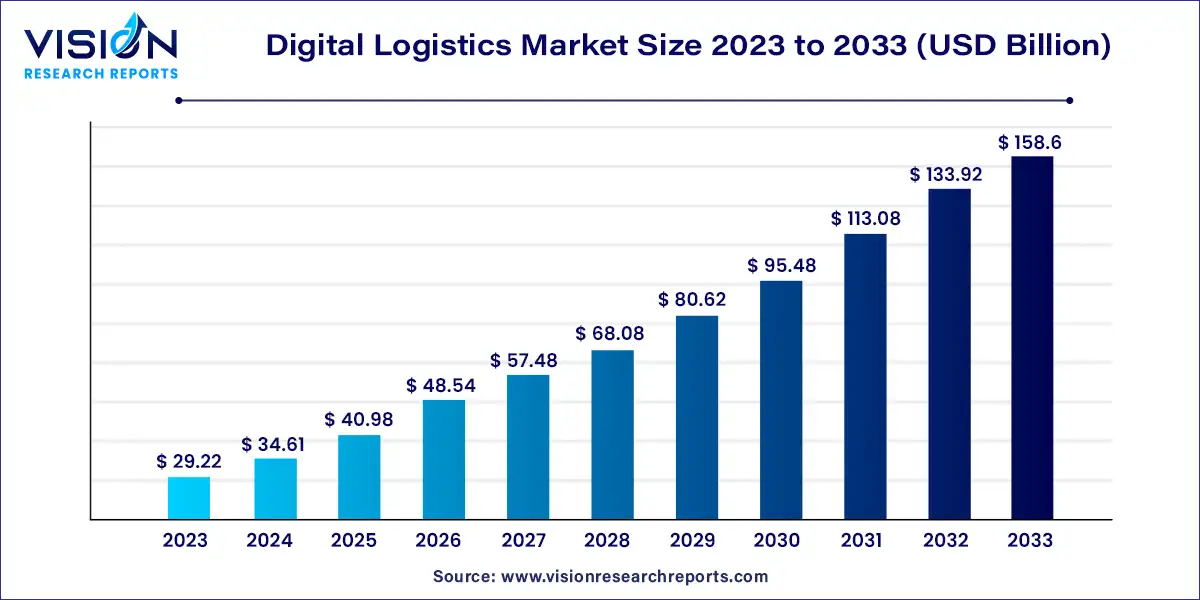

The global digital logistics market size was estimated at USD 29.22 billion in 2023 and it is expected to surpass around USD 158.6 billion by 2033, poised to grow at a CAGR of 18.43% from 2024 to 2033. The digital logistics market is rapidly evolving as businesses seek to optimize their supply chains and improve operational efficiency through technology. This market encompasses a range of solutions that leverage digital technologies to streamline logistics operations, enhance transparency, and enable real-time decision-making.

The growth of the digital logistics market is propelled by the technological advancements such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain are revolutionizing logistics operations by enhancing real-time tracking, predictive analytics, and supply chain visibility. These innovations enable businesses to optimize routes, reduce costs, and improve overall efficiency. Additionally, the surge in e-commerce has significantly increased the demand for agile and reliable logistics solutions, as companies strive to meet the expectations of fast and accurate deliveries. Furthermore, the drive for operational efficiency is pushing organizations to adopt digital tools that automate and streamline various logistics functions, leading to cost savings and enhanced performance.

North America led the global digital logistics market in 2023, accounting for over 37% of revenue. The region's growth is attributed to its rapid adoption of advanced technologies such as IoT, AI, robotics, and blockchain. These technologies are integrated into digital logistics systems to enhance supply chain visibility and optimize operations. Government initiatives and private investments are also boosting the logistics network's efficiency. For example, in May 2024, the Government of Canada announced a USD 35 million investment in digital infrastructure projects to improve supply chain efficiency and reduce trade barriers, fostering innovation and economic growth.

| Attribute | North America |

| Market Value | USD 10.81 Billion |

| Growth Rate | 18.45% CAGR |

| Projected Value | USD 58.68 Billion |

Asia Pacific is expected to grow at the highest CAGR of 19.73% from 2024 to 2033. This growth is driven by the region's rapid e-commerce expansion, urbanization, and population growth. The booming e-commerce sector in Asia Pacific increases the demand for digital logistics solutions to manage complex supply chains and enhance last-mile delivery. Rapid urbanization and population growth are further driving the need for efficient logistics systems to handle high-density urban environments.

Europe is projected to grow at a significant CAGR of 17.4% from 2024 to 2033. This growth is largely due to the region's focus on sustainability initiatives. European companies are leveraging digital logistics technologies to reduce carbon footprints, optimize routes, and implement green logistics practices, aligning with the EU's sustainability goals. Additionally, significant investments in transportation and logistics infrastructure across Europe are supporting the market growth, with upgrades to ports, railways, and roads facilitating the integration of digital technologies into logistics operations.

In 2023, the solution segment led the market, capturing over 65% of global revenue. This dominance is driven by the increasing need to enhance logistics efficiency and minimize manual processes. Companies are increasingly implementing digital logistics solutions to automate and optimize their supply chains, which reduces manual tasks and boosts operational efficiency. Technologies such as artificial intelligence (AI), machine learning, and robotics are central to these solutions, driving demand for advanced logistics software. Additionally, the transition to cloud-based logistics solutions offers businesses scalable, flexible, and cost-effective tools for managing operations. The ease of integration and lower initial costs of cloud platforms are encouraging more companies to invest in digital logistics solutions.

The services segment is anticipated to experience substantial growth from 2024 to 2033. This growth is attributed to the complexity of digital transformation processes. As businesses undergo digital changes, there is a rising need for expert services to assist with integration, system upgrades, and training. Regular updates and maintenance are necessary due to rapid technological advancements, and service providers play a crucial role in keeping systems current, helping businesses remain competitive in a fast-evolving logistics environment.

In 2023, the cloud segment dominated the market, accounting for over 76% of global revenue. This leadership is due to the scalability, flexibility, and cost-efficiency of cloud-based digital logistics solutions. Cloud platforms offer unparalleled scalability, allowing logistics companies to expand without significant IT infrastructure investments. This flexibility helps businesses quickly adapt to changing market conditions, such as demand fluctuations or new service introductions. For example, in December 2023, Fujitsu launched a cloud-based service built on Amazon Web Services (AWS) to standardize and visualize logistics data, addressing challenges like driver shortages and carbon footprint reduction, while enhancing sustainability and collaborative logistics planning.

The on-premises segment is projected to grow at a notable CAGR from 2024 to 2033. This growth is driven by the need for data control and customization that on-premises solutions offer. Organizations handling sensitive or proprietary information often prefer on-premises solutions due to their enhanced data security. These businesses are cautious about cloud storage, especially in industries where data breaches can have severe consequences. On-premises deployment allows for stringent security protocols and compliance with regulatory standards.

In 2023, the transportation management segment led the market, accounting for over 32% of global revenue. The increasing need for real-time supply chain visibility is driving the adoption of advanced Transportation Management Systems (TMS). These systems leverage data analytics to provide valuable insights, enabling businesses to make informed decisions and quickly address disruptions. Companies are integrating automation and AI into their TMS to optimize route planning, load management, and real-time tracking, which enhances operational efficiency and reduces costs.

The warehouse management segment is expected to grow at the fastest CAGR from 2024 to 2033. This growth is fueled by advancements in automation and robotics and the rise of omnichannel retailing. Automation technologies, such as Automated Guided Vehicles (AGVs) and robotic arms, are transforming warehouse operations. These systems, managed by advanced Warehouse Management Systems (WMS), improve efficiency, reduce labor costs, and enhance order fulfillment accuracy. The increase in omnichannel retail strategies also drives demand for warehouse management solutions that integrate online and offline channels, ensuring product availability and effective inventory management.

In 2023, the retail and e-commerce segment led the market with over 34% of global revenue. The need to meet customer expectations for faster delivery is propelling this segment's growth. E-commerce companies are investing in sophisticated logistics systems to optimize delivery routes, manage warehousing, and provide real-time tracking. The rapid global expansion of e-commerce is driving demand for scalable and efficient logistics solutions to handle inventory, order fulfillment, and last-mile delivery.

The healthcare and pharmaceuticals segment is projected to grow at a significant CAGR from 2024 to 2033. This growth is driven by the need to comply with stringent regulatory requirements. The healthcare and pharmaceutical industries face strict guidelines for storing, handling, and transporting medical products. Digital logistics solutions assist in meeting these regulations by offering real-time monitoring, tracking, and documentation. The increasing demand for temperature-sensitive medications, such as vaccines and biologics, further drives the adoption of advanced digital logistics systems that ensure precise temperature control and monitoring throughout the supply chain.

By Component

By Deployment

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others