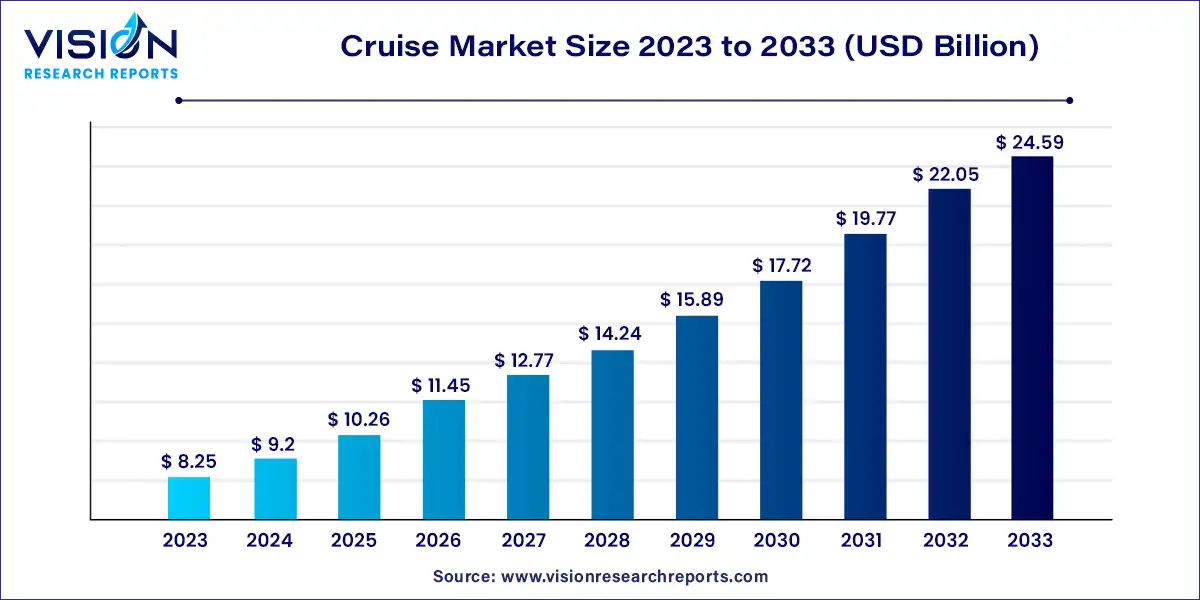

The global cruise market size was estimated at USD 8.25 billion in 2023 and it is expected to surpass around USD 24.59 billion by 2033, poised to grow at a CAGR of 11.54% from 2024 to 2033. The global cruise market represents a dynamic segment of the travel and tourism industry, characterized by a diverse range of offerings and continuous innovation. It encompasses various cruise types, including luxury, premium, contemporary, and expedition cruises, each catering to different consumer preferences and market segments.

The growth of the cruise market is propelled by an increasing disposable incomes globally have expanded consumer access to cruise vacations, making them more attainable for a broader demographic. Additionally, the rising popularity of experiential travel, where passengers seek unique and immersive experiences, has driven demand for diverse and innovative cruise offerings. Advances in technology are enhancing onboard experiences and personalizing services, further attracting travelers. The industry's focus on sustainability, including the adoption of green technologies and eco-friendly practices, aligns with growing environmental consciousness among consumers. Moreover, the expansion of cruise itineraries to new and exotic destinations appeals to adventurous travelers seeking novel experiences. Collectively, these factors are fueling robust growth and shaping the future of the cruise market.

In 2023, North America dominated the cruise market, accounting for approximately 51% of the revenue share. This leading position is attributed to the presence of major international cruise lines and a well-developed industry infrastructure. Contributing factors include higher disposable incomes, robust consumer spending, and a mature tourism sector.

The Asia Pacific region is anticipated to experience the highest growth rate during the forecast period, with an expected CAGR of 12.53% from 2023 to 2033. The cruise industry is shifting its focus from North America and Europe to this region, driven by government initiatives aimed at boosting tourism and economic output. For example, the Indian government’s decision to reduce berth charges by 70.0% as of August 19, 2020, is designed to enhance cruise tourism in the region.

Europe held the second-largest revenue share in 2023, accounting for around 25%. The region is expected to see significant growth in the coming years, fueled by a rising demand for sustainable tourism. This trend is leading to increased interest from small and medium-sized tour operators, who are focusing on local communities and contributing to the overall market expansion.

In 2023, the ocean cruise segment represented over 81% of the total market revenue. This substantial share is largely due to the dominance of major players offering extensive intercontinental ocean cruise services. The appeal of ocean cruises is bolstered by their exciting packages, abundant amenities, and a wide range of entertainment options. The large size of ocean cruise ships allows for spacious accommodations and diverse activities that attract a broad customer base, making them a preferred choice over other types of cruises.

The river cruise segment is projected to experience the highest growth rate, with a compound annual growth rate (CAGR) of 13.63% from 2023 to 2033. This rapid growth is driven by the increasing popularity of river cruises among vacationers. Unlike ocean cruises, which are typically restricted to coastal regions due to their size, river cruises navigate through inland waterways, offering access to numerous internal destinations and sightseeing opportunities. River cruising, particularly in Europe, is gaining traction, with routes like the Danube River providing the opportunity to travel through multiple countries, enhancing its appeal.

By Type

By Region

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Cruise Market

5.1. COVID-19 Landscape: Cruise Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Cruise Market, By Type

8.1.Cruise Market, by Type, 2024-2033

8.1.1. Ocean Cruises

8.1.1.1.Market Revenue and Forecast (2021-2033)

8.1.2. River Cruises

8.1.2.1.Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cruise Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

Chapter 10.Company Profiles

10.1. Carnival Corporation & Plc

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Royal Caribbean Group

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. MSC Cruises S.A.

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Norwegian Cruise Line Holdings Ltd.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Disney Cruise Line

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Genting Hong Kong Limited

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Fred. Olsen Cruise Lines

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Cruiseaway

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Island Queen Cruises

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Luxury Cruise Connections

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others