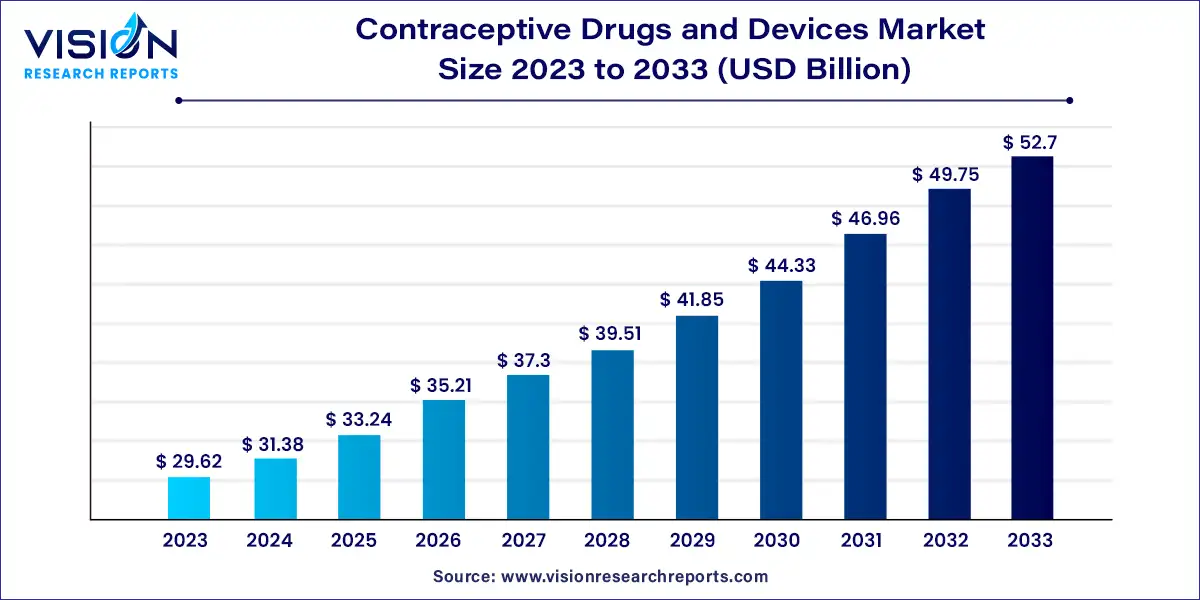

The global contraceptive drugs and devices market size was estimated at around USD 29.62 billion in 2023 and it is projected to hit around USD 52.7 billion by 2033, growing at a CAGR of 5.93% from 2024 to 2033. The contraceptive drugs and devices market encompasses a wide range of products aimed at preventing unintended pregnancies and reducing the spread of sexually transmitted infections (STIs). This market includes both contraceptive drugs, such as oral pills, patches, injectables, and emergency contraception, as well as contraceptive devices, including intrauterine devices (IUDs), condoms, vaginal rings, diaphragms, and subdermal implants. Increasing awareness about reproductive health, government initiatives promoting family planning, and advancements in contraceptive technologies are driving the growth of this market

The growth of the contraceptive drugs and devices market is driven by an including the rising awareness of family planning and reproductive health. Government initiatives promoting the use of contraceptives, coupled with the increasing global population, have significantly contributed to the demand for these products. Additionally, advancements in contraceptive technologies, such as the development of long-acting reversible contraceptives (LARCs), offer more effective and convenient options for users. The growing prevalence of sexually transmitted infections (STIs) has also spurred the adoption of barrier contraceptives. Furthermore, increasing access to healthcare services, particularly in developing regions, and a shift in societal attitudes toward contraception are key drivers in this market.

In 2023, Asia Pacific led the contraceptive drugs and devices market with a 34% share. This growth was largely due to government initiatives aimed at increasing awareness about STDs and unwanted pregnancies. Public health programs have also enhanced the availability of contraceptive measures through government-funded medical institutions. The region’s urban population is increasingly focusing on family planning, driven by concerns over population growth and the spread of STDs, which has boosted sales of contraceptive drugs and devices.

| Attribute | Asia Pacific |

| Market Value | USD 10.07 Billion |

| Growth Rate | 5.94% CAGR |

| Projected Value | USD 17.91 Billion |

North America held a 31% share of the global contraceptive drugs and devices market in 2023. This growth was primarily driven by the rising population and the increasing prevalence of STDs and unwanted pregnancies in the region. Urban populations in North America are more inclined to use contraceptive measures to reduce instances of unplanned pregnancies, abortion, and the spread of STDs. Additionally, the region’s advanced healthcare infrastructure, along with supportive government initiatives, has positively impacted market growth.

The contraceptive drugs and devices market in Europe has emerged as a lucrative region, benefiting from a developed healthcare infrastructure and growing awareness about contraception. The region’s urban population is increasingly utilizing contraceptive options such as IUDs, condoms, and other methods, reflecting a heightened focus on sexual health and family planning. These trends, combined with strong healthcare systems, are fostering growth in the European contraceptive market.

In 2023, the contraceptive devices segment led the market, accounting for 69% of the total share. This segment is further categorized into intrauterine devices (IUDs), condoms, vaginal rings, subdermal implants, and diaphragms. The growth of this segment can be attributed to increasing awareness of contraceptive options, largely due to active government and public welfare initiatives aimed at preventing unwanted pregnancies. Contraceptive devices are also highly effective in preventing the spread of sexually transmitted diseases (STDs) and in avoiding unplanned pregnancies. Furthermore, leading industry players are heavily investing in the development of innovative contraceptive devices, further driving market expansion.

Contraceptive drugs are projected to grow at a compound annual growth rate (CAGR) of 3.53% during the forecast period. This growth is driven by increasing awareness around the prevention of unwanted pregnancies and the availability of contraceptive methods such as pills, patches, and injectables. The rising accessibility of these products and their growing acceptance, particularly among urban populations, are key factors propelling this segment, as more individuals prioritize sexual health and family planning.

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Contraceptive Drugs and Devices Market

5.1. COVID-19 Landscape: Contraceptive Drugs and Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Contraceptive Drugs and Devices Market, By Product

8.1.Contraceptive Drugs and Devices Market, by Product Type

8.1.1. Contraceptive Drugs

8.1.1.1. Market Revenue and Forecast

8.1.2. Contraceptive Devices

8.1.2.1. Market Revenue and Forecast

8.1.3. Vaginal Ring

8.1.3.1. Market Revenue and Forecast

8.1.4. Diaphragm

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Contraceptive Drugs and Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product

Chapter 10. Company Profiles

10.1. Abbvie, Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Afaxys, Inc.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Agile Therapeutics

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Bayer AG

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. China Resources (Holdings) Co., Ltd.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Church & Dwight Co., Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Cupid Limited

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Helm AG

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Johnson & Johnson Services, Inc.

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Organon Group of Companies

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others