inflammation, infection, and more.

By type, the Point-of-Care (POC) segment held the highest share of the market in 2023. The segment includes testing services provided at point-of-care (i.e., where the pet receives care), such as at home or veterinary hospital/ clinic. Results are provided within minutes, or a few hours (more quickly than send-out lab results), thus enabling veterinarians to provide efficient diagnoses and decide next steps (such as more testing or treatment) preferably in the same visit. In August 2022, PepiPets launched mobile diagnostic testing services for dog and cat owners for at-home diagnostic testing. Such initiatives account for the high segment share.

The Laboratory-based segment is estimated to witness the fastest growth of 7.06% in the near future. The segment includes laboratories (owned and run by companies or public bodies) where customers (mostly vet hospitals & clinics) avail services by submitting samples by courier or overnight delivery and receiving results same-day or within a few days. In September 2022, Antech Diagnostics, for instance, expanded its molecular diagnostic offerings by adding OncoK9 from PetDx and Vidium Animal Health’s SearchLight DNA to its portfolio to enhance canine cancer diagnostics. This is expected to fuel the segment's growth.

By region, North America dominated the market with a share of over 36% in 2023. This is owing to the presence of a large number of pet diagnostic service providers, a high medicalization rate, and growing pet expenditure. Medicalization rate, for instance, is defined as the percentage of pets that have visited a veterinarian at least once in the past 12 months. As per the Canadian Animal Health Institute (CAHI) estimates, from 2020 to 2022 the medicalization rate per year for dogs was estimated at 86%. However, a 3% increase was observed in the medicalization rate of cats. This is expected to fuel the demand for reliable diagnostic services.

Asia Pacific region is expected to grow at the fastest rate of 9.03% during the forecast period. This is due to the increasing awareness of diseases in animals, the pet population, and the presence of local market players. Progress in veterinary medical knowledge and technology has expanded the range of available diagnostic tests and improved their accuracy. Pet owners are becoming more educated and aware of the importance of diagnostic services for their pets. This leads to a higher demand for comprehensive and advanced diagnostic testing.

By Animal Type

By Testing Category

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Animal Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Companion Animal Diagnostic Services Market

5.1. COVID-19 Landscape: Companion Animal Diagnostic Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Companion Animal Diagnostic Services Market, By Animal Type

8.1. Companion Animal Diagnostic Services Market, by Animal Type, 2024-2033

8.1.1 Dogs

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cats

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Horses

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Other Companion Animals

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Companion Animal Diagnostic Services Market, By Testing Category

9.1. Companion Animal Diagnostic Services Market, by Testing Category, 2024-2033

9.1.1. Clinical Chemistry

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Microbiology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Parasitology

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Histopathology

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cytopathology

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Hematology

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Immunology & Serology

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Imaging

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Molecular Diagnostics

9.1.9.1. Market Revenue and Forecast (2021-2033)

9.1.10. Other Categories

9.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Companion Animal Diagnostic Services Market, By Type

10.1. Companion Animal Diagnostic Services Market, by Type, 2024-2033

10.1.1. Point-of-Care (POC)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Laboratory-based

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Companion Animal Diagnostic Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.1.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.2.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.3.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.5.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Testing Category (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Type (2021-2033)

Chapter 12. Company Profiles

12.1. Zoetis Services LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. IDEXX Laboratories, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mars Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. The Animal Medical Center.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Embark Veterinary, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SYNLAB

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. NationWide Laboratories.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. IVC Evidensia

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CVS Group Plc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Greencross Vets

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others