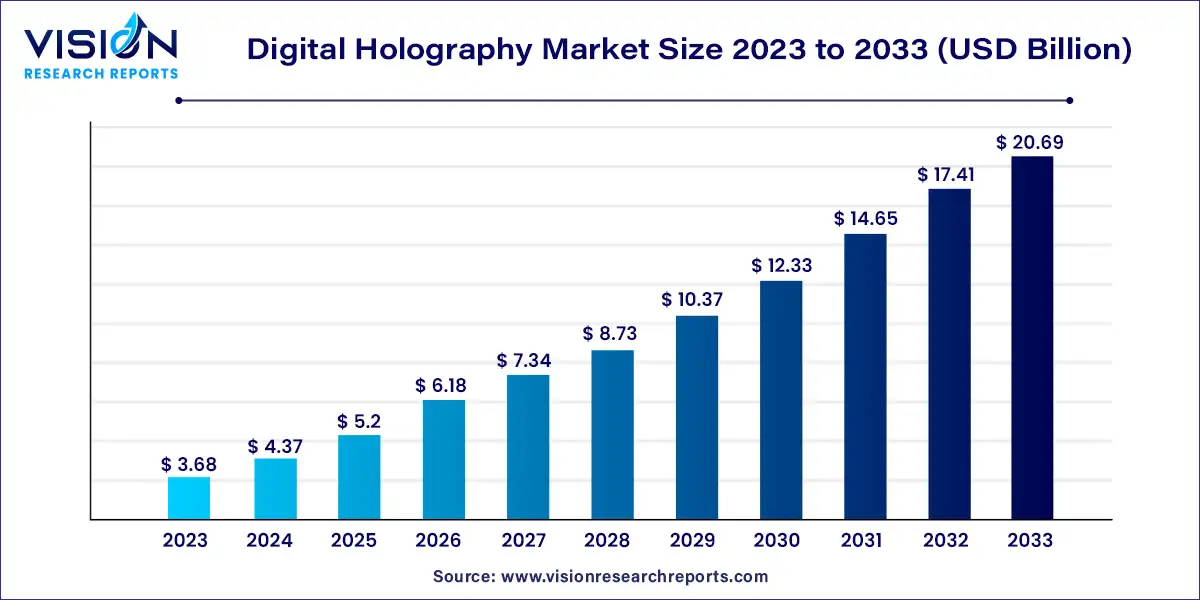

The global digital holography market size was surpassed at USD 3.68 billion in 2023 and is expected to hit around USD 20.69 billion by 2033, growing at a CAGR of 18.85% from 2024 to 2033.

Digital holography, an advanced imaging technique, captures and reconstructs three-dimensional (3D) images by recording the interference pattern between reference and object waves. Unlike conventional photography or imaging methods, digital holography offers unparalleled depth perception and realism, making it indispensable across diverse applications ranging from biomedical imaging to industrial inspection.

The digital holography market has witnessed exponential growth in recent years, driven by the burgeoning demand for high-resolution, real-time 3D imaging solutions across various industries. Rapid advancements in digital sensor technology, computational algorithms, and display systems have fueled the adoption of digital holography in an array of sectors, including healthcare, automotive, aerospace, and entertainment.

The digital holography market is propelled by the continuous advancements in imaging technology, including digital sensors and computational algorithms, have significantly enhanced the resolution, speed, and accuracy of digital holography systems, expanding their applicability across diverse industries. Secondly, the increasing demand for high-resolution, real-time 3D imaging solutions across sectors such as healthcare, automotive, aerospace, and entertainment is driving the adoption of digital holography for various applications. Furthermore, the integration of digital holography in industrial automation and inspection processes has led to improved efficiency, cost savings, and quality control measures. Additionally, the rising popularity of augmented reality (AR) and virtual reality (VR) applications has created new opportunities for digital holography, enabling immersive user experiences and realistic simulations.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 34% |

| CAGR of Asia Pacific from 2024 to 2033 | 19.44% |

| Revenue Forecast by 2032 | USD 18.41 billion |

| Growth Rate from 2024 to 2033 | CAGR of 18.83% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Lyncee TEC SA; RealView Imaging; Holoxica Limited; EON Reality, Inc.; Phase Holographic Imaging AB (PHI); Holotech Switzerland AG; Holmarc Opto-Mechatronics; Geola Digital Uab; Leia Inc.; ovizio imaging systems; RealFictions; Himax Technologies, Inc.; MetroLaser; HYPERVSN; SAMSUNG; Meta |

Based on offering, the market is classified into hardware and software. The hardware segment dominated with the largest revenue share of 55% in 2023 and is expected to retain its dominance over the forecast period. The growing need for sophisticated and advanced hardware components capable of supporting complex holographic processes is propelling the hardware segment. Manufacturers such as RealFictions, and HYPERVSN, among others, are developing enhanced hardware solutions, such as high-resolution sensors, displays, powerful CPUs, and energy-efficient optical systems. The growing use of holographic displays in healthcare, retail, and entertainment industries has increased the demand for hardware components.

For instance, in March 2023, ARHT Media launched retail hologram experiences that enable brands to engage customers in immersive and interactive ways. The technology utilizes digital holographic displays to create lifelike virtual experiences, allowing retailers to showcase products and engage with customers in a unique and attention-grabbing manner. Holographic displays are crucial for creating immersive and realistic visual experiences, and as their popularity increases, the hardware segment benefits by fulfilling market demands. These technical breakthroughs improve display quality, holographic imaging, and system performance, which boosts the hardware segment's growth.

The software segment is anticipated to grow at a significant CAGR of 18.34% over the forecast period. This is attributed to software developments driving innovations in holographic display technology, enabling better visualization and user experience. Furthermore, software solutions, such as holographic data processing software are crucial for processing and analyzing holographic data, playing a vital role in various fields such as healthcare and research. Using algorithms, these software solutions reconstruct three-dimensional representations from the captured interference patterns in holograms, enabling accurate visualization of the shape and depth information of the original object.

In terms of dimension, the market is classified into two-dimensional (2D) and three-dimensional (3D). The two-dimensional (2D) segment, in 2023, dominated with a revenue share of 56%. The 2D segment involves the capture and display of two-dimensional holographic images, providing a realistic and immersive visual experience. The 2D digital holography technique finds extensive use in medical imaging, where it enables healthcare professionals to examine and analyze complex anatomical structures in significant detail.

For instance, according to INTEGRATED MICRO-ELECTRONICS, INC, researchers in South Korea are leveraging artificial intelligence (AI) to convert 2D medical imaging into immersive 3D holograms that can be viewed without the need for specialized glasses. This innovative technology tracks the user's eye movements, allowing the hologram to adjust accordingly. Furthermore, users can manipulate the hologram's size and orientation using simple hand or head movements, enhancing the user experience and providing more intuitive interaction capabilities. In addition, the 2D hologram is utilized in areas such as digital signage, advertising, and education, where it offers an engaging and interactive way to present information and captivate audiences.

The three-dimensional (3D) segment is expected to grow at the fastest CAGR of 19.45% during the forecast period. The 3D digital holography is being utilized in events and concerts. For instance, in September 2021, ABBA announced a hologram concert, marking their return to the stage after a long hiatus. This innovative use of 3D hologram technology demonstrates its growing potential in the entertainment industry, offering a unique and immersive concert experience for fans while showcasing the versatility and appeal of holographic performances. Furthermore, 3D holography finds applications in engineering, design, and scientific research, where precise 3D measurements and analysis are crucial. The 3D digital holography segment is expected to witness continued growth as demand for realistic and interactive holographic experience increases across multiple industries.

In terms of application, the market is classified into holographic microscopy, holographic imaging, holographic telepresence, and others. The holographic microscopy segment held the largest revenue share of 36% in 2023. This advanced microscopy technique enables accurate measurement of size, shape, and surface characteristics, making it valuable in various fields such as nanotechnology, material science, and biological research. For instance, in September 2023, scientists developed a holographic microscope that can create detailed 3D images of the skull's internal structure.

It enables researchers to study and analyze the intricacies of the skull, providing valuable insights for various fields, including anthropology, paleontology, and medical research. The holographic microscope offers a non-invasive and high-resolution imaging method, revolutionizing the way scientists examine and understand the internal structures of the skull. The demand for holographic microscopy is driven by the need for precise measurements and analysis, and its applications are expanding as industries seek advanced imaging solutions for scientific advancements and process optimization.

The holographic imaging segment is anticipated to grow at the fastest CAGR of 19.26% throughout the forecast period. The advancements in holographic display technologies have significantly improved the quality and resolution of holographic images, making them more realistic and immersive. This has expanded the applications of holographic imaging in sectors such as healthcare, automotive, entertainment, and education. Furthermore, the increasing demand for precise and accurate visualization in medical diagnostics, surgical planning, and research is driving the adoption of holographic imaging solutions.

Based on end-use vertical, the market is classified into healthcare, automotive, aerospace & defense, education, consumer electronics, entertainment, and others. The healthcare segment dominated with a revenue share of 25% in 2023. Digital holography provides healthcare professionals with advanced visualization capabilities, enabling accurate and detailed examination of anatomical structures. This technology is being widely adopted for medical imaging, surgical planning, and education, leading to improved diagnosis, treatment interventions, and patient outcomes.

For instance, in October 2020, Researchers at New York University developed a holographic imaging technique that can detect highly sensitive viruses and antibodies. Through the projection of laser light onto a liquid sample, they can capture and analyze holographic patterns to identify and quantify the presence of viruses, offering potential applications in diagnostics and medical research. In addition, the demand for remote healthcare solutions and telemedicine has further accelerated the growth of digital holography in the healthcare sector, as it allows for realistic and immersive virtual consultations and remote examinations.

The education segment is anticipated to witness the fastest CAGR of 19.77% throughout the forecast period. Digital holography offers immersive learning experiences that enhance student understanding, engagement, and retention by enabling visualization of complex concepts in three dimensions. It has become more accessible and affordable, allowing educational institutions to easily incorporate holographic materials into their lessons. The shift to online and blended learning models has further accelerated the demand for digital holography, as it provides interactive and immersive virtual environments for remote students to experience realistic 3D visualizations and simulations.

For instance, in May 2023, Gallaudet University, a renowned institution for the deaf and hard of hearing, implemented holograms to enhance American Sign Language (ASL) instruction. Through the implementation of holographic technology, the university aims to provide a more immersive and interactive learning experience for ASL students, enabling them to practice and engage with sign language realistically and engagingly. This innovative approach has the potential to revolutionize ASL education and improve communication accessibility for the deaf and hard-of-hearing community.

North America dominated the overall market in 2023, with a share of 35% in terms of revenue. North America has prominent market players such as RealView Imaging and EON Reality, Inc. The increasing investments in research and development activities related to holographic displays, augmented reality (AR), and virtual reality (VR) technologies are fueling the growth of the digital holography industry in North America. These investments are aimed at enhancing the quality, resolution, and user experience of holographic displays, which can lead to increased adoption in sectors such as advertising, entertainment, and gaming. The healthcare sector in North America is increasingly adopting digital holography for medical imaging, surgical planning, and telemedicine applications. The ability of digital holography to provide detailed and realistic 3D visualizations is revolutionizing medical diagnostics and treatment interventions.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 19.45% during the forecast period, which is mainly driven by increasing demand across industries, investments in research and development, and the presence of major technology hubs. The region's large population, rapid urbanization, and industrialization contribute to the growing adoption of advanced visualization technologies like digital holography. In addition, the popularity and increasing penetration of mobile devices further drive the demand for mobile-based holographic applications in the Asia Pacific region.

By Offering

By Dimension

By Application

By End-use Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Holography Market

5.1. COVID-19 Landscape: Digital Holography Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Holography Market, By Offering

8.1. Digital Holography Market, by Offering, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Holography Market, By Dimension

9.1. Digital Holography Market, by Dimension, 2024-2033

9.1.1. Two-dimensional (2D)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Three-dimensional (3D)

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Holography Market, By Application

10.1. Digital Holography Market, by Application, 2024-2033

10.1.1. Holographic Microscopy

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Holographic Imaging

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Holographic Telepresence

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Holography Market, By End-use Vertical

11.1. Digital Holography Market, by End-use Vertical, 2024-2033

11.1.1. Healthcare

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Automotive

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Automotive

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Education

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Consumer Electronics

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Entertainment

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Holography Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Offering (2021-2033)

12.1.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Offering (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Offering (2021-2033)

12.2.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Offering (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Offering (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Offering (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Offering (2021-2033)

12.3.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Offering (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Offering (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Offering (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Offering (2021-2033)

12.4.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Offering (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Offering (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Offering (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Offering (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Offering (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Dimension (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. Lyncee TEC SA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. RealView Imaging

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Holoxica Limited

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. EON Reality, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Phase Holographic Imaging AB (PHI)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Holotech Switzerland AG

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Holmarc Opto-Mechatronics

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Geola Digital Uab

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Leia Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. ovizio imaging systems

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others