Coronary Heart Disease Diagnostic Imaging Devices Market Size and Trends

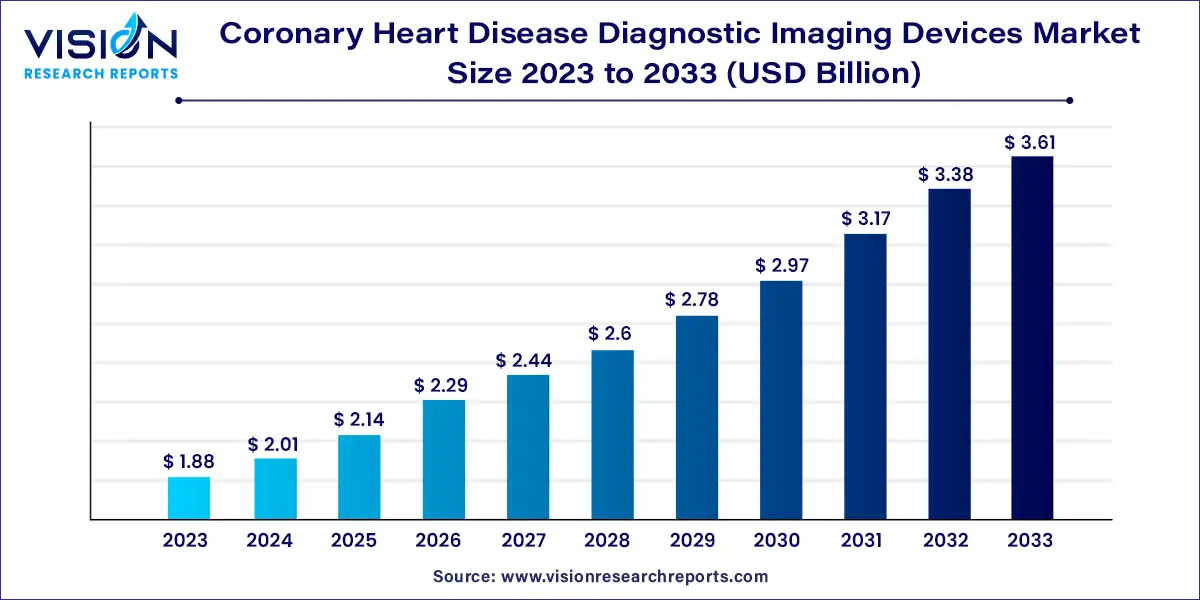

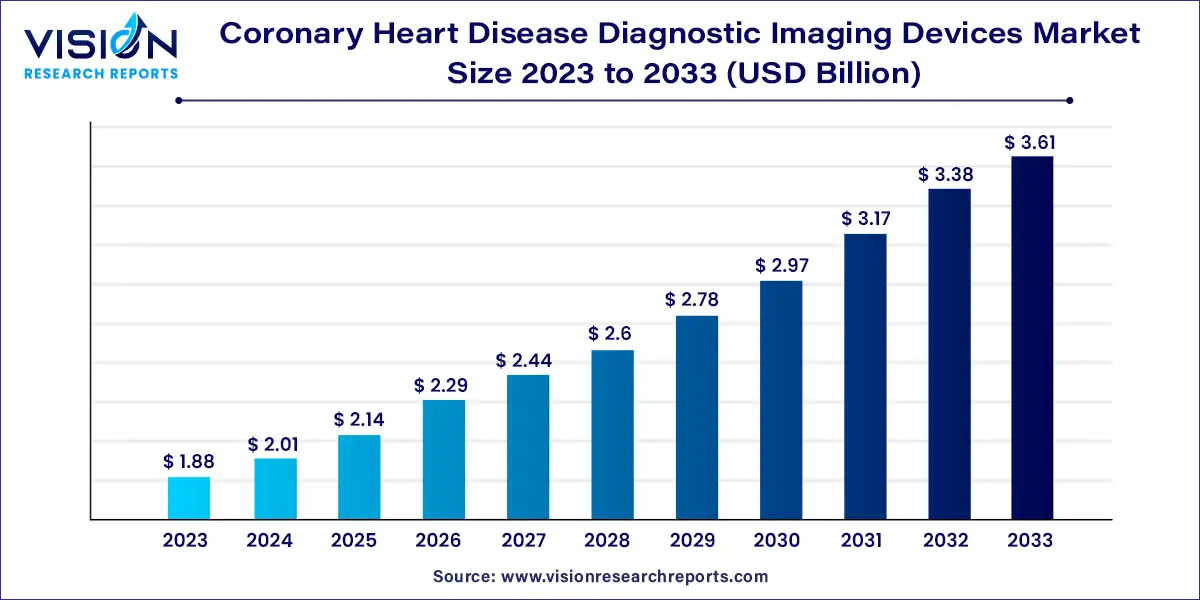

The global coronary heart disease diagnostic imaging devices market was estimated at USD 1.88 billion in 2023 and it is expected to surpass around USD 3.61 billion by 2033, poised to grow at a CAGR of 6.73% from 2024 to 2033. The Coronary Heart Disease (CHD) Diagnostic Imaging Devices Market is a critical segment of the healthcare industry, focusing on the early detection and management of coronary artery disease. As coronary heart disease remains one of the leading causes of morbidity and mortality globally, the demand for advanced diagnostic imaging technologies has been on the rise.

Key Pointers

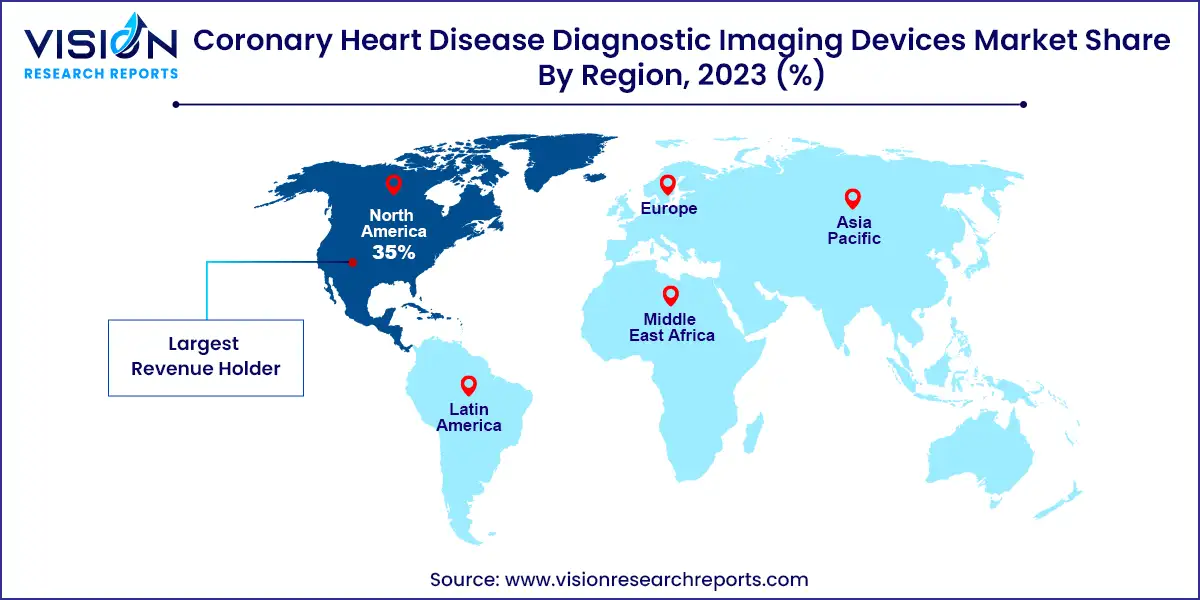

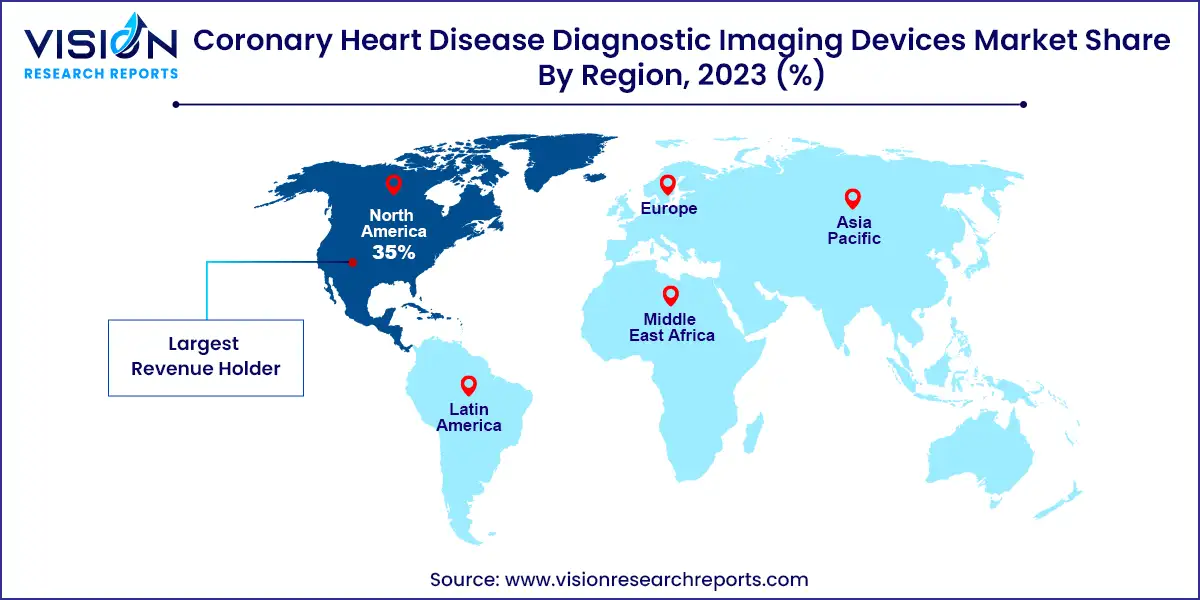

- North America dominated the global coronary heart disease diagnostic imaging devices market with the largest market share of 35% in 2023.

- By Modality, the nuclear medicine held the largest share of 30% in 2023.

- By Modality, the computed tomography (CT) segment is currently experiencing the fastest growth.

What are the Growth Factors of Coronary Heart Disease Diagnostic Imaging Devices Market?

The growth of the coronary heart disease diagnostic imaging devices market is driven an increasing prevalence of coronary heart disease, largely due to aging populations, sedentary lifestyles, and unhealthy dietary habits, is fueling the demand for advanced diagnostic tools. Technological advancements in imaging devices, such as improved CT scanners, MRI systems, and nuclear imaging techniques, have significantly enhanced the accuracy and efficiency of disease detection, further propelling market growth. Additionally, the rising awareness of heart health and the importance of early diagnosis through regular screenings is contributing to the market's expansion. The ongoing development of healthcare infrastructure in emerging economies, coupled with increased government investments in cardiovascular care, is also playing a crucial role in driving the market forward.

What are the Trends in Coronary Heart Disease Diagnostic Imaging Devices Market?

- Integration of Artificial Intelligence (AI): The incorporation of AI and machine learning algorithms into diagnostic imaging devices is revolutionizing the market. AI-enhanced imaging tools offer improved image analysis, faster processing, and more accurate diagnosis of coronary heart disease. This trend is expected to continue as AI technology evolves and becomes more sophisticated.

- Advancements in Imaging Technology: Significant technological advancements in imaging devices, such as higher-resolution CT scanners, advanced MRI systems, and cutting-edge nuclear imaging techniques, are driving the market. These innovations provide more detailed and precise imaging, enabling earlier and more accurate detection of coronary heart disease.

- Growing Adoption of Non-Invasive Imaging Techniques: There is a growing preference for non-invasive imaging methods, such as coronary CT angiography and cardiac MRI, over invasive procedures. Non-invasive techniques offer reduced risk to patients, shorter recovery times, and increased patient comfort, contributing to their rising adoption.

- Rise in Preventive Healthcare and Screening Programs: Increasing emphasis on preventive healthcare and early screening for coronary heart disease is fueling the demand for diagnostic imaging devices. Public health initiatives and awareness campaigns promoting regular heart health check-ups are encouraging more people to undergo diagnostic imaging.

What are the Key Challenges Faced by Coronary Heart Disease Diagnostic Imaging Devices Market?

- High Cost of Advanced Imaging Devices: The significant cost of advanced diagnostic imaging devices, such as high-resolution CT scanners and MRI machines, poses a barrier to widespread adoption. High capital expenditure and maintenance costs can be a challenge for healthcare facilities, especially in developing regions.

- Limited Access in Low-Income Regions: Access to state-of-the-art diagnostic imaging technologies is often limited in low-income and remote areas. This disparity affects the early detection and management of coronary heart disease, as these regions may lack the necessary infrastructure and resources.

- Regulatory Hurdles: The diagnostic imaging devices market faces stringent regulatory requirements and approval processes, which can delay the introduction of new technologies. Navigating complex regulatory landscapes across different regions can be challenging for manufacturers and may impact market growth.

- Technical Complexity and Training Requirements: Advanced imaging devices require specialized technical knowledge for operation and interpretation. The complexity of these devices necessitates extensive training for healthcare professionals, which can be a hurdle in achieving widespread adoption and optimal use.

Which Region Dominates the Coronary Heart Disease Diagnostic Imaging Devices Market?

North America led the global market for coronary heart disease diagnostic imaging devices, capturing 35% of the revenue share in 2023. This dominance is driven by the high prevalence of cardiovascular diseases and the need for early detection. North America is home to several major medical device manufacturers, such as GE Healthcare and Siemens Healthineers, who are continually innovating and introducing new products. The market is further bolstered by the high adoption rates of advanced imaging technologies, including CT and MRI, for diagnosing coronary artery diseases (CAD). For example, in September 2023, Forum Health Fond du Lac introduced the Multifunction Cardiogram (MCG) scan technology, designed to detect early signs of heart disease.

What is the Contribution of North America to Coronary Heart Disease Diagnostic Imaging Devices Market?

| Attribute |

North America |

| Market Value |

USD 0.65 Billion |

| Growth Rate |

6.75% CAGR |

| Projected Value |

USD 1.26 Billion |

The European market for coronary heart disease diagnostic imaging devices is influenced by stringent regulatory standards from organizations such as the European Medicines Agency (EMA) and the European Society of Cardiology (ESC). While these regulations ensure patient safety and product quality, they also present challenges related to compliance costs and the time required to bring new devices to market. The aging population and heightened awareness of preventive healthcare contribute to the growing demand for advanced diagnostic imaging solutions in Europe.

The Asia Pacific region is experiencing significant growth in the coronary heart disease diagnostic imaging devices market, driven by the rising prevalence of cardiovascular diseases and an expanding geriatric population. Countries like Japan, China, and India are leading this growth with advancements in healthcare infrastructure and technology adoption. There is a growing demand for non-invasive diagnostic imaging devices in countries such as South Korea and Australia. Additionally, increasing awareness about the importance of early diagnosis and treatment of heart diseases is fueling market expansion across the region.

Modality Insights

In 2023, Nuclear Medicine held the largest share of 30% in the modality segment. This dominance is attributed to the increasing incidence of cardiovascular diseases, the urgent need for early diagnosis, and the growing adoption of advanced imaging technologies. Nuclear imaging techniques, including single-photon emission computed tomography (SPECT) and positron emission tomography (PET), are extensively used to diagnose coronary artery disease by evaluating myocardial blood flow, metabolism, and viability. The non-invasive nature of nuclear imaging makes it a preferred choice for patients with suspected or confirmed coronary heart disease, thus driving the segment's growth.

The computed tomography (CT) segment is currently experiencing the fastest growth. Innovations in CT technology, such as multi-slice and dual-source CT scanners, have significantly enhanced image quality and reduced scan times. These advancements facilitate more accurate and efficient diagnosis of coronary artery disease (CAD). The global rise in coronary heart disease cases has increased the demand for effective diagnostic tools, with CT angiography emerging as a popular non-invasive method for providing detailed images of blood vessels and evaluating coronary artery blockages.

Who are the Top Manufactures in Coronary Heart Disease Diagnostic Imaging Devices Market?

- Canon

- Esaote SPA

- FUJIFILM Holdings Corporation

- GE Healthcare

- Hitachi Medical Corporation

- Koninkilijhe Phillips N.V.

- SAMSUNG

- Siemens Healthineers AG

- Ziehm Imaging GmbH

Recent Developments

- In May 2024, GE HealthCare entered into a partnership with Medis Medical Imaging to advance non-invasive coronary assessments. This collaboration focuses on enhancing the diagnosis and treatment of coronary artery disease (CAD) by integrating cutting-edge imaging technologies with innovative software solutions, aiming to improve diagnostic accuracy and patient outcomes.

- In September 2023, Martini Hospital in Groningen, Netherlands, introduced a groundbreaking continuous remote cardiac monitoring service. This service utilizes Philips' ePatch combined with AI-driven cardiology analytics, offering a modern alternative to traditional Holter monitors. The new solution provides a more convenient and efficient method for monitoring patients' cardiac health, enhancing overall patient care.

- In January 2023, Cleerly launched the Cleerly ISCHEMIA, an innovative diagnostic tool that recently received clearance from the U.S. Food and Drug Administration (FDA) under the 510(k) medical device approval process. This product aims to offer advanced capabilities in coronary artery disease assessment, contributing to more accurate and effective diagnostic evaluations.

Coronary Heart Disease Diagnostic Imaging Devices Market Segmentation:

By Modality

- Computed Tomography

- X rays

- Ultrasound

- Magnetic Resonance Imaging

- Nuclear Medicine

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Frequently Asked Questions

The global coronary heart disease diagnostic imaging devices market size was reached at USD 1.88 billion in 2023 and it is projected to hit around USD 3.61 billion by 2033.

The global coronary heart disease diagnostic imaging devices market is growing at a compound annual growth rate (CAGR) of 6.73% from 2024 to 2033.

The North America region has accounted for the largest coronary heart disease diagnostic imaging devices market share in 2023.

The leading companies operating in the coronary heart disease diagnostic imaging devices market are GE Healthcare, Fujifilm, Siemens Healthineers, Toshiba, Hitachi, Koninklijke Phillips, Canon Medical, and Analogic Corp.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others