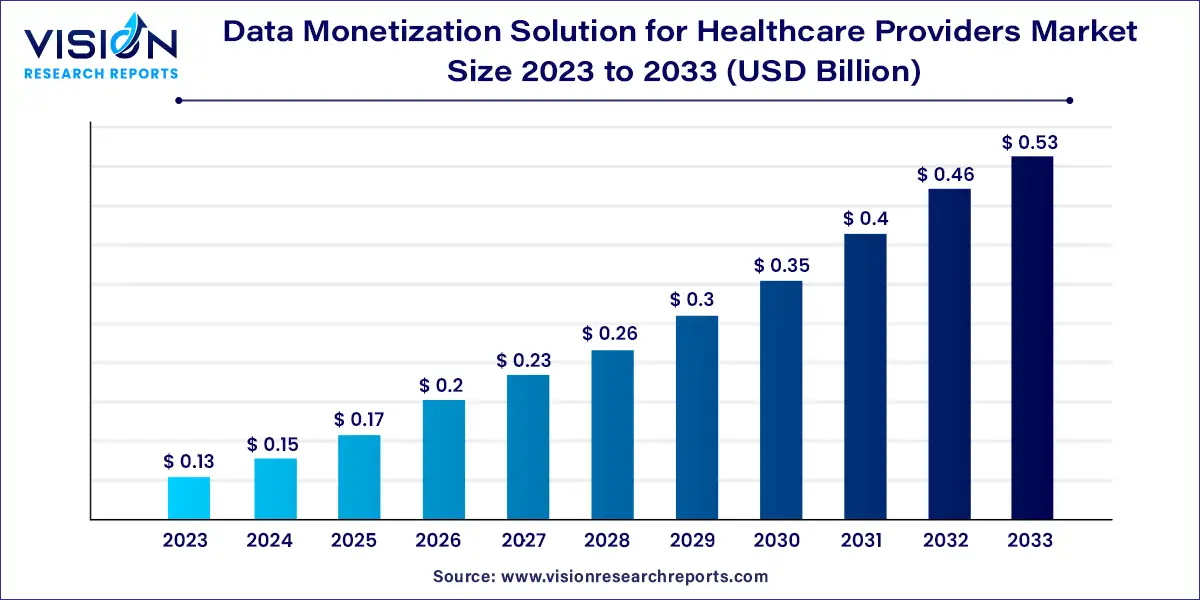

The global data monetization solution for healthcare providers market was estimated at USD 0.13 billion in 2023 and it is expected to surpass around USD 0.53 billion by 2033, poised to grow at a CAGR of 15.04% from 2024 to 2033.

The healthcare industry is undergoing a transformative phase driven by the digital revolution. One significant aspect of this transformation is the advent of data monetization solutions. These solutions enable healthcare providers to leverage their vast troves of data to generate new revenue streams while enhancing patient care and operational efficiency.

The growth of the data monetization solutions market for healthcare providers is propelled by the exponential increase in healthcare data volumes, driven by electronic health records (EHRs) and digital health solutions, provides a vast resource for monetization. Second, advancements in big data analytics and artificial intelligence (AI) enable healthcare providers to extract actionable insights from these data, enhancing decision-making and operational efficiency. Additionally, supportive regulatory initiatives promoting data sharing and interoperability among healthcare entities further stimulate market growth. These factors collectively contribute to a promising landscape for data monetization in the healthcare sector, fostering new revenue opportunities and improved patient care outcomes.

Based on type, the software segment led the market with a substantial revenue share of 58% in 2023. Advanced software solutions play a crucial role in converting raw data into actionable insights, thereby enhancing patient outcomes, operational efficiency, and generating new revenue streams. The ongoing digital transformation in healthcare encourages providers to adopt sophisticated technologies like data analytics, artificial intelligence (AI), and machine learning (ML) to maximize the value derived from their data assets.

In March 2022, Nokia announced its collaboration with Equideum Health to develop and implement healthcare use-cases in the U.S. This partnership utilizes Nokia's Data Marketplace (NDM) solution, offered through a Software-as-a-Service (SaaS) model since 2021. NDM facilitates secure data exchange and AI model deployment, supporting digital transformation and data monetization across the ecosystem.

The services segment is poised for significant growth over the forecast period, driven by the increasing complexity of healthcare data. Healthcare providers, faced with diverse data sources, require specialized services for effective data management, analysis, and monetization. Service providers offer critical expertise in data governance, integration, and analytics, empowering healthcare organizations to unlock valuable insights from their data assets and driving market expansion.

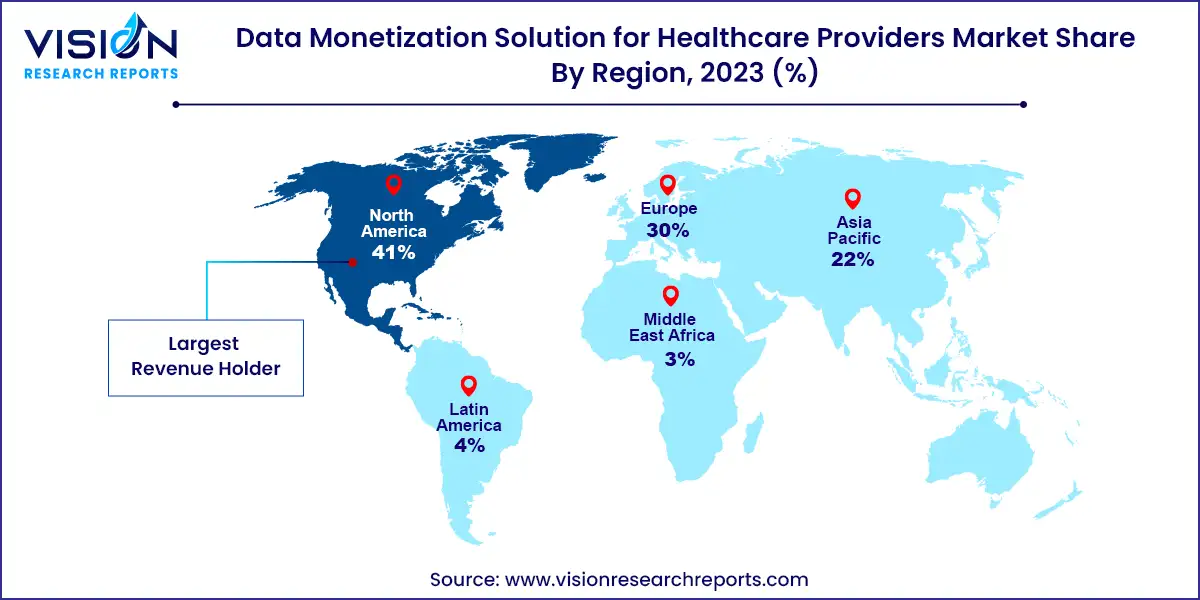

In 2023, North America dominated the data monetization solution for healthcare providers market, commanding a significant revenue share of 41%. This leadership is driven by advanced technological capabilities and stringent regulatory frameworks. The integration of electronic health records (EHRs), widespread adoption of wearable health devices, and advancements in data analytics are transforming how healthcare providers leverage data. Moreover, the region's emphasis on precision medicine and value-based care models fuels the demand for sophisticated data monetization solutions.

Looking ahead, the Asia Pacific market is poised to exhibit the highest growth rate during the forecast period. Countries like China, India, and Japan are making substantial investments in healthcare IT infrastructure, EHR systems, and AI-driven healthcare solutions. Government initiatives supporting digital health transformation and a growing focus on personalized medicine are further propelling the adoption of data monetization solutions across the region.

Specifically, China led the Asia Pacific data monetization solution for healthcare providers market in 2023. Factors such as the increasing use of external data sources, rising partnerships among industry players, and efforts to manage healthcare costs are expected to drive market expansion. Additionally, the growing adoption of AI in precision medicine is anticipated to contribute significantly to market growth.

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Monetization Solution for Healthcare Providers Market

5.1. COVID-19 Landscape: Data Monetization Solution for Healthcare Providers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Monetization Solution for Healthcare Providers Market, By Type

8.1. Data Monetization Solution for Healthcare Providers Market, by Type, 2024-2033

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Monetization Solution for Healthcare Providers Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

Chapter 10. Company Profiles

10.1. Accenture Plc

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. H1

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Infor

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Informatica Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Infosys Limited

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Innovaccer, Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Microsoft Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. OpenText Corporation

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Oracle Corporation

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Salesforce, Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others