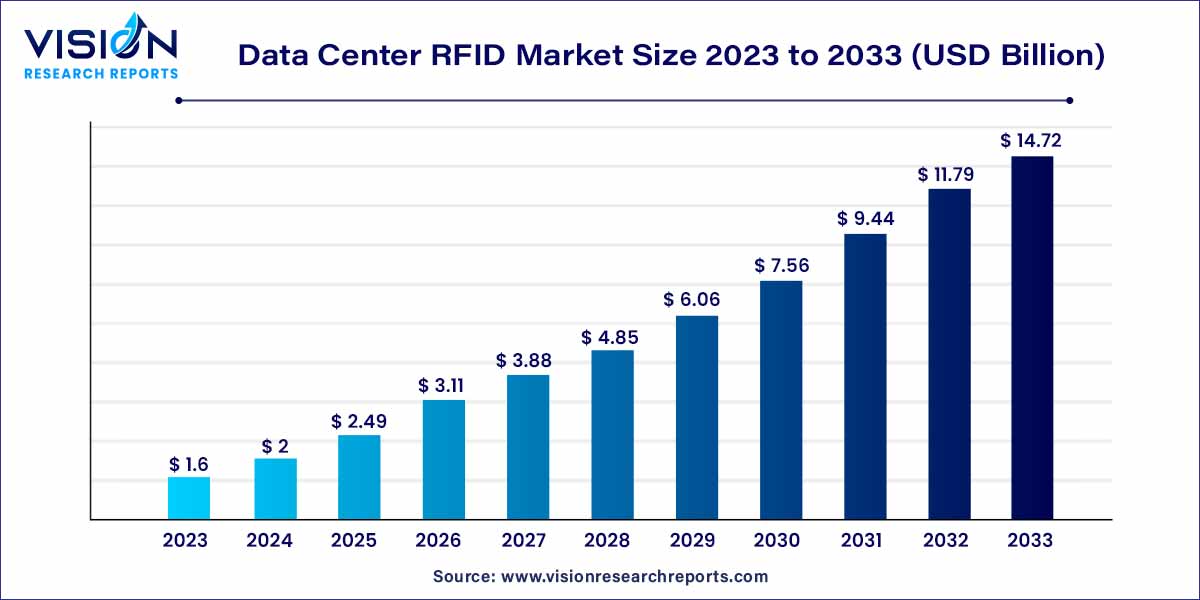

The global data center RFID market size was estimated at around USD 1.6 billion in 2023 and it is projected to hit around USD 14.72 billion by 2033, growing at a CAGR of 24.86% from 2024 to 2033.

In the ever-evolving data centers, technologies continually redefine the landscape, and Radio-Frequency Identification (RFID) has emerged as a pivotal player. This overview delves into the dynamics of the Data Center RFID market, exploring its key components, market drivers, challenges, and future prospects.

The Data Center RFID market is experiencing robust growth driven by several key factors. Foremost among these is the escalating demand for enhanced asset management and tracking solutions within data centers. RFID technology offers a streamlined and efficient approach to monitoring and securing valuable assets, contributing to heightened operational efficiency. Additionally, the increasing complexity and scale of data centers, coupled with the rising need for real-time information, further propel the adoption of RFID solutions. The ability of RFID to provide accurate, instantaneous data on asset location and status is instrumental in optimizing inventory control and minimizing manual errors. Moreover, as data security remains a paramount concern, the advanced tracking capabilities of RFID contribute to bolstering overall data center security. The integration of RFID technology aligns with the broader industry trend towards automation and digitization, positioning it as a pivotal growth factor in the dynamic landscape of data centers.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 24.86% |

| Market Revenue by 2033 | USD 14.72 billion |

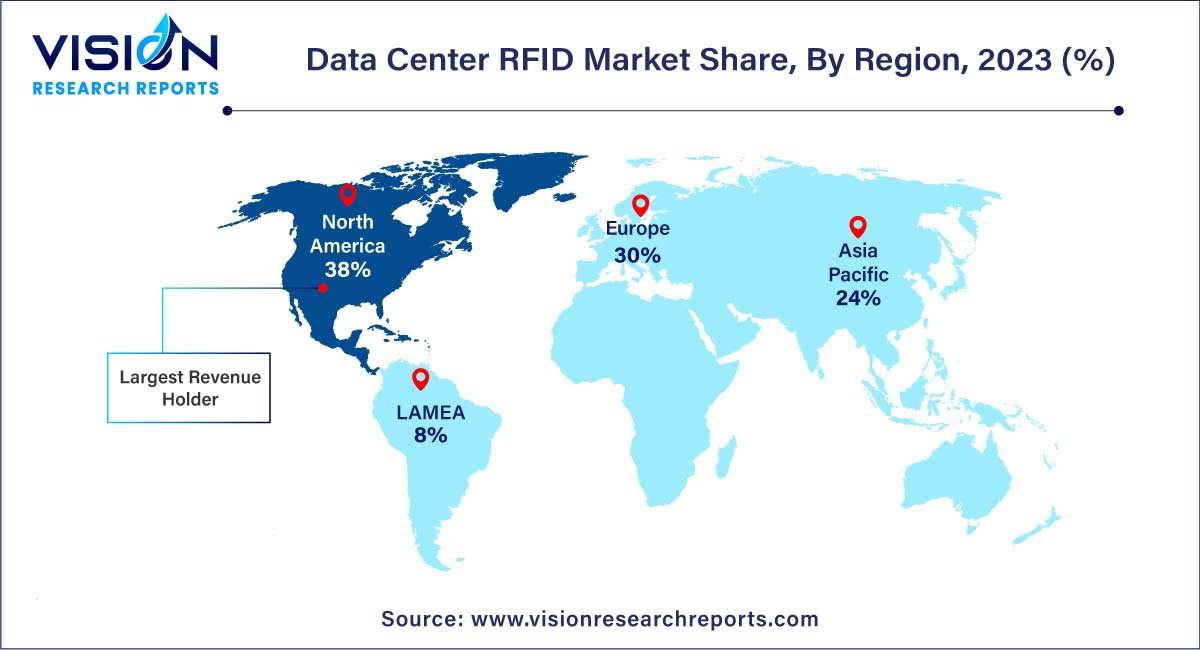

| Revenue Share of North America in 2022 | 38% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Hardware component led the market with the highest revenue share of 74% in 2023. The growing demand for data storage and processing necessitates the construction and expansion of data centers, creating a substantial market for hardware components. Hardware components are becoming more sophisticated, offering features like longer read ranges, higher data capacity, and improved environmental resistance. These advancements enhance the effectiveness and value proposition of data center RFID, driving further adoption.

The services segment is expected to register the fastest CAGR over the forecast period 2024 to 2033. As data centers grow and become complex, managing, and optimizing operations becomes increasingly challenging. Services providers offer expertise and solutions to overcome these challenges, ensuring data center operators can leverage the full potential of their RFID investments. Implementing and maintaining a data center RFID system requires specialized knowledge and technical expertise.

The reader segment generated the maximum market share of 36% in 2023. This is attributable to Data center operators increasingly recognizing the benefits of RFID technology. Its ability to automate tasks, improve efficiency, and enhance security is driving widespread adoption within the industry. Continuous advancements in RFID technology are making it more affordable, reliable, versatile, and feature rich. Longer read ranges, higher data capacity, improved environmental resistance, and seamless integration with existing systems enhance the effectiveness and value proposition of data center RFID.

The antenna segment is expected to witness the fastest CAGR over the forecast period. Advancements in antenna design, including polarization diversity and multi-beam antennas, enhance tag detection accuracy and improve data transmission efficiency. These advanced features enable data center operators to optimize their RFID systems and maximize the effectiveness of their asset tracking and management processes.

UHF segment occupied the largest market share of around 71% in 2023. UHF tags transmit data at a much faster rate compared to HF and LF tags; this allows for quicker identification and processing of information, which is crucial for real-time monitoring and efficient data center operations. UHF tags offer significantly longer read ranges than HF and LF tags, typically reaching several meters to tens of meters; this is crucial for data centers where assets are spread over a wide area, ensuring reliable data capture and efficient asset tracking.

The HF segment is expected to have the fastest CAGR over the forecast period. The smaller size of HF tags makes them ideal for attaching to smaller or delicate assets that cannot accommodate larger UHF tags; this allows for wider application and easier implementation in data centers with diverse asset types. The shorter read range of HF tags, typically only a few centimeters to meters, can be advantageous in situations where precise asset location tracking is critical; this allows for more accurate identification of assets in proximity, such as within server racks or cabinets.

The handheld reader type is expected to occupy the largest market share of around 61% in 2023. Handheld readers provide immediate access to data, enabling real-time identification and tracking of assets; this allows for instant confirmation of asset location and identification of missing or misplaced items, minimizing downtime and ensuring efficient inventory control. Handheld readers can be easily scaled to accommodate the size and complexity of the data center. Additional readers can be added to cover larger areas or increase data collection efficiency. This scalability ensures the system adapts to the evolving needs of the data center. Modern handheld readers offer a range of functionalities beyond basic RFID tag reading.

The fixed reader type is expected to witness the fastest CAGR over the forecast period. Fixed readers automate data collection, eliminating manual tasks and ensuring consistent and reliable data capture; this improves data accuracy and reduces the risk of errors associated with manual processes. While the initial investment for fixed readers can be higher than for handheld readers, their automated data collection and larger coverage area reduce the need for manual labor and additional hardware, which leads to lower operational costs in the long run.

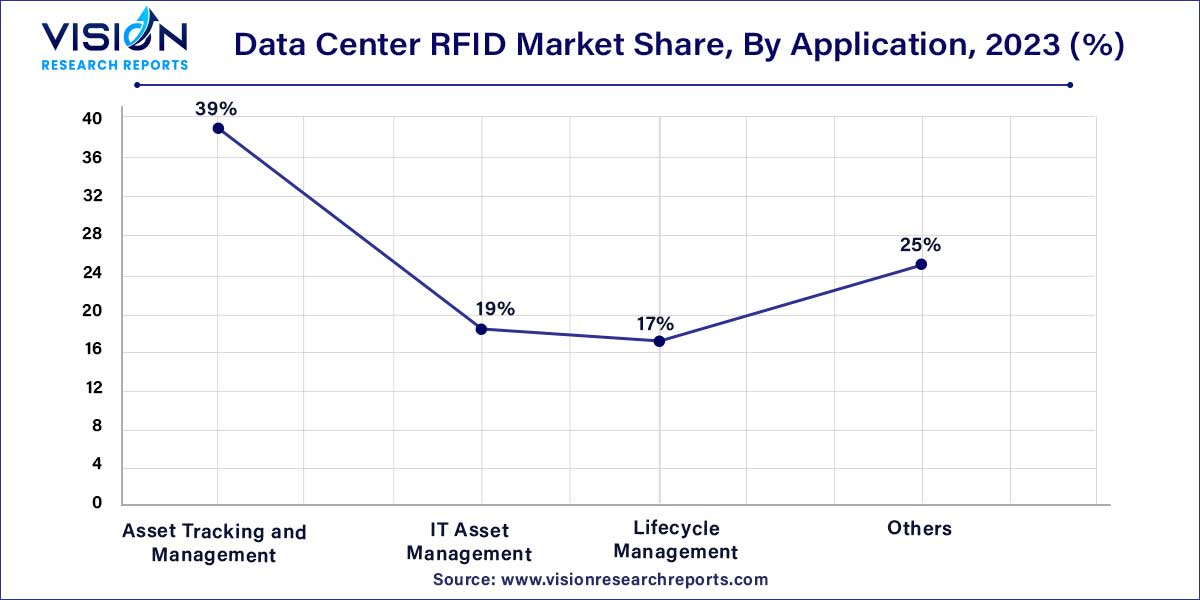

The asset tracking and management segment held the largest revenue share of 39% in 2023, which is the highest. RFID-based AT&M systems can help organizations quickly locate and identify assets, even in large and complex data centers; this can significantly reduce the time and resources required to troubleshoot problems and perform maintenance tasks, improving overall data center efficiency. RFID-based AT&M systems can help organizations extend the lifecycles of their assets by providing predictive maintenance and failure analysis capabilities.

Lifecycle Management (LCM) plays a pivotal role in the market, enabling data center operators to optimize the entire life cycle of their assets, from acquisition and deployment to maintenance, repair, and end-of-life management. Through real-time data and insights gleaned from RFID technology, LCM systems empower organizations to streamline operations, maximize asset utilization, and enhance data center performance. By proactively addressing maintenance needs, optimizing resource allocation, and ensuring responsible end-of-life management, LCM systems deliver significant cost reductions, improved data security, and a more sustainable data center environment.

North America dominated the market with the largest market share of 38% in 2023. North America houses the largest concentration of data centers globally, driven by its high internet penetration, cloud computing adoption, and technological advancements. This extensive data center footprint creates a substantial demand for RFID solutions to manage and optimize operations. The US is home to leading technology companies like Google, Amazon, and Microsoft, which operate vast data centers and heavily invest in cutting-edge technologies like RFID. This high concentration of tech giants drives the demand for advanced data center solutions and accelerates technology adoption.

Asia Pacific is anticipated to witness significant growth in the market. The APAC region is witnessing a surge in data center construction, driven by factors like rising internet penetration, booming e-commerce, and expanding cloud computing services. This rapid growth in data center infrastructure creates a substantial demand for efficient management solutions, including RFID technology. The Indian government actively supports data center development through policies and initiatives promoting technology adoption. Schemes like "Make in India" encourage local production of data center equipment, including RFID solutions, fostering a self-sufficient market.

By Component

By Hardware

By Tag Frequency

By Reader

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Center RFID Market

5.1. COVID-19 Landscape: Data Center RFID Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Center RFID Market, By Component

8.1. Data Center RFID Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Center RFID Market, By Hardware

9.1. Data Center RFID Market, by Hardware, 2024-2033

9.1.1. Tags

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Reader

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Printer

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Antenna

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Data Center RFID Market, By Tag Frequency

10.1. Data Center RFID Market, by Tag Frequency, 2024-2033

10.1.1. LHF

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. HF

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. UHF

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Data Center RFID Market, By Reader

11.1. Data Center RFID Market, by Reader, 2024-2033

11.1.1. Fixed

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Handheld

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Data Center RFID Market, By Application

12.1. Data Center RFID Market, by Application, 2024-2033

12.1.1. Asset Tracking and Management

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. IT Asset Management

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Lifecycle Management

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Data Center RFID Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.1.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.1.4. Market Revenue and Forecast, by Reader (2021-2033)

13.1.5. Market Revenue and Forecast, by Application (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Reader (2021-2033)

13.1.7. Market Revenue and Forecast, by Application (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Reader (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Application (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.2.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.2.4. Market Revenue and Forecast, by Reader (2021-2033)

13.2.5. Market Revenue and Forecast, by Application (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.2.7. Market Revenue and Forecast, by Reader (2021-2033)

13.2.8. Market Revenue and Forecast, by Application (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.2.10. Market Revenue and Forecast, by Reader (2021-2033)

13.2.11. Market Revenue and Forecast, by Application (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Reader (2021-2033)

13.2.13. Market Revenue and Forecast, by Application (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Reader (2021-2033)

13.2.15. Market Revenue and Forecast, by Application (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.3.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.3.4. Market Revenue and Forecast, by Reader (2021-2033)

13.3.5. Market Revenue and Forecast, by Application (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Reader (2021-2033)

13.3.7. Market Revenue and Forecast, by Application (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Reader (2021-2033)

13.3.9. Market Revenue and Forecast, by Application (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Reader (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Application (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Reader (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Application (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.4.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.4.4. Market Revenue and Forecast, by Reader (2021-2033)

13.4.5. Market Revenue and Forecast, by Application (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Reader (2021-2033)

13.4.7. Market Revenue and Forecast, by Application (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Reader (2021-2033)

13.4.9. Market Revenue and Forecast, by Application (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Reader (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Application (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Reader (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Application (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.5.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.5.4. Market Revenue and Forecast, by Reader (2021-2033)

13.5.5. Market Revenue and Forecast, by Application (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Reader (2021-2033)

13.5.7. Market Revenue and Forecast, by Application (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Hardware (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Tag Frequency (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Reader (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Application (2021-2033)

Chapter 14. Company Profiles

14.1. Alien Technology

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. AVERY DENNISON CORPORATION

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Confidex

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Detego

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. GAO Group

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. HID Global

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Honeywell International Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Impinj, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. MOJIX

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Nedap

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others