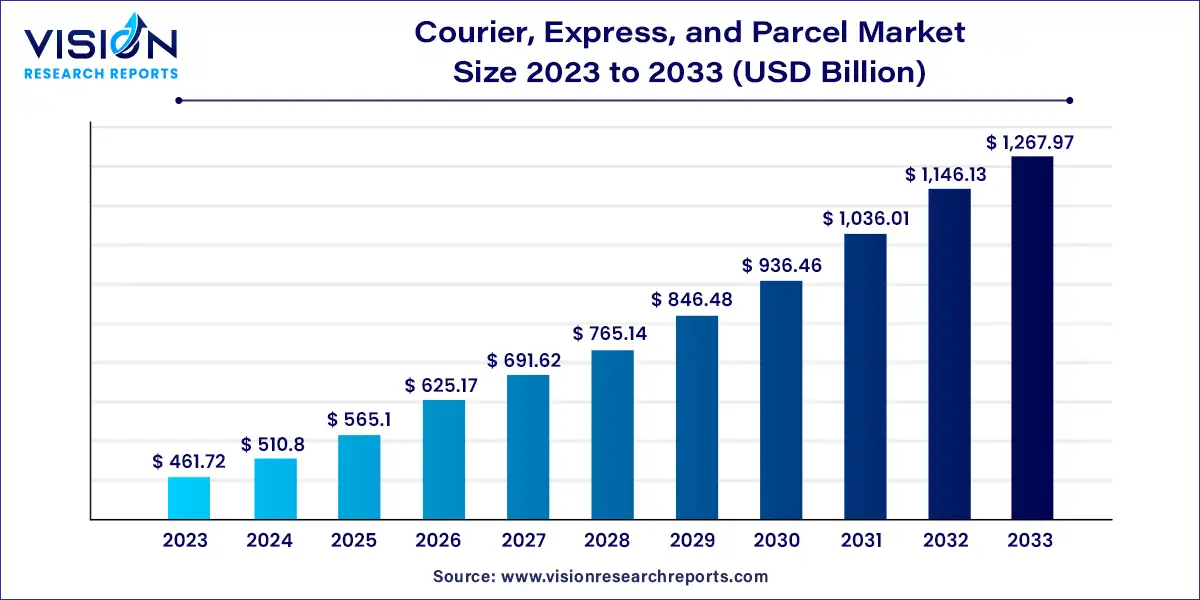

The global courier, express, and parcel market size was estimated at around USD 461.72 billion in 2023 and it is projected to hit around USD 1,267.97 billion by 2033, growing at a CAGR of 10.63% from 2024 to 2033. The courier, express, and parcel (CEP) market has seen substantial growth in recent years, driven by the rise in e-commerce, globalization of trade, and technological advancements. This market involves the delivery of packages and documents from one location to another, typically within a specific timeframe. It serves various industries, including retail, healthcare, manufacturing, and e-commerce, providing crucial logistics solutions for both business-to-business (B2B) and business-to-consumer (B2C) transactions.

The growth of the courier, express, and parcel (CEP) market is fueled by the rapid expansion of e-commerce, which has led to a significant increase in online shopping. Consumers today expect fast and reliable delivery services, prompting businesses to rely more heavily on CEP providers to meet these demands. Additionally, globalization has expanded cross-border trade, requiring efficient logistics solutions to manage the increased volume of international shipments. Technological advancements, such as real-time tracking and automation, have also enhanced the efficiency and reliability of delivery services, making them more appealing to businesses and consumers alike. Furthermore, the rise in disposable income and urbanization in emerging markets is contributing to greater demand for CEP services, as more consumers gain access to online shopping and expect quick delivery of goods. These factors collectively drive the robust growth of the CEP market globally.

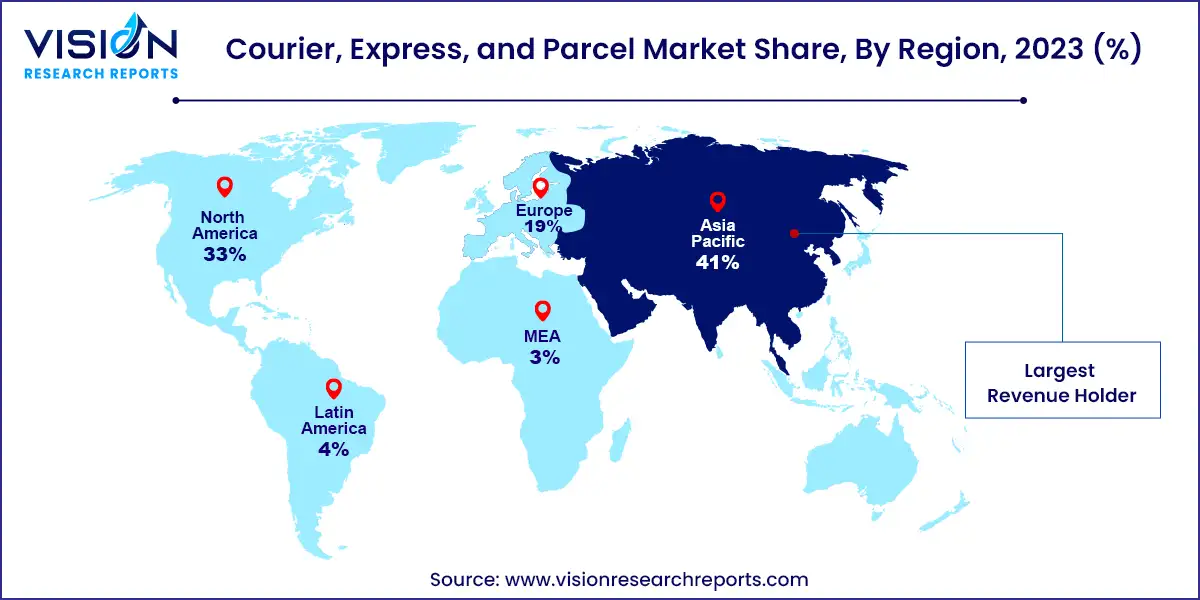

The Asia Pacific region led the global CEP market in 2023, accounting for a 41% share of global revenue. Economies like China, Japan, South Korea, and India are major contributors, with China holding the largest market share due to its vast e-commerce landscape. The region’s large and growing middle class, combined with high smartphone and internet penetration rates, has resulted in a surge in online shopping, driving demand for CEP services.

| Attribute | Asia Pacific |

| Market Value | USD 189.30 Billion |

| Growth Rate | 10.65% CAGR |

| Projected Value | USD 519.86 Billion |

The North American CEP market is set to witness steady growth from 2024 to 2033, driven by a robust e-commerce sector, technological advancements in logistics, and rising consumer expectations for quicker deliveries. The United States and Canada are key players, with the U.S. market being particularly strong due to its extensive consumer base and the dominance of e-commerce giants like Amazon and Walmart. Significant investments in logistics infrastructure, such as the expansion of warehousing facilities, adoption of automated sorting systems, and utilization of advanced data analytics for route optimization, bolster regional growth.

The CEP market in Europe is projected to grow significantly from 2024 to 2033. The increase in internet penetration and widespread adoption of online shopping have boosted the need for quick and reliable delivery services, especially in densely populated urban areas. Additionally, Europe’s focus on sustainability and green logistics is shaping the market, with companies investing in electric vehicles, carbon-neutral delivery options, and eco-friendly packaging to comply with regulations and meet consumer demands. The integration of advanced technologies, such as automated sorting centers and AI-driven route planning, has enhanced operational efficiency and reduced delivery times.

In 2023, the standard delivery segment led the market, capturing over 38% of the global revenue share. This category includes deliveries that don’t require urgent handling, typically taking between 3 to 7 days. Both businesses and individual consumers favor standard delivery for non-urgent shipments, significantly contributing to the total parcel volume. The affordability of standard delivery makes it ideal for bulk and routine shipments. Moreover, these services benefit from established networks and infrastructure, ensuring reliable and consistent delivery.

The same-day delivery segment is forecasted to grow at the fastest rate from 2024 to 2033. Offering delivery within hours of placing an order, this service meets urgent needs and boosts customer satisfaction. The rise of e-commerce, especially in urban areas where customers expect quick delivery, supports this growth. Companies are heavily investing in logistics technology and last-mile delivery solutions to meet these high demands. The COVID-19 pandemic also accelerated the adoption of same-day delivery as businesses adapted to shifting consumer behaviors, emphasizing the importance of fast and reliable service.

The business-to-business (B2B) segment led the market in 2023. B2B deliveries, which often involve bulk shipping, scheduled logistics, and higher-value transactions, play a critical role in the CEP industry. Sectors such as manufacturing, retail, and healthcare rely heavily on B2B CEP services to maintain efficient supply chains and adhere to production schedules. Long-term contracts and recurring orders in the B2B space provide a stable revenue stream for CEP providers. Additionally, B2B deliveries often require specialized handling, secure transport, and compliance with regulations, all of which are strengths of CEP companies. The growth of global trade and industrial activities continues to drive the demand for B2B services.

The business-to-consumer (B2C) segment is expected to experience the fastest growth from 2024 to 2033. The shift towards online shopping has transformed consumer expectations, leading to increased demand for direct-to-consumer delivery services. B2C services cater to individual customers who expect timely and reliable delivery directly to their homes. The rise of mobile commerce, convenience shopping, and personalized delivery options further fuel the expansion of the B2C segment. Advances in technology, such as real-time tracking, automated sorting, and efficient last-mile delivery solutions, enhance customer satisfaction and streamline operations. The trend of retailers offering free or low-cost shipping to attract customers also contributes to the B2C market’s rapid growth.

The roadways segment dominated the CEP market in 2023 due to its extensive reach and flexibility. Road transport is the preferred mode for last-mile delivery, connecting urban and rural areas effectively and cost-efficiently. The well-developed infrastructure for road transport, including highways and local roads, supports reliable and timely deliveries. Roadways are particularly advantageous for short to medium distances, providing essential door-to-door service for both B2B and B2C markets. The dominance of roadways is also due to their capacity to handle a variety of parcel sizes and weights, catering to diverse delivery needs. Innovations in vehicle technology, route optimization, and real-time tracking have further enhanced the efficiency of road transport.

The airways segment is projected to grow at the highest rate during the forecast period, driven by the demand for fast delivery services. The increasing need for expedited shipping due to the rise of e-commerce and global trade underpins this growth. Air transport is vital for long-distance and time-sensitive deliveries, offering speed unmatched by other modes. The expansion of global air cargo networks and the establishment of dedicated air freight services by major logistics companies have significantly contributed to this trend. Advances in aircraft technology and cargo handling efficiency have also boosted air transport capacity and effectiveness.

In 2023, the e-commerce segment dominated the CEP market, driven by the rapid growth of online shopping. Major e-commerce companies like Amazon and Alibaba are continually enhancing their logistics capabilities to meet customer demands for faster deliveries. The widespread use of mobile devices and improved internet access have accelerated the growth of e-commerce, making it a significant driver for the CEP market. Technological advancements such as automated sorting centers, real-time tracking, and advanced inventory management systems have increased the efficiency and reliability of e-commerce deliveries.

The wholesale and retail segment is expected to grow at the fastest compound annual growth rate (CAGR) from 2024 to 2033. Retailers face pressure to maintain lean inventory levels and ensure timely stock replenishment, requiring reliable and fast CEP services. This growth is particularly evident in omnichannel retail strategies, where seamless integration between online and offline channels is essential for customer satisfaction. Wholesale distributors also depend heavily on CEP services to manage large volumes and ensure swift deliveries to retailers and end-users. The adoption of advanced technologies, such as real-time tracking, route optimization, and automated warehousing, has significantly improved the efficiency and reliability of delivery services in this sector.

By Service

By Business Model

By Destination

By Mode of Transport

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others