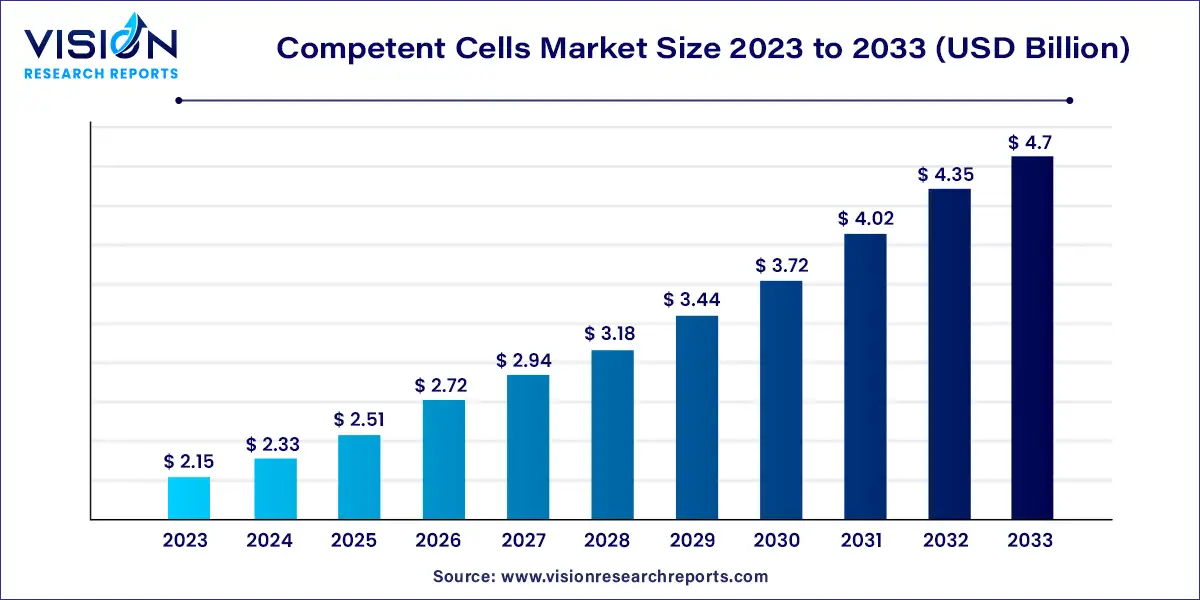

The global competent cells market size was estimated at USD 2.15 billion in 2023 and it is expected to surpass around USD 4.7 billion by 2033, poised to grow at a CAGR of 8.14% from 2024 to 2033.

The competent cells market is experiencing significant growth driven by advancements in genetic engineering and biotechnology research. Competent cells, essential in molecular biology techniques, enable the uptake of foreign DNA, crucial for cloning and transformation processes. Key factors propelling market expansion include rising research and development activities in pharmaceutical and biotechnological sectors, coupled with increasing demand for genetically modified organisms (GMOs).

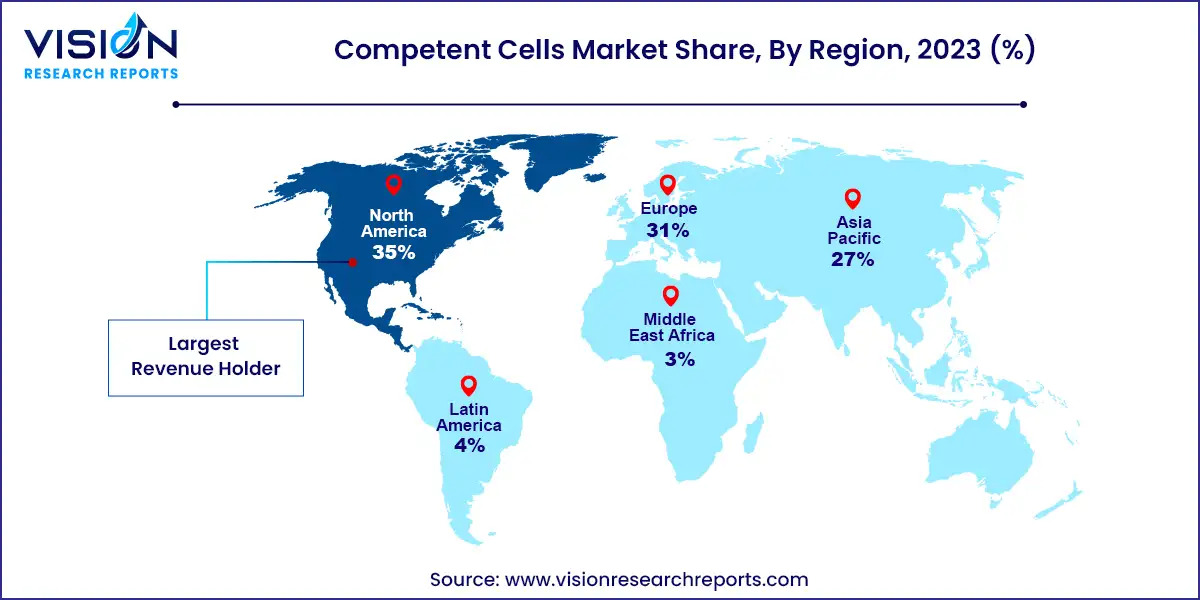

The growth of the competent cells market is influenced by several key factors. Advances in genetic engineering and biotechnology are driving increased demand for competent cells, which play a crucial role in molecular biology techniques such as cloning and transformation. The expanding applications of genetically modified organisms (GMOs) across various sectors, including pharmaceuticals and agriculture, further contribute to market growth. Additionally, continuous innovations by market players to develop efficient and reliable competent cell products are enhancing market dynamics. Geographically, North America leads the market due to significant investments in biotechnology research and robust infrastructure, while Asia-Pacific offers promising growth opportunities driven by the rapid expansion of biopharmaceutical industries and supportive government initiatives.

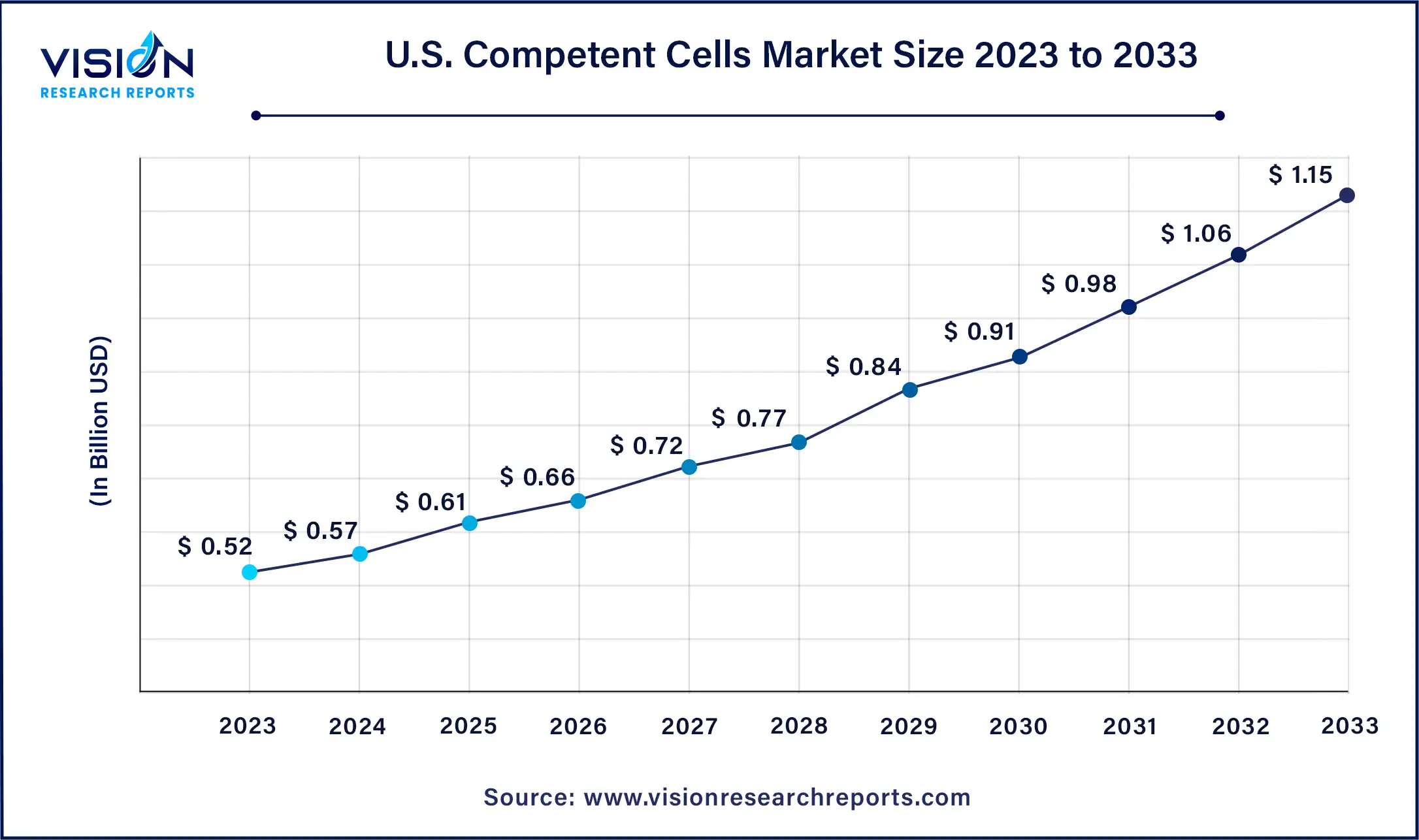

The U.S. competent cells market size was estimated at around USD 0.52 billion in 2023 and it is projected to hit around USD 1.15 billion by 2033, growing at a CAGR of 8.26% from 2024 to 2033.

North America held the largest market share of 35% in 2023, driven by advancements in molecular cloning research, technological innovations, and robust commercial demand for molecular cloned products. The region benefits from substantial investments in research and development, government funding in biotechnology and healthcare sectors, and advanced healthcare infrastructure.

Asia Pacific is expected to witness the fastest CAGR of 8.94% from 2024 to 2033 in the competent cells market. This growth is fueled by increasing adoption of protein expression technologies in countries like India and China, alongside rising focus on proteomics and genomics research. China, in particular, is poised for significant market expansion due to escalating investments and supportive government initiatives in biotechnology research and development.

The chemically competent cells segment led the market in 2023, holding a substantial share of 44%. This dominance is attributed to their high transformation efficiency, compatibility with heat shock treatment, and straightforward handling. Chemically competent cells find extensive use in molecular biology applications such as cloning, DNA sequencing, and library construction.

Electrocompetent cells are projected to grow at the highest CAGR during the forecast period. They play a critical role in introducing external DNA into host cells for applications like gene cloning, protein production, and functional genomics. Electrocompetent cells facilitate precise DNA delivery, enabling genetic modifications and desired phenotypic changes.

In 2023, pharmaceutical and biotechnology companies accounted for the largest market share at 42%. These companies utilize competent cells primarily for standard cloning experiments, which are essential for cloning and subcloning processes. The demand for competent cells in pharmaceutical companies is bolstered by advancements in molecular cloning technologies, enhancing the efficiency and accuracy of genetic manipulation in drug discovery and development.

Academic and research institutes are expected to experience the fastest CAGR over the forecast period. These institutions engage in diverse research activities requiring molecular cloning and recombinant DNA technology. Competent cells are employed for various applications including subcloning, phage display library production, and mutagenesis. Collaborations between academic institutes and biotechnology firms further drive market growth through knowledge exchange and joint research initiatives.

Cloning dominated the market in 2023 with a significant share of 45%. The increasing prevalence of infectious and non-communicable diseases has heightened the demand for competent cells in research and development activities, particularly in the development of recombinant antibodies and other therapeutic proteins.

The protein expression segment is anticipated to grow at a rapid CAGR of 9.06% during the forecast period. Competent cells are crucial for synthesizing proteins and enzymes used in biotechnology and the food & beverage industry. They are also integral in constructing sub-libraries and phage-display libraries for therapeutic research and development.

By Type

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others