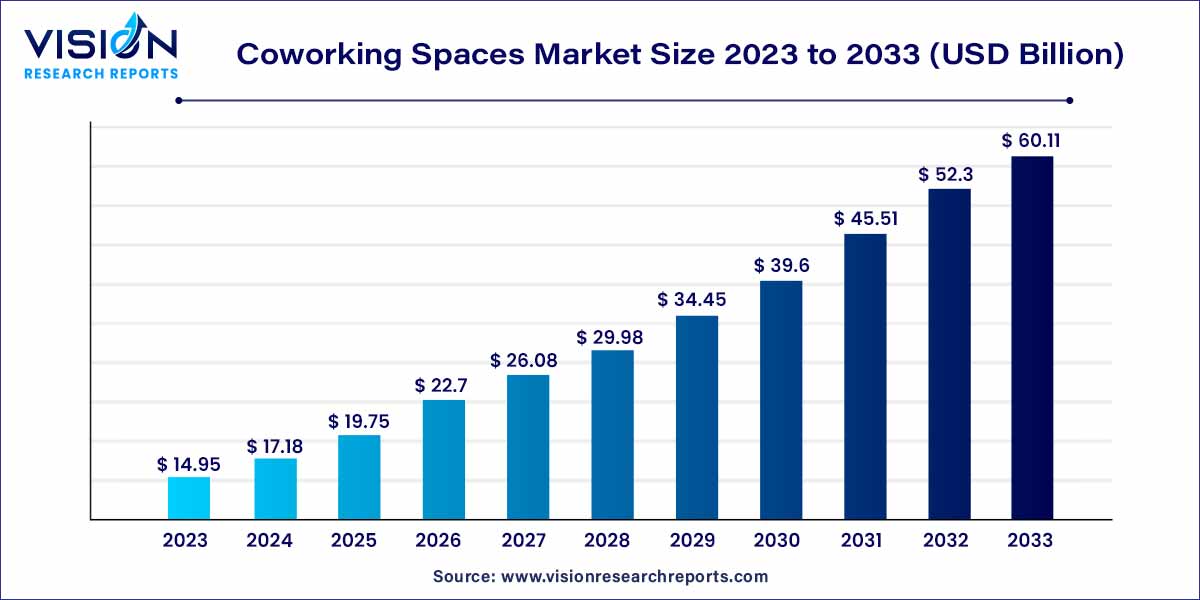

The global coworking spaces market was estimated at USD 14.95 billion in 2023 and it is expected to surpass around USD 60.11 billion by 2033, poised to grow at a CAGR of 14.93% from 2024 to 2033.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 60.11 billion |

| Growth Rate from 2024 to 2033 | CAGR of 14.93% |

| Revenue Share of North America in 2023 | 37% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Coworking spaces gaining significant growth as technological improvements and the expansion of the freelance economy. This tendency affects the real estate sector, which includes landlords, developers, and real estate brokers, in addition to how individuals interact and collaborate with one another. Tenants are in greater competition than ever, and many are looking to the coworking concept and business model as an appealing, cost-effective, and adaptable replacement for traditional office space.

The traditional lease and rental office premises have seen a radical transformation with the emergence of coworking spaces. Landlords and service providers are capitalizing on the coworking concept to present a more appealing, flexible, and cost-effective alternative to traditional office space as the market for office space rents gets more competitive. The rise of remote work, a burgeoning startup culture, and a growing need for flexible office spaces are augmenting the market growth. As more people have migrated to remote work, COVID-19 has hastened the expansion of the coworking space business. The number of people working from home or remotely, as well as the creation of sustainable coworking spaces, are the key reasons driving the expansion of the market.

Furthermore, the growing number of freelancers and entrepreneurs is thought to be a major driver of the coworking spaces industry. Coworking revolves around communication and connectivity. Managing coworking spaces enables you to connect with a range of nearby companies and financiers. This raises the bar for membership plans and service quality. Effective teamwork and investment generate more revenue, add value for members, and generate new leads. Collaborations frequently prove to be cost-effective tactics that boost revenue as well.

The corporate/professional segment constituted a significant revenue share of 28% in 2023. These spaces cater to corporate and professional needs by providing dedicated desks, private offices, meeting rooms, high-quality furniture, cutting-edge technology, and other amenities. Designed to meet the requirements of professionals and established businesses seeking a structured work environment, these spaces offer a more formal setting, making them ideal for focus-driven purposes, such as those required by legal firms or financial consultants.

One of the primary advantages of business coworking spaces is the enhancement of productivity. Compared to traditional workplaces, collaborative workspaces foster more inventive and creative surroundings, resulting in increased productivity. Workers benefit from shared resources that may be limited in traditional office settings, such as access to equipment and conference rooms. The flexibility offered by coworking environments contributes to higher employee satisfaction and retention rates.

On the other hand, open coworking spaces provide a flexible setting that encourages networking among a diverse range of professionals, freelancers, entrepreneurs, and small businesses. These spaces typically feature open floor plans with shared workstations or tables situated near lounges or cafeterias. Conventional office owners are increasingly integrating coworking spaces into their developments, either through partnerships with well-known coworking space providers or by establishing their own brands in the market.

The large size enterprise segment took the lead in the market holding a share of 28% in 2023. Major corporations are increasingly turning to coworking spaces, drawn by numerous advantages, particularly in terms of affordability. These spaces provide an opportunity to reduce overhead expenses and avoid long-term commitments. Large enterprises capitalize on the flexibility and scalability offered by coworking spaces instead of investing in dedicated office spaces. There is a notable shift towards decentralized workplace strategies among companies, ensuring convenient commuting for employees rather than relying on a single, large, central headquarters. Users enjoy the freedom to choose workplace options that easily adapt to evolving business needs, allowing them to swiftly respond to changing market dynamics.

On the other hand, Small and Medium-sized Enterprises (SMEs) are anticipated to register the highest CAGR over the forecast period. The surge in coworking spaces aligns with the entrance of millennials into the workforce. Individuals initiating their enterprises, launching startups, or consolidating smaller firms seek a suitable yet affordable workplace for collaboration and teamwork. Coworking spaces fulfill these needs and more. Renting shared workplace facilities offers employees the flexibility to rent desk space for as long or as little time as required. This flexibility benefits workers, who can use shared workspaces on their terms, while businesses save costs compared to traditional commercial leases. Importantly, SMEs are not tethered to a fixed office space, allowing for potential expansion as needed.

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment claimed the largest revenue share. Notably, major banks across various countries are actively opting for and contributing to the growth of the coworking space sector. An exemplar in this trend is The Royal Bank of Scotland (RBS), a key player that has embraced coworking spaces. Within this paradigm, some RBS employees currently operate from flexible workspaces at Edinburgh's Square, situated in a comfortable, spacious, and open-plan office. This workspace is thoughtfully designed not only for startups, entrepreneurs, and freelancers but also for RBS employees. The overarching objective is to cultivate a stimulating work environment that fosters the generation and thriving of new ideas, challenging the more conventional and formal image traditionally associated with banks.

Concurrently, the Information Technology (IT) segment is anticipated to exhibit a significant CAGR throughout the forecast period. Coworking spaces offer IT firms the flexibility and procedural adaptability necessary to scale their operations as required. This flexibility extends to the easy expansion and contraction of office space to accommodate changes in projects and team sizes, making coworking spaces an ideal solution for IT firms with dynamic and evolving needs. Moreover, coworking spaces provide a cost-effective option for IT firms by allowing them to share the costs of facilities and amenities, including conference rooms, high-speed internet, and common areas, with other businesses. This shared resource model helps reduce overhead expenses, enabling IT firms to allocate more resources to key business activities.

North America dominated the market with a revenue share of 37% in 2023. This region boasts the largest coworking spaces, averaging 9,799 square feet per site. The significant demand for coworking spaces in North America is driven by the growing acceptance of flexible work techniques, service offices, and remote teams. Industry giants like WeWork and Regus manage an extensive 23 million square feet, reflecting the widespread adoption of coworking spaces. This surge is not solely attributed to freelancers and startups seeking casual coworking environments; larger organizations are also leveraging coworking spaces to expand their businesses in a controlled and cost-effective manner. Noteworthy growth in coworking spaces has been observed in key cities such as New York, Chicago, San Francisco, and Los Angeles, each experiencing over 15% year-on-year growth, totaling 566 workspaces.

Asia Pacific is poised to witness a substantial CAGR throughout the forecast period. Cities in the region, including Hong Kong, Sydney, Singapore, and Tokyo, have emerged as focal points for coworking spaces. India, in particular, is experiencing a surge in startups and Small and Medium-sized Enterprises (SMEs), contributing to the heightened demand for coworking spaces. The increased investments in startups and a growing population of independent freelancers and part-time employees have positioned India as a burgeoning market for coworking spaces. The Indian government's proactive policies and plans aimed at fostering the growth of micro, small, and medium-sized firms (MSMEs), such as providing substantial budgets and lowering interest rates on MSME loans, are expected to further propel the expansion of MSMEs in the region, thereby contributing to the overall market growth.

By Type

By Application

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Coworking Spaces Market

5.1. COVID-19 Landscape: Coworking Spaces Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Coworking Spaces Market, By Type

8.1. Coworking Spaces Market, by Type, 2024-2033

8.1.1 Corporate /Professional

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Open/ Conventional

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Industry-specific

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Coworking Spaces Market, By Application

9.1. Coworking Spaces Market, by Application, 2024-2033

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Large size enterprises

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Freelancers

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Coworking Spaces Market, By Industry Vertical

10.1. Coworking Spaces Market, by Industry Vertical, 2024-2033

10.1.1. BFSI

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Professional Services

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Information Technology

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Real Estate

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Recruitment

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Healthcare

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Government

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Coworking Spaces Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 12. Company Profiles

12.1. WeWork.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. IWG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. justgroup.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. The Work Project Management Pte Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. The Executive Centre.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Servecorp

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. The Great Room.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Newmark Group, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Impact Hub GmbH.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Techspace Group Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others