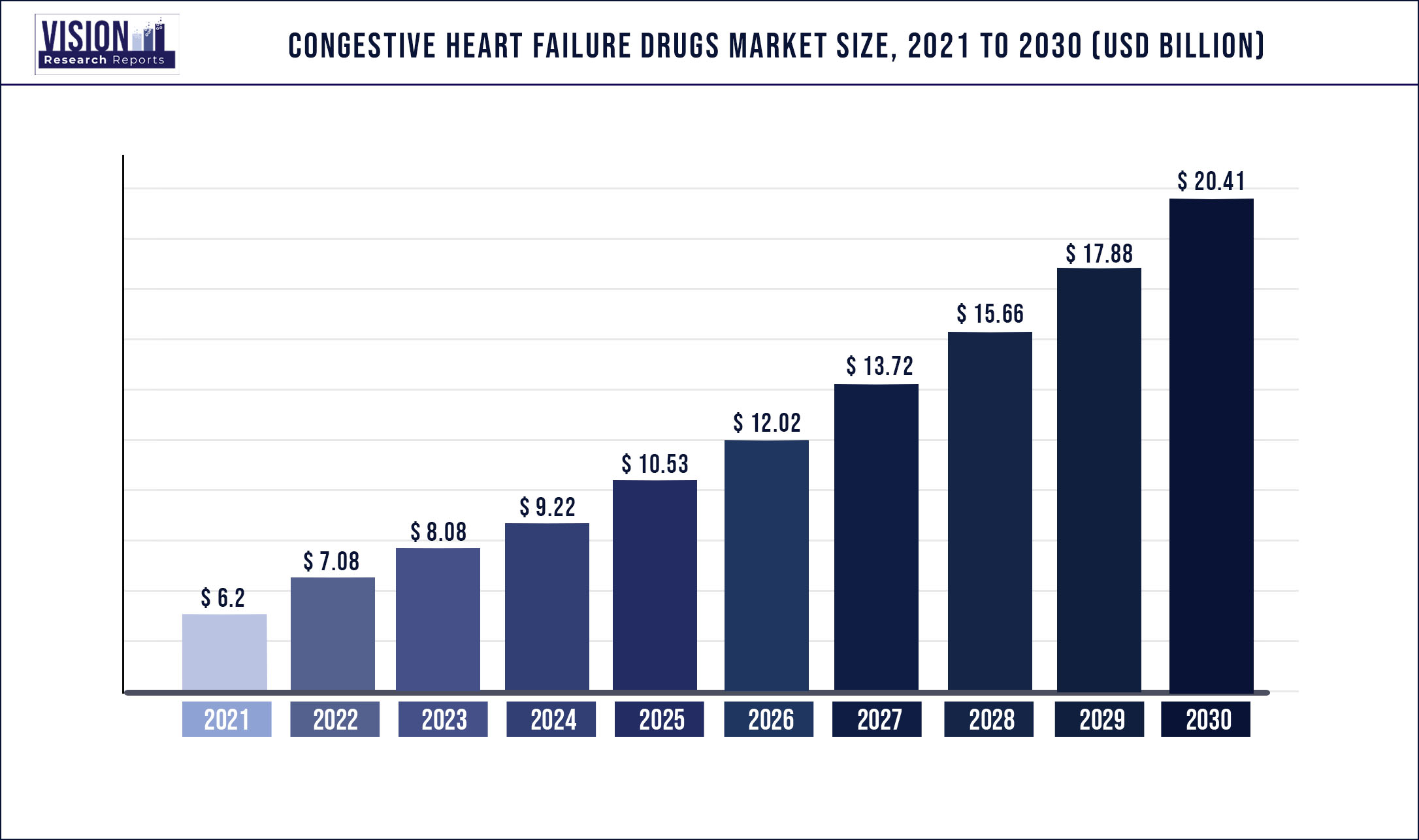

The global congestive heart failure drugs market was surpassed at USD 6.2 billion in 2021 and is expected to hit around USD 20.41 billion by 2030, growing at a CAGR of 14.15% from 2022 to 2030.

Report Highlights

The increase in the prevalence of congestive heart failure (CHF), the rising aging population leading to increased risk of disease, and growing research and development for better treatment approaches are the key factors augmenting the growth. In 2020, around 64.34 million people worldwide were suffering from heart failure. In addition, its estimated prevalence rate is high in patients with diseases such as diabetes and hypertension.

Increasing research and development for better treatment options is a major factor behind the presence of multiple products in the pipeline. Novo Nordisk’s Semaglutide, Zensun’s Neucardin, Bayer’s vericiguat, and AstraZeneca’s AZD4831 are among the prominent drug candidates. Moreover, approval of an extended label for sodium-glucose co-transporter 2 (SGLT2) inhibitors for CHF is expected to fuel market growth. For instance, in February 2022, Jardiance (empagliflozin) and in May 2020, Farxiga (dapagliflozin) received label expansion for the treatment of CHF.

Key players such as AstraZeneca; Bristol-Myers Squibb Company; Amgen Inc.; and Boehringer Ingelheim are strategically engaged in geographical expansions, regulatory approvals, collaborations, and partnerships through mergers and acquisitions in emerging and economically favorable regions. For instance, in February 2021, AstraZeneca announced the approval of Forxiga (dapagliflozin) in China, indicated for CHF with or without type-2 diabetes. Before China, the drug was already approved in the U.S., Europe, and Japan for the same indication.

COVID-19 impacted the demand and supply of drugs, and patients faced difficulty in healthcare access, resulting in a decline in product demand amid the pandemic. Due to imposed restrictions, research and development saw a setback in clinical trial proceedings. However, after the pandemic, the industry regained its pace.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 6.2 billion |

| Revenue Forecast by 2030 | USD 20.41 billion |

| Growth rate from 2022 to 2030 | CAGR of 14.15% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Drug class, distribution channel, region |

| Companies Covered |

Bayer AG; Novartis AG; Merck & Co., Inc.; AstraZeneca; Bristol-Myers Squibb Company; Amgen Inc.; Boehringer Ingelheim International GmbH; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; Eli Lilly and Company; Novo Nordisk A/S |

Drug Class Insights

The angiotensin-converting enzyme (ACE) inhibitors segment dominated the market in 2021 with a revenue share of over 30.02%. This can be due to its effectiveness as an individual treatment or approved combination therapeutic options in the market. Moreover, it is the first choice of treatment for CHF patients. It includes drugs such as Vasotec, Epaned (enalapril), Zestril, Qbrelis, Prinivil (lisinopril), and captopril. Inhibitors block the production of Angiotensin-2, and release arterial pressure, resulting in increased cardiac output without affecting heart rate. This is the most targeted mechanism of action to control heart failure.

Furthermore, approval of an extended label for sodium-glucose co-transporter 2 (SGLT2) inhibitors for CHF is anticipated to propel the segment growth. For instance, in May 2020, Farxiga (dapagliflozin) and in February 2022, Jardiance (empagliflozin) received label expansion for the treatment of CHF. These SGLT2 inhibitor drugs clinically demonstrated significant cardioprotective benefits and a 35% reduction in hospitalization. The drug class has also demonstrated clinical significance in controlling CHF in patients without diabetes.

Distribution Channel Insights

The hospital pharmacies held the largest share of over 55.12% in 2021. The retail pharmacies segment is anticipated to witness the highest growth over the forecast period. Retail pharmacies are at ease with most medications, especially in the homecare setting as CHF disease management takes long support of medications. Additionally, CHF drugs are prescription medicines. All these factors favor the growth of the segment.

The online pharmacies segment is expected to expand at a CAGR of 13.66% during the forecast period. Online pharmacy platform encourages the comfort of buying. In addition, in developing countries such as India, companies such as Netmeds Marketplace Ltd. and Tata 1mg promote online medicines buying. However, online buying of prescription drugs is unfavorable to many individuals, which is expected to slow down online pharmacy growth.

Regional Insights

North America held the largest share of over 35.04% in 2021. This can be attributed to the high disease burden, rise in patient awareness, increased healthcare expenditure, and presence of major players in the region. Furthermore, rising approval of new products is expected to fuel the industry growth over the forecast period.

In the European region, Italy was the least affected, and Germany had the highest CHF prevalence in 2021. The Asia Pacific region is expected to register the highest CAGR of 15.74% over the forecast period. This growth is due to the substantial presence of global companies in this region and the high CHF prevalence in countries such as China, Japan, and Australia. For instance, in 2020, in Australia, the estimated prevalence rate of CHF ranged between 1.2% and 5.3%, majorly due to the rising incidences of diabetes and obesity in the country.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Congestive Heart Failure Drugs Market

5.1. COVID-19 Landscape: Congestive Heart Failure Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Congestive Heart Failure Drugs Market, By Drug Class

8.1. Congestive Heart Failure Drugs Market, by Drug Class, 2022-2030

8.1.1. ACE Inhibitors

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Angiotensin 2 Receptor Blockers

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Beta Blockers

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Diuretics

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Aldosterone Antagonists

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Inotropes

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Congestive Heart Failure Drugs Market, By Distribution Channel

9.1. Congestive Heart Failure Drugs Market, by Distribution Channel, 2022-2030

9.1.1. Hospital Pharmacies

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Retail Pharmacies

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Online Pharmacies

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Congestive Heart Failure Drugs Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Drug Class (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

Chapter 11. Company Profiles

11.1. Bayer AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Novartis AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Merck & Co., Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. AstraZeneca

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Bristol-Myers Squibb Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Amgen Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Boehringer Ingelheim International GmbH

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Pfizer, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Johnson & Johnson Services, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Otsuka Pharmaceutical Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others