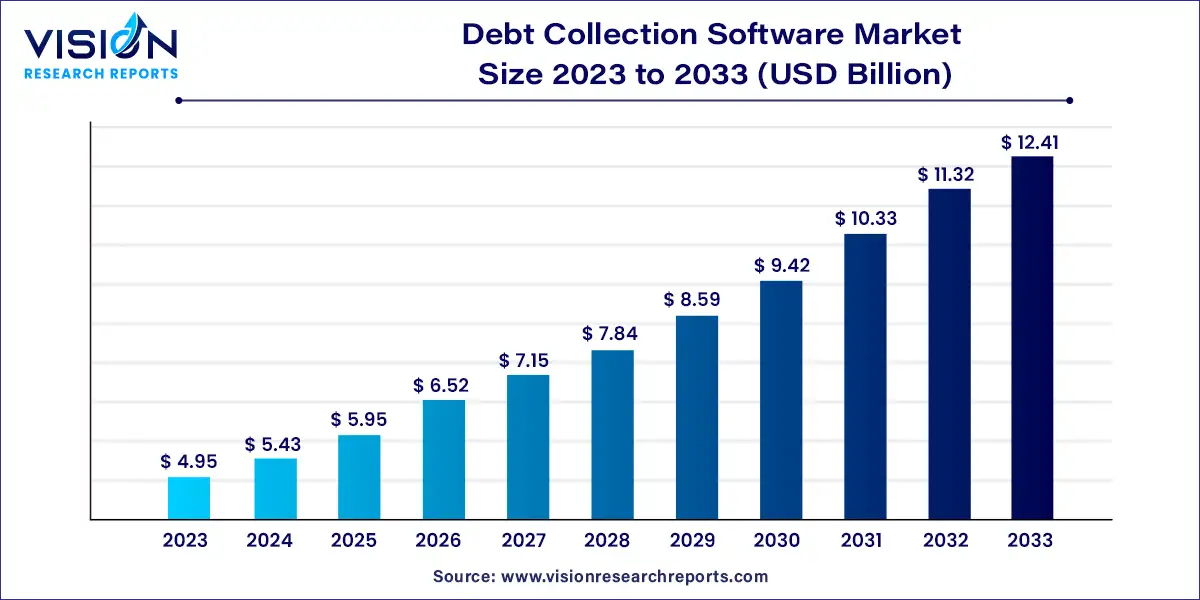

The global debt collection software market size was estimated at around USD 4.95 billion in 2023 and it is projected to hit around USD 12.41 billion by 2033, growing at a CAGR of 9.63% from 2024 to 2033. The debt collection software market is witnessing significant growth as businesses and financial institutions seek efficient solutions to manage their debt recovery processes.

The growth of the debt collection software market is propelled by an escalating volume of debt across industries due to economic fluctuations stimulates the demand for efficient debt recovery solutions. Additionally, the increasing adoption of digital technologies, such as cloud-based platforms and artificial intelligence, enhances the effectiveness and efficiency of debt collection processes. Moreover, stringent regulatory requirements mandate organizations to invest in compliant software solutions to mitigate legal risks. Furthermore, the focus on improving operational efficiency and reducing costs drives businesses to seek innovative debt collection software that streamlines workflows and enhances productivity. These combined factors create a conducive environment for the sustained expansion of the debt collection software market.

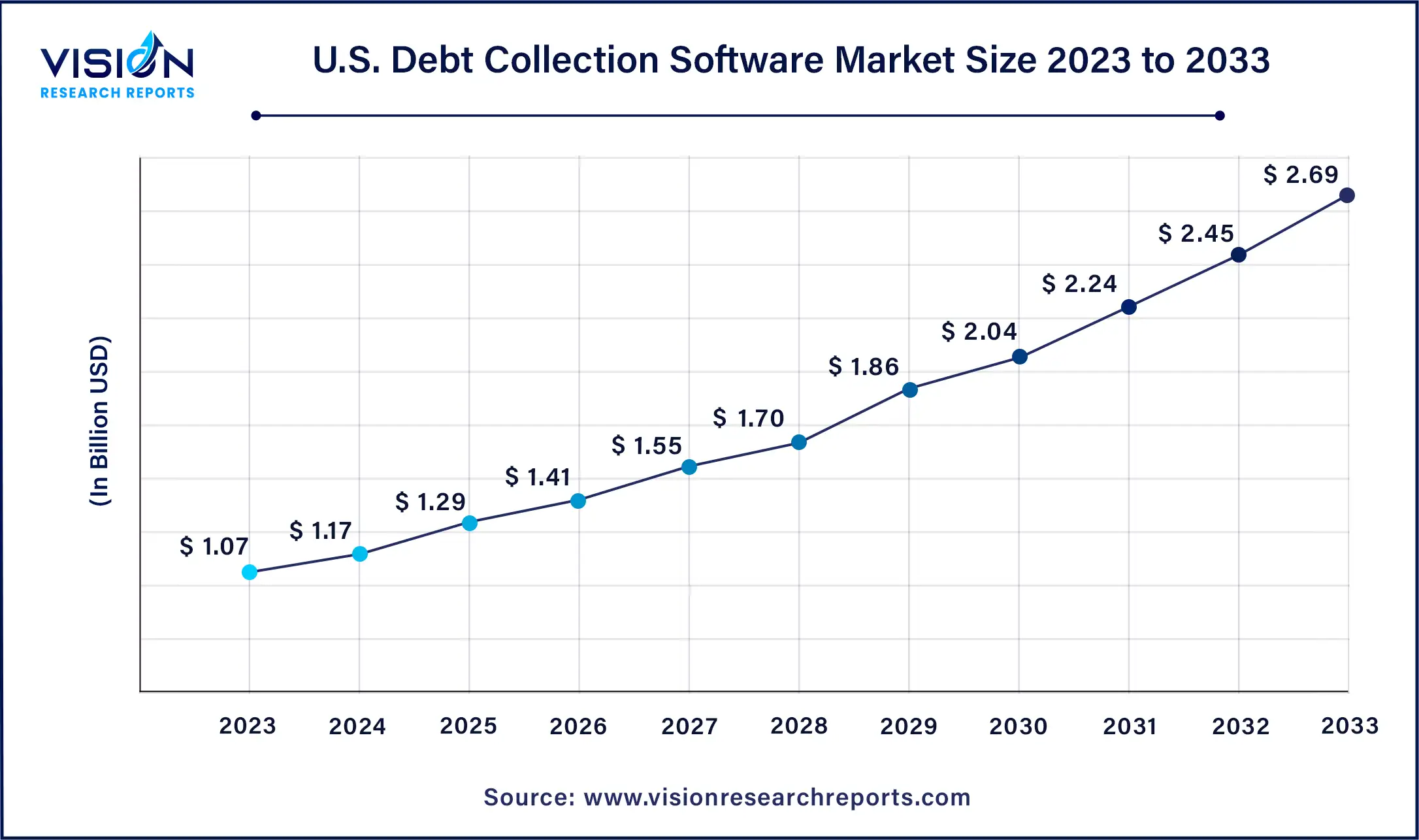

The U.S debt collection software market size was estimated at around USD 1.07 billion in 2023 and it is projected to hit around USD 2.69 billion by 2033, growing at a CAGR of 9.65% from 2024 to 2033.

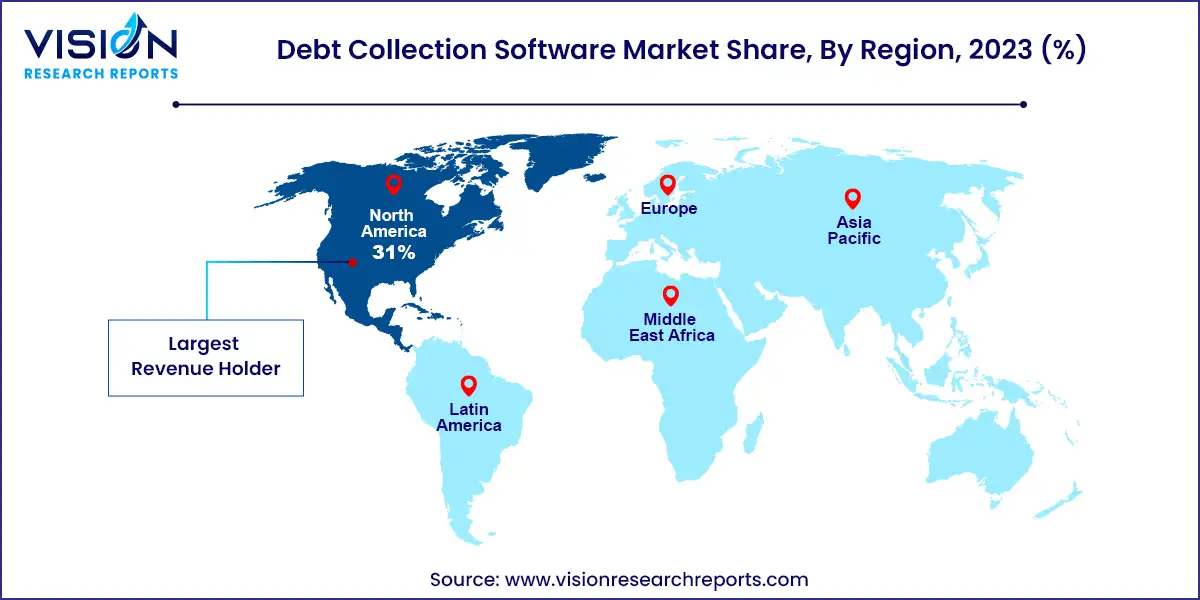

In 2023, North America emerged as the dominant force in the market, capturing a significant revenue share of 31%. The region's robust embrace of technology has cultivated an environment conducive to the expansion of the debt collection software market. Serving as a beacon of technological innovation, North America propels the development of cutting-edge software solutions. Companies within the region harness technologies such as Artificial Intelligence (AI), machine learning, and data analytics to refine collection strategies, enhance debtor engagement, and optimize operational workflows.

Asia Pacific is poised to experience the swiftest growth within the debt collection market. This surge can be attributed to the region's widespread adoption of technology, fueled by factors such as burgeoning internet accessibility, smartphone proliferation, and concerted digitalization endeavors. Debt collection software solutions capitalize on technologies like Artificial Intelligence (AI), machine learning, and data analytics to fine-tune collection approaches, elevate debtor interactions, and bolster operational efficacy in alignment with these prevailing trends, thereby propelling market expansion.

In 2023, the software segment emerged as the market leader, commanding a substantial share of 66%. This dominance is attributed to the global momentum of the Industry 4.0 initiative, propelling growth within the segment. Key functionalities of debt collection software encompass case management, automated workflows, payment processing, reporting and analytics, and compliance management. Additionally, supplementary features such as skip tracing, credit reporting, negotiation tools, chatbots, AI-powered communication, document management, team collaboration tools, and integrations with existing software bolster users with automation and debt recovery capabilities.

On the other hand, the service segment is poised to exhibit the most rapid growth throughout the forecast period. This trend is fueled by the escalating demand for Software-as-a-Service (SaaS) models, offering reduced upfront costs, heightened flexibility, and scalability. To meet this burgeoning demand, numerous companies are unveiling innovative solutions. For instance, in October 2023, Mobicule Technologies, a pioneer in mobile field force-based product development, launched MCollect. This phygital debt recovery service aims to deliver cost-effective debt collection solutions, aligning with the evolving needs of the market.

The dominance of the cloud segment in the market is attributed to the growing necessity for seamless data exchange and connectivity between users and clients. Cloud-based solutions offer numerous advantages, including real-time collaboration, streamlined communication, and efficient data integration. Moreover, they enable remote access and mobility, allowing users to retrieve data from any location at any time. Cloud deployment is characterized by its cost-effectiveness, scalability, and flexibility, offering automatic updates, maintenance, and heightened security measures. It also ensures disaster recovery capabilities, crucial for mitigating unforeseen system failures or data loss incidents.

Conversely, the on-premise segment is anticipated to witness significant growth in the forecast period. On-premise solutions afford organizations maximum control, customization options, and data privacy assurances. They empower businesses to tailor software to their specific collection procedures, compliance needs, and team configurations. This approach enables companies to retain full authority over their sensitive data and implement bespoke security protocols, thereby enhancing overall security.

On-premise systems inherently pose fewer cybersecurity risks compared to their cloud-based counterparts. This enhanced security aspect provided by on-premise systems is particularly vital for enterprises handling highly sensitive data. For instance, according to IBM, the global average cost of a data breach surged to USD 4.45 million in 2023, marking a 15% increase in expenses over three years.

In 2023, the large enterprise segment emerged as the market leader, driven by escalating data complexity and the imposition of stricter regulations. Large enterprises, particularly those operating in heavily regulated industries and regions, prioritize compliance as a paramount concern. To ensure adherence to legal mandates and mitigate associated risks, these enterprises demand debt collection software equipped with robust compliance features. These include automated regulatory updates, comprehensive audit trails, and secure data handling mechanisms.

Conversely, the SME segment is poised for significant growth, spurred by an increasing emphasis on Customer Relationship Management (CRM). Software integrating CRM functionalities empowers SMEs to efficiently manage customer interactions, personalize communication, and uphold a positive customer experience throughout the debt collection journey. Debt collection software serves as a pivotal tool for businesses in safeguarding their reputation and fostering customer loyalty, thereby paving the path for long-term financial prosperity.

In 2023, the financial institutions segment emerged as the market leader, holding the largest market share. The segment's growth is propelled by the increasing imperative for fraud detection measures. Financial institutions face heightened vulnerability to fraudulent activities owing to the involvement of sensitive financial data. Debt collection software assumes a pivotal role in mitigating such risks by offering advanced features tailored for fraud detection. These include suspicious activity monitoring, correlation of multiple accounts, and checks on device and IP addresses. Such functionalities aid in identifying anomalous transactions, detecting suspicious login attempts, and flagging geographically inconsistent activities.

Conversely, the telecom & utilities segment is poised for significant growth, projected to exhibit a substantial CAGR throughout the forecast period. This growth is attributed to the escalating prevalence of fraudulent accounts, which adversely impact bad debts and revenue streams. Debt collection software emerges as a critical tool in detecting and preventing fraudulent accounts within this segment. Its functionalities encompass fraud detection, integration with external databases, initiation of alerts, implementation of verification procedures, and segmentation of customer data based on risk profiles. These factors collectively contribute to the anticipated growth of this segment.

By Component

By Deployment

By Enterprise Size

By End-user

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others