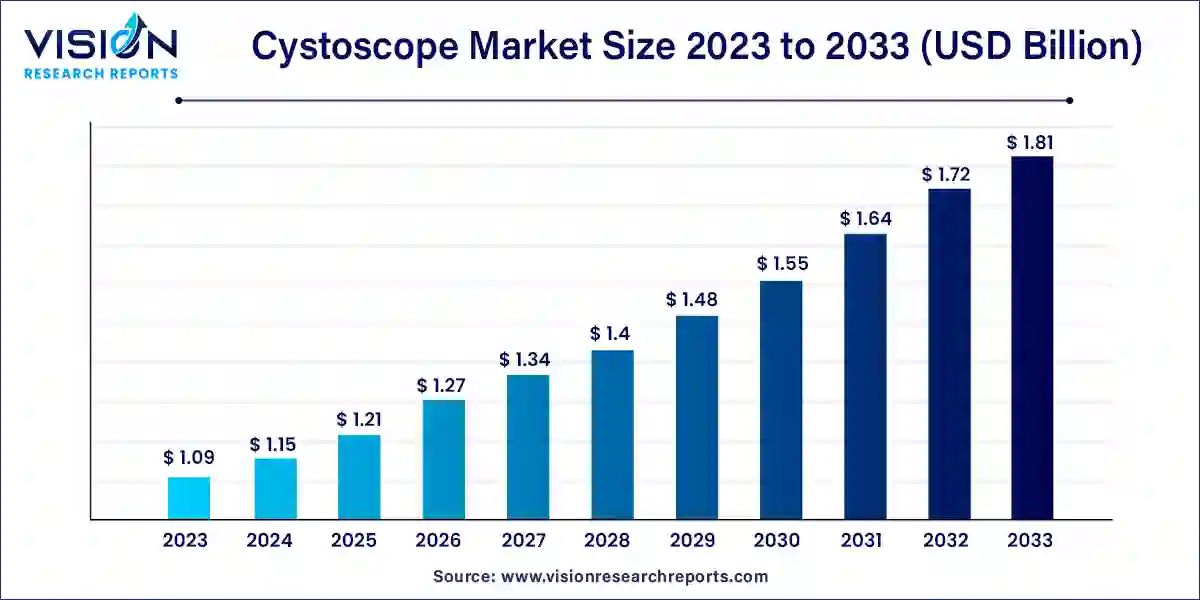

The global cystoscope market size was valued at USD 1.09 billion in 2023 and is anticipated to reach around USD 1.81 billion by 2033, growing at a CAGR of 5.2% from 2024 to 2033. The cystoscope market is a vital segment within the global medical device industry, primarily focusing on instruments used for examining the bladder and urethra. Cystoscopes are essential for diagnosing and treating various urological conditions, including bladder cancer, urinary tract infections, and other bladder disorders. This market has witnessed significant growth due to advancements in technology, increasing prevalence of urological diseases, and a growing aging population.

The growth of the cystoscope market is driven by an increasing prevalence of urological disorders, such as bladder cancer and recurrent urinary tract infections, necessitates more diagnostic and therapeutic procedures, thereby boosting the demand for cystoscopes. Secondly, advancements in technology have led to the development of innovative cystoscopy devices, including flexible and high-definition models, which enhance visualization and improve patient comfort during procedures. Additionally, the rising elderly population, who are more susceptible to urological conditions, further amplifies the need for these diagnostic tools. Furthermore, an increase in healthcare expenditure, particularly in developing regions, is enabling healthcare facilities to invest in advanced cystoscopy equipment, thus expanding the market.

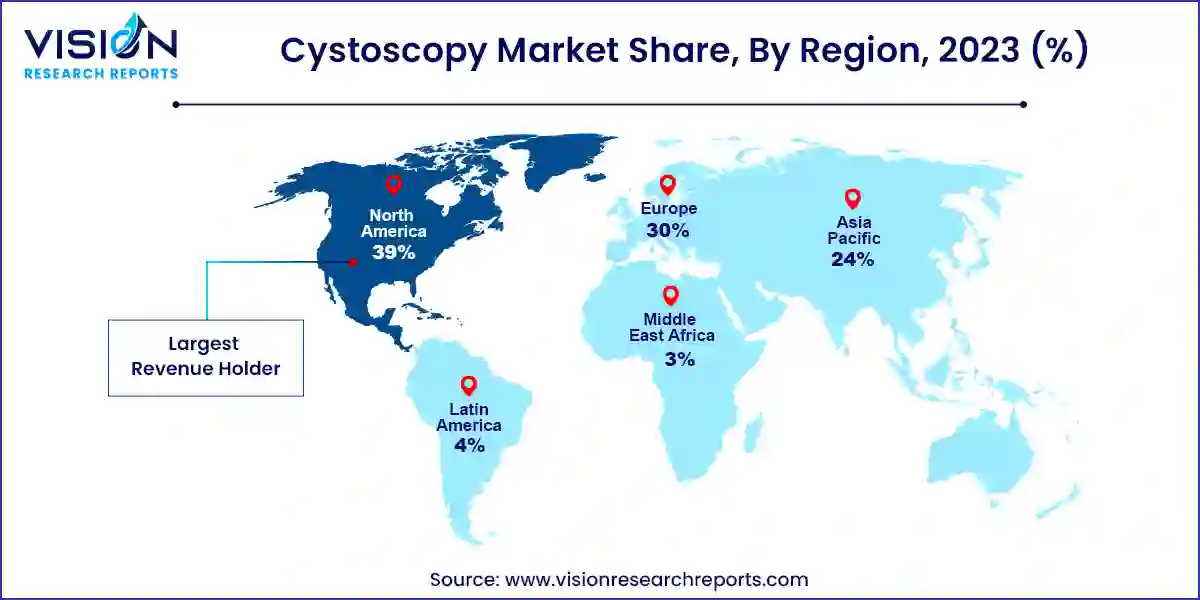

North America emerged as the dominant market for cystoscopes, capturing over 39% in 2023. This leadership can be attributed to the region's advanced healthcare infrastructure, substantial healthcare expenditures, and a rising incidence of urological disorders that require cystoscopic diagnosis and treatment. The market's growth is further supported by the presence of major industry players and continuous technological advancements in medical devices.

Europe maintains a significant market share as well, driven by increased awareness of bladder health issues, strong governmental backing for healthcare facilities, and comprehensive healthcare policies that facilitate access to cutting-edge medical devices. The demand in this region is also heightened by an aging population that is more vulnerable to urological conditions.

The Asia-Pacific region is recognized as the fastest-growing market for cystoscopes. This rapid expansion is fueled by enhancements in healthcare infrastructure, increased investments from both public and private sectors, and a growing medical tourism industry in countries like India and Thailand. The region's large and aging population, combined with a rise in bladder-related health issues, further propels the demand for cystoscopic procedures.

In 2023, the Flexible Cystoscope segment emerged as a dominant force in the cystoscope market, capturing over 64% of the market share. This significant position can be attributed to technological advancements that enhance both procedural comfort and efficiency. Flexible cystoscopes are particularly preferred for diagnostic and therapeutic procedures due to their ability to navigate the urinary tract with minimal patient discomfort. The growing inclination towards less invasive medical practices further supports the segment’s expansion in urology.

Conversely, the Rigid Cystoscope segment, while smaller, plays a vital role in the market. These instruments are appreciated for their durability and superior imaging capabilities, which are crucial for intricate surgical procedures. Although rigid cystoscopes lack the flexibility of their counterparts, their precision makes them essential in specific surgical contexts. The ongoing demand for rigid cystoscopes underscores their critical function in precise medical interventions, contributing to a balanced growth trajectory within the Cystoscope market.

In 2023, the Flexible Cystoscope segment also led the end-user category of the cystoscope market, claiming over 54% of the share. This dominance results from technological advancements, a growing preference for minimally invasive procedures, and superior diagnostic capabilities. Hospitals emerged as the primary users of these devices, utilizing them extensively for diagnosing and treating urological conditions, particularly for their reliability and high-quality imaging in managing issues like bladder cancer and urinary tract infections.

Clinics and Ambulatory Surgical Centers (ASCs) have also significantly adopted flexible cystoscopes. Clinics leverage these devices to improve outpatient care, aligning with patient preferences for faster recovery times. Meanwhile, ASCs incorporate flexible cystoscopes to provide cost-effective surgical options, reflecting the trend towards healthcare decentralization and patient-centered services. With the rising incidence of urological disorders and continuous technological enhancements, further growth in these segments is anticipated, as healthcare providers prioritize innovative diagnostic tools that enhance patient outcomes and streamline operations.

In 2023, the Flexible Cystoscope segment maintained a leading position in the technology segment of the cystoscope market. This dominance stems from the advanced features of flexible cystoscopes, including improved maneuverability and enhanced patient comfort during procedures. These devices are crucial for diagnosing and treating bladder conditions, leading to their widespread use in urological practices globally.

Additionally, video cystoscopes are gaining popularity and are expected to experience significant growth in the coming years. These devices improve visualization and documentation during examinations by leveraging digital imaging technology. The advantages of video cystoscopes, such as increased diagnostic accuracy and user-friendliness, are anticipated to drive their adoption. Although the fiber optic cystoscope segment is experiencing slower growth, it remains relevant, particularly in cost-sensitive regions where affordability is essential.

By Type

By End-User

By Technology

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cystoscope Market

5.1. COVID-19 Landscape: Cystoscope Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cystoscope Market, By Type

8.1. Cystoscope Market, by Type

8.1.1 Flexible Cystoscope

8.1.1.1. Market Revenue and Forecast

8.1.2. Rigid Cystoscope

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Cystoscope Market, By End-User

9.1. Cystoscope Market, by End-User

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast

9.1.2. Clinics

9.1.2.1. Market Revenue and Forecast

9.1.3. Ambulatory Surgical Centers

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Cystoscope Market, By Technology

10.1. Cystoscope Market, by Technology

10.1.1. Video Cystoscope

10.1.1.1. Market Revenue and Forecast

10.1.2. Fiber Optic Cystoscope

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Cystoscope Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type

11.1.2. Market Revenue and Forecast, by End-User

11.1.3. Market Revenue and Forecast, by Technology

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type

11.1.4.2. Market Revenue and Forecast, by End-User

11.1.4.3. Market Revenue and Forecast, by Technology

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type

11.1.5.2. Market Revenue and Forecast, by End-User

11.1.5.3. Market Revenue and Forecast, by Technology

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type

11.2.2. Market Revenue and Forecast, by End-User

11.2.3. Market Revenue and Forecast, by Technology

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type

11.2.4.2. Market Revenue and Forecast, by End-User

11.2.4.3. Market Revenue and Forecast, by Technology

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type

11.2.5.2. Market Revenue and Forecast, by End-User

11.2.5.3. Market Revenue and Forecast, by Technology

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type

11.2.6.2. Market Revenue and Forecast, by End-User

11.2.6.3. Market Revenue and Forecast, by Technology

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type

11.2.7.2. Market Revenue and Forecast, by End-User

11.2.7.3. Market Revenue and Forecast, by Technology

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type

11.3.2. Market Revenue and Forecast, by End-User

11.3.3. Market Revenue and Forecast, by Technology

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type

11.3.4.2. Market Revenue and Forecast, by End-User

11.3.4.3. Market Revenue and Forecast, by Technology

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type

11.3.5.2. Market Revenue and Forecast, by End-User

11.3.5.3. Market Revenue and Forecast, by Technology

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type

11.3.6.2. Market Revenue and Forecast, by End-User

11.3.6.3. Market Revenue and Forecast, by Technology

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type

11.3.7.2. Market Revenue and Forecast, by End-User

11.3.7.3. Market Revenue and Forecast, by Technology

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type

11.4.2. Market Revenue and Forecast, by End-User

11.4.3. Market Revenue and Forecast, by Technology

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type

11.4.4.2. Market Revenue and Forecast, by End-User

11.4.4.3. Market Revenue and Forecast, by Technology

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type

11.4.5.2. Market Revenue and Forecast, by End-User

11.4.5.3. Market Revenue and Forecast, by Technology

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type

11.4.6.2. Market Revenue and Forecast, by End-User

11.4.6.3. Market Revenue and Forecast, by Technology

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type

11.4.7.2. Market Revenue and Forecast, by End-User

11.4.7.3. Market Revenue and Forecast, by Technology

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type

11.5.2. Market Revenue and Forecast, by End-User

11.5.3. Market Revenue and Forecast, by Technology

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type

11.5.4.2. Market Revenue and Forecast, by End-User

11.5.4.3. Market Revenue and Forecast, by Technology

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type

11.5.5.2. Market Revenue and Forecast, by End-User

11.5.5.3. Market Revenue and Forecast, by Technology

Chapter 12. Company Profiles

12.1. SCHÖLLY FIBEROPTIC GMBH.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BD.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Boston Scientific Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ackermann Instrument.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Shenyang Shenda Endoscope Co. Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Stryker Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Olympus Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. KARL STORZ GmbH & Co. KG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Coloplast Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. NeoScope Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others