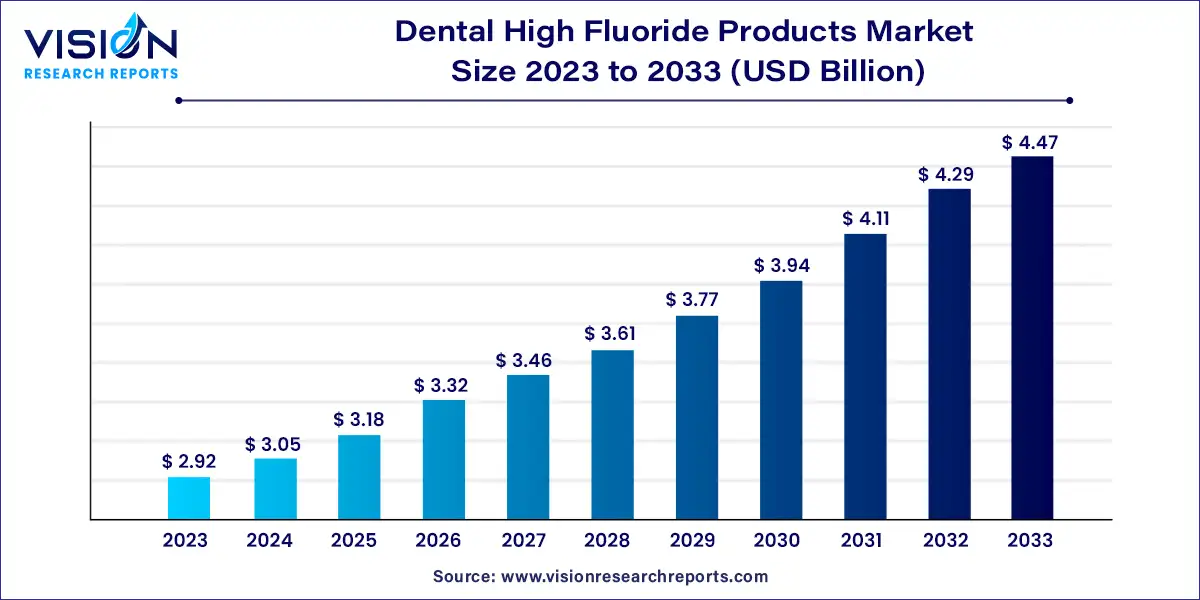

The global dental high fluoride products market size was valued at USD 2.92 billion in 2023 and it is predicted to surpass around USD 4.47 billion by 2033 with a CAGR of 4.36% from 2024 to 2033.

The dental high fluoride products market encompasses a range of specialized oral care solutions designed to address varying degrees of fluoride needs in dental health. Fluoride, a key component in dental care, is renowned for its ability to strengthen tooth enamel and prevent dental caries.

The growth of the dental high fluoride products market is primarily driven by an increasing awareness about oral health benefits and the rising prevalence of dental caries globally. Fluoride, known for its ability to strengthen tooth enamel and prevent cavities, has spurred demand for products such as high fluoride toothpaste, varnishes, and gels. Technological advancements in dental care formulations and application techniques further contribute to market expansion. However, stringent regulatory standards and competitive pressures necessitate continuous innovation among market players to maintain compliance and meet consumer needs effectively.

The toothpaste segment asserted its dominance in the market, holding the largest revenue share of 49% in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2033. This segment's leadership is attributed to its pivotal role in preventive dental care, offering enhanced protection against dental caries and decay with higher fluoride concentrations compared to regular toothpaste. Sodium monofluorophosphate and sodium fluoride emerge as the most utilized fluoride compounds in these products, addressing the widespread prevalence of dental caries affecting 60% to 90% of school-aged children and a majority of adults.

Market leaders like Colgate-Palmolive and 3M Company have capitalized on this demand through the introduction of high dental fluoride toothpaste products, such as Colgate PreviDent 5000 Booster Plus, boasting the highest fluoride content available in any toothpaste or mouthwash. The segment's growth is bolstered by increasing consumer awareness and adoption of such products, underscoring a competitive landscape where key players innovate to meet evolving consumer needs.

The varnish segment is experiencing robust growth owing to its efficacy in preventing tooth decay, providing a highly concentrated fluoride application administered topically by dental professionals. Fluoride varnish strengthens tooth enamel and mitigates acid erosion risks, making it ideal for patients with moderate-to-high caries levels. This segment witnesses frequent product launches featuring new flavors and formulations, such as BISCO's FluoroCal 5% Sodium Fluoride Varnish with Tri-Calcium Phosphate. Additionally, the affordability and ease of use of fluoride varnish, particularly in pediatric care, contribute to its popularity as an anticavity treatment.

In 2023, the North America dental high fluoride products market commanded the largest revenue share of 36%, driven by increasing dental hygiene awareness and escalating dental caries rates. A January 2022 study by BioMin Technologies Limited underscored the superior efficacy of fluoride-based toothpaste in preventing tooth decay compared to conventional options. BioMin F, integrating patented bioactive technology incorporating calcium, phosphate, and fluoride, exemplifies innovative approaches to combating tooth decay. The emphasis on dental hygiene and rising dental caries rates are poised to propel toothpaste demand, further driving sector growth.

The Asia Pacific dental high fluoride products market is expected to witness the highest CAGR of 4.93% from 2024 to 2033. Demand for fluoride treatments is surging in countries like India, China, and Australia, fueled by heightened oral health awareness and rising dental caries prevalence. These nations, characterized by large populations and expanding middle classes, prioritize dental care investments, elevating the importance of preventive measures like fluoride treatments. The World Health Organization (WHO) underscores fluoride's pivotal role in preventing tooth decay, prompting intensified efforts across Asia Pacific to integrate fluoride treatments into routine dental care. Governments, such as India's, promote fluoride treatments through national oral health programs, while China advocates for fluoride-containing products to combat dental caries. With significant rates of dental caries and limited adherence to recommended oral hygiene practices, educational initiatives and improved access to fluoride treatments present substantial opportunities to enhance dental health outcomes across the region.

By Product Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others